Australia Construction Demolition Waste Recycling Market Size, Share, Trends and Forecast by Material, Source, Service, and Region, 2026-2034

Australia Construction Demolition Waste Recycling Market Overview:

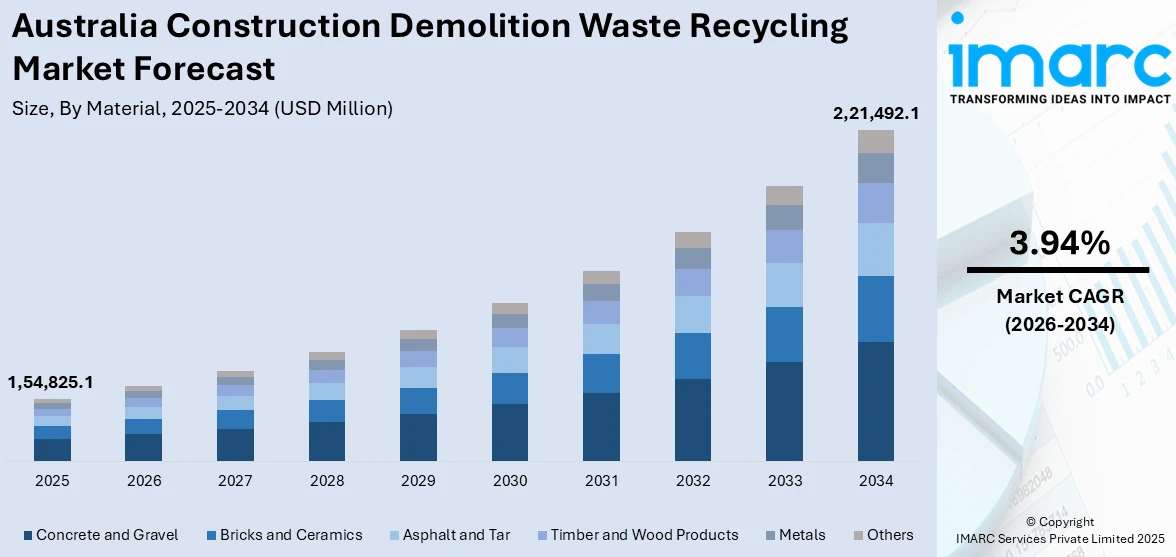

The Australia construction demolition waste recycling market size reached USD 1,54,825.1 Million in 2025. Looking forward, the market is expected to reach USD 2,21,492.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.94% during 2026-2034. The market is driven by stringent environmental regulations, encouraging companies to adopt sustainable waste management practices. Economic incentives for resource recovery and the cost-efficiency of recycling methods further propel market growth. Technological advancements in sorting and processing waste make recycling more effective and economically viable, further augmenting the Australia construction demolition waste recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,54,825.1 Million |

| Market Forecast in 2034 | USD 2,21,492.1 Million |

| Market Growth Rate 2026-2034 | 3.94% |

Key Trends of Australia Construction Demolition Waste Recycling Market:

Stringent Environmental Regulations and Policies

The enforcement of strict environmental regulations has a major impact on the market's development. Government policies mandating waste reduction, recycling, and proper disposal have forced construction and demolition companies to adopt more sustainable practices. These regulations encompass specific targets for recycling rates and the reduction of landfill waste. As concerns over climate change and resource depletion grow, governments across Australia have continued to tighten regulations on waste management, with penalties for non-compliance. This regulatory pressure encourages industries to explore recycling solutions that minimize environmental impact and maximize resource recovery. As per a 2025 industry report, the nation generated approximately 26.8 million tons of construction and demolition (C&D) waste in 2022–23. Australia's C&D waste recycling sector reported a recovery rate of 84%, based on figures from the National Waste and Resource Recovery Report 2024 published by the Department of Climate Change, Energy, the Environment and Water. The trend toward sustainability in construction projects has increased the demand for materials that can be reused or recycled, offering a viable business opportunity for companies involved in waste processing. Environmental compliance, coupled with a growing demand for eco-friendly practices, is driving companies to adopt innovative recycling technologies, thereby contributing to the expansion of the market. These factors influence both the public and private sectors, encouraging collaboration on waste reduction initiatives. Enhanced environmental policies are essential drivers of industry growth, aligning with the global trend toward sustainability. As a result, the tightening of waste management regulations is key in shaping the trajectory of the Australia construction demolition waste recycling market growth.

To get more information on this market Request Sample

Economic Benefits of Recycling and Resource Recovery

Economic incentives serve as a major driver for the expansion of the market. Recycling construction and demolition waste allows companies to save costs by reusing materials instead of purchasing new ones. The savings on raw material procurement, disposal fees, and landfill charges are significant, especially for large-scale construction projects. Furthermore, recycling can lead to job creation and stimulate local economies by fostering industries focused on waste processing and material recovery. Governments have recognized the economic benefits of recycling, offering incentives such as tax breaks, grants, and subsidies to businesses that invest in waste recovery technologies. With pressure to reduce operational costs, construction companies increasingly seek cost-effective, environmentally friendly solutions, which makes recycling an attractive option. Additionally, there is an emerging demand for sustainable building materials, further driving the use of recycled materials in construction projects. As demand for green buildings and certifications such as LEED grows, companies are keen on using recycled products to meet environmental standards. Notably, Veolia reported that its waste management program in Gold Coast, Australia aims to boost the city’s resource recovery rate by 5% by the end of 2025, contributing to the national goal of 80% recovery by 2030. The initiative is expected to avoid 77,000 tons of carbon emissions annually and deliver AUD 35 Million in benefits over seven years (USD 23 Million equivalent). The economic advantage makes recycling a competitive practice, encouraging widespread adoption across the sector. By tapping into the economic opportunities that recycling presents, companies are aligning with industry trends while also enhancing their profitability, thus pushing the market's growth forward.

Growth Drivers of Australia Construction Demolition Waste Recycling Market:

Circular Economy Pledges and Sectoral Change

Australia's increasing adoption of a circular economy is emerging as a key driver for the market in construction and demolition waste recycling. Nationally, governments and companies are abandoning the linear model of "take, make, dispose" in favor of one that is focused on recovering and reusing resources. This is especially applicable in construction, which produces a considerable percentage of Australia's overall waste. Developers and industry leaders are gradually adopting circular building principles that seek to close material loops. These involve designing for deconstruction, specifying recycled products in tender, and engaging waste processors early in the project stage. National policies such as circular economy roadmaps and product stewardship programs are promoting supply chain cooperation from the architect to the recycler, with an aim to move away from virgin materials. In a nation where building lies at the core of economic activity, integrating circular ways proves both environmentally and commercially beneficial, underlining pressure for effective recycling facilities and development.

Urban Development, Infrastructure Initiatives and Building Activity

Another significant growth driver in the C&D recycling industry in Australia is urban development scale and major infrastructure schemes, particularly within rapidly developing city areas. Urban areas such as Brisbane, Sydney, and Melbourne are experiencing growing populations, new residential estates, transport infrastructure upgrades, and large-scale public works that create huge quantities of demolition and construction waste. As much of that material is generated near or in metropolitan areas, there is potential, along with the need to reduce the cost and environmental penalty of transport to landfill. In South East Queensland, for instance, the establishment of new processing facilities is viewed as necessary to meet demand for recycled sand and aggregate for road base and fill material, with the added advantage of a decrease in emissions from haulage. Moreover, large-scale events and scheduled projects (like transit projects, airport developments, and sports stadiums) need huge amounts of construction materials, and this provides an opportunity for recycled materials to substitute virgin resources in most elements. The value proposition becomes stronger when recycled materials are sourced locally, saving both time and money, and environmental qualifications assist in winning public contracts.

Increased Private Investment and Diversification of Market

A key driver of growth in the Australian C&D waste recycling market is the rise of private investment and diversification of players moving into the recycling sector. While recycling used to be a domain of major players, today there is a more diversified group of construction companies, technology firms, and raw material manufacturers investing in waste treatment plants, digital tracking systems, and secondary material markets. These players are discovering new methods of extracting value from waste such as converting recycled material into high-performance products such as engineered sand, road base mixes, or precast construction components. Further, the commercial real estate industry is increasingly focusing on sustainability, aiming to achieve green building certifications that promote the use of recycled material. Financial institutions are also beginning to align their funding criteria with environmental outcomes, offering green finance options for projects that incorporate significant recycling or material recovery components. This market momentum is helping to create a more competitive and innovative recycling ecosystem, further accelerating growth.

Opportunities of Australia Construction Demolition Waste Recycling Market:

Regional Recycling Infrastructure Expansion

Australia's remote geography and widespread population provide a singular opportunity to increase construction and demolition (C&D) waste recycling infrastructure expansion in the regions and country towns. Although key cities such as Sydney and Melbourne are already experiencing developments in recycling facilities, most regional communities continue to use landfilling because of a shortage of local processing plants. This presents a vast investment opportunity for mobile or modular recycling facilities that will be able to run cost-effectively in low-density regions. With the vast amounts of infrastructure and resource schemes in places like the Pilbara, Northern Queensland, and parts of South Australia, recycled aggregates and fill material demand is likely to increase. Shipping virgin material long distances is both costly and environmentally intensive, so using locally sourced recycled material is a cost-efficient and eco-friendly solution. By creating scalable, decentralized recycling technologies that are adapted to local contexts, Australia can minimize environmental footprints and generate new economic opportunities in regions previously underserved by recycling services.

Innovation in Recycled Product Development

Australia's drive for green construction is creating new opportunities in producing high-value products from recycled C\&D waste. Historically, recycling has been centered on low-grade materials such as road base and backfill, yet advances in material processing and engineering now make it possible to produce advanced recycled products including engineered sand, precast concrete components, and composite building products. Such products are finding increasing support among architects, civil engineers, and contractors seeking low-carbon solutions that provide satisfactory performance. With Australia's increasing interest in green building certification and environmental product declarations, the incorporation of certified recycled materials into new building projects is becoming more and more attractive. In addition, Australian research centers and private businesses are working together on material testing and product development, sometimes with support from government initiatives. This partnership creates a pipeline of new recycled products that may be employed nationally while also be exported to other countries with the same sustainability targets, making Australia the leader in the circular construction economy.

Public Procurement and Policy-Driven Demand

Australian government procurement and policy campaigns present an influential platform to expand the market for C\&D waste recycling. Government infrastructure projects, sponsored by the federal and state governments, account for a substantial percentage of aggregate construction activity and thus play a significant role in material selection. Increased demands for reporting on sustainability and recycled content use in government tenders encourage contractors to deploy recycling as a normative business practice. For instance, transport infrastructure departments in some states have started to make minimum recycled content requirements in road works and civil engineering. Such policies create steady demand for recycled products while also ensuring market certainty that stimulates private sector investment in recycling facilities and transport. In addition, Australia's developing waste and circular economy policies are assisting in the development of more defined end-of-waste criteria and quality standards, which aid the mainstreaming of recycled products into construction supply chains. All this public policy alignment with industry practice provides a stable and increasing base for the recycling market to grow.

Government Regulations of Australia Construction Demolition Waste Recycling Market:

State-Based Regulatory Frameworks and Landfill Levies

According to the Australia construction demolition waste recycling market analysis, recycling is largely determined by state-based regulatory environments, which dictate the management, transportation, and reusing of the waste. Every state and territory possess its own environmental protection authority (EPA) or similar institution that determines provisions regarding waste diversion and recycling targets. One of the more important regulatory measures applied in majority of states is the landfill charge, which is a money component levied on materials deposited at landfill, whooping up firms to divert recyclables. In states like New South Wales and Victoria, these charges are among the highest in Australia, directly stimulating investment in recycling facilities and recovery of resources. These laws have prompted a significant change in waste management procedures, particularly among construction companies that create high amounts of materials such as asphalt, concrete, timber, and bricks. The difference in policies among states has also created discrepancies in compliance levels and operational measures, usually making logistics cumbersome for firms that operate across borders. Consequently, there is an increasing demand for increased national harmonization of regulatory strategies to rationalize recycling activities and facilitate cross-jurisdictional best practices.

Waste Classification, Licensing, and End-of-Waste Criteria

Regulation by government in Australia also touches on the way construction and demolition waste is classified, treated, and considered suitable for reuse. Waste classification legislation is used to decide whether a material is hazardous, restricted, or general waste, and this will influence how they are treated and if they can be recycled. Licensing is required for recycling and waste treatment plant operators, which ensures that environmental risks are addressed and recovered materials are of an acceptable standard and safety. One of the key regulatory measures here is the principle of "end-of-waste" criteria, which determines when a product recycled is no longer waste and can be applied to commercial use. Queensland and South Australia have established clearer end-of-waste guidelines, with legal certainty for purchasers and recyclers, that underpin market growth. Yet in other states, the lack of such a framework incites regulatory uncertainty, so some contractors fear employing recycled materials because of assumed liability or compliance issues. National standardization of these criteria would enhance a more uniform and assured adoption of recycled materials by the construction industry.

Circular Economy Strategies and Supportive Policy Agendas

In addition to stringent legislation, state and federal government policies are progressively encouraging recycling through carefully implemented strategies linked to sustainability and circular economy objectives, which further supports the Australia construction demolition waste recycling market growth. Numerous Australian states have introduced circular economy plans that focus on waste reduction, material recovery expansion, and innovation in recycling technologies. These policies typically involve funding programs for upgrading facilities, pilot project grants, and incentives for adopting recycled materials during construction. Nationally, the Australian Government has also made available frameworks that seek to minimize the use of landfill and enhance transparency of waste data, which is very important for policy planning and accountability of the industry. The push for sustainable infrastructure through government procurement policies such as requiring recycled content in public works projects, is another tool being used to create reliable demand for recycled materials. These policy directions signal long-term government commitment while also encouraging private sector collaboration and investment, reinforcing the role of regulation as a catalyst for positive change in the construction and demolition waste recycling market.

Challenges of Australia Construction Demolition Waste Recycling Market:

Inconsistent Regulations and Fragmented Market Approaches

One of the major issues confronting the Australian construction and demolition (C&D) waste recycling industry is the lack of uniformity in regulations between states and territories. Waste policy, landfill levies, and material classification requirements differ considerably from one region to the next, resulting in a patchwork of regulation that makes it difficult for national construction firms and recycling operations. For example, a recycled material approved for use in road construction in one state may not meet the compliance criteria in another, forcing businesses to modify their practices and incur additional compliance costs. This lack of national standardization limits scalability and investment confidence, particularly for companies looking to establish or expand recycling operations across multiple regions. It also prevents the establishment of harmonized end-of-waste criteria, which are necessary to ensure trust in recycled products. As attempts are being made to foster a more harmonized process, the existing differences still function as a tremendous limitation to effective resource recovery and market development.

Limited Infrastructure and Processing Capacity

Another key concern for Australia's C\&D waste recycling industry is the lack of state-of-the-art infrastructure and processing capacity, particularly beyond large metropolitan cities. Although big cities such as Sydney, Melbourne, and Brisbane have made great efforts to build big-scale recycling plants, regional and rural areas of the country continue to not enjoy access to advanced sorting and treatment technology. This presents logistical hurdles for long-distance transportation of bulky waste materials, which is expensive and environmentally costly, tending to make landfilling a more cost-effective choice. Also, urban facilities can be subject to capacity and technology limitations, especially when processing mixed or contaminated waste streams that call for higher-end processing techniques. Without mass investment in centralized as well as mobile recycling facilities, the industry cannot keep pace with Australia's construction boom volume of waste. The absence of infrastructure also restricts the quality and type of recyclates that can be manufactured, influencing their competitiveness in the general construction market.

Market Perception and Demand for Recycled Materials

Although there is increased awareness about sustainability concerns, market perception is still a stumbling block to the use of recycled building materials in Australia on a large scale. Contractors and developers perceive most recycled products, including crushed concrete, recycled wood, and engineered fill, as inferior to virgin materials in quality and performance. This is so even when recycled materials are as good as, or better than, regulatory and performance standards. Also, public and private sector procurement practices fail to prioritize or require use of recycled content, which reduces demand and deters supply chain investment. Sometimes insurance and liability issues also are a cause of caution, as stakeholders are concerned about the long-term performance of buildings constructed using unconventional materials. To address these problems, the sector requires stronger product certification, testing for performance, and awareness campaigns to change mind-sets. Establishing market confidence is vital for environmental purposes, and for generating a self-supporting economy on recycled C&D materials in Australia.

Australia Construction Demolition Waste Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on material, source, and service.

Material Insights:

- Concrete and Gravel

- Bricks and Ceramics

- Asphalt and Tar

- Timber and Wood Products

- Metals

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes concrete and gravel, bricks and ceramics, asphalt and tar, timber and wood products, metals, and others.

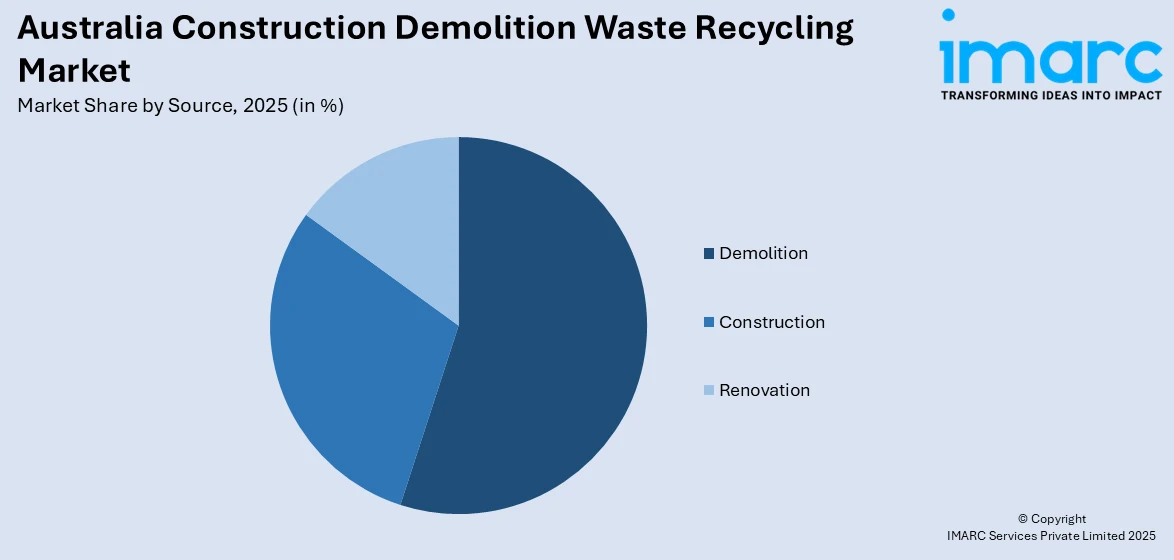

Source Insights:

Access the comprehensive market breakdown Request Sample

- Demolition

- Construction

- Renovation

The report has provided a detailed breakup and analysis of the market based on the source. This includes demolition, construction, and renovation.

Service Insights:

- Disposal

- Collection

The report has provided a detailed breakup and analysis of the market based on the service. This includes disposal and collection.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Construction Demolition Waste Recycling Market News:

- On April 15, 2024, Repurpose It reported processing over 700,000 tons of construction, demolition, and organic waste annually at its Melbourne facility, achieving a resource recovery rate of 99%. The operation diverts more than 30,000 tons of CO₂ emissions each year and produces reused materials like sand, aggregates, compost, and mulch for infrastructure and landscaping. The initiative supports Australia’s construction and demolition waste recycling goals by replacing virgin materials and supplying circular products to government and commercial sectors.

Australia Construction Demolition Waste Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Concrete and Gravel, Bricks and Ceramics, Asphalt and Tar, Timber and Wood Products, Metals, Others |

| Sources Covered | Demolition, Construction, Renovation |

| Services Covered | Disposal, Collection |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia construction demolition waste recycling market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia construction demolition waste recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia construction demolition waste recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia construction demolition waste recycling market was valued at USD 1,54,825.1 Million in 2025.

The Australia construction demolition waste recycling market is projected to exhibit a CAGR of 3.94% during 2026-2034.

The Australia construction demolition waste recycling market is expected to reach a value of USD 2,21,492.1 Million by 2034.

The Australia construction demolition waste recycling market is showcasing trends toward increased adoption of advanced sorting technologies, circular economy practices, and the use of recycled materials in infrastructure projects. Growing emphasis on sustainability, regional recycling facility development, and government-led green procurement policies are shaping the market’s evolution toward greater resource efficiency.

The Australia construction demolition waste recycling market is driven by strict government regulations, growing urban development, and increasing environmental awareness. Rising landfill costs and the push for sustainable building practices encourage recycling, while technological advancements and government incentives support efficient waste processing and the use of recycled materials in construction projects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)