Australia Commercial Real Estate Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Australia Commercial Real Estate Market Size and Share:

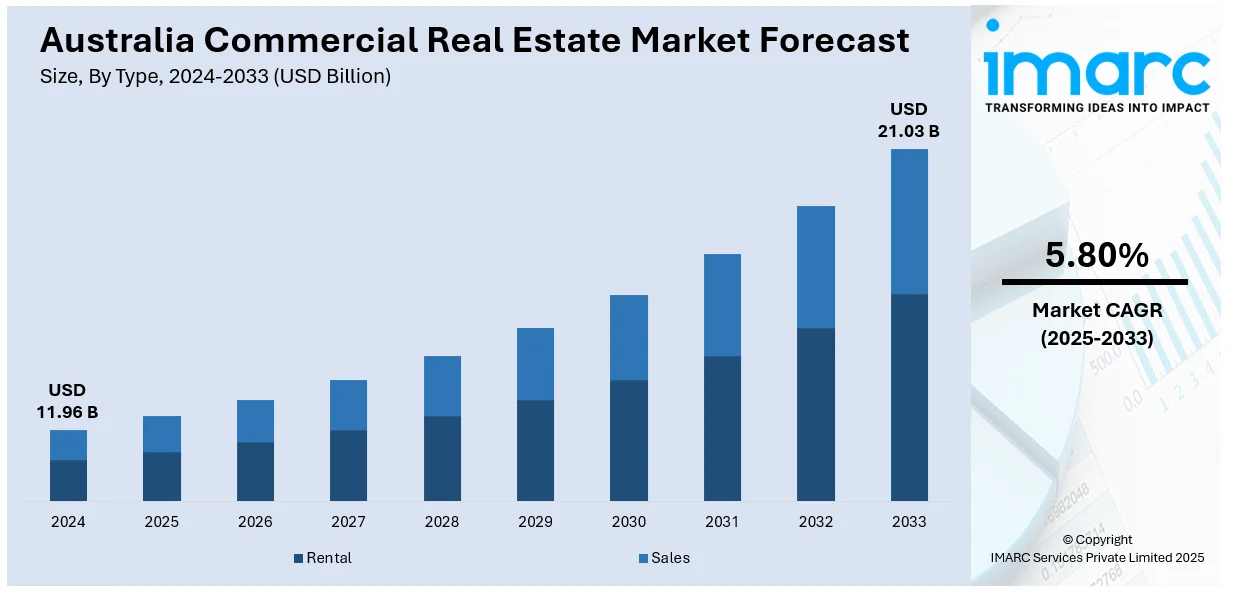

The Australia commercial real estate market size reached USD 11.96 Billion in 2024. The market is projected to reach USD 21.03 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is driven by the rise of hybrid work, accelerating demand for flexible office spaces, and a strong focus on sustainability, with green-certified buildings attracting premium tenants. Urbanization and infrastructure investments in major cities support growth, while low vacancy rates in prime locations drive competition. Additionally, foreign investments and favorable government policies are further expanding the Australia commercial real estate market share, ensuring steady demand for high-quality commercial assets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.96 Billion |

| Market Forecast in 2033 | USD 21.03 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

Key Trends of Australia Commercial Real Estate Market:

Rising Demand for Flexible Office Spaces

The market is experiencing a growing demand for flexible office spaces, driven by changing workplace preferences. In July 2024, Australia's national office vacancy rate dipped marginally to 14.6%, which marked the first time since early 2023 that both CBD and non-CBD markets reported strong demand. Brisbane posted the biggest fall, at a vacancy rate of 9.5%, followed by Sydney, which fell to 11.6%. Melbourne's vacancy rate increased to 18% since more than 500,000 square meters of new office space is due to be launched in Sydney and Melbourne by 2026, with 61.4% of Sydney's and 20% of Melbourne's future developments pre-leased. Businesses, particularly startups and SMEs, are increasingly opting for coworking offices and serviced offices due to their affordability and flexibility. The increasing trend towards hybrid working is driving this growth, where businesses desire flexible leases that can be adapted to the number of workers in the office. Cities such as Sydney, Melbourne, and Brisbane are witnessing a growth in high-end flexible workspace providers, such as quick internet services, collaboration areas, and wellness facilities. Landlords also want to transform their buildings, with flexible lease arrangements for conventional office structures, due to the competitive market's changing dynamics. The trend is expected to continue to expand as businesses will continue to focus on agility in the new work world, and flexible office and workspace choices are a major growth area in the market.

To get more information on this market, Request Sample

Increasing Investment in Sustainable Buildings

Sustainability is becoming a critical factor in the commercial real estate sector, with investors and tenants prioritizing energy-efficient and environmentally friendly buildings. During the 2023/24 year, Australia's Green Building Council certified over 1,000 projects, taking the total area of Green Star-certified space to 64 million square meters, with 46% of central business district offices now sustainability certified. The adoption of government-led Net Zero policies and an increase in industry submissions have accelerated the adoption of sustainable building practices. With 3.4 million daily shoppers passing through Green Star-rated shopping malls and almost a million residents of certified communities, sustainable design is revolutionizing Australia's commercial property industry. Green certifications such as NABERS and Green Star are now major selling points, as they enhance property valuations and attract long-term tenants. Therefore, this is also propelling the Australia commercial real estate market growth. In accordance with shifting consumer behavior and the demand for environmentally friendly choices, developers are more incorporating eco-sustainable features such as solar panels, rainwater harvesting, and smart energy monitoring and management systems into their properties. Business environmental, social, and governance (ESG) commitments and government regulation will further drive this trend as landlords refit existing older buildings in order to enhance energy performance. The major office markets of Sydney and Melbourne are undergoing the most significant change, whereby buildings with sustainable features are drawing higher rents and lower vacancy rates than traditional buildings. With the growth of climate-friendly investing in Australia, green commercial real estate will be an essential part of the commercial property market, delivering financial returns as well as an environmental benefit.

Rapid Suburban Shift

The suburban move is a trend taking hold in the Australia commercial real estate market where companies are increasingly choosing to move into office space away from central city areas. The trend is driven almost entirely by the increased use of remote work and hybrid work environments which have diminished the need for companies to keep costly city-center office buildings. Consequently, businesses are looking for economical options in the suburbs where office space rental is typically less expensive. Also, altered commuting trends with fewer workers traveling into urban centers each day make suburban offices more attractive. The trend also has backing from enhanced transport connectivity and the increasing phenomenon of localizing businesses to increase employees' work-life balance further propelling the Australia commercial real estate market demand.

Outlook of Australia Commercial Real Estate Market:

Resilience and Adaptation to Hybrid Work Models

The commercial real estate market still holds a positive view mainly because companies are adapting to hybrid work models. The demand for conventional office spaces has declined. However, the increase in the preference for flexible working arrangements has immensely contributed to the evolution of coworking spaces. Corporations nowadays are reconsidering their space requirements putting more emphasis on quality rather than quantity, which has increased the need for flexible and shared office environments. And this trend will most definitely continue, with companies now attempting to find the right balance for their employees in terms of flexibility and the tangible presence of the office. Hence, flexible office workspaces will be crucial tools in the commercial real estate market for many years.

Sustainability and Green Building Trends

Sustainability is expected to be a significant growth factor in Australia's commercial real estate market. Both tenants and investors have rapidly increased their preference for energy-efficient and carbon-conscious properties. This trend is pushing forth demand for green buildings and sustainable office spaces that aim at lessening their carbon footprints while also reducing operating costs. Government regulations and corporate social responsibility initiatives are pushing developers and property owners to incorporate green building certifications such as NABERS and Green Star. As these standards become increasingly important for both tenants and investors, sustainability will play a critical role in the market’s future direction. According to Australia commercial real estate market analysis, sustainability is projected to be a primary factor shaping the market's growth trajectory.

Suburban Growth and Logistics Expansion

The future outlook for Australia's commercial real estate market also includes the trend of a significant shift towards suburban office space and logistics properties. The popularity of working remotely keeps reducing the necessity of having central offices in the major cities as most businesses are looking for more affordable and flexible alternatives across the suburbs. This trend is complemented by a rising demand for industrial spaces through e-commerce and last-mile delivery hub growth. Additionally, Australia's strategic position in the Asia-Pacific region is boosting demand for logistics and data centers. This combined focus on suburban offices and logistics properties is set to shape the market’s growth trajectory in the coming years.

Challenges of Australia Commercial Real Estate Market:

Supply and Demand Imbalance

Australia's commercial real estate market faces an ongoing supply and demand imbalance. In key cities like Sydney and Melbourne high demand for office spaces, retail outlets, and industrial properties often exceeds available supply particularly in prime locations. This shortage has led to increased rental prices making it challenging for small businesses to enter the market. There is also a significant investment in new developments. The slow ability to meet demand in this country is due to zoning restrictions, high construction costs, and delays in building approvals. This gives both investors and tenants a good balance of opportunities and risks.

Economic Uncertainty and Interest Rate Hikes

Australia’s commercial real estate market has been significantly affected by economic uncertainty and rising interest rates. The interest rate hikes by the Reserve Bank of Australia to curb inflation have increased borrowing costs making financing for new projects more expensive. These hikes also impact existing commercial properties as property owners with variable-rate loans face higher repayments potentially leading to reduced profitability. Investors can be less willing to accept new ventures or buy properties bringing down market activity. As inflation goes on to affect the overall economy uncertainty hangs in the air influencing investor confidence as well as demand in certain industries.

Shift to Hybrid and Remote Work Models

The global shift toward remote and hybrid work models has caused disruptions in the Australian commercial real estate market. Office demand has dropped as more companies embrace flexible work arrangements leading to higher vacancy rates in CBD office buildings. Many organizations are rethinking their real estate strategies, downsizing, or opting for flexible office spaces affecting long-term lease demand. The pandemic effect on office space seems still to be a challenge; although some tenants are returning to offices, many are opting for smaller and more adaptive spaces, which puts pressure on landlords to adapt to the fast-changing landscape of work.

Opportunities of Australia Commercial Real Estate Market:

Growth in the Industrial and Logistics Sector

The rapid rise of e-commerce has created a surge in demand for warehouses, distribution centers, and logistics hubs in Australia. With online shopping becoming increasingly popular the demand for large-scale industrial properties near key urban centers has never been higher. This sector presents substantial opportunities for developers and investors particularly in areas with excellent transportation links. Additionally, the supply chain disruptions caused by the pandemic have led businesses to invest more in local distribution capabilities driving further growth in the industrial real estate market particularly in cities such as Sydney, Melbourne, and Brisbane.

Retail Transformation and Experience-Based Retail Spaces

Though e-commerce challenges the traditional retail space, there is an upward trend toward experience-based retail environment. More traffic exists in the shopping malls and retail precincts that provide immersive, social, or entertainment-driven experiences. Landlords and developers are taking advantage of these shifts by repositioning the retail space to suit evolving consumer needs. Opportunities exist in repurposing vacant or underperforming spaces to create mixed-use developments that incorporate entertainment, dining, and experiential elements to attract shoppers. This trend aligns with the evolving demand for more dynamic and engaging retail environments.

Adaptive Reuse and Redevelopment Projects

The adaptive reuse of existing buildings provides a crucial window of opportunity in the commercial real estate market in Australia, especially in metropolitan areas. The diminishing demand for traditional office space is working in favor of developers who are converting older buildings into mixed-use developments, residential spaces, and creative office environments that can deliver good returns. Historic or old commercial buildings are thus being retrofitted in cities such as Sydney and Melbourne to minimize the environmental footprint of new construction and fulfill the demand for environmentally sustainable and flexible spaces. Incentives offered by the government further support the trend, making investment points and a growth corridor for these districts. Upon acceptance of adaptive reuse, developers can revive cities and enrich the environment and society.

Australia Commercial Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Rental

- Sales

The report has provided a detailed breakup and analysis of the market based on the type. This includes rental and sales.

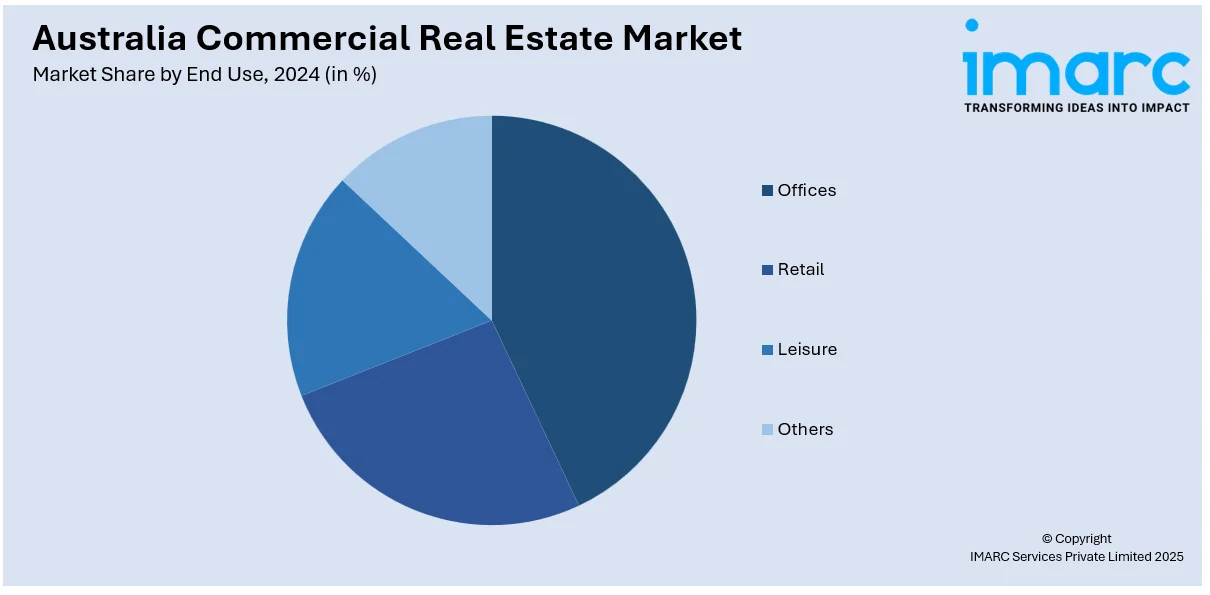

End Use Insights:

- Offices

- Retail

- Leisure

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes offices, retail, leisure, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Commercial Real Estate Market News:

- May 9, 2025: CoStar Group, a leading provider of commercial real estate information and analytics, finalized a binding agreement to buy the entirety of Domain Holdings, one of Australia's premier property marketplaces, for AUD 3.0 Billion. Following the earlier acquisition of a 17% stake at AUD 452 Million, CoStar will make a AUD 4.43 per share bid for the balance 83%, subject to shareholders' and regulators' approval. This strategic deal strengthens CoStar's international presence and reinforces Australia's commercial real estate digital infrastructure.

Australia Commercial Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rental, Sales |

| End Uses Covered | Offices, Retail, Leisure, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia commercial real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia commercial real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia commercial real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial real estate market in the Australia was valued at USD 11.96 Billion in 2024.

The Australia commercial real estate market is projected to exhibit a compound annual growth rate (CAGR) of 5.80% during 2025-2033.

The Australia commercial real estate market is expected to reach a value of USD 21.03 Billion by 2033.

The Australian commercial real estate market is seeing growth in industrial properties driven by e-commerce demand. Hybrid work models are shifting office space needs, with more flexible solutions sought. Sustainability in construction is increasingly prioritized, influencing demand for energy-efficient and eco-friendly buildings across sectors.

E-commerce expansion is a major driver, fueling demand for logistics and industrial spaces. Urbanization continues to increase demand for office, retail, and residential real estate in key cities. Additionally, government infrastructure projects are enhancing connectivity, which further supports real estate growth and investment opportunities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)