Australia Connected Vehicles Market Size, Share, Trends and Forecast by Technology, Application, Connectivity, Vehicle Connectivity, Vehicle, and Region, 2025-2033

Australia Connected Vehicles Market Overview:

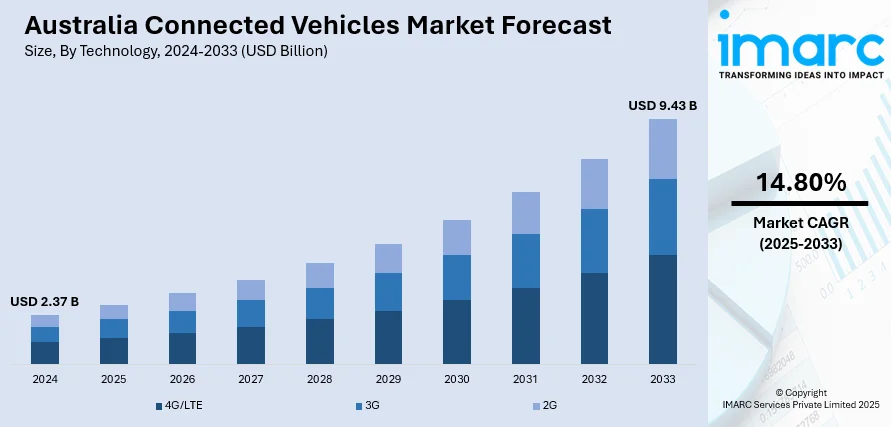

The Australia connected vehicles market size reached USD 2.37 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.43 Billion by 2033, exhibiting a growth rate (CAGR) of 14.80% during 2025-2033. The market is driven by the growing consumer demand for sophisticated safety features and improved driving experiences in connected cars. Furthermore, the rollout of government initiatives and smart infrastructure investments, coupled with growing 5G connectivity adoption, are driving connected technology integration in the automotive industry. The increasing emphasis on relieving traffic congestion, enhancing road safety, and optimizing vehicle-to-vehicle communication are also expanding the Australia connected vehicle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.37 Billion |

| Market Forecast in 2033 | USD 9.43 Billion |

| Market Growth Rate 2025-2033 | 14.80% |

Australia Connected Vehicles Market Trends:

Integration of 5G Connectivity in Connected Vehicles

One of the key trends in the market is the integration of 5G connectivity, which is creating a positive market outlook. The rollout of 5G networks brings significant improvements in communication speed, latency, and reliability, factors facilitating the efficient functioning of connected vehicles. With enhanced network capabilities, vehicles can exchange real-time data, facilitating features like vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, which are essential for safety and traffic management. As of January 31, 2024, Australia's 5G infrastructure is expanding, with Telstra leading the way with 5,082 sites, followed by Optus with 4,038 and TPG with 3,050. This widespread coverage is providing a strong foundation for the expansion of connected vehicle technologies throughout the country, supporting easier interlinking of sophisticated systems and encouraging the use of autonomous and intelligent driving solutions. Additionally, 5G facilitates faster data exchange between cars, allowing them to receive information about road conditions, traffic flow, and areas with frequent accidents. These features enable better decision-making and help in minimizing road traffic as well as accidents. Besides this, the initiatives of the Australian government to increase 5G infrastructure in urban as well as rural areas are fueling the adoption process of this technology. Apart from this, the Australian government's efforts to expand 5G infrastructure across urban and rural regions are accelerating the adoption of this technology, which is providing a boost to the Australia connected vehicles market growth.

To get more information on this market, Request Sample

Growing Consumer Demand for Advanced Safety and Infotainment Features

The growing consumer preference for enhanced in-vehicle experiences and advanced safety features is propelling the expansion of the market in Australia. In an industry survey conducted among 562 residents in Melbourne, 47% of people said that autonomous cars will ease driving workload, indicating that Australians are increasingly interested in autonomous technology. Such a surge in customer demand is leading to a higher need for vehicles integrated with contemporary technologies, like autonomous driving ability, advanced driver-assistance systems (ADAS), and intelligent infotainment systems. Based on real-time data exchange and connectivity, such features provide increased safety through minimal human errors and improved vehicle performance. Moreover, connected vehicles equipped with ADAS can provide functions such as automatic emergency braking, lane-keeping assistance, and adaptive cruise control, thereby helping prevent accidents and ensuring a safer driving environment. At the same time, consumers are also looking for seamless integration of smartphones, voice assistants, and entertainment options within their vehicles. With connectivity being an integral feature across new car models, manufacturers are aiming to provide sophisticated technological solutions to cater to these consumer needs. The demand for improved safety, along with infotainment, is a key growth driver for the market.

Australia Connected Vehicles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, application, connectivity, vehicle connectivity, and vehicle.

Technology Insights:

- 4G/LTE

- 3G

- 2G

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes 4G/LTE, 3G, and 2G.

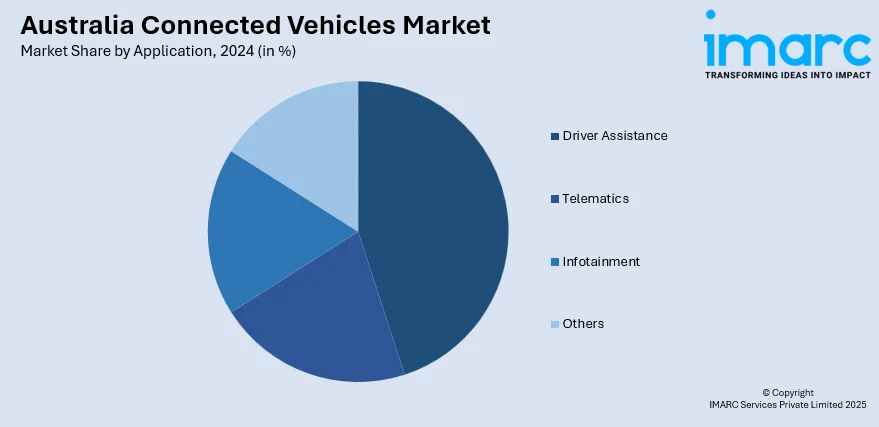

Application Insights:

- Driver Assistance

- Telematics

- Infotainment

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes driver assistance, telematics, infotainment, and others.

Connectivity Insights:

- Integrated

- Embedded

- Tethered

A detailed breakup and analysis of the market based on the connectivity have also been provided in the report. This includes integrated, embedded, and tethered.

Vehicle Connectivity Insights:

- Vehicle to Vehicle (V2V)

- Vehicle to Infrastructure (V2I)

- Vehicle to Pedestrian (V2P)

The report has provided a detailed breakup and analysis of the market based on the vehicle connectivity. This includes vehicle to vehicle (V2V), vehicle to infrastructure (V2I), and vehicle to pedestrian (V2P).

Vehicle Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle. This includes passenger cars and commercial vehicles.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Connected Vehicles Market News:

- On May 15, 2025, Main Roads Western Australia, in collaboration with Kapsch TrafficCom, announced the successful completion of a trial for connected vehicle technology on Perth's roads. The trial demonstrated that both the Cooperative Intelligent Transport Systems (C-ITS) technology and Western Australia's road infrastructure are prepared for widespread deployment, aiming to enhance road safety and efficiency. Kapsch highlighted that such technology enables real-time communication between vehicles and infrastructure, potentially reducing fatalities and serious accidents.

Australia Connected Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | 4G/LTE, 3G, 2G |

| Applications Covered | Driver Assistance, Telematics, Infotainment, Others |

| Connectivities Covered | Integrated, Embedded, Tethered |

| Vehicle Connectivities Covered | Vehicle to Vehicle (V2V), Vehicle to Infrastructure (V2I), Vehicle to Pedestrian (V2P) |

| Vehicles Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia connected vehicles market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia connected vehicles market on the basis of technology?

- What is the breakup of the Australia connected vehicles market on the basis of application?

- What is the breakup of the Australia connected vehicles market on the basis of connectivity?

- What is the breakup of the Australia connected vehicles market on the basis of vehicle connectivity?

- What is the breakup of the Australia connected vehicles market on the basis of vehicle?

- What is the breakup of the Australia connected vehicles market on the basis of region?

- What are the various stages in the value chain of the Australia connected vehicles market?

- What are the key driving factors and challenges in the Australia connected vehicles?

- What is the structure of the Australia connected vehicles market and who are the key players?

- What is the degree of competition in the Australia connected vehicles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia connected vehicles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia connected vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia connected vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)