Australia Consumer Electronics Market Report by Product Type (Home Appliances, Entertainment and Communication, Personal Care and Grooming), Category (Smart, Conventional), End-Use (Residential, Commercial), Distribution Channel (B2B, B2C), and Region 2025-2033

Australia Consumer Electronics Market Size and Share:

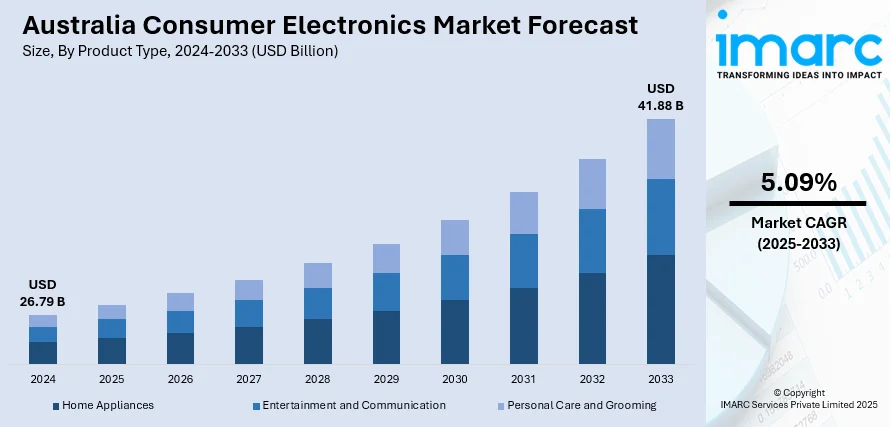

The Australia consumer electronics market size reached USD 26.79 Billion in 2024. Looking forward, the market is expected to reach USD 41.88 Billion by 2033, exhibiting a growth rate (CAGR) of 5.09% during 2025-2033. The market is driven by the growing demand for kitchen appliances with new features, such as touchscreens, voice control, and energy-efficient technology, along with the increasing number of online shoppers in Australia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26.79 Billion |

| Market Forecast in 2033 | USD 41.88 Billion |

| Market Growth Rate 2025-2033 | 5.09% |

Key Trends of Australia Consumer Electronics Market:

Rising Demand for Kitchen Appliances

The need for new kitchen appliances is promoting innovations and technological developments in the industry. Manufacturers are offering new features, such as touchscreens, voice control, and energy-efficient technology, which increase the appeal of these products. When it comes to upgrading or replacing aging kitchen equipment, people are more inclined to choose for new and high-tech options. This replacement cycle is driving overall spending on kitchen devices and appliances. As the demand for kitchen appliances is rising, electronics firms are engaging in more targeted marketing and promotional efforts. Increased exposure and customer awareness can result in improved sales and market growth. The popularity of home renovations and upgrades frequently includes upgrading the kitchen with cutting-edge appliances. This trend is not only driving the demand for new kitchen equipment, but it is also improving consumer spending in the overall consumer electronics sector. As Australia has robust economy, there is a greater emphasis on convenience and efficiency in everyday life. This trend is catalyzing the demand for high-tech kitchen appliances, which are part of the larger consumer electronics sector. According to the IMARC Group’s report, the Australia kitchen appliances market size is projected to exhibit a growth rate (CAGR) of 2.30% during 2024-2032.

To get more information on this market, Request Sample

Increasing Number of Online Shoppers

As per an article published on the website of the Australia Post in 2024, 8 in 10 Australian households shopped online in 2023. As more Australians are relying on online shopping for convenience and lower prices, e-commerce platforms are becoming a significant channel for consumer electronics sales. This move is expanding the overall market size because a greater proportion of electronics sales occur online. Online shopping is giving people access to a broader selection of electrical products that may not be available in physical stores. Increased product availability leads to higher sales and market growth. The rise of online buying increases rivalry between retailers and brands. People can compare prices and find offers, resulting in improved pricing and promotions that can increase sales volumes in the consumer electronics sector. Buyers like online purchasing because of its ease, which includes home delivery and flexible return policies. Customer evaluations and ratings are common on online buying platforms, and they affect purchasing decisions. Positive evaluations and ratings for consumer electronics can enhance sales.

Growth Drivers of Australia Consumer Electronics Market:

Technological Advancements and Smart Integration

Australia's consumer electronics industry is witnessing robust expansion on the back of increasing adoption of next-generation technologies like artificial intelligence, Internet of Things (IoT), and home automation. These technologies are revolutionizing consumer choices with individuals increasingly looking for products that offer greater functionality, easy connectivity, and energy efficiency. Products like smart TVs, AI-based speakers, networked appliances, and home automation solutions are becoming hot favorites, driven by their ease of use and potential to enhance everyday lives. The demand for integrated ecosystems that allow control through smartphones or voice assistants is also boosting sales across product categories, further fueling the Australia consumer electronics market share. As tech-savvy consumers seek more intelligent and personalized experiences, manufacturers are investing heavily in research and development (R&D) to meet evolving expectations, further accelerating the adoption of smart consumer electronics throughout Australia.

Urbanization and Rising Disposable Income

Consumer electronics consumption trends are largely being affected by the high rate of urbanization in Australia and the continuous increase in the level of disposable income. As the population is being attracted to the urban core, the demand is shifting towards modern high-tech living facilities provided with the latest electronic appliances. The higher the income, the more households are ready to spend on high-quality products that help improve lifestyle, labour productivity, and entertainment. According to the Australia consumer electronics market analysis, this includes advanced smartphones, gaming consoles, home theater systems, and wearable devices. Upgrades from basic to high-performance electronics have become common, reflecting a preference for superior quality and innovation. The shift toward digital lifestyles, fueled by urban convenience and financial capability, is encouraging Australians to embrace newer technologies, driving consistent market expansion across various electronics categories.

Expanding Product Availability and Brand Presence

The growing presence of both global and domestic consumer electronics brands in Australia is playing a crucial role in the Australia consumer electronics market growth. Companies are expanding their footprint through retail chains, e-commerce platforms, and brand-exclusive stores, making a wide range of products easily accessible to consumers nationwide. Competitive pricing, frequent promotional campaigns, and localized product offerings have improved affordability and relevance for diverse consumer segments. The availability of new launches and product innovations across major cities and regional areas ensures broader market reach. Additionally, enhanced after-sales services, product warranties, and financing options have boosted consumer confidence and purchase decisions. This widespread product accessibility, paired with robust brand visibility and customer engagement strategies, is strengthening consumer loyalty and accelerating the overall growth of the electronics market in Australia.

Opportunities of Australia Consumer Electronics Market:

Surge in Eco-Friendly and Energy-Efficient Products

Australia's growing focus on sustainability is creating strong opportunities in the consumer electronics market for eco-friendly and energy-efficient products. With increasing awareness of climate change and environmental impact, consumers are becoming more inclined toward purchasing appliances that reduce energy consumption and use recyclable or biodegradable materials. Products with green certifications and high energy ratings are gaining popularity, especially as government incentives and regulations encourage energy-efficient living. Brands that incorporate sustainable practices into their product design and packaging are seeing greater consumer acceptance and long-term loyalty, escalating the Australia consumer electronics market demand. This shift in consumer behavior is prompting manufacturers to invest in cleaner technologies and materials, creating a favorable environment for innovation. As eco-consciousness rises, sustainability is becoming a key differentiator in purchasing decisions across Australia's electronics landscape.

Growth of the Refurbished and Second-Hand Electronics Segment

Australia is witnessing notable growth in the refurbished and second-hand consumer electronics segment, driven by rising economic awareness and sustainable consumption habits. As inflation and cost-of-living concerns influence purchasing decisions, more consumers are turning to pre-owned or factory-refurbished gadgets that offer value without compromising functionality. Products like smartphones, laptops, and home appliances are increasingly traded and sold through specialized platforms, certified retailers, and peer-to-peer marketplaces. This trend not only reduces electronic waste but also supports circular economy models that extend product lifecycles. Brands and retailers are responding by offering certified refurbishment programs with warranties and after-sales support, which help build trust among buyers. As demand for affordable yet reliable alternatives continue to grow, this segment is emerging as a promising opportunity within Australia's consumer electronics space.

Expansion into Rural and Underserved Regions

As Australia's digital infrastructure continues to improve, particularly in rural and remote areas, new opportunities are opening for the consumer electronics market. Historically underserved due to limited connectivity and distribution, these regions now present untapped potential for companies aiming to broaden their customer base. With increased internet access and better logistics, brands can reach these communities more effectively by offering affordable, durable, and easy-to-use electronics tailored to local needs. Retailers can also leverage mobile commerce and localized promotions to attract buyers in these areas. Additionally, partnerships with regional distributors and community-based service providers can enhance last-mile delivery and support. By investing in these markets, companies not only expand their reach but also contribute to digital inclusion, fostering long-term growth and market diversification.

Australia Consumer Electronics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, category, end-use, and distribution channel.

Product Type Insights:

- Home Appliances

- Large Electronics Appliances

- Refrigerators

- Air Conditioners

- Washing Machines

- Air Purifiers

- Others

- Small Electronic Appliances

- Microwave Ovens

- Food Processors

- Electric Fans

- Vacuum Cleaners

- Others

- Large Electronics Appliances

- Entertainment and Communication

- Televisions

- Mobiles and Smartphones

- Laptops and Computers

- Audio and Video Players

- Cameras

- Speakers

- Video Games

- Others

- Personal Care and Grooming

- Wearables

- Smartwatches

- Headphones

- Earphones and Earbuds

- Others

- Hair Care Devices

- Hair Straightener

- Hair Curler

- Hair Dryer

- Others

- Beauty Devices

- Face/Skin Care Devices

- Hair Removal Devices

- Nail Care Devices

- Others

- Others

- Wearables

The report has provided a detailed breakup and analysis of the market based on the product type. This includes [home appliances (large electronics appliances {refrigerators, air conditioners, washing machines, air purifiers, and others} and small electronics appliances {microwave ovens, food processors, electric fans, vacuum cleaners, and others}), entertainment and communication (televisions, mobiles and smartphones, laptops and computers, audio and video players, cameras, speakers, video games, and others), and personal care and grooming (wearables {smartwatches, headphones, earphones and earbuds, and others}, hair care devices {hair straightener, hair curler, hair dryer, and others}, and beauty devices {face/skin care devices, hair removal devices, nail care devices, and others}, and others)].

Category Insights:

- Smart

- Conventional

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes smart and conventional.

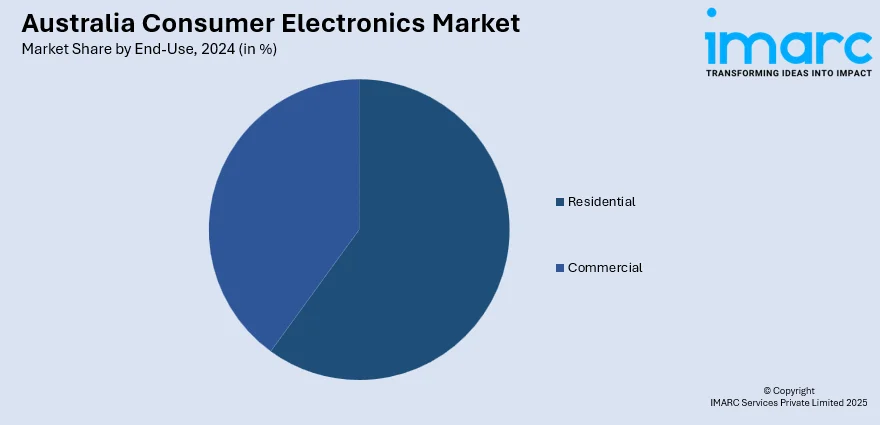

End-Use Insights:

- Residential

- Commercial

- Hotels and Restaurants

- Cafes

- Hospitals

- Corporate Offices

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes residential and commercial (hotels and restaurants, cafes, hospitals, corporate offices, and others).

Distribution Channel Insights:

- B2B

- B2C

- Online

- Company-owned Websites

- E-commerce Websites

- Offline

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes B2B and B2C [online (company-owned websites and e-commerce websites) and offline (supermarkets/hypermarkets, specialty stores, and others)].

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Consumer Electronics Market News:

- July 2024: Samsung Electronics Australia announced a partnership with Scentre Group BrandSpace for the expansion of Galaxy AI, with the launch of the Samsung Galaxy Z Fold6 and Galaxy Flip6.

- April 2024: HP launched its range of commercial and consumer AI PCs in Australia, providing additional power for artificial intelligence (AI) workloads.

Australia Consumer Electronics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Categories Covered | Smart, Conventional |

| End-Uses Covered |

|

| Distribution Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia consumer electronics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia consumer electronics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia consumer electronics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The consumer electronics market in Australia was valued at USD 26.79 Billion in 2024.

The Australia consumer electronics market is projected to exhibit a CAGR of 5.09% during 2025-2033.

The Australia consumer electronics market is projected to reach a value of USD 41.88 Billion by 2033.

Australia’s consumer electronics market is being transformed by widespread smart home adoption, AI-powered personalization in devices, and immersive AR/VR experiences enhancing retail and usability. Rising popularity of wearable device is further shifting consumer preferences toward consumer electronics.

Australia’s consumer electronics market is fueled by growing demand for smart and energy-efficient devices, rising disposable incomes, and rapid digital adoption. Advancements in 5G infrastructure, expanding e-commerce access, and government support for tech innovation also play a key role in driving sustained market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)