Australia Courier, Express and Parcel (CEP) Market Size, Share, Trends and Forecast by Service Type, Destination, Type, End Use Sector, and Region, 2025-2033

Australia Courier, Express and Parcel (CEP) Market Overview:

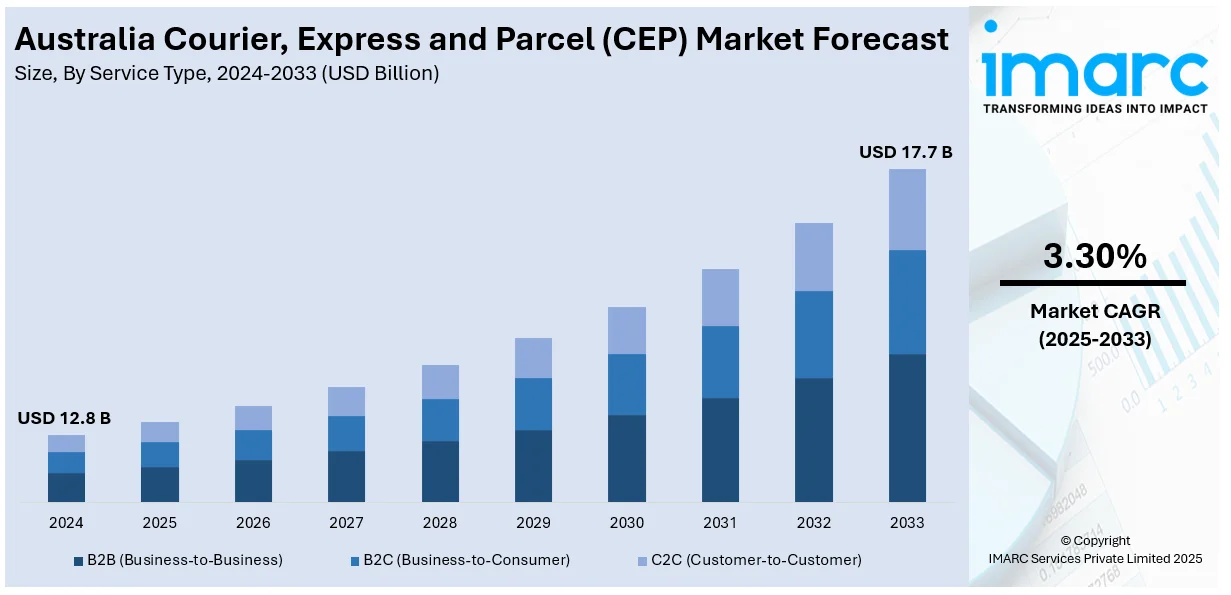

The Australia courier, express and parcel market size reached USD 12.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.30% during 2025-2033. The rapid growth of e-commerce, leading to higher demand for fast, reliable deliveries; a shift towards sustainable, eco-friendly logistics practices; and the integration of advanced technologies like artificial intelligence (AI), automation, and robotics to enhance operational efficiency and customer satisfaction is impelling the Australia courier, express and parcel (CEP) market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.8 Billion |

| Market Forecast in 2033 | USD 17.7 Billion |

| Market Growth Rate 2025-2033 | 3.30% |

Australia Courier, Express and Parcel (CEP) Market Trends:

Technological Advancements in Delivery Systems

Technological advancements are greatly changing the Australian courier, express, and parcel (CEP) market, increasing efficiency in sorting, tracking, and delivery. Automation, artificial intelligence (AI), and Internet of Things (IoT) are powering logistics innovations, with big retailers like Coles spending money on AI-powered fulfillment centers, like the Wetherill Park center in Sydney. This center employs advanced robotics in processing over 10, 000 orders a day, increasing the order accuracy and delivery speed for over five million customers. Warehouse robots, drones, and self-driving vehicles are increasingly becoming common, reducing errors and lowering the cost of operations. Live-tracking tools increase transparency, enabling customers to track their packages with ease. Predictive analytics also enhances delivery route optimization, making the shipments faster and cheaper. These technologies are transforming last-mile logistics and making operations more efficient throughout Australia's expanding CEP market.

To get more information on this market, Request Sample

E-commerce Growth and Increased Parcel Volume

The fast growth in e-commerce in Australia is heavily influencing the Australia courier, express, and Parcel (CEP) market share. As people shop online more, particularly in the post-pandemic era, parcel volumes have risen. People now expect quicker and more convenient delivery solutions, pushing CEP players to improve operational efficiency. This trend affects multiple facets of the market, ranging from packaging to tracking mechanisms and last-mile delivery solutions. Retailers and logistics providers are reacting by growing their delivery networks, enhancing logistics infrastructure, and adopting new technologies to serve customers' needs. The focus on fast, reliable deliveries is transforming the entire logistics industry, driving Australia courier, express and parcel (CEP) market outlook while also concentrating on enhancing customer satisfaction.

Sustainability and Green Logistics

Sustainability is playing a crucial role in reshaping the Australian courier, express, and parcel (CEP) market as businesses adopt eco-friendly practices to minimize environmental impact. Companies are increasingly using electric delivery vehicles, optimizing routes to reduce fuel consumption, and utilizing recyclable packaging. Amazon, for instance, has replaced single-use plastics with recyclable paper and cardboard, eliminating approximately 3 million tonnes of unnecessary packaging since 2015. Likewise, Australia Post is increasing its fleet of electric vehicles (EVs) to aid in greener deliveries. These changes are being driven by regulatory pressure and the changing consumer desire for sustainable services. With governments urging lower carbon emissions, CEP providers are green-tech investing and using sustainable logistics, creating new markets and opportunities while solving environmental issues and enhancing parcel delivery efficiency in the long term.

Australia Courier, Express and Parcel (CEP) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on service type, destination, type and end use sector.

Service Type Insights:

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

- C2C (Customer-to-Customer)

The report has provided a detailed breakup and analysis of the market based on the service type. This includes B2B (business-to-business), B2C (business-to-consumer), and C2C (customer-to-customer).

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic, and international.

Type Insights:

- Air

- Ship

- Subway

- Road

The report has provided a detailed breakup and analysis of the market based on the type. This includes air, ship, subway, and road.

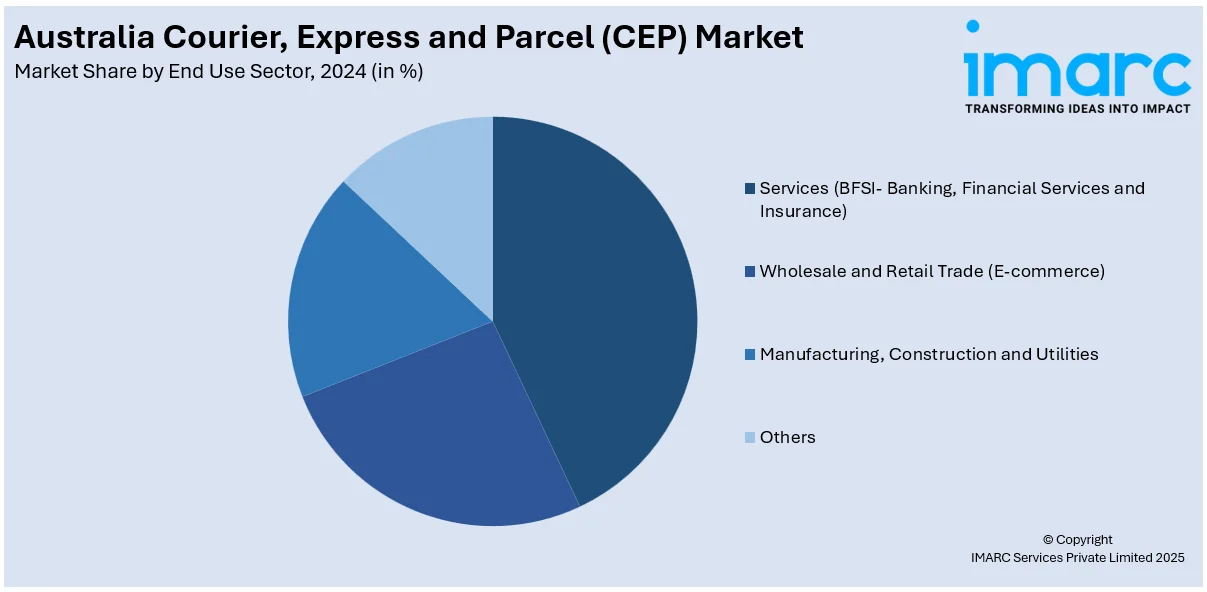

End Use Sector Insights:

- Services (BFSI- Banking, Financial Services and Insurance)

- Wholesale and Retail Trade (E-commerce)

- Manufacturing, Construction and Utilities

- Others

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes services (BFSI- banking, financial services and insurance), wholesale and retail trade (e-commerce), manufacturing, construction and utilities, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Courier, Express and Parcel (CEP) Market News:

- In June 2024, Australia Post expanded its next-day delivery service to Perth and Adelaide, enhancing speed and reliability for retailers and shoppers. This move follows data showing that 68% of online shoppers abandon purchases due to slow delivery. The Australia Post Metro service aims to meet evolving consumer expectations by prioritizing next-day delivery in metro areas. Executive General Manager Gary Starr emphasized the company's commitment to providing greater choice, simplicity, and reliability for online shoppers.

- In February 2024, CouriersPlease is expanding its parcel-handling capacity with three new sustainable depots in Sydney, Melbourne, and Perth. These facilities will support the company’s growth and enhance services for customers and franchisees. Under CEO Richard Thame, CouriersPlease has seen a 20% rise in parcel volumes and now delivers for over half of Australia’s major retailers. The company, celebrating 40 years, operates with 1,200 couriers across 800 territories nationwide.

Australia Courier, Express and Parcel (CEP) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | B2B (Business-to-Business), B2C (Business-to-Consumer), C2C (Customer-to-Customer) |

| Destinations Covered | Domestic, International |

| Types Covered | Air, Ship, Subway, Road |

| End Use Sectors Covered | Services (BFSI- Banking, Financial Services and Insurance), Wholesale and Retail Trade (E-commerce), Manufacturing, Construction and Utilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia courier, express and parcel (CEP) market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia courier, express and parcel (CEP) market on the basis of service type?

- What is the breakup of the Australia courier, express and parcel (CEP) market on the basis of destination?

- What is the breakup of the Australia courier, express and parcel (CEP) market on the basis of type?

- What is the breakup of the Australia courier, express and parcel (CEP) market on the basis of end use sector?

- What is the breakup of the Australia courier, express and parcel (CEP) market on the basis of region?

- What are the various stages in the value chain of the Australia Courier, Express and Parcel (CEP) market?

- What are the key driving factors and challenges in the Australia courier, express and parcel (CEP)?

- What is the structure of the Australia courier, express and parcel (CEP) market t and who are the key players?

- What is the degree of competition in the Australia courier, express and parcel (CEP) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia courier, express and parcel (CEP) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia courier, express and parcel (CEP) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia courier, express and parcel (CEP) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)