Australia Conversational AI Market Size, Share, Trends and Forecast by Component, Type, Technology, Deployment, Organization Size, End User, and Region, 2025-2033

Australia Conversational AI Market Overview:

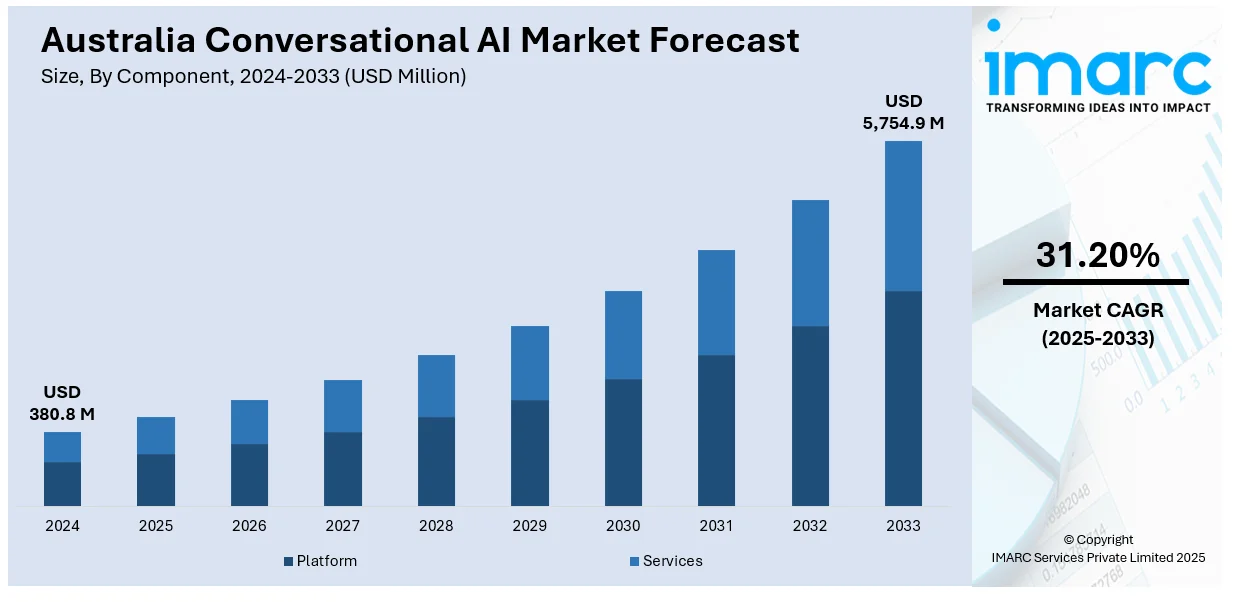

The Australia conversational AI market size reached USD 380.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,754.9 Million by 2033, exhibiting a growth rate (CAGR) of 31.20% during 2025-2033. The market share is expanding rapidly due to enterprise-wide digital transformation, increased human-AI collaboration that supports rather than replaces workers, and the widespread adoption of voice-enabled technologies offering seamless, hands-free interactions across industries prioritizing efficiency and client engagement.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 380.8 Million |

| Market Forecast in 2033 | USD 5,754.9 Million |

| Market Growth Rate 2025-2033 | 31.20% |

Australia Conversational AI Market Trends:

Shift Towards Digital Transformation in Enterprises

Australia’s continuous digital transformation is transforming the way businesses engage with clients and oversee operations, driving significant momentum for the adoption of conversational AI. As businesses seek to enhance efficiency and reduce costs, AI-driven tools like chatbots and virtual assistants are being incorporated into customer service, sales, and internal processes across sectors such as banking, insurance, government, and retail. For instance, in 2024, Commonwealth Bank launched Australia's first generative AI chatbot for customer messaging. The tool improved service response quality, sped up loan approvals, and enhanced fraud and scam detection. It was designed to assist 10 million customers with faster, smarter service options. The achievement of this deployment underscores the growing significance of conversational platforms as key resources in digital-first business strategies. As organizations persist in focusing on efficient, technology-driven engagement, conversational AI is transitioning from being an auxiliary tool to a core component of enterprise technology infrastructure. These advancements are fueling robust Australia conversational AI market growth, with adoption accelerating across both public and private sectors.

To get more information on this market, Request Sample

Enhancement of Human-AI Collaboration

Human-AI collaboration is becoming a significant factor in promoting the adoption of conversational AI in Australia, particularly in industries where automation must complement human decision-making. Instead of displacing workers, AI is being incorporated to take care of repetitive duties, allowing employees to focus on more intricate and sensitive matters. This method enhances both effectiveness and service excellence, especially in industries that engage directly with customers. A pilot initiative in 2024 by Macquarie University and APATE.AI, in collaboration with CommBank, demonstrates this transition. The project utilized conversational AI bots to interact with phone scammers, collect intelligence in real time, and enhance safeguards for possible victims. Instead of operating independently, the bots augmented the security measures led by humans, demonstrating how AI can assist rather than replace skilled experts. These partnerships are establishing a standard in various sectors, demonstrating that conversational AI is most effective when combined with human supervision, promoting acceptance by offering automation advantages along with the guarantee of human participation when essential.

Growing Adoption of Voice-Enabled Technologies

With the integration of smart speakers, mobile voice assistants, and in-car systems into everyday routines, users are increasingly at ease utilizing voice commands for their interactions. Companies are reacting by putting money into voice-driven AI solutions to adapt to this change in user behavior. Voice interfaces provide hands-free ease, quicker services, and customized interaction, advantages that are particularly appealing to industries such as retail, hospitality, and automotive. In 2024, Oliver's introduced "Ollie," the nation's inaugural conversational AI system for drive-thru orders. Created in collaboration with Sodaclick, Ollie facilitated natural, spontaneous voice interactions, provided users with menu information, and then notified staff to fulfill the order. It subsequently grew to include in-store kiosks, enhancing accessibility and customer movement. This launch emphasizes how companies are utilizing voice AI not merely for novelty, but for tangible, scalable enhancements in client experience and operational efficiency. These developments indicate a promising Australia conversational AI market outlook, with strong growth potential across multiple consumer-facing sectors.

Australia Conversational AI Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, type, technology, deployment, organization size, and end user.

Component Insights:

- Platform

- Services

- Support and Maintenance

- Training and Consulting

- System Integration

The report has provided a detailed breakup and analysis of the market based on the component. This includes platform and services (support and maintenance, training and consulting, and system integration).

Type Insights:

- Intelligent Virtual Assistant (IVA)

- Chatbots

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes intelligent virtual assistant (IVA) and chatbots.

Technology Insights:

- Machine Learning

- Deep Learning

- Natural Language Processing

- Automatic Speech Recognition

The report has provided a detailed breakup and analysis of the market based on the technology. This includes machine learning, deep learning, natural language processing, and automatic speech recognition.

Deployment Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes cloud-based and on-premises.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprise.

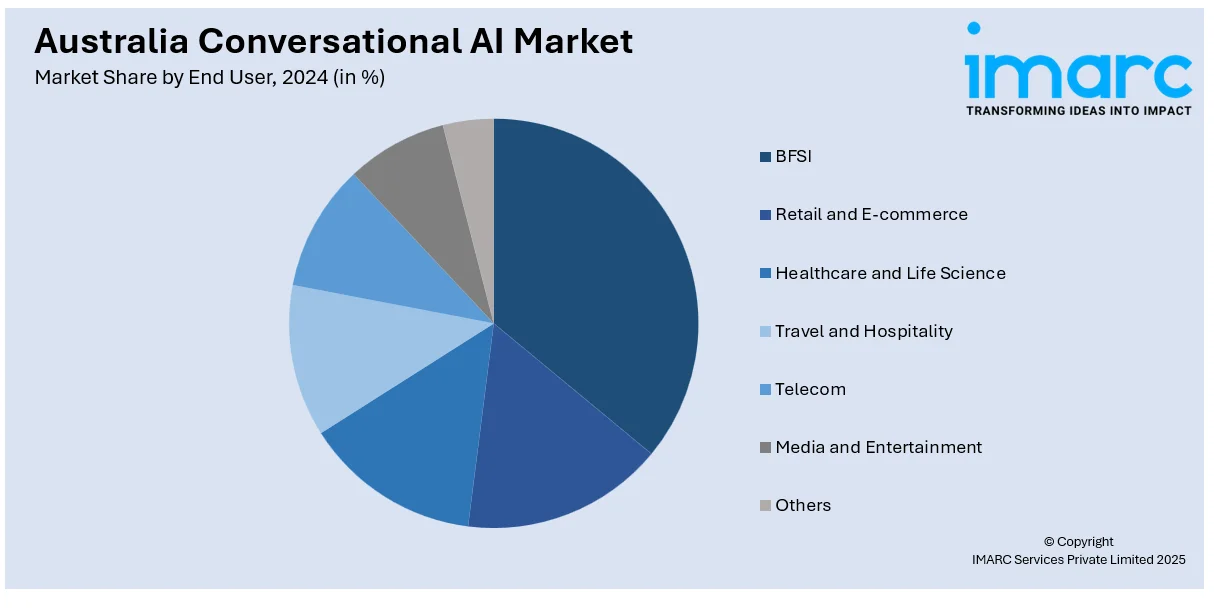

End User Insights:

- BFSI

- Retail and E-Commerce

- Healthcare and Life Science

- Travel and Hospitality

- Telecom

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes BFSI, retail and e-commerce, healthcare and life science, travel and hospitality, telecom, media and entertainment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Conversational AI Market News:

- In March 2025, Amazon announced the upcoming launch of Alexa+, an enhanced version of its voice assistant featuring conversational AI. Alexa+ will offer deeper integration with services like Uber, Spotify, and Disney+, and more intuitive smart device control. It will initially launch in the US, expanding to Australia and New Zealand later.

- In February 2025, Virgin Australia announced it will integrate conversational AI into its contact centers to enhance self-service options for Velocity members and guests. This move is part of the airline’s broader digital transformation aimed at modernizing customer support. The AI will enable more flexible, personalized service experiences.

Australia Conversational AI Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Types Covered | Intelligent Virtual Assistant (IVA), Chatbots |

| Technologies Covered | Machine Learning, Deep Learning, Natural Language Processing, Automatic Speech Recognition |

| Deployments Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprise |

| End Users Covered | BFSI, Retail and E-Commerce, Healthcare and Life Science, Travel and Hospitality, Telecom, Media and Entertainment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia conversational AI market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia conversational AI market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia conversational AI industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The conversational AI market in Australia was valued at USD 380.8 Million in 2024.

The conversational AI market in Australia is projected to exhibit a CAGR of 31.20% during 2025-2033, reaching a value of USD 5,754.9 Million by 2033.

The conversational AI market in Australia is driven by growing adoption across sectors like banking, healthcare, and retail to enhance customer engagement and operational efficiency. Advancements in natural language processing and machine learning technologies fuel innovation. Increasing demand for automated customer support, cost reduction, and personalized user experiences also contribute significantly. Additionally, government investments in AI research and digital transformation initiatives encourage market growth and the development of more sophisticated conversational AI solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)