Australia Construction Safety Equipment Market Size, Share, Trends and Forecast by Equipment Type, Construction Type, Application, and Region, 2025-2033

Australia Construction Safety Equipment Market Overview:

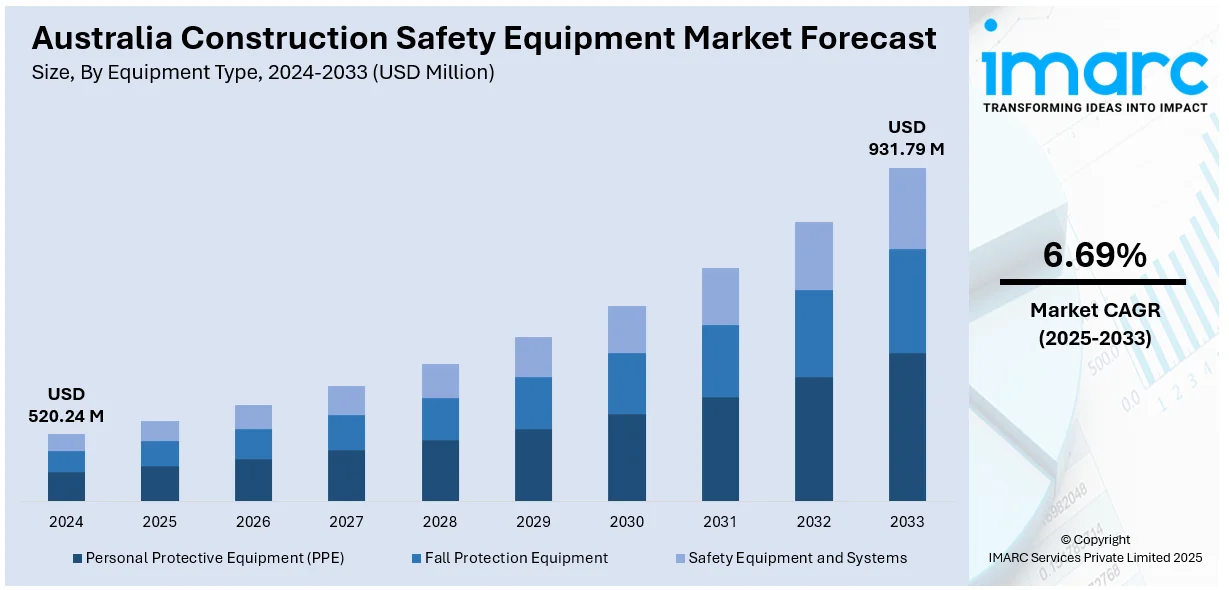

The Australia construction safety equipment market size reached USD 520.24 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 931.79 Million by 2033, exhibiting a growth rate (CAGR) of 6.69% during 2025-2033. The market is driven by advanced safety solutions like real time monitoring smart wearables, ergonomic personal protective gear to enhance comfort, and integrated fall protection solutions for high-risk locations. These advances are a trend towards proactive, technology-based safety practices that emphasize workers' wellbeing as well as regulatory compliance. With growing innovation and awareness, the need for new safety equipment also keeps on rising, directly helping to amplify the Australia construction safety equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 520.24 Million |

| Market Forecast in 2033 | USD 931.79 Million |

| Market Growth Rate 2025-2033 | 6.69% |

Australia Construction Safety Equipment Market Trends:

Smart Wearable Integration into Safety Measures

Within Australia's building industry, the use of smart wearables has been at the forefront of trends, with the promotion of on-site safety through real-time data acquisition and surveillance. Helmets fitted with sensors, vests that track biometrics, and boots with GPS tracking are highly being used to track workers' health, fatigue, posture, and distance from danger zones. These technologies send real-time data to safety management systems in a central location, enabling supervisors to identify risks and intervene before accidents happen. Smart wearables also assist in occupational safety compliance by logging and storing safety-related data. Increased accessibility and interoperability with current systems are spurring mass adoption in residential, commercial, and industrial building sites. For instance, in March 2024, Arrowes Roading Safety, designed and built entirely in Australia, launched the Automated Cone Truck (ACT) to automate road cone deployment and retrieval safely with a single operator inside the cab, reducing worker risk. Moreover, this trend is away from reactive towards predictive safety solutions, encouraging a culture of ongoing monitoring and early intervention. With these technologies, as they continue to mature, the potential exists for them to play a major role in fueling Australia construction safety equipment market growth, enabling safer, data-driven working conditions.

To get more information on this market, Request Sample

Use of Modular and Ergonomic Personal Protective Equipment (PPE)

The use of modular and ergonomically advanced personal protective equipment (PPE) continues to rise within Australia's construction industry. Conventional one-size-fits-all protective equipment is slowly giving way to gear made to fit each worker's requirements, with improved comfort, flexibility, and long lifespan. Among the innovations are helmets that are adjustable with thermal regulation, modular harnesses that accommodate different body types, and versatile gloves that balance protection and sensitivity of the fingers. These advancements minimize physical strain, improve mobility, and promote regular use, particularly over the course of long shifts or harsh weather conditions prevalent on Australian job sites. For instance, in November of 2024, Help Enterprises officially assisted the world-wide triumph of Lock Jaw Ladder Grip by providing logistics, packaging, and distribution solutions to enable sales of over 13,000 units during the 2024 financial year. Furthermore, modular PPE parts can also be replaced separately, conserving waste and maintenance expenses. The trend also benefits an inclusive workforce, including geriatric workers and others with unique ergonomic needs. As industry players prioritize safety and productivity equally, ergonomically designed PPE is increasingly becoming the norm. These improvements markedly support Australia construction safety equipment development, supporting a worker-oriented focus on site safety.

Step-Up in Fall Protection System Deployment on High-Risk Construction Sites

Fall protection is an ongoing priority within Australia's construction sector, especially on high-risk construction sites like high-rise developments, bridges, and major infrastructure projects. Current trends indicate the fast-paced deployment of advanced fall arrest systems, such as retractable lifelines, dual-connection harnesses, and energy-absorbing lanyards. These systems are designed to dissipate the impact force and avoid secondary injuries when a fall occurs. Many building sites are also performing pre-installation risk assessments to identify best anchor point location, load capacity, and system compatibility. Fall protection techniques are also increasingly brought into digital inspection platforms to maintain consistent functionality and compliance with regulations. Forced safety education now frequently incorporates immersive simulation, enabling employees to rehearse fall arrest procedures in carefully controlled simulations. These efforts as a whole exemplify a proactive approach to safety, with prevention taking top priority. Incorporating sound fall protection technologies and onsite procedures, the industry is far improving Australia construction safety equipment development, promoting safer project delivery.

Australia Construction Safety Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type, construction type, and application.

Equipment Type Insights:

- Personal Protective Equipment (PPE)

- Head Protection

- Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Foot Protection

- Hearing Protection

- Fall Protection Equipment

- Harnesses

- Lanyards

- Lifelines

- Anchors

- Safety Equipment and Systems

- Fire Safety Equipment

- Safe Access Equipment

- Gas Detection Systems

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes personal protective equipment PPE (head protection, eye and face protection, respiratory protection, hand and arm protection, protective clothing, foot protection, and hearing protection), fall protection equipment (harnesses, lanyards, lifelines, and anchors), and safety equipment and systems (fire safety equipment, safe access equipment, and gas detection systems).

Construction Type Insights:

- Residential Construction

- Commercial Construction

- Industrial Construction

A detailed breakup and analysis of the market based on the construction type have also been provided in the report. This includes residential construction, commercial construction, and industrial construction.

Application Insights:

- Worker Body Safety

- Workplace Safety

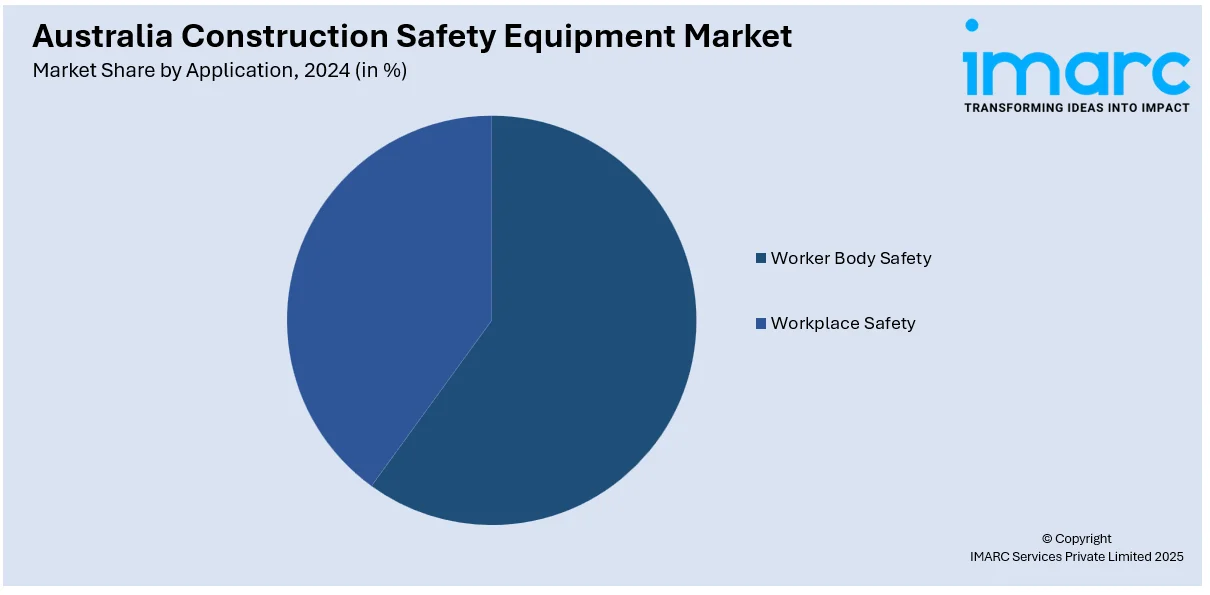

The report has provided a detailed breakup and analysis of the market based on the application. This includes worker body safety and workplace safety.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Construction Safety Equipment Market News:

- In August 2024, Kemppi introduced the lightweight Zeta Fresh Air welding helmets with TH3-level respirators to provide ultimate breathing protection and full-face safety. With VISION+ technology and auto-darkening filters, the helmets enhance visibility, comfort, and usage convenience with built-in LED work lights.

Australia Construction Safety Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Construction Types Covered | Residential Construction, Commercial Construction, Industrial Construction |

| Applications Covered | Worker Body Safety, Workplace Safety |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia construction safety equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia construction safety equipment market on the basis of equipment type?

- What is the breakup of the Australia construction safety equipment market on the basis of construction type?

- What is the breakup of the Australia construction safety equipment market on the basis of application?

- What is the breakup of the Australia construction safety equipment market on the basis of region?

- What are the various stages in the value chain of the Australia construction safety equipment market?

- What are the key driving factors and challenges in the Australia construction safety equipment?

- What is the structure of the Australia construction safety equipment market and who are the key players?

- What is the degree of competition in the Australia construction safety equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia construction safety equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia construction safety equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia construction safety equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)