Australia Connected Car Market Size, Share, Trends and Forecast by Technology, Connectivity Solution, Service, End Market, and Region, 2026-2034

Australia Connected Car Market Overview:

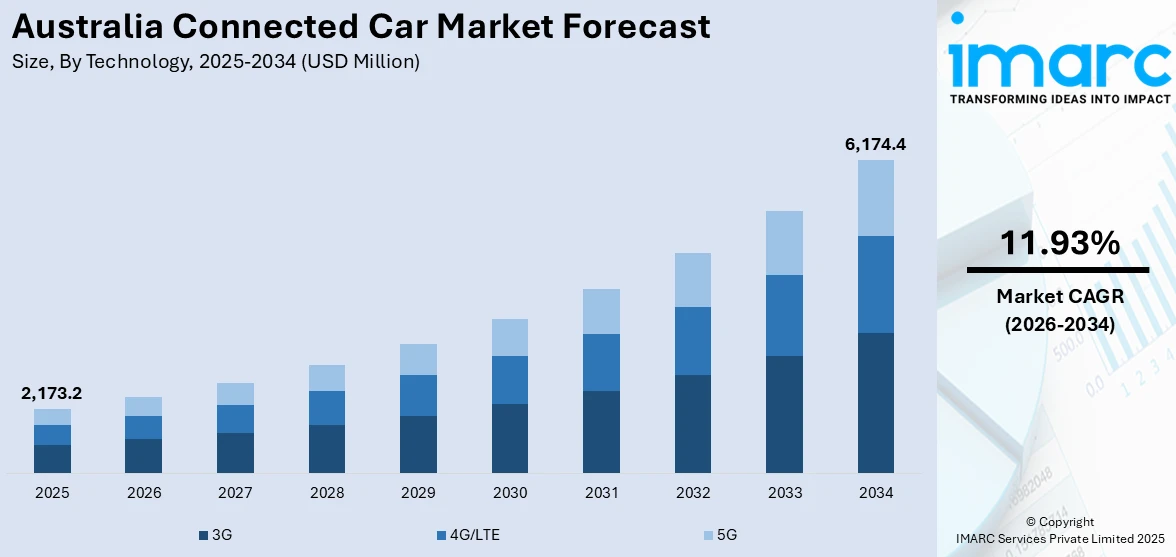

The Australia connected car market size reached USD 2,173.2 Million in 2025. Looking forward, the market is expected to reach USD 6,174.4 Million by 2034, exhibiting a growth rate (CAGR) of 11.93% during 2026-2034. The growth of the market is driven by expanding 5G connectivity, enabling real-time navigation and over-the-air updates. Government support for smart transportation and IoT integration accelerates development. Additionally, automakers are shifting toward subscription-based models, offering flexible, personalized services. Increasing consumer demand for advanced safety and infotainment features is further expanding the Australia connected car market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,173.2 Million |

| Market Forecast in 2034 | USD 6,174.4 Million |

| Market Growth Rate 2026-2034 | 11.93% |

Key Trends of Australia Connected Car Market:

Growth in 5G-Enabled Connected Car Services

A significant growth in the market is being witnessed as a result of the spread of 5G networks. High-end features such as real-time navigation, OTA software updates, and enhanced vehicle-to-everything (V2X) communication are dependent on the faster data speed and lower latency of 5G. Hence, the automotive players and telematics service providers are incorporating 5G connectivity to enhance safety, entertainment, and autonomous driving capabilities. Additionally, telecom providers are investing in 5G infrastructure, further supporting the adoption of connected car technologies. As of January 2024, Australia's 5G infrastructure is growing, led by Telstra with 5,082 sites, then Optus with 4,038, and TPG with 3,050. The rollout is concentrated in large cities, where 66.3% of Telstra's sites now support 5G. The expansion supports Australia's connected cars market by enhancing network capacity to enable fast and low-latency communication between cars. The demand for seamless in-car connectivity, including high-definition streaming and cloud-based services, is driving this trend. As 5G coverage expands across urban and regional areas, more consumers are opting for connected vehicles, propelling the Australia connected car market growth. Government initiatives promoting smart transportation and IoT integration are also accelerating this shift, marking 5G as a key driver in the market.

To get more information on this market Request Sample

Rising Adoption of Electric Vehicles (EVs) with Connected Features

The rise of electric vehicles (EVs) in Australia is supporting the growth of connected car technologies. In 2024, Australia recorded an all-time high in electric vehicle (EV) sales at 114,000 units, of which 91,000 were battery electric vehicles (BEVs) and 23,000 plug-in hybrids (PHEVs), accounting for 9.65% of the market. This is up from 8.45% in 2023 and highlights the increasing consumer demand brought about by improved infrastructure and more models on offer. The shift to EVs is instrumental for the networked car market, as it raises the requirement for intelligent automotive technology and connectedness in networks. The growing popularity of EVs with embedded connectivity features offering real-time battery monitoring, charging station locators, and energy optimization is credited to the increasing adoption of sustainable mobility by consumers as well as businesses. To improve the EV ownership experience, manufacturers are adding increasingly advanced telematics to the vehicles in order to offer features such as remote climate control as well as predictive maintenance. This is also being encouraged by government incentives to accelerate EV adoption, as well as a growth in charging infrastructure overall. Furthermore, fleet operators also started utilizing connected EVs for better fuel management and route optimization. In Australia, electrification and connectivity are a significant interplay in the process toward the automotive landscape as a smart, data-driven corpus of EVs that are turning into a mainstream trend in the market.

Growth Drivers of Australia Connected Car Market:

Government Efforts and Infrastructure Development

One of the major drivers of growth for the connected car market in Australia is the active initiative of the government toward promoting digitalization in the transportation industry. The Australian Government has been proactively engaging in the efforts for implementing intelligent transport systems (ITS), with specific emphasis on vehicle-to-everything (V2X) communication technologies. These efforts have the goal of improving road safety, alleviating congestion, and improving the overall traffic efficiency of cities. Australia's drive toward developing "smart cities" has also helped to finance 5G infrastructure development, which will be integral to real-time data sharing within connected vehicles. Further, government support in collaborating with industry players for trials of autonomous and connected vehicles shows a sharp direction toward adoption. The regulatory backing for innovation in the form of regulatory sandboxes and agile testing environments provides a special arena where automobile manufacturers and technology firms can collaborate to advance new mobility solutions adapted to Australia's extensive geographical extent and diverse road conditions.

Urbanization and Shifting Consumer Expectations

The region’s fast-developing urban population and transforming consumer behaviors have emerged as central to shaping the Australia connected car market demand. As increasing numbers of Australians move toward urban lifestyles, pressure for intelligent and efficient transport has grown. Contemporary consumers on the continent are increasingly looking for convenience, safety, and online connectivity on wheels, which mirrors international trends yet also manifests differently in its regional characteristics. The ascendancy of apps-based services like tracking, predictive maintenance, and entertainment systems reflects the techno-savviness of Australian urbanites. In addition, increased demand for electric vehicles (EVs), particularly in urban areas such as Sydney and Melbourne, is compelling carmakers to make connected technology standard. The consumers in Australia also take into account the complexities of long-distance travel over vast unpopulated regions, which makes real-time guidance, connectivity, and over-the-air diagnostics especially desirable. This call for smart features is remaking the automotive landscape, compelling makers to address local demands through high-end technological assimilation.

Automotive-Tech Sector Collaboration

The convergence of the Australian automotive and technology industries has created a thriving ecosystem enabling the development of connected cars. Domestic collaborations between automotive makers, telcos, and tech companies are cultivating innovation specific to the Australian market. Advanced driver assistance systems (ADAS) and over-the-air (OTA) updates that improve vehicle performance in remote locations are two examples of technologies that companies are investigating to meet both urban and out-of-town needs. The comparatively high rate of penetration of smartphones and digital devices in Australia also facilitates the take-up of connected services like app-based vehicle control and smart diagnostics. In addition, institutions of higher learning and research universities throughout Australia are engaged in the development of autonomous system, machine learning, and cybersecurity technologies, all essential to the future of connected cars. The ability to field test and iterate these technologies throughout Australia's wide variety of geography, from coastal metropolises to the outback, is a unique benefit, and the area becomes a living laboratory for mobility solutions of the future.

Opportunities of Australia Connected Car Market:

Rollout of Connected Solutions in Remote and Regional Regions

Australia's huge geography and limited population outside major centers provide the ideal situation to expand connected car technology suited to remote and regional environments. In contrast to dense countries, a large percentage of the Australian population is remote from metropolitan areas, with vehicles needing to travel enormous distances through often harsh and remote country. This provides a compelling use case for features like real-time diagnostics, satellite navigation, emergency support, and predictive maintenance systems that can function effectively in regions of limited infrastructure. The opportunity is to design robust, resilient connectivity solutions that can keep vehicle-to-network communication going even in the most rural areas of the country. Additionally, fleet owners in mining, agriculture, and logistics, which are industries that are significant in regional Australia, are shifting toward connected vehicle technologies to maximize operations, monitor assets, and guarantee safety. This presents considerable market potential for automotive manufacturers and connectivity-focused tech businesses.

Convergence with Emergent Smart City Ecosystems

According to the Australia connected car market analysis, investment in smart city initiatives is steadily on the rise, presenting a rich environment for connected car technologies to flourish. Urban areas like Melbourne, Sydney, and Brisbane are transforming into digitalized ecosystems where transport plays a central role. With the deployment of intelligent traffic management technologies by these cities, connected vehicles can feature centrally in minimizing congestion, enhancing commuter safety, and facilitating real-time urban transport data collection. Opportunities exist for carmakers and technology providers to align their offerings with city-level infrastructure, such as vehicle-to-infrastructure (V2I) communication systems, smart traffic lights, and adaptive traffic control. These integrations benefit individual vehicle owners and support public transportation systems and urban planning strategies. With Australia's unique challenges of bushfire areas and seasonal flooding, vehicle-to-everything connected cars with environment-responsive routing and hazard detection technology can also help deliver safer, more intelligent city mobility, further boosting the resilience and sustainability of urban transport networks.

Local Innovation and Export Potential

Australia's robust research capacity and expanding tech startup community offer significant potential for developing and exporting connected car innovations to the world. Universities and research institutions nationwide are creating innovations in artificial intelligence, vehicle automation, and telematics that can be applied to the real world in the context of connected vehicles. These domestic technologies can be applied to domestic and international automotive platforms, particularly in markets with comparable geographic and demographic issues. The potential is unlimited to local adoption, and places Australia as a participant in the international connected car value chain. Local companies are also exploring niche solutions for areas such as rural mobility, road safety, and real-time emergency response systems, which are areas where Australian expertise, informed by real-world conditions, can be particularly valuable. Additionally, government support for tech export initiatives and international partnerships enables Australian-developed connected car solutions to reach broader markets, enhancing the country’s reputation as a hub for automotive innovation in the Asia-Pacific region and beyond.

Challenges of Australia Connected Car Market:

Geographic and Connectivity Limitations

One of the biggest difficulties for the connected car market in Australia is the nation's huge and thinly populated geography, which presents serious challenges to sustained and reliable connectivity. Although cities such as Sydney, Melbourne, and Brisbane enjoy relatively sophisticated telecommunications infrastructure, much of the region remains plagued by patchy network coverage. This presents a significant obstacle to mass adoption of connected car technologies, especially those in constant need of an internet connection like real-time navigation, over-the-air software updates, and vehicle-to-everything (V2X) communications. Australia's use of mobile networks for connectivity also has the effect of outages caused by natural phenomena like bushfires or storms blocking services in entire areas over long periods of time. To make connected cars effective nationwide, a lot of investment needs to be made in rural network infrastructure, which could turn out to be commercially unviable in low-density areas. This geographical limitation is still limiting the scalability of connected car services in Australia.

Data Privacy and Cybersecurity Issues

The more advanced connected cars become, the more concerns related to data privacy and cybersecurity have arisen in Australia. As cars gather, process, and send sensitive data, anything from driver behavior to travel history, the way this data is stored, exchanged, and secured has become of prime interest. Consumers in Australia are getting concerned about who is accessing their private driving records, particularly in the wake of previous hacks in other sectors. The Australian regulatory environment is changing, yet it still lacks clarity and consistency regarding data governance in the automotive industry. This brings about uncertainty among consumers and automakers, who are faced with having to comply with intricate requirements without a fully established legal environment. Furthermore, the vulnerability of connected vehicles to cyberattacks gives rise to concerns related to safety, particularly when technologies are used to manage core systems such as braking, steering, or engine performance. It is important to address these concerns in order to develop trust and promote adoption in the Australian market.

High Cost of Adoption and Market Readiness

The cost barrier related to connected vehicle technologies is another main challenge in the Australian market. Advanced connectivity features tend to cost more, so connected cars are out of reach for a broad segment of the population. This is especially true in a market such as Australia, where it is common for people to own cars, yet customers tend to be budget-conscious, particularly in regional areas where cars are used for utility than for luxury. Also, the absence of a mature second-hand market for connected cars hinders these technologies from penetrating beyond the new car purchasing segment. Adding another layer to this issue is the preparedness of the local automotive service sector. A great number of workshops and mechanics around Australia, especially those in non-urban regions, are not yet prepared to deal with diagnostics or maintenance of connected vehicles. This is creating reservations among customers who are not sure about long-term support. The high initial cost and unclear service picture hinder the adoption rate and restrict the potential of the market to grow.

Australia Connected Car Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology, connectivity solution, service, and end market.

Technology Insights:

- 3G

- 4G/LTE

- 5G

The report has provided a detailed breakup and analysis of the market based on the technology. This includes 3G, 4G/LTE, and 5G.

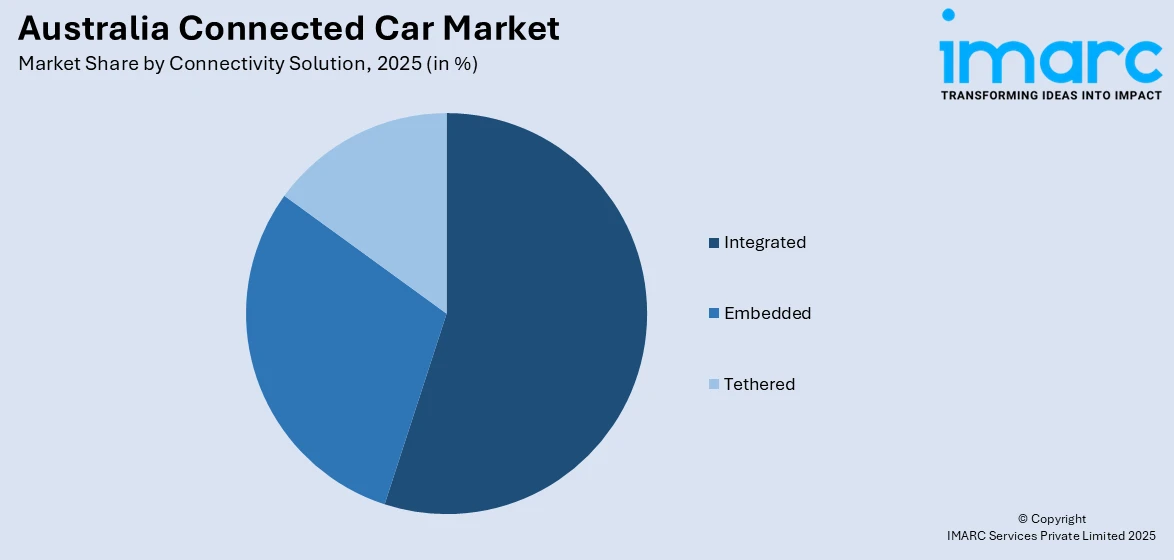

Connectivity Solution Insights:

Access the comprehensive market breakdown Request Sample

- Integrated

- Embedded

- Tethered

A detailed breakup and analysis of the market based on the connectivity solution have also been provided in the report. This includes integrated, embedded, and tethered.

Service Insights:

- Driver Assistance

- Safety

- Entertainment

- Vehicle Management

- Mobility Management

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes driver assistance, safety, entertainment, vehicle management, mobility management, and others.

End Market Insights:

- Original Equipment Manufacturer (OEMs)

- Aftermarket

A detailed breakup and analysis of the market based on the end market have also been provided in the report. This includes original equipment manufacturer (OEMs) and aftermarket.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Connected Car Market News:

- February 11, 2025: Renault Australia completed local tests of its totally redesigned Captur SUV, launching in the latter part of 2025. The vehicle will be the first Renault car available in Australia to include connected car services, such as Google Maps with real-time traffic updates, over-the-air software updates, and voice operation through Google Assistant. The Captur is anticipated to provide world-class technology, a spacious interior, and upgraded electronic safety features.

- May 07, 2024: Telstra partnered with Honda to provide enhanced connectivity for the recently launched Honda Accord in Australia, including Google built-in services including Google Maps, Assistant, and Play through Telstra's mobile network. This enhanced connectivity offers features such as real-time traffic information, vehicle telemetry data, and upcoming Vehicle-to-Everything (V2X) technology. This partnership is a significant step forward in connected car experiences, combining Telstra's IoT expertise with Honda's innovative spirit for a seamless in-car experience.

Australia Connected Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | 3G, 4G/LTE, 5G |

| Connectivity Solutions Covered | Integrated, Embedded, Tethered |

| Services Covered | Driver Assistance, Safety, Entertainment, Vehicle Management, Mobility Management, Others |

| End Markets Covered | Original Equipment Manufacturer (OEMs), Aftermarket |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia connected car market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia connected car market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia connected car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia connected car market was valued at USD 2,173.2 Million in 2025.

The Australia connected car market is projected to exhibit a CAGR of 11.93% during 2026-2034.

The Australia connected car market is expected to reach a value of USD 6,174.4 Million by 2034.

The Australia connected car market is experiencing trends like rising integration of vehicle-to-everything (V2X) technology, increased adoption of electric and autonomous vehicles, and growing demand for in-car infotainment and telematics. Smart city developments and 5G expansion are also influencing connectivity solutions tailored for both urban centers and remote regional areas.

The Australia connected car market is driven by government support for smart transport systems, growing urbanization, and increasing consumer demand for safety and convenience. Expanding 5G infrastructure and collaboration between automotive and tech industries further accelerate adoption, while the country's diverse terrain fosters innovation in connectivity and vehicle-to-everything (V2X) technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)