Australia Construction Aggregates Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Australia Construction Aggregates Market Overview:

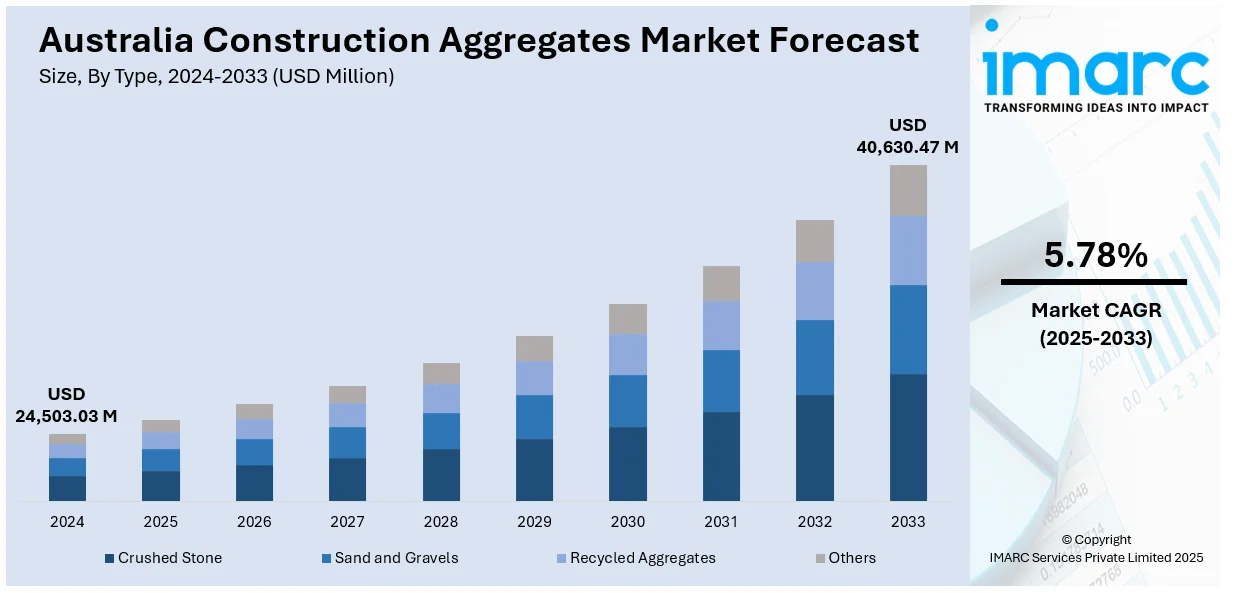

The Australia construction aggregates market size reached USD 24,503.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 40,630.47 Million by 2033, exhibiting a growth rate (CAGR) of 5.78% during 2025-2033. The market is driven by large-scale infrastructure and renewable energy projects. Aggregates are essential for roads, railways, and energy installations, with consistent demand supported by long-term public and private investment, engineering requirements, and geographically distributed project activity. This steady and diversified user base is strengthening the position of key suppliers and shaping the overall Australia construction aggregates market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24,503.03 Million |

| Market Forecast in 2033 | USD 40,630.47 Million |

| Market Growth Rate 2025-2033 | 5.78% |

Australia Construction Aggregates Market Trends:

Infrastructure Investment by Public and Private Sectors

Major investments in Australia's transport and urban infrastructure are catalyzing the demand for construction aggregates. Government-funded programs and private sector efforts are supporting the extensive use of materials, such as crushed stone, gravel, and sand, especially for foundational projects and bulk fill. These materials are crucial in various applications, ranging from foundational layers in highways to subgrades in railway corridors. In 2025, Minister for Regional Development Kristy McBain declared the Albanese Labor Government's pledge of $17.1 billion for road and rail infrastructure, signifying a notable enhancement to national construction efforts. Considerable allocations comprise $7.2 billion for the Bruce Highway improvement and $2 billion for the rail connection to Melbourne Airport. These initiatives aim to boost safety, alleviate congestion, and improve freight transport, all of which necessitate a consistent and significant supply of aggregates. The lengthy timelines and engineering challenges of these projects are promoting long-term supply agreements between contractors and aggregate suppliers. Furthermore, local sourcing of materials is being highlighted to lower transportation expenses and prevent delays, enhancing the importance of regional quarries. With multiple large-scale projects underway or in the pipeline across states, aggregate demand is being driven not just by short-term building cycles but by a multi-year infrastructure agenda. This ongoing effort guarantees a consistent Australia construction aggregates market growth, backed by well-defined procurement timelines and material specifications designed for heavy civil construction norms.

To get more information on this market, Request Sample

Renewable Energy Projects

The swift expansion of Australia’s renewable energy industry is creating the need for construction aggregates, especially in rural and semi-urban areas where extensive solar and wind projects are being established. These initiatives depend significantly on robust materials for building access roads, reinforcing turbine foundations, setting up substation bases, and facilitating the transport and installation of heavy machinery. In 2024, the Australian Government unveiled 19 renewable energy initiatives through the Capacity Investment Scheme, contributing 6.4 GW of clean energy to the National Electricity Market. Covering New South Wales, Victoria, South Australia, and Queensland, these initiatives were projected to supply energy to around 3 million households and essential for achieving the national goal of 82% renewable energy by 2030. Every installation requires significant civil works in the initial construction stages, resulting in substantial aggregate usage. The decentralized nature of these projects also implies that supply chains need to adjust to provide materials effectively across various distant sites. Aggregates are crucial not just for the physical stability of renewable energy assets, but also for the transmission systems required to link them to the larger grid. As the expansion of clean energy is deeply integrated into national policy, construction aggregates are playing a crucial role in Australia’s energy transition. Their application is no longer limited to conventional infrastructure but is also becoming essential for promoting long-term, sustainable energy solutions in diverse geographic areas and terrain types.

Australia Construction Aggregates Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Crushed Stone

- Sand and Gravels

- Recycled Aggregates

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes crushed stone, sand and gravels, recycled aggregates, and others.

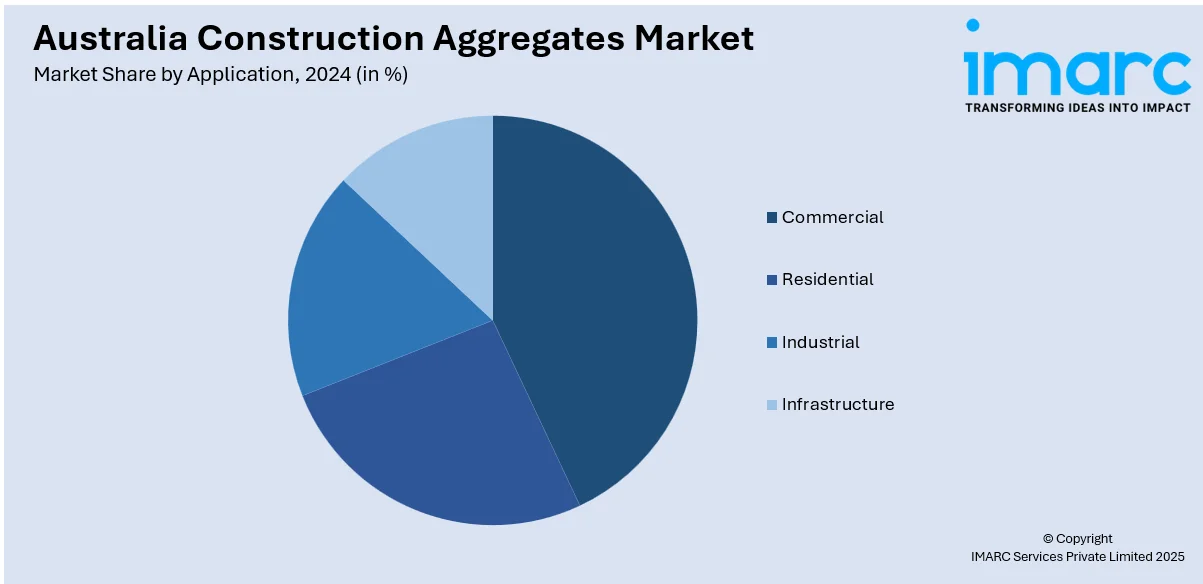

Application Insights:

- Commercial

- Residential

- Industrial

- Infrastructure

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, residential, industrial, and infrastructure.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Construction Aggregates Market News:

- In September 2024, Cement Concrete & Aggregates Australia (CCAA) launched its 2024–2026 strategic plan and an updated constitution. The plan focused on advocacy, sustainability, and secure access to raw materials. The strategy aimed to align the industry’s story with national issues, making certain that cement, concrete, and aggregates are acknowledged for their vital contribution to Australia’s infrastructure.

Australia Construction Aggregates Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Crushed Stone, Sand and Gravels, Recycled Aggregates, Others |

| Applications Covered | Commercial, Residential, Industrial, Infrastructure |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia construction aggregates market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia construction aggregates market on the basis of type?

- What is the breakup of the Australia construction aggregates market on the basis of application?

- What is the breakup of the Australia construction aggregates market on the basis of region?

- What are the various stages in the value chain of the Australia construction aggregates market?

- What are the key driving factors and challenges in the Australia construction aggregates market?

- What is the structure of the Australia construction aggregates market and who are the key players?

- What is the degree of competition in the Australia construction aggregates market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia construction aggregates market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia construction aggregates market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia construction aggregates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)