Australia Construction Materials Market Size, Share, Trends and Forecast by Material Type, End User, and Region, 2025-2033

Australia Construction Materials Market Size and Share:

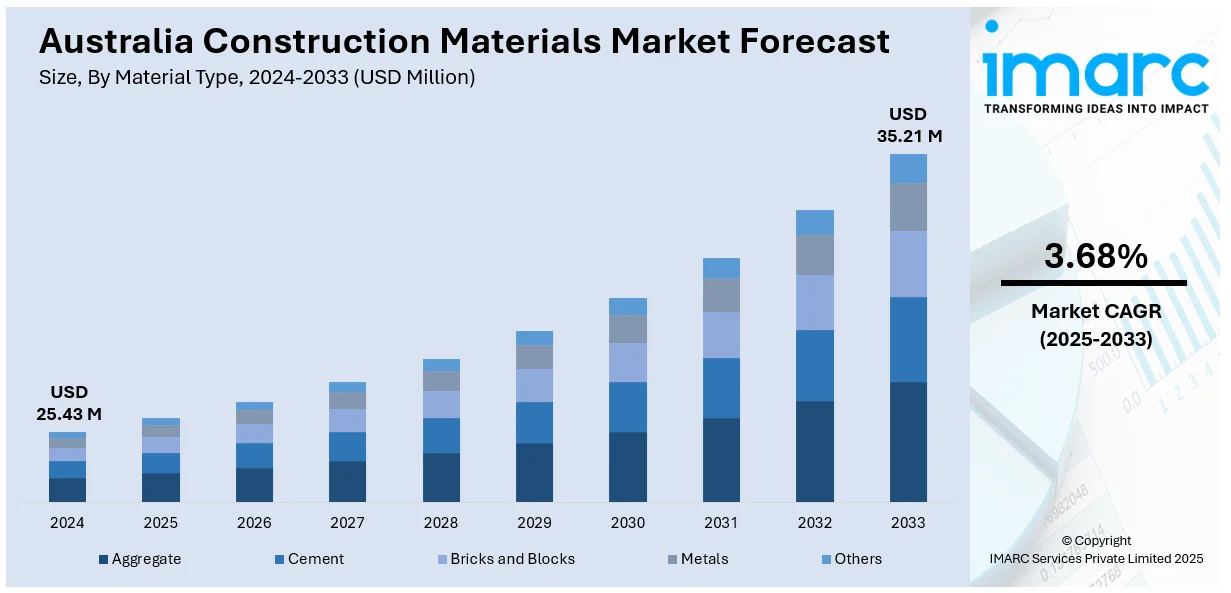

The Australia construction materials market size reached USD 25.43 Million in 2024. Looking forward, the market is expected to reach USD 35.21 Million by 2033, exhibiting a growth rate (CAGR) of 3.68% during 2025-2033. The market is fueled by strong urbanization, high government infrastructure investment, and increasing focus on sustainability. Advances in construction technology and materials further improve efficiency and performance. Such factors combined boost the Australia construction materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.43 Million |

| Market Forecast in 2033 | USD 35.21 Million |

| Market Growth Rate 2025-2033 | 3.68% |

Key Trends of Australia Construction Materials Market:

Adoption of Prefabricated and Modular Construction Methods

The Australian construction materials industry is witnessing an immense movement towards prefabricated and modular construction methods. These involve fabricating building elements off-site under controlled conditions, which are later assembled on-site. Prefabrication being adopted has a number of benefits associated with it, such as decreased construction time, lesser material waste, and enhanced quality control. Prefabricated construction also solves the issue of labor shortages by decreasing on-site labor requirements and allowing quicker project completion. Government campaigns and industry promotions are also encouraging the adoption of these techniques to improve efficiency and sustainability in construction work. For instance, in January 2025, Commonwealth Bank of Australia (CBA) joined prefabAUS, the peak body for Australia's off-site construction industry, to support prefabricated housing. CBA will help streamline the process for customers purchasing prefabricated homes by introducing new policies that reduce upfront costs and enable progress payments. This collaboration aims to scale the prefabricated construction sector, addressing Australia’s housing shortage by enabling faster, more efficient home building. This trend is expected to continue driving the Australia construction materials market growth as the demand for efficient and cost-effective building solutions increases.

To get more information on this market, Request Sample

Integration of Sustainable and Recycled Materials

Sustainability is now at the forefront of the Australian construction sector and has resulted in increased use of green and recycled products. The uptake of green building practices, as advocated by the Green Building Council of Australia, supports the incorporation of environmentally friendly materials. Recycled products, such as aggregates and bio-based materials, are being progressively used in construction activities to minimize waste and decrease carbon footprints. Moreover, advancements in material science have resulted in high-performance materials that satisfy contemporary construction requirements while being eco-friendly. Such a paradigm shift towards greener materials contributes significantly to the Australia construction materials market growth in line with national ambitions for carbon neutrality and sustainable development. For instance, as per industry reports, on World Ecolabel Day 2024, GECA and Eco Choice Aotearoa signed an MoU to streamline sustainability certification across Australia and New Zealand. The first dual-certified company is saveBOARD, a circular economy leader producing building materials from recycled waste. This partnership simplifies ecolabel access, reduces costs, and strengthens trans-Tasman sustainability efforts. saveBOARD’s certification supports its expansion and affirms its environmental and social responsibility. The MoU reflects a unified approach to sustainable production under the Global Ecolabelling Network’s rigorous standards.

Emphasis on Smart and High-Performance Building Materials

The demand for smart and high-performance building materials is on the rise in Australia, driven by the need for energy-efficient and technologically advanced structures. Materials such as self-healing concrete, thermochromic glass, and phase-change materials are being utilized to enhance building performance and sustainability. These materials offer benefits like improved energy efficiency, reduced maintenance costs, and enhanced occupant comfort. For instance, in December 2024, Boral officially opened upgraded carbon-reducing technology at its Berrima Cement Works in NSW. The key feature, a Chlorine Bypass system, enables alternative fuel use to rise to 60% within three years, up from the current 30% coal substitution. Supplying 40% of cement in NSW and ACT, Berrima is central to Boral’s net-zero strategy. The upgrade, supported by federal and state governments, marks a major step in decarbonising Australia’s cement industry.The integration of smart materials aligns with the growing trend of smart buildings, which incorporate technologies like Building Information Modeling (BIM) and Internet of Things (IoT) devices to optimize building operations. As the construction industry continues to prioritize innovation and efficiency, the adoption of smart materials is expected to contribute significantly to the Australia construction materials market growth.

Growth Drivers of Australia Construction Materials Market:

Surge in Infrastructure Development Projects

One of the major growth drivers in the construction materials market is the continued investment by the Australian government in major infrastructure development, including highways, railways, airports, and other public amenities. State programs such as the National Infrastructure Construction Schedule (NICS), multi-billion-dollar projects at the state level in New South Wales, Victoria, and Queensland are stimulating the demand for concrete, asphalt, steel, and aggregates. These initiatives are essential to sustain population expansion, urban mobility, and economic flexibility. Additionally, long-term infrastructure plans such as Western Sydney Airport and Melbourne Metro Tunnel fuel sustained demand for a wide range of construction materials. With public infrastructure continuing to account for a significant portion of total construction output, this trend reinforces a stable and expanding market for building materials across the country.

Rising Urbanization and Residential Housing Demand

Rapid urbanization and strong population growth, especially in major metropolitan areas like Sydney, Melbourne, and Brisbane, are pushing up demand for residential and mixed-use developments. As people migrate to urban centers for employment and lifestyle benefits, the pressure to develop affordable housing, apartment complexes, and smart communities intensifies. This leads to increased consumption of bricks, cement, tiles, insulation, and other essential materials. Government schemes such as the National Housing Accord, aiming to deliver hundreds of thousands of new homes in the coming years, further amplify this need. Coupled with low-interest rates and high housing demand, urban expansion continues to fuel a robust construction pipeline, directly propelling the Australia construction market demand.

Sustainability Focus and Green Building Initiatives

Environmental concerns and Australia’s commitment to reducing carbon emissions are prompting greater demand for sustainable construction materials. Green building certifications such as Green Star, NABERS, and WELL are encouraging developers to adopt eco-friendly alternatives like recycled concrete, low-carbon cement, sustainably sourced timber, and insulation made from natural fibers. This sustainability trend is not only regulatory-driven but also increasingly demanded by environmentally conscious consumers and investors. In response, manufacturers are innovating to produce materials with lower embodied carbon, better energy efficiency, and improved life cycle performance. With Australia moving toward a net-zero carbon economy, the adoption of green building practices will significantly accelerate material innovation and market expansion in the years ahead.

Challenges of Australia Construction Materials Market:

Rising Material Costs and Inflationary Pressures

Soaring prices of construction materials are a major hurdle for developers, contractors, and suppliers across Australia. Key inputs like steel, concrete, glass, and timber have witnessed sharp cost hikes due to both local shortages and global inflationary trends. In turn, this puts pressure on project budgets, especially in residential and public infrastructure segments where profit margins are already narrow. The volatility of input prices forces frequent contract renegotiations and increases the financial risk for stakeholders. Furthermore, unpredictable pricing undermines long-term planning and investment decisions, particularly for small and medium-sized construction firms. These cost challenges not only slow down construction activity but also threaten affordability in the housing sector, contributing to broader economic stress in the construction ecosystem.

Supply Chain Disruptions and Material Shortages

One of the most pressing challenges facing the Australian construction materials market is supply chain instability. Widespread global challenges stemming from geopolitical conflicts, natural calamities, and the continued impact of the COVID-19 pandemic have led to significant supply chain disruptions. These issues have resulted in delays and constraints in importing critical raw materials like timber, steel, and cement-related additives, creating bottlenecks that affect construction operations. Delays at ports, rising shipping costs, and fluctuating foreign exchange rates further aggravate the issue. Domestically, transportation constraints and workforce shortages impact logistics efficiency, leading to project delays and cost overruns. According to the Australia construction market analysis, these challenges make it difficult for builders to maintain timelines and budgets, particularly for large-scale developments. As the demand for construction materials increases, the lack of a resilient and localized supply chain threatens to hinder sustainable market growth and sector stability.

Regulatory Complexities and Environmental Compliance

Navigating Australia’s diverse and evolving regulatory framework presents a significant challenge for construction material suppliers. Each state and territory may enforce different standards related to material safety, emissions, and construction codes, making compliance more complex and costly. Additionally, increasing focus on environmental sustainability has led to stricter regulations regarding waste management, embodied carbon, and the use of recycled materials. While these are essential for greener construction, they often require companies to invest in costly upgrades or reconfigure production methods. Smaller manufacturers may find it difficult to meet compliance expectations without government support or subsidies. The administrative burden and compliance costs associated with environmental and building regulations can create delays, raise operational costs, and deter innovation within the construction materials sector.

Australia Construction Materials Market Outlook:

Emphasis on Sustainable and Green Materials

Australia’s construction materials market is expected to shift significantly toward sustainability over the coming years. With rising environmental concerns and national commitments to net-zero emissions, there is growing demand for eco-friendly and low-carbon building products. This includes greater use of recycled concrete, low-emission cement, sustainably sourced timber, and energy-efficient insulation materials. Government incentives and updated building codes are encouraging developers and manufacturers to integrate green materials into projects. Additionally, consumers are increasingly prioritizing sustainability in residential and commercial construction, driving long-term demand. This trend is likely to stimulate innovation in product development and supply chain optimization. As green building becomes a standard rather than an option, sustainability will play a crucial role in influencing the Australian construction materials market.

Increased Infrastructure Investment to Drive Material Demand

The outlook for Australia’s construction materials market remains strong, underpinned by significant infrastructure investment at federal and state levels. Major projects in transportation, water systems, energy, and public housing are projected to create sustained demand for essential materials such as cement, aggregates, steel, and asphalt. Government stimulus packages and long-term planning strategies are focused on boosting economic recovery and enhancing national connectivity. This robust pipeline of infrastructure development ensures a stable and growing demand for construction inputs, offering long-term opportunities for material manufacturers and suppliers. Moreover, advanced construction technologies and modular designs will increase the need for precision-engineered materials. As infrastructure becomes a backbone for economic progress, it will continue to anchor the expansion of the construction materials sector in Australia.

Regional Growth and Urban Expansion to Boost Material Consumption

Rapid urbanization and population growth in regional centers and outer suburbs are poised to reshape material demand across Australia. Cities like Brisbane, Perth, and Adelaide, along with satellite towns, are witnessing heightened residential and commercial development. This geographic diversification creates new growth avenues for construction materials beyond traditional urban hubs like Sydney and Melbourne. Expansion of transportation networks, new industrial zones, and housing projects in these areas are expected to drive steady consumption of concrete, bricks, cladding, and insulation products. Local governments are also pushing for development through land release and infrastructure support, reinforcing regional demand. This shift supports decentralization and helps balance national construction activity, fostering a more resilient and widespread construction materials market outlook across Australia.

Australia Construction Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material type and end user.

Material Type Insights:

- Aggregate

- Cement

- Bricks and Blocks

- Metals

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes aggregate, cement, bricks and blocks, metals, and others.

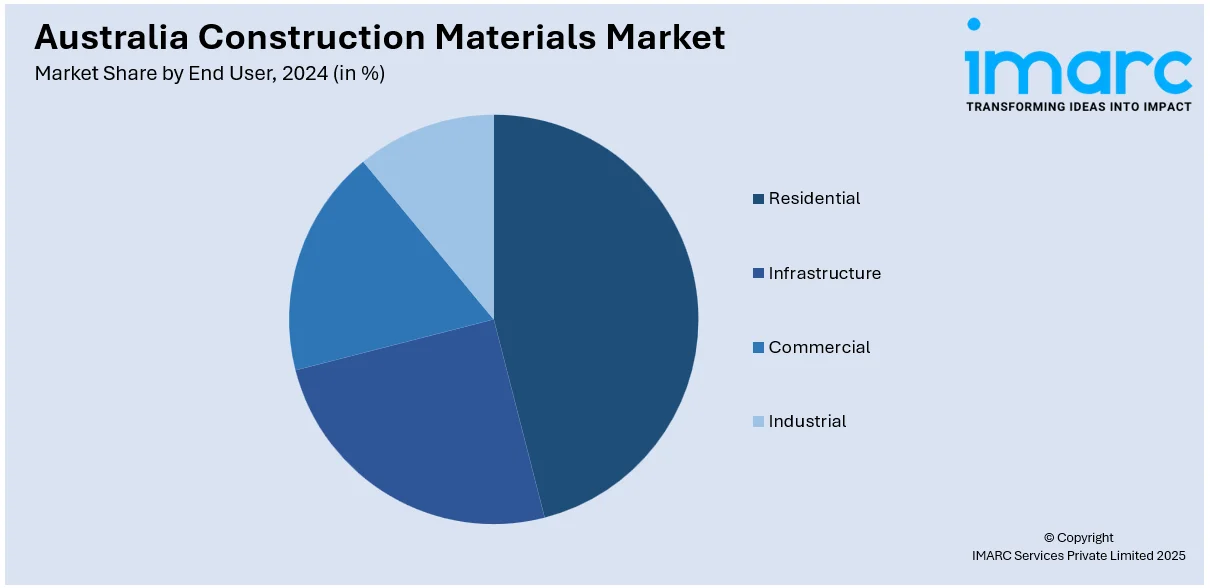

End User Insights:

- Residential

- Infrastructure

- Roads

- Bridges

- Waste Management

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, infrastructure (roads, bridges, and waste management), commercial, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Construction Materials Market News:

- In March 2025, Boral secured a $24.5M Federal grant to reduce CO₂ emissions at its Berrima Cement Works by up to 100,000 tonnes annually. The project will install a new kiln feed system, increasing alternative raw materials use from 9% to 23%, cutting emissions from limestone calcination. This follows earlier upgrades, including a Chlorine Bypass system.

- In December 2024, Heidelberg Materials' joint venture, Cement Australia (with Holcim), announced the acquisition of the cementitious division of Buckeridge Group (BGC) in Perth. This includes a high-capacity, modern cement grinding unit and broad construction operations. The deal strengthens Heidelberg Materials’ presence in Western Australia and supports its sustainability goals by expanding its portfolio of innovative, low-carbon products.

- In November 2024, Hanson Australia rebranded to Heidelberg Materials Australia, aligning with its parent company’s global strategy. The change reflects a focus on innovation, sustainability, and expanded offerings in construction materials.

Australia Construction Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Aggregate, Cement, Bricks and Blocks, Metals, Others |

| End Users Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia construction materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia construction materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia construction materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction materials market in Australia was valued at USD 25.43 Million in 2024.

The Australia construction materials market is projected to reach a value of USD 35.21 Million by 2033.

The Australia construction materials market is projected to exhibit a CAGR of 3.68% during 2025-2033.

Rapid infrastructure development, booming residential and commercial construction, government sustainable building initiatives, growing demand for green-certified materials, and increased renovation activities all fuel market expansion. Additionally, rising urbanization and resilient local manufacturing support consistent demand.

The market is trending toward sustainable, low-carbon materials and eco-friendly alternatives. Prefabrication and modular building techniques are growing. Demand for high-performance, energy-efficient materials is rising. Digitalization, like BIM and supply chain software, is streamlining procurement. Moreover, local sourcing is increasing as trade protectionism and supply chain resilience gain importance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)