Australia Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

Australia Confectionery Market Overview:

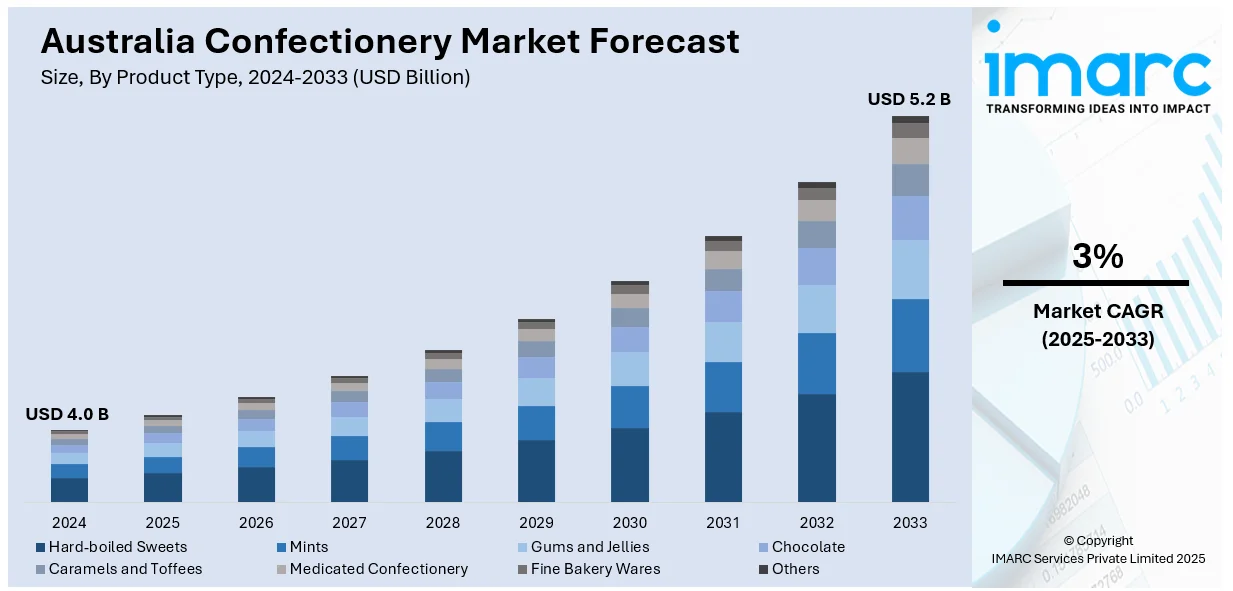

The Australia confectionery market size reached USD 4.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3% during 2025-2033. The market is seeing steady expansion due to high consumer demand, extensive availability of products, effective distribution, and rising exposure throughout retail channels, leading to steady performance nationwide without dependence on individual product categories or seasonal highs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.0 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Market Growth Rate 2025-2033 | 3% |

Key Trends of Australia Confectionery Market:

Innovation for Health-Conscious Consumers Reshaping Confectionery Choices

The Australia confectionary market outlook is changing as health-conscious consumers increasingly prefer products with less sugar, natural sweeteners, and functional benefits added. Products with ingredients like stevia, monk fruit, and dietary fibre are becoming popular among millennials, parents, and urban professionals. There is also interest in sweets that promote particular health outcomes, such as digestion, energy, or immunity without sacrificing taste. Portion control packs, calorie-packaged products, and "better-for-you" goods are faring well in all retail outlets. Companies are redesigning products to satisfy nutritional needs while retaining the indulgent draw that supports core confectionery sales. For example, in October 2024, ALDI Australia launched its limited-edition Sweet Haven Mini Churros in Apple & Cinnamon and Cocoa & Hazelnut flavours as part of a seasonal range with more than 40 new and returning confectionery and snack products. Furthermore, the growing presence of organic, vegan, and gluten-free confectionery products on retail shelves reflects a sustained shift in consumer preferences, rather than a transient trend. The Australian confectionery market is projected to experience continued growth, underpinned by wellness-oriented trends, as consumers increasingly seek indulgent options that align with their broader health and lifestyle considerations.

To get more information of this market, Request Sample

Premiumization and Gifting Driving Product Expansion

Premiumization keeps redefining the Australian confectionery industry, as people look for products that provide indulgence, but also taste, exclusivity, and beauty. Luxury chocolates, artisanal candies, and limited-time offers are trendy, especially during festive occasions, corporate functions, and personal achievements. Consumers are demanding higher quality ingredients, unique textures, and aesthetic packaging, with many prepared to pay a premium for sweets that serve as gifts or symbols of gratitude. For instance, in March 2023, Nestlé Australia unveiled a limited-edition KitKat Milkybar union, combining crunchy wafer with smooth white chocolate, a novel combination of two favorite confectionery treats under its iconic brand. Moreover, the trend has created growth in boutique confectionery stores, internet customization sites, and expertly curated gift box schemes. Confectionery is increasingly becoming a luxury food category, rather than an every-day snack. Upscaling by packaging design and flavor innovation is a major strategy among both established and new brands. Australia confectionery market share is growing in the premium segment, as consumers perceive sweets not only as food but as an experience of refined and customized consumption.

Sustainability and Ethical Sourcing Gaining Traction

Environmental and social responsibility are playing an increasingly significant role in shaping purchasing decisions within Australia confectionery market. Consumers are giving greater attention to the sourcing of ingredients, packaging of products, and working conditions of supply chain members. Recyclable packaging, compostable packaging, and single-use plastic reductions are now expected across retail channels. Cocoa that comes from fair-trade or traceable schemes is gaining increased demand, with customers positively reacting to transparent ethical labelling and sustainability guarantees. Confectionery with such standards is typically preferred, even at premium prices. Companies are also adopting carbon offsetting, local sourcing, and energy-efficient manufacturing to cater to consumer expectations and regulatory updates. Sustainability messaging is shaping brand loyalty, especially among younger and urban consumers. Australian confectionery development is increasingly linked to sustainability, as values and environmental footprint have a greater influence on what constitutes value and trust in an otherwise hedonistic product category.

Growth Drivers of Australia Confectionery Market:

Cultural Affinity for Indulgence

Australians have a deep cultural predisposition towards rich snack foods and desserts, which continues to be a driving force in the confectionery industry. Confections like chocolates, sugar confectionery, and gums continue to be well-liked, with consumers frequently linking them to comfort, celebration, and daily indulgence. This deep-seated inclination creates a consistent and robust demand base, even in times of economic downturn. Confectionery is closely associated with social routine, gifting, and festive periods, further underpinning regular sales across categories. Even though tastes are changing, indulgence continues to be at the center of buying decisions, enabling both incumbent and new brands to succeed. Such cultural affinity not only perpetuates the market but also provides opportunities for innovation specific to consumers' need for memorable, indulgent experiences.

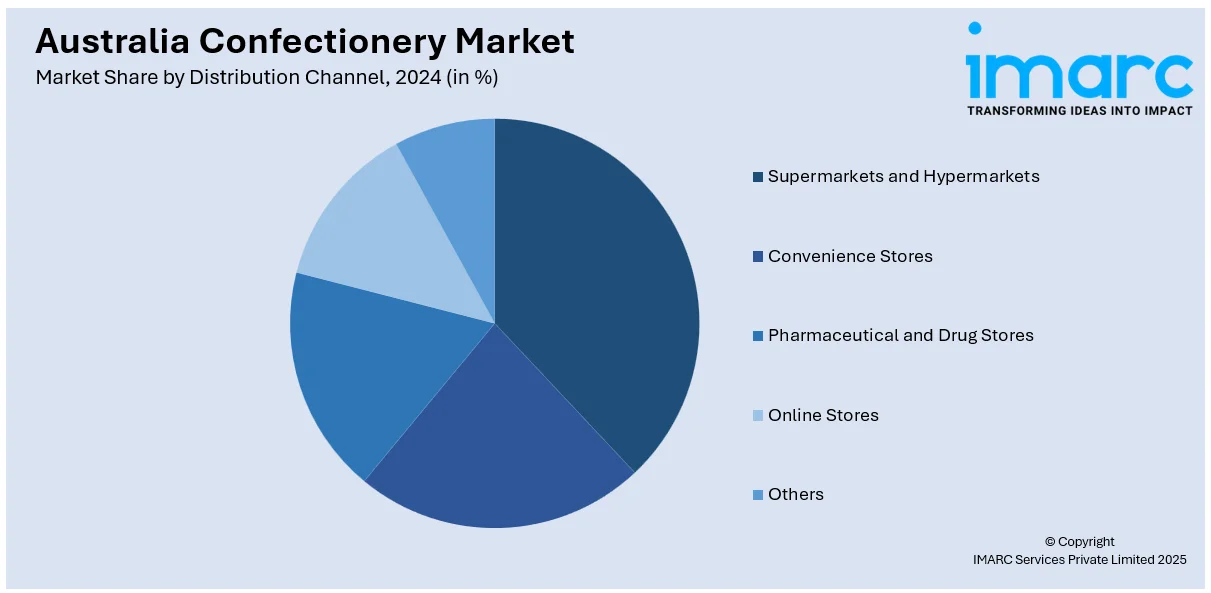

Expanding Retail Channels

The expansion of retail channels in Australia is significantly boosting the Australia confectionery market demand. Supermarkets, convenience stores, and specialty outlets continue to be strong sales contributors, while the rapid rise of online platforms is enhancing product accessibility across both urban and regional areas. E-commerce and digital retail innovations allow brands to directly engage with consumers, offering subscription boxes, bundle deals, and personalized promotions. Convenience channels further encourage impulse purchases, especially through strategic product placement near checkout counters. The combination of offline and online distribution ensures that confectionery products are available whenever and wherever consumers desire. This omnichannel growth strengthens brand reach, drives higher consumption, and provides companies with greater opportunities to capture diverse consumer segments with targeted offerings.

Flavor Innovation and Limited Editions

Flavor innovation and limited-edition releases are powerful growth drivers in the Australian confectionery market. Consumers, particularly younger demographics, actively seek unique and adventurous taste experiences, making bold flavor pairings and global inspirations increasingly popular. Seasonal launches tied to holidays, festivals, and special events create excitement, encouraging consumers to try new products while driving impulse purchases. Limited-edition variants also generate a sense of exclusivity, motivating repeat purchases and fostering brand loyalty. This constant stream of innovation keeps the market dynamic and competitive, enabling brands to stand out amid strong rivalry. By blending novelty with familiarity, confectionery companies can maintain consumer interest, attract trend-focused buyers, and strengthen long-term engagement through evolving product experiences.

Opportunities of Australia Confectionery Market:

Digital Marketing and E-commerce Growth

The rapid growth of digital marketing and e-commerce is reshaping opportunities in the Australian confectionery market. Online platforms enable brands to connect directly with consumers through targeted campaigns, personalized promotions, and interactive content. Subscription models and curated bundles are gaining traction, offering convenience and enhancing customer loyalty. Social media further amplifies brand reach, allowing companies to showcase new launches, seasonal editions, and behind-the-scenes stories that appeal to younger, tech-savvy audiences. E-commerce also makes it easier for consumers in regional and remote areas to access a wider variety of confectionery products, bridging availability gaps. With increasing reliance on digital engagement, confectionery brands can build stronger relationships, expand visibility, and capture evolving consumer preferences through innovative online experiences and convenient shopping options.

Functional and Fortified Confectionery

Functional and fortified confectionery presents a strong opportunity in Australia as health-conscious consumers seek indulgence with added benefits. Products enriched with vitamins, minerals, proteins, or energy-boosting ingredients allow brands to cater to demand for healthier snacking options without compromising on taste. According to the Australia confectionery market analysis, this shift has created a hybrid category where indulgence meets wellness, attracting a growing audience of fitness enthusiasts, busy professionals, and parents seeking nutritious treats for children. Fortified chocolates, sugar-free gums with added minerals, or candies infused with functional botanicals are examples of products gaining traction. By positioning such items as convenient, guilt-free indulgences, confectionery companies can differentiate themselves from traditional offerings, open new revenue streams, and establish a competitive edge in a market where balanced lifestyles increasingly influence buying behavior.

Tourism and Export Potential

Tourism and export expansion represent valuable opportunities for the Australian confectionery market. With millions of international visitors annually, Australia can showcase its premium chocolates, artisanal sweets, and uniquely flavored products as part of its cultural experience. Tourists often purchase confectionery as souvenirs, enhancing brand visibility and driving seasonal sales. Additionally, Australia’s strong trade ties and global reputation for quality food products create pathways to expand into international markets, especially in Asia-Pacific regions where demand for premium and Western-style confectionery is rising. Exporting distinctive flavors inspired by local ingredients also gives Australian brands a unique competitive edge abroad. By leveraging both tourism-driven demand and international trade, confectionery producers can extend their reach, strengthen global brand presence, and unlock new long-term growth opportunities.

Challenges of Australia Confectionery Market:

Stringent Health Regulations

Stringent health regulations pose significant challenges to confectionery manufacturers in Australia. Growing government scrutiny over sugar content, calorie counts, and the use of artificial additives has placed pressure on brands to reformulate products. Restrictions on advertising, particularly targeting children, further complicate marketing strategies and limit brand outreach. Mandatory labeling requirements, such as clear nutritional disclosures, push companies to be more transparent while increasing compliance costs. These measures, while aimed at promoting public health, create operational hurdles for producers who must balance indulgence with responsibility. Adapting to these regulations often requires investment in research and product development, reformulation processes, and consumer education campaigns. Brands that fail to comply risk reputational damage, loss of trust, and reduced competitiveness in an already crowded market.

Rising Input Costs

Rising input costs are a major concern for the Australian confectionery market, impacting both profitability and pricing strategies. Volatile global prices of key raw materials like cocoa, sugar, and dairy directly affect production expenses. In addition, packaging costs are rising due to increasing demand for sustainable materials and higher energy prices. Manufacturers are often forced to absorb part of these expenses, squeezing margins, or pass them on to consumers, risking reduced affordability and sales. Smaller local brands, in particular, face greater financial strain as they lack the economies of scale enjoyed by multinational players. These cost pressures highlight the need for supply chain efficiency, strategic sourcing, and innovative packaging solutions to maintain competitiveness without compromising product quality or consumer trust.

High Market Competition

The Australian confectionery market faces intense competition due to the presence of global giants and well-established local brands. International companies bring vast resources, large-scale distribution, and advanced marketing campaigns, while domestic players leverage local preferences, innovation, and regional loyalty. This competitive mix forces all brands to continuously differentiate through flavor innovation, product positioning, and brand storytelling. Aggressive marketing, frequent new launches, and price wars often dominate the landscape, creating challenges for smaller entrants attempting to gain visibility. Maintaining consumer loyalty is difficult as buyers are quick to experiment with new flavors and products. To thrive, companies must invest in innovation, personalized marketing, and sustainable practices while balancing affordability, thereby standing out in a crowded and fast-evolving confectionery space.

Australia Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Confectionery Market News:

- In March 2025, Woolworths and Coles answered skyrocketing demand for pistachio-flavored products by growing their range, such as Pistachio Cheesecake and Messina Pistachio Praline gelato, indicating increasing consumer desire for nut-based flavor trends in Australia's confectionery and dessert markets.

- In January 2024, Mars Wrigley introduced M&M'S Cookie Dough to the Australia region, with the move representing a world-first innovation created by its Ballarat Innovation Hub. The treat features a genuine cookie dough centre surrounded by M&M shells, addressing the demand for flavour and texture diversity in confectionery and evidencing Australia's domestic product development capabilities.

Australia Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The confectionery market in Australia was valued at USD 4.0 Billion in 2024.

The Australia confectionery market is projected to exhibit a CAGR of 3% during 2025-2033.

The Australia confectionery market is projected to reach a value of USD 5.2 Billion by 2033.

The Australia confectionery market is shaped by rising demand for premium and artisanal products, growing popularity of healthier options with reduced sugar and natural ingredients, and strong consumer preference for innovative flavors. Seasonal sales, sustainable packaging, and the expansion of online retail channels are further influencing purchasing patterns and brand strategies.

Growth in the Australia confectionery market is driven by rising consumer demand for indulgent treats, increasing popularity of premium and innovative flavors, and growing preference for healthier, low-sugar alternatives. Expanding retail distribution, e-commerce adoption, and a strong gifting culture further support sustained market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)