Australia Contract Lifecycle Management Software Market Size, Share, Trends and Forecast by Deployment Model, CLM Offerings, Enterprise Size, Industry, and Region, 2025-2033

Australia Contract Lifecycle Management Software Market Overview:

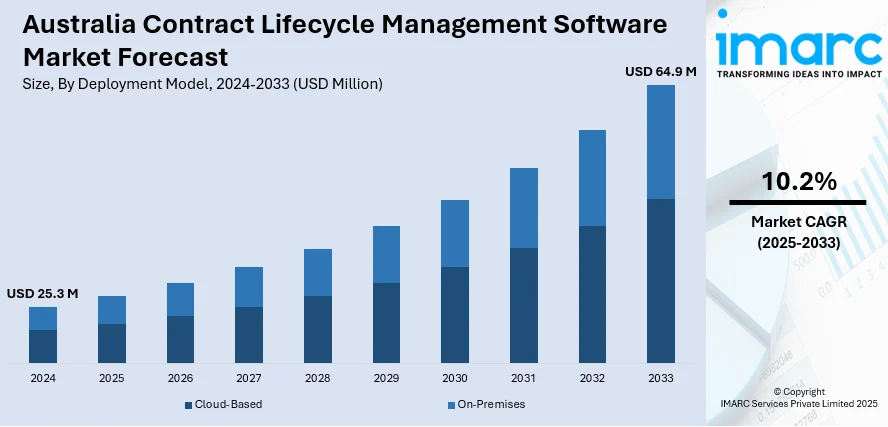

The Australia contract lifecycle management software market size reached USD 25.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 64.9 Million by 2033, exhibiting a growth rate (CAGR) of 10.2% during 2025-2033. The increasing digital transformation across industries, rising demand for compliance and risk management, growing adoption of cloud-based solutions, and the need for streamlined contract processes to improve operational efficiency, reduce legal costs, and enhance transparency are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.3 Million |

| Market Forecast in 2033 | USD 64.9 Million |

| Market Growth Rate 2025-2033 | 10.2% |

Australia Contract Lifecycle Management Software Market Trends:

Modular Solutions Driving Adoption across Enterprises and Government

In Australia, contract management solutions are increasingly defined by their modular architecture and ability to support the full lifecycle, from drafting and approval to compliance and renewal. Organizations and government departments are gravitating toward platforms that offer configurable components, allowing them to tailor features to specific workflows without overhauling existing systems. This shift reflects a broader push for operational efficiency, transparency, and tighter oversight in contract-heavy environments. With growing digital transformation across sectors, tools that integrate seamlessly with enterprise systems and support centralized oversight are seeing rising demand. The emphasis is on functionality, scalability, and ease of use, making modular, end-to-end solutions the preferred choice. These systems are no longer just administrative utilities, they are becoming essential to governance, risk management, and performance tracking across departments and industries. For example, in 2024, ReadyTech's Ready Contracts became a leading contract management solution in Australia and New Zealand, used by over 150 large organizations and government departments. The platform offers modular solutions for managing various components of the contract lifecycle.

To get more information on this market, Request Sample

Rising Emphasis on Post-Award Contract Oversight

Contract lifecycle software adoption in Australia is being shaped by the increasing volume and complexity of public sector procurement. With multiple contracts awarded annually by government bodies, there’s a growing focus on improving post-award oversight to ensure that supplier obligations align with procurement goals. Contract management is no longer seen as a one-time process, it requires ongoing performance tracking, risk mitigation, and compliance assurance throughout the contract’s duration. Departments are seeking digital tools that support structured monitoring, automated alerts, and centralized visibility across multiple agreements. This shift is driving demand for platforms that enable proactive management rather than reactive administration. By embedding contract oversight into broader procurement strategies, public institutions aim to extract greater value, minimize disputes, and strengthen accountability, making full-lifecycle contract systems critical to modern governance frameworks. For instance, in July 2023, the Australian government awarded approximately 70,000 contracts annually, emphasizing the need for effective contract management practices. The Department of Finance highlighted the significance of ongoing contract management to achieve procurement objectives.

Australia Contract Lifecycle Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on deployment model, CLM offerings, enterprise size, and industry.

Deployment Model Insights:

- Cloud-Based

- On-Premises

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes cloud-based and on-premises.

CLM Offerings Insights:

- Licensing and Subscription

- Services

A detailed breakup and analysis of the market based on the CLM offerings have also been provided in the report. This includes licensing and subscription and services.

Enterprise Size Insights:

- Large Enterprise

- Small and Medium Enterprise

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprise and small and medium enterprise.

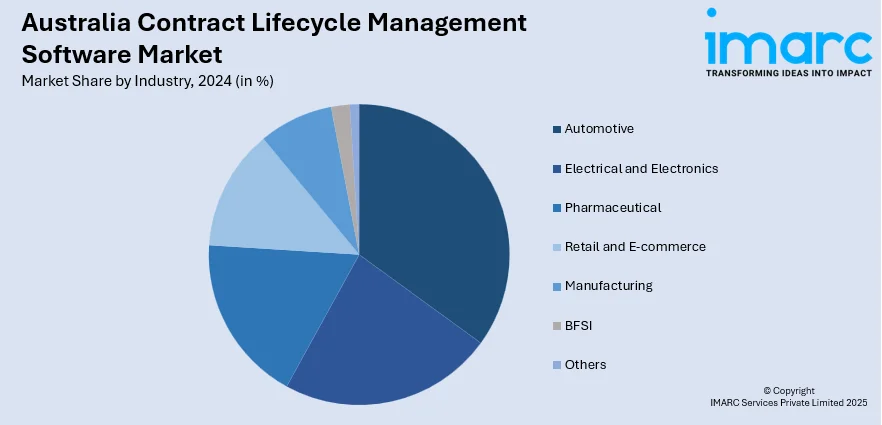

Industry Insights:

- Automotive

- Electrical and Electronics

- Pharmaceutical

- Retail and E-commerce

- Manufacturing

- BFSI

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes automotive, electrical and electronics, pharmaceutical, retail and e-commerce, manufacturing, BFSI, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Contract Lifecycle Management Software Market News:

- In October 2024, ENGIE Australia implemented Plexus' CLM software to streamline its contract workflow. The adoption led to over 300 users across 13 departments utilizing the platform, enhancing contract approval and execution processes.

- In March 2024, the Australian Government Department of Finance released the contract management guide to provide practical guidance for officials managing procurement contracts. The guide emphasizes the importance of good contract management in achieving value for money in government procurements.

Australia Contract Lifecycle Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Models Covered | Cloud-Based, On-Premises |

| CLM Offerings Covered | Licensing and Subscription, Services |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium Enterprise |

| Industries Covered | Automotive, Electrical and Electronics, Pharmaceutical, Retail and E-commerce, Manufacturing, BFSI, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia contract lifecycle management software market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia contract lifecycle management software market on the basis of deployment model?

- What is the breakup of the Australia contract lifecycle management software market on the basis of CLM offerings?

- What is the breakup of the Australia contract lifecycle management software market on the basis of enterprise size?

- What is the breakup of the Australia contract lifecycle management software market on the basis of industry?

- What are the various stages in the value chain of the Australia contract lifecycle management software market?

- What are the key driving factors and challenges in the Australia contract lifecycle management software market?

- What is the structure of the Australia contract lifecycle management software market and who are the key players?

- What is the degree of competition in the Australia contract lifecycle management software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia contract lifecycle management software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia contract lifecycle management software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia contract lifecycle management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)