Australia Copper Alloys Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Australia Copper Alloys Market Overview:

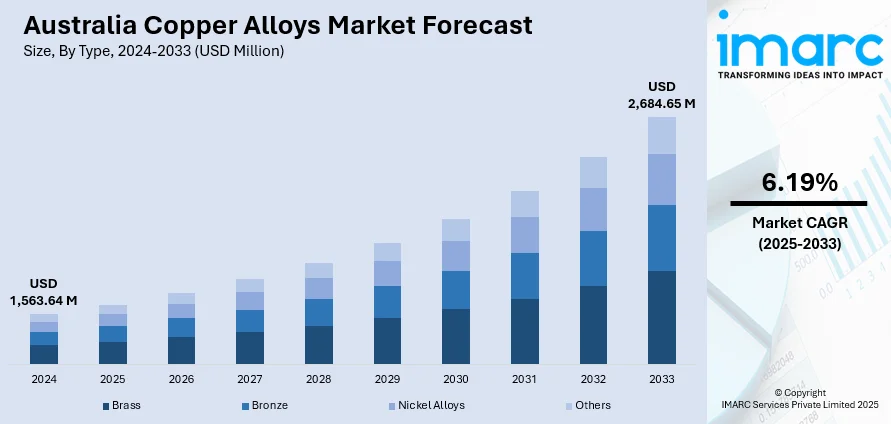

The Australia copper alloys market size reached USD 1,563.64 Million in 2024. Looking forward, the market is projected to reach USD 2,684.65 Million by 2033, exhibiting a growth rate (CAGR) of 6.19% during 2025-2033. The demand is being spurred by growing demand in defense, renewable energy, and electrical infrastructure markets. Copper alloys have better conductivity, corrosion resistance, and strength, making them the key to high-tech applications and energy systems. Continued investments in clean energy and military modernization are driving growth and increasing manufacturing automation drives efficiency of production. Also, high emphasis on recycling and sustainability complies with international environmental norms, enhancing long-term Australia copper alloys market share as a principal exporter of high-performance copper alloys.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,563.64 Million |

| Market Forecast in 2033 | USD 2,684.65 Million |

| Market Growth Rate 2025-2033 | 6.19% |

Key Trends of Australia Copper Alloys Market:

Rising Demand from Defense and Renewable Energy Sectors

Australia's copper alloy sector is being spurred by growing demand from the defence and renewable energy industries, both critical to a low-carbon economy. Copper alloys, prized for their strength, conductivity, and resistance to corrosion, play a crucial role in high-performance defence hardware and cutting-edge communication systems. At the same time, the worldwide renewable energy revolution, driven by climate targets, has spurred demand for copper-based material in solar panels, wind turbines, and energy storage. The International Energy Agency estimates demand for copper will increase over 40% by 2040 to fuel these green technologies. These interrelated industries demand copper alloys with strength coupled with electrical efficiency, further cementing Australia's role as a major supplier. While defense modernization and renewable energy increase, Australia's copper alloy market is also set to grow steadily, playing a vital role in facilitating future-proofing emerging global technologies and the shift to a low-carbon economy.

To get more information of this market, Request Sample

Technological Innovation in Manufacturing Processes

Australia's copper alloys sector is adopting technology innovation to enhance the manufacturing process and remain competitive. The modernization of manufacturing plants through automation, precision engineering, and digital monitoring is transforming the way copper alloys are produced. These technologies enable more uniform quality, reduced waste, and accelerated turnaround times. Consequently, manufacturers are able to produce customized alloys that satisfy the intricate requirements of industries such as aerospace, automotive, and electronics. In addition, there is increasing emphasis on energy-saving production methods that lower environmental footprints and costs. Investing in technology allows manufacturers to be more responsive to worldwide fluctuations in demand, change in response to material sourcing issues, and offer customized solutions. It is this emphasis on efficiency and quality that is pushing the Australia copper alloys market growth towards a new productivity and innovation era.

Sustainability and Recycling as Strategic Priorities

Sustainability is becoming a keystone of the Australian copper alloy sector, with recycling central to operations. Copper's special property of being infinitely recycled without degradation renders it an ideal candidate for circular economy principles. In point of fact, as of 2024 nearly 95% of domestically consumed copper is recycled, making Australia a world leader in sustainable copper use. Businesses are increasingly adding recycled copper into manufacturing to minimize environmental footprint and raw material extraction dependence. Not only is this environmentally friendly, but also it fulfills increasing customer demand as well as regulatory requirements. Manufacturers are going green by reducing emissions, saving energy, and enhancing waste management. By integrating sustainability into business operations, Australia copper alloy manufacturers are participating in worldwide environmental objectives, enhancing their competitive position, and creating long-term strength in a growing ecologically aware market that appreciates accountable sourcing and manufacturing.

Growth Drivers of Australia Copper Alloys Market:

Infrastructure and Construction Boom

The growing infrastructure sector in Australia is driving a significant increase in the demand for copper alloys. Extensive investments in transportation, housing, energy, and public utilities necessitate materials that are durable, resistant to corrosion, and conductive. Copper alloys fulfill these requirements in various construction applications, including electrical wiring in residential structures, plumbing systems, and industrial heat exchangers. Their capacity to withstand extreme conditions and ensure a long service life makes them perfect for enhancing infrastructure durability. As both government and private sectors continue to finance urban and regional development projects, this steady demand is boosting the Australia copper alloys market share, particularly in the construction and building components segment, where reliability and performance are essential.

Advanced Manufacturing and Engineering

The growth of advanced manufacturing in Australia is leading to an increased utilization of copper alloys in precision engineering applications. Industries such as robotics, automation, and the production of electrical equipment require materials that possess high thermal and electrical conductivity, strength, and wear resistance. Copper alloys, particularly those incorporating elements like beryllium or nickel, are utilized in components such as motor windings, contacts, terminals, and industrial connectors. With Australia focusing on domestic manufacturing and high-value production, the demand for these alloys is on the rise. The trend towards producing efficient, durable components for machinery and electrical devices further propels Australia copper alloys market demand, especially within sectors that emphasize reliability and high performance.

Mining and Heavy Industry Utilization

The mining and heavy industries in Australia heavily rely on copper alloys for equipment durability and reliability in challenging operational environments. These alloys are commonly found in applications including bushings, bearings, valve components, and fittings that need to endure high loads, abrasion, and chemical exposure. In oil & gas and mineral processing facilities, corrosion resistance and mechanical strength are crucial qualities that copper alloys consistently provide. As mining operations continue to modernize and expand, the demand for efficient, long-lasting materials is increasing. This trend is especially significant for Australia’s export-driven resource economy. According to Australia copper alloys market analysis, current usage patterns and industrial activity suggest that this sector is a vital contributor to the nation’s economic growth and industrial sustainability.

Australia Copper Alloys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Brass

- Bronze

- Nickel Alloys

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes brass, bronze, nickel alloys, and others.

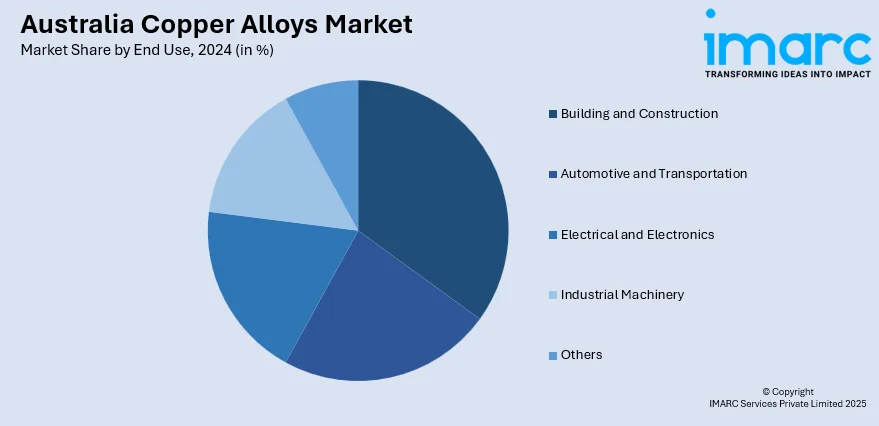

End Use Insights:

- Building and Construction

- Automotive and Transportation

- Electrical and Electronics

- Industrial Machinery

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes building and construction, automotive and transportation, electrical and electronics, industrial machinery, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Copper Alloys Market News:

- In March 2025, Lebronze Alloys (LBA), a portfolio company of Astorg, acquired Allied Copper Alloys (UK) and AW Fraser (New Zealand) as part of its global expansion strategy. These strategic acquisitions enhance LBA’s production capabilities, service network, and product portfolio. Following Astorg’s 2024 acquisition of LBA, the move strengthens its position in key markets and supports its plan to broaden applications and specialty copper alloy offerings across diverse industries.

- In July 2024, Indonesian billionaire Anthoni Salim’s Mach Metals Australia offered AUD 393 million to acquire Rex Minerals, aiming to secure full ownership. Already holding a 15.8% stake, Mach’s bid follows Rex’s search for partners to develop its Hillside copper-gold project in South Australia. The Rex board supports the deal, which is pending shareholder and regulatory approval, with completion expected by late October 2025. The move aligns with Mach’s energy transition strategy.

Australia Copper Alloys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Brass, Bronze, Nickel Alloys, Others |

| End Uses Covered | Building and Construction, Automotive and Transportation, Electrical and Electronics, Industrial Machinery, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia copper alloys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia copper alloys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia copper alloys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The copper alloys market in Australia was valued at USD 1,563.64 Million in 2024.

The Australia copper alloys market is projected to exhibit a compound annual growth rate (CAGR) of 6.19% during 2025-2033.

The Australia copper alloys market is expected to reach a value of USD 2,684.65 Million by 2033.

Rising adoption of copper alloys in renewable energy systems, electric vehicles, and smart infrastructure is the primary key trend. Demand for precision-engineered components in advanced manufacturing, export interest from Asia, and alloy innovations focused on strength, conductivity, and corrosion resistance are further shaping industry preferences.

Infrastructure upgrades, mining expansion, and investment in local manufacturing are boosting copper alloy demand. Their essential role in electrical, mechanical, and thermal applications makes them vital across sectors. Government support for domestic metal processing and rising use in energy, transport, and automation further accelerate market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)