Australia Concrete Reinforcement Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Australia Concrete Reinforcement Market Overview:

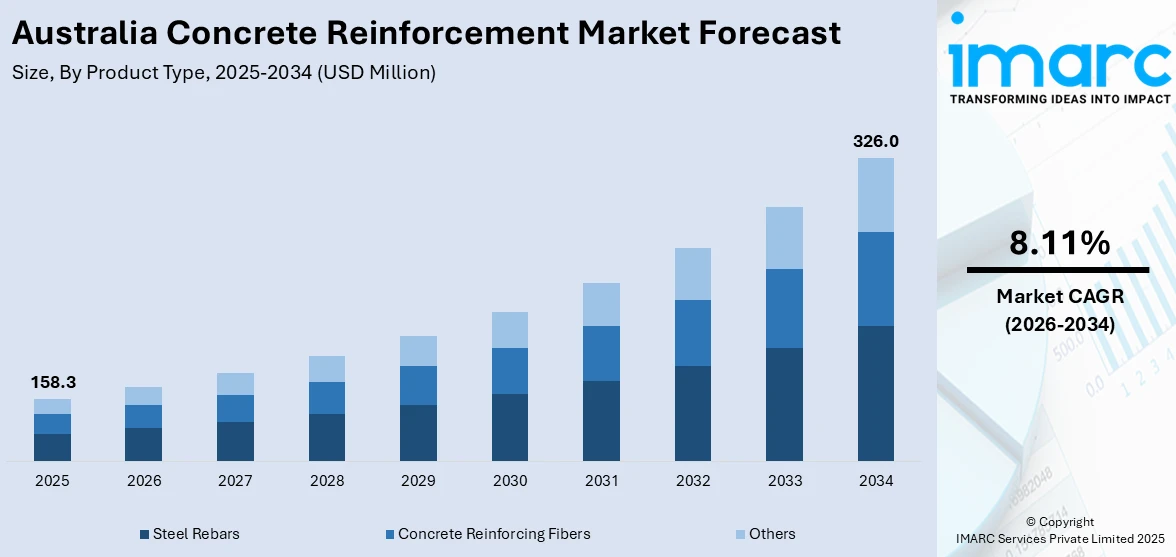

The Australia concrete reinforcement market size reached USD 158.3 Million in 2025. Looking forward, the market is expected to reach USD 326.0 Million by 2034, exhibiting a growth rate (CAGR) of 8.11% during 2026-2034. The market is driven by infrastructure expansion and the rise of prefabricated construction. Transport upgrades demand high-strength, durable materials, while modular building requires precision-engineered reinforcement for factory-assembled components. Together, these trends are reshaping reinforcement design and supply, supporting consistent demand through evolving project needs, regulatory compliance, and modern construction practices across the country, ultimately influencing the Australia concrete reinforcement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 158.3 Million |

|

Market Forecast in 2034

|

USD 326.0 Million |

| Market Growth Rate 2026-2034 | 8.11% |

Key Trends of Australia Concrete Reinforcement Market:

Infrastructure Expansion Across Transport and Urban Sectors

Australia's growing investment in infrastructure is catalyzing the demand for concrete reinforcement materials. Reinforced concrete is critical for high-load uses like roads, bridges, tunnels, and railways, where strength, durability, and adherence to national performance standards are mandatory. These initiatives depend on reinforcement elements, such as steel rods, welded wire fabrics, and fiber additives, to guarantee structural strength and enduring integrity. In 2025, the Australian Government allocated $17.1 billion for road and rail infrastructure in the 2025–26 Budget, reinforcing this trend further. The funding encompasses significant enhancements to the Bruce Highway, Sunshine Station, and several regional roads, with efforts extending across multiple states. Such extensive infrastructure planning facilitates steady procurement cycles, promoting local production and supply of reinforcement materials. Pre-cast and in-situ concrete structures are crucial to these projects, providing design and execution flexibility. As existing assets are upgraded and new ones are created to satisfy increasing transport needs, reinforced concrete remains the preferred material. The extent and permanence of these initiatives facilitate continuous building and supports the Australia concrete reinforcement market growth.

To get more information on this market Request Sample

Prefabrication and Modular Construction Trends

The increasing use of prefabricated and modular building techniques in Australia is influencing the market growth, leading to a transition toward products designed for off-site production. In modular building, components like walls, slabs, and beams are manufactured and strengthened in regulated factory settings prior to being delivered for assembly at the construction site. This approach requires highly accurate reinforcement elements, including tailored bars, pre-constructed cages, and welded grids, that adhere to rigorous dimensional precision and expedited installation timelines. Contractors gain from quicker construction schedules, fewer site workers, and minimized weather-induced setbacks. Reinforcement providers are adjusting by delivering factory-prepared solutions that incorporate smoothly with modular design. In 2025, the Commonwealth Bank of Australia (CBA) revealed its collaboration with prefabAUS, indicating institutional backing for the prefab industry. CBA launched updated lending policies allowing progress payments prior to homes being permanently attached to land, which is an initiative aimed at reducing financing obstacles and promoting greater acceptance of off-site housing. This advancement is anticipated to speed up modular home building and boost the demand for reinforcement materials appropriate for prefabrication methods. As both public and private sector initiatives expand modular implementation, reinforced concrete continues to be a fundamental structural material, providing the necessary strength and dependability for secure and lasting construction.

Growth Drivers of Australia Concrete Reinforcement Market:

Growth in Industrial Projects and Renewable Energy

Australia's shift to renewable energy and growth in its industrial base are playing a major role in driving demand for concrete reinforcement. As the nation speeds up the development of solar farms, wind power plants, and battery storage facilities, strong and resilient concrete structures are needed. Reinforced concrete foundations and structural support systems are essential to the stability of turbines, substations, and solar panel support structures, particularly in isolated or harsh environments. Likewise, investments in mining and processing plants, particularly in mineral-rich states such as Western Australia and Queensland, are heavy-duty reinforced concrete that supports high-load industrial applications. The emphasis on creating durable, low-maintenance infrastructure across these industries is fueling demand for high-strength reinforcement solutions such as steel and corrosion-resistant materials. These innovations present a solid growth trajectory for producers and suppliers of reinforced concrete products that fulfill Australia's industrial and renewable energy sector's specific structural requirements, which further contribute to the growing Australia concrete reinforcement market demand.

Population and Urbanization in Major Regions

Australia's cities are witnessing consistent growth in the population, specifically in cities like Sydney, Melbourne, Brisbane, and Perth. This population movement is compelling the growth of residential and commercial development to meet the growing need for housing, office space, schools, and healthcare centers. Concrete is still the preferred material for such structures because of its workability and structural load capacity, and rebar within that concrete is necessary to provide the longevity and safety level needed in densely populated urban areas. Further, the high-rise trend and the mixed-use development trend have made stronger and more reliable rebar systems necessary to bear vertically loaded structures and seismic loads. Government stimulus for increasing housing supply also fuels this demand. Developers are increasingly looking for quicker and cheaper building processes, and prefabricated reinforced concrete pieces are becoming increasingly popular as a result. These forces combined make population-driven urban growth a major driver of growth for Australia's concrete reinforcement industry.

Sustainability Push and Use of New Materials

According to the Australia concrete reinforcement market analysis, growing focus on sustainable building practices is forming the pattern of change in the concrete reinforcement industry. Since the nation is planning for decreased carbon emissions in the built environment, there is increasing interest in sustainable reinforcement options like recycled steel and fiber-reinforced polymers (FRP). These have lower environmental impact without sacrificing or even improving performance over traditional steel reinforcement. The green building programs of Australia, such as the Green Star certification and state-level sustainability policies, are promoting innovative construction methods and materials. Moreover, advances in design and materials science are making it possible to produce high-strength and corrosion-resistant reinforcement products, which are especially useful in coastal and high-salinity areas like some of Western Australia and Northern Queensland. The shift toward circular economy strategies and sustainable urban development offers long-term opportunities for producers and suppliers that are aligned with these environmental targets, supporting sustained expansion of the reinforcement segment.

Australia Concrete Reinforcement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and application.

Product Type Insights:

- Steel Rebars

- Concrete Reinforcing Fibers

- Polypropylene Fibers

- Steel Fibers

- Basalt Fibers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes steel rebars, concrete reinforcing fibers (polypropylene fibers, steel fibers, basalt fibers, and others), and others.

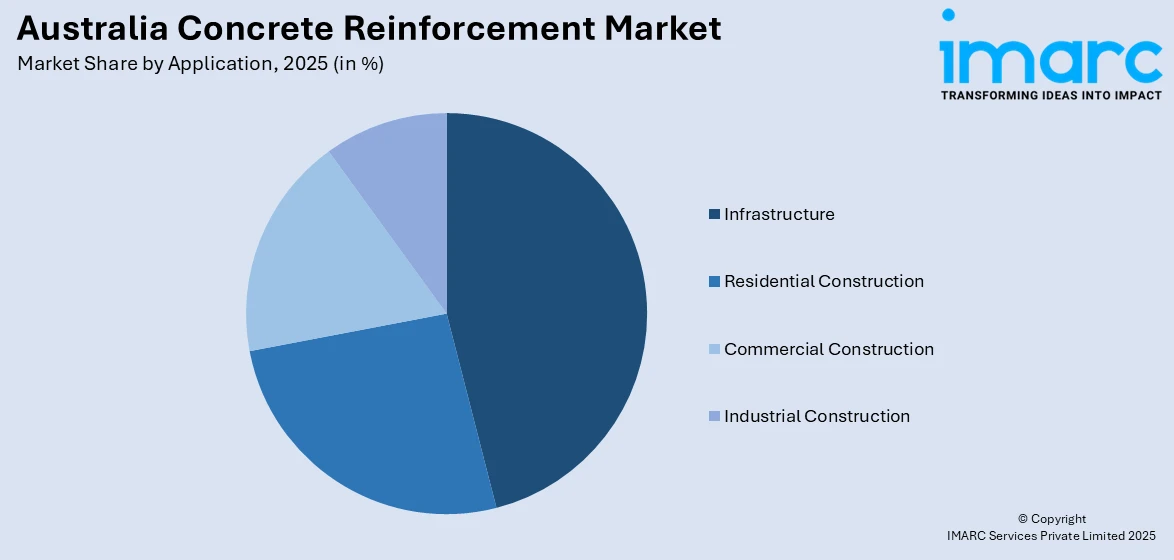

Application Insights:

Access the comprehensive market breakdown Request Sample

- Infrastructure

- Residential Construction

- Commercial Construction

- Industrial Construction

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes infrastructure, residential construction, commercial construction, and industrial construction.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Concrete Reinforcement Market News:

- In November 2024, Danbar launched Re-Poly RF47, a 100% recycled macro synthetic fiber designed for non-structural concrete reinforcement. Made in Australia from locally recycled plastic, it enhanced durability and supports sustainability.

- In October 2024, Green Steel Australia contracted Danieli to build the world’s first 100% gas-free rolling mill near Sydney. The facility will use hydrogen-powered burners to eliminate CO₂ emissions and produce 600,000 tons of rebar annually.

Australia Concrete Reinforcement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Infrastructure, Residential Construction, Commercial Construction, Industrial Construction |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia concrete reinforcement market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia concrete reinforcement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia concrete reinforcement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia concrete reinforcement market was valued at USD 158.3 Million in 2025.

The Australia concrete reinforcement market is projected to exhibit a CAGR of 8.11% during 2026-2034.

The Australia concrete reinforcement market is expected to reach a value of USD 326.0 Million by 2034.

Trends in Australia concrete reinforcement market include growing use of corrosion-resistant and high-strength materials, adoption of fiber-reinforced polymers, and increased demand for prefabricated components. Urban high-rise projects and renewable energy infrastructure further influence material design and application.

The Australia concrete reinforcement market is driven by rising infrastructure investments, rapid urbanization, and growth in renewable energy and industrial projects. Increasing demand for durable, high-performance materials in coastal and high-stress environments, along with a push for sustainable construction practices, continues to boost the need for advanced reinforcement solutions nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)