Australia Commercial Refrigeration Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Australia Commercial Refrigeration Market Overview:

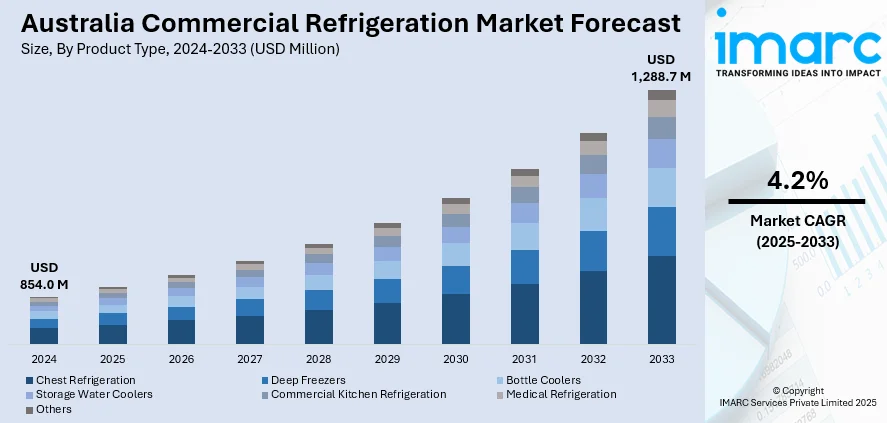

The Australia commercial refrigeration market size reached USD 854.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,288.7 Million by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. The market driven by demand for energy-saving solutions, new technology, and the critical importance of refrigeration across sectors including food retailing, healthcare, and hospitality, and all factors resulting in continued growth across the nation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 854.0 Million |

| Market Forecast in 2033 | USD 1,288.7 Million |

| Market Growth Rate 2025-2033 | 4.2% |

Australia Commercial Refrigeration Market Trends:

Emergence of Energy-Saving Refrigeration Solutions

There has been growing emphasis on sustainability that has influenced the Australian business market to transition aggressively towards energy-efficient refrigeration systems. Companies are now shifting to units incorporating inverter technology, enhanced thermal insulation, and sophisticated refrigerants to reduce power consumption. The solutions not only decrease operational expenditure but also complement national energy performance standards and green initiatives. Demand is strongest in food retail, hospitality, and healthcare, where energy-hungry refrigeration is required. Furthermore, smart control and Internet of Things (IoT) integrated systems are also increasing their appeal through energy monitoring and performance optimization in real-time. As Australia promotes low-emission technology across industries, energy-efficient refrigeration is also on the path to becoming standard rather than exceptional. For instance, in May 2024, Cold Logic introduced the world's first refrigeration system in Renmark, cutting the time to cool table grapes from 12-14 hours down to 40 minutes, further expanding the Australia commercial refrigeration market. Moreover, Australia commercial refrigeration market outlook captures this trend, looking for strong growth fueled by regulatory incentives and heightened long-term energy-saving awareness. These technologies will influence purchasing decisions through the next decade.

To get more information on this market, Request Sample

Expansion and Infrastructural Growth in Cold Chains

Australia's increasing dependence on temperature-sensitive products has prompted fast innovation in cold chain infrastructure, with its significant impact on commercial refrigeration requirements. The growing demand for perishable foods, drugs, and ready-to-eat meals has increased the demand for highly advanced refrigerating units with improved temperature control over storage and transport. The increasing trend has generated investment in city and regional installations, such as supermarkets, warehouse distribution centers, and medical storehouses. Greater cold chain logistics are not just enhancing food safety and public health but also opening up the export market diversification of Australia. Moreover, the demand for scalable and high-capacity refrigeration systems is accelerating. For example, in December 2024, Mitsubishi Electric introduced the MR-LX442EX compact French door refrigerator in Sydney, Australia, catering to the demands of small kitchen spaces with a 442L capacity, innovative cooling technology, and a 4.0 Star Energy Rating. Furthermore, Australia commercial refrigeration market share is witnessing steady growth in industries associated with cold chain expansion, such as food processing and retail medicines. Further development in transportation, warehousing, and monitoring technologies is anticipated to facilitate the industry's evolution, rendering efficient refrigeration an imperative component in the supply chain network.

Integration of Smart Technologies in Refrigeration Systems

Digital transformation is transforming commercial refrigeration in Australia by the application of intelligent technologies like IoT sensors, cloud-based monitoring, and artificial intelligence (AI) based diagnostics. These new technologies enable firms to track temperature, humidity, energy consumption, and equipment status in real-time, minimizing spoilage and unexpected downtime. In industries like retail, hospitality, and healthcare, the uptake of smart refrigeration provides operation transparency and ensures food safety regulatory compliance. Predictive maintenance via data analytics is becoming increasingly useful, enabling interventions ahead of time before mechanical failure can set in. Remote-access functionality is enhancing system management of multi-site operations. With decreasing costs and enhanced usability, uptake is accelerating with digital solutions. The Australia commercial refrigeration market growth trend is closely associated with this digital transition, facilitating smarter, more reactive operations that tie in with larger efficiency and automation agendas. This path is poised to reconfigure refrigeration management in the future.

Australia Commercial Refrigeration Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Chest Refrigeration

- Deep Freezers

- Bottle Coolers

- Storage Water Coolers

- Commercial Kitchen Refrigeration

- Medical Refrigeration

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes chest refrigeration, deep freezers, bottle coolers, storage water coolers, commercial kitchen refrigeration, medical refrigeration, and others.

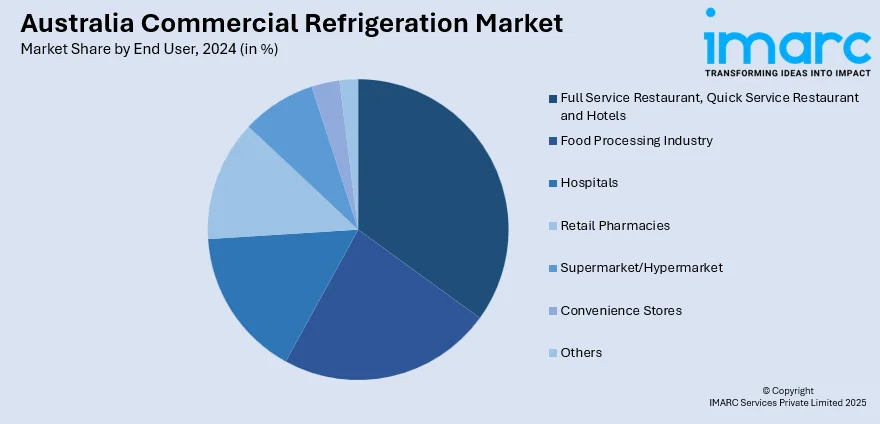

End User Insights:

- Full Service Restaurant, Quick Service Restaurant and Hotels

- Food Processing Industry

- Hospitals

- Retail Pharmacies

- Supermarket/Hypermarket

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes full service restaurant, quick service restaurant and hotels, food processing industry, hospitals, retail pharmacies, supermarket/hypermarket, convenience stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Commercial Refrigeration Market News:

- In July 2024, Honeywell collaborates with Actrol to supply energy-efficient, low-GWP refrigerant Solstice L40X (R-455A) for commercial refrigerators in Australia. The partnership reinforces the country's efforts to curb carbon emissions from high-GWP refrigerants and improve energy efficiency in supermarkets, restaurants, and other commercial refrigeration uses.

- In July 2024, UniSA researchers, in partnership with Glaciem Cooling Technologies, have designed a world-first energy-efficient refrigeration system currently installed at Coles, Norwood, SA. The system saves 19.6% of annual refrigeration energy consumption and 37% of peak electricity demand, providing substantial cost savings and lower greenhouse gas emissions.

Australia Commercial Refrigeration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chest Refrigeration, Deep Freezers, Bottle Coolers, Storage Water Coolers, Commercial Kitchen Refrigeration, Medical Refrigeration, Others |

| End Users Covered | Full Service Restaurant, Quick Service Restaurant and Hotels, Food Processing Industry, Hospitals, Retail Pharmacies, Supermarket/Hypermarket, Convenience Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia commercial refrigeration market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia commercial refrigeration market on the basis of product type?

- What is the breakup of the Australia commercial refrigeration market on the basis of end user?

- What is the breakup of the Australia commercial refrigeration market on the basis of region?

- What are the various stages in the value chain of the Australia commercial refrigeration market?

- What are the key driving factors and challenges in the Australia commercial refrigeration?

- What is the structure of the Australia commercial refrigeration market and who are the key players?

- What is the degree of competition in the Australia commercial refrigeration market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia commercial refrigeration market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia commercial refrigeration market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia commercial refrigeration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)