Australia Copper Pipes and Tubes Market Size, Share, Trends and Forecast by Finish Type, Outer Diameter, End-User, and Region, 2025-2033

Australia Copper Pipes and Tubes Market Overview:

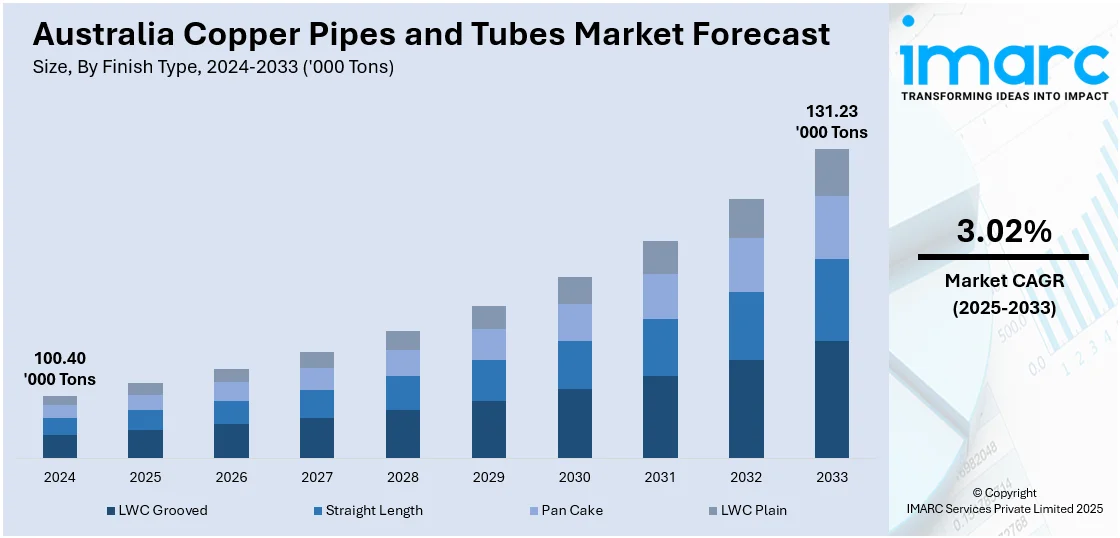

The Australia copper pipes and tubes market size reached 100.40 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 131.23 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 3.02% during 2025-2033. The market is growing steadily, driven by rising demand from the construction and HVAC sectors, increased local copper refining capacity, and wider adoption of press-fit systems that enhance installation speed, safety, and long-term system reliability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 100.40 Thousand Tons |

| Market Forecast in 2033 | 131.23 Thousand Tons |

| Market Growth Rate 2025-2033 | 3.02% |

Australia Copper Pipes and Tubes Market Trends:

Expansion in Local Copper Processing Capacity

One major trend shaping the Australian copper pipes and tubes market is the growing emphasis on local processing capabilities. As demand for copper infrastructure increases across sectors like construction, industrial manufacturing, and clean energy, ensuring stable and efficient supply has become a priority. The shift toward localized production helps avoid international supply disruptions and reduces dependence on imports, which can fluctuate due to trade constraints or geopolitical issues. It also encourages greater investment in downstream applications such as plumbing, HVAC systems, and industrial equipment that rely on high-quality copper tubes. In January 2025, BHP awarded an EPCM contract to Fluor Australia and Hatch to support the expansion of its copper smelter and refinery in South Australia. The initial USD 40 Million investment was intended to drive the strategic planning stages, with long-term production targets set to exceed 500,000 Tons of refined copper cathode annually by the early 2030s. This development signaled strong national-level support for copper value chain enhancement. As refined cathode serves as a key input for copper pipe and tube manufacturing, the move is expected to benefit local producers directly. By increasing domestic output, the project supports consistent raw material availability and promotes Australia as a stable copper supplier, reinforcing long-term market confidence.

To get more information on this market, Request Sample

Shift Toward Press-Fit Installation Systems

The growing adoption of efficient, time-saving jointing solutions particularly press-fit systems is driving the market growth. These systems offer cleaner, faster, and more secure installations without the need for open flame soldering or welding, which enhances job site safety and reduces labor costs. This is increasingly important across residential and commercial plumbing, air conditioning systems, and industrial applications, where timelines and precision are critical. The trend reflects a broader industry move toward low-maintenance, high-performance installation technologies that meet modern construction standards. In March 2025, ASTM introduced the B1029 standard for press-connect joints using seamless copper and copper alloy tubes. This new specification, developed with input from Viega, established detailed guidelines to enhance connection strength, leak prevention, and system durability. It also brought consistency to press-fit component manufacturing and installation practices. As a result, confidence in press-fit copper systems has grown, particularly among engineers and plumbing professionals. The introduction of this standard is expected to boost demand for compatible copper tubes and fittings in Australia. It further supports market expansion by enabling faster project completion, reducing installation errors, and encouraging broader use of copper in modern infrastructure builds.

Australia Copper Pipes and Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on finish type, outer diameter, and end-user.

Finish Type Insights:

- LWC Grooved

- Straight Length

- Pan Cake

- LWC Plain

The report has provided a detailed breakup and analysis of the market based on the finish type. This includes LWC grooved, straight length, pan cake, and LWC plain.

Outer Diameter Insights:

- 3/8, 1/2, 5/8 Inch

- 3/4, 7/8, 1 Inch

- Above 1 Inch

The report has provided a detailed breakup and analysis of the market based on the outer diameter. This includes 3/8, 1/2, 5/8 inch, 3/4, 7/8, 1 inch, and above 1 inch.

End User Insights:

- HVAC

- Industrial Heat Exchanger

- Plumbing

- Electrical

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes HVAC, industrial heat exchanger, plumbing, electrical, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Copper Pipes and Tubes Market News:

- March 2025: ASTM published the B1029 standard for press-connect joints using seamless copper and copper alloy tubes. Developed with Viega's input, the standard improved installation reliability and efficiency, encouraging wider adoption of press-fit systems and boosting demand in Australia's copper pipes and tubes sector.

- February 2025: MAC Copper Limited updated its CSA Copper Mine reserves to 545kt contained Cu at 3.4% grade, with production guidance until 2036. This strengthened Australia's copper supply outlook, supporting stable raw material availability and pricing for the domestic copper pipes and tubes industry.

Australia Copper Pipes and Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Finish Types Covered | LWC Grooved, Straight Length, Pan Cake, LWC Plain |

| Outer Diameters Covered | 3/8, 1/2, 5/8 Inch, 3/4, 7/8, 1 Inch, Above 1 Inch |

| End-Users Covered | HVAC, Industrial Heat Exchanger, Plumbing, Electrical, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia copper pipes and tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia copper pipes and tubes market on the basis of finish type?

- What is the breakup of the Australia copper pipes and tubes market on the basis of outer diameter?

- What is the breakup of the Australia copper pipes and tubes market on the basis of end user?

- What are the various stages in the value chain of the Australia copper pipes and tubes market?

- What are the key driving factors and challenges in the Australia copper pipes and tubes?

- What is the structure of the Australia copper pipes and tubes market and who are the key players?

- What is the degree of competition in the Australia copper pipes and tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia copper pipes and tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia copper pipes and tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia copper pipes and tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)