Australia Craft Spirits Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Australia Craft Spirits Market Overview:

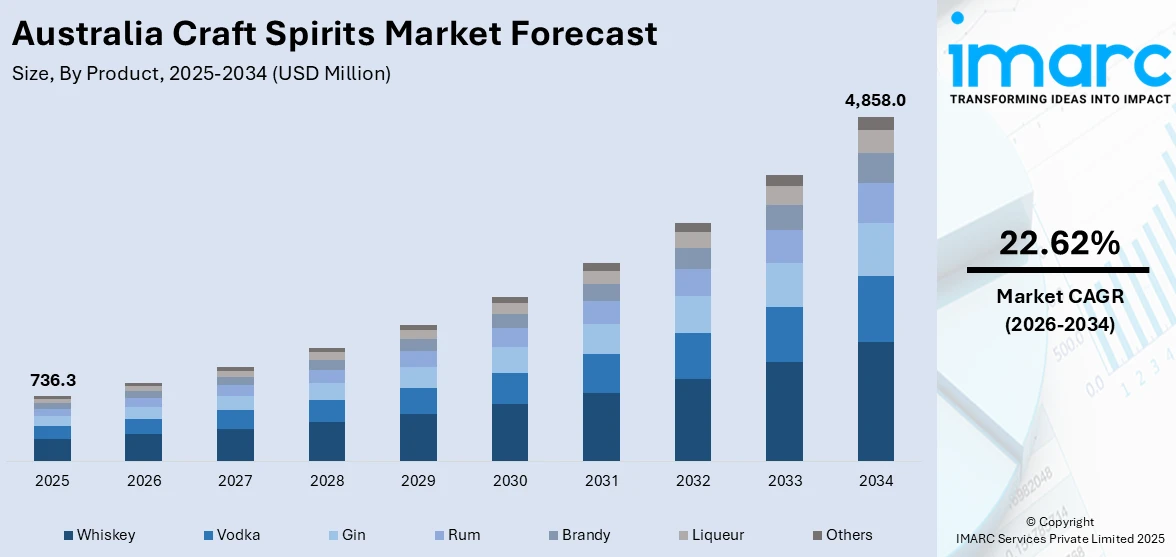

The Australia craft spirits market size reached USD 736.3 Million in 2025. Looking forward, the market is expected to reach USD 4,858.0 Million by 2034, exhibiting a growth rate (CAGR) of 22.62% during 2026-2034. The market is influenced by accelerating demand for premium, craft product, a heightened emphasis on sustainable, locally made production, and increasing consumer interest in experiential, lifestyle-driven engagements. These are representative of growing movement toward authenticity, eco-responsiveness, and experiential brand engagement. With consumers highly desiring higher quality and greater connection with what they buy, each of these influences plays an equal role in the growth of the Australia craft spirits market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 736.3 Million |

| Market Forecast in 2034 | USD 4,858.0 Million |

| Market Growth Rate 2026-2034 | 22.62% |

Key Trends of Australia Craft Spirits Market:

Growing Consumer Demand for Premium and Artisanal Products

There is a growing trend among Australian drinkers to opt for premium and artisanal spirits, which mirrors the general shift in consumer preferences to authenticity, excellence, and local character. Instead of mass-produced brands, consumers are looking for spirits that express craftsmanship and characteristic regional flavors. Younger age groups in particular are driving this trend, as they are keen on experiencing distinctive drinking experiences and open production processes. The focus on hand-crafted techniques and locally sourced materials plays an essential part in making purchasing decisions, supporting the theme of quality over quantity. Furthermore, there is increasing demand for spirits that provide innovation in taste with roots in traditional distillation methods. This creates pressure for producers to innovate through botanicals, barrel aging, and fermentation styles. Australia craft spirits growth is being heavily fueled by these changing advancements of consumers and desire to spend on premium quality, making the segment a key driver to reshape the country's alcoholic beverage industry. According to the sources, in September 2024, South Australia's craft distilling industry became internationally renowned as Imperial Measures Distilling (IMD) won five significant awards at the Tasting Australia Spirit Awards, affirming excellence in the Australia craft spirits industry.

To get more information on this market Request Sample

Growth of Sustainable and Locally Produced Production Methods

Sustainability has become a defining feature in the production of craft spirits throughout Australia. Environmental awareness is growing to have an impact on consumer decision-making and distillery processes. From grain-to-glass transparency to carbon-neutral manufacturing and use of renewable energy, craft distillers are bringing their operations in line with sustainable practices. Locally sourced raw materials add to lessened environmental footprint and local agriculture and economy support. This process not only increases traceability but also adds a touch of authenticity and place to every product, something that rings very true with green-conscious consumers. Packaging innovation, like recyclable bottles and stripped-down designs, is also on the upswing in this direction. Sustainability as a differentiator enables a stronger connection between brands and consumers. Australia craft spirits growth captures the extent to which greenery and ethical sourcing are no longer afterthoughts, but mainstay pillars in the development of the country's craft spirit space.

Inclusion of Craft Spirits into Experiential and Lifestyle Trends

Craft spirits are no longer just relegated to the classic beverage niche now, they're being coupled with a wider lifestyle and experiential movement. From expert tasting sessions and distillery tours to mixology courses and food pairing sessions, consumers are actively looking for involvement that extends beyond the bottle. Immersive experiences such as these enable people to appreciate the art form that goes into spirit making, driving loyalty and advocacy for the brand. As per the sources, in June 2024, Six South Australian craft spirit makers—Prohibition Liquor Co., Barossa Distilling Co., Little Juniper, Kangaroo Island Spirits, Heaps Good Gin, and Mad Monkey—were feted for leading the state's thriving spirits sector. Furthermore, social media has heightened this trend further, as consumers share and document their experiences, building a culture celebrating discovery and community around craft drinks. The association of craft spirits with creativity, heritage, and leisure has positioned them as a preferred option in contemporary hospitality and home entertainment alike. Australia craft spirits development is being heavily influenced by this meeting of culture and consumption, as spirits become lifestyle products that provide personal connection, learning, and experiential memories.

Growth Drivers of Australia Craft Spirits Market:

Rising Consumer Sophistication and Premium Product Preference

Australian consumers are increasingly developing sophisticated palates and demonstrating a willingness to pay premium prices for authentic, high-quality craft spirits. This demographic shift is driven by millennials and Gen Z consumers who prioritize experiences, authenticity, and craftsmanship over mass-market alternatives. The ascending culture of wine in Australia has informed the consumers regarding the terroir, mode of production and flavor profiles, which directly translate to the enjoyment of spirits. This trend is being exploited by local distilleries, which are trying to exploit the unique flavour profiles by using native Australian botanicals to produce unique products that cannot be duplicated elsewhere. This consumerism goes as far as to the knowledge of production methods, encouragement of small enterprises, and appreciation of artisanal methods, and this is the basic driving force behind market growth and charging luxury prices in the craft spirits market.

Government Support and Tourism Industry Integration

The Australian government's commitment to supporting local manufacturing and tourism industries has created favorable conditions for Australia craft spirits market demand. State governments actively promote distillery tourism through marketing campaigns, grant programs, and infrastructure development initiatives that position craft distilleries as tourist destinations. The integration of distilleries into wine regions and agricultural areas has created synergistic effects, attracting visitors who seek comprehensive regional experiences. Tax incentives, reduced regulatory barriers for small producers, and export promotion programs further stimulate industry growth. Additionally, the government's focus on regional development and job creation aligns with craft distillery establishment, particularly in rural areas where these businesses contribute significantly to local economies and employment opportunities.

Innovation in Production Techniques and Native Ingredient Utilization

Australian craft distillers are pioneering innovative production techniques that differentiate their products in global markets while celebrating unique local characteristics. The utilization of native botanicals such as wattle seed, lemon myrtle, eucalyptus varieties, and pepperberry creates distinctive flavor profiles unavailable elsewhere in the world. Advanced distillation technologies, unique aging processes using Australian wine barrels, and experimental fermentation methods enable producers to create premium products with compelling stories. Climate advantages in certain regions allow for accelerated aging processes and unique environmental influences on spirit development. This innovation extends to sustainable production methods, water management systems, and energy-efficient operations that appeal to environmentally conscious consumers while reducing operational costs and environmental impact.

Opportunities of Australia Craft Spirits Market:

Export Market Expansion and International Brand Recognition

The global recognition of Australian craft spirits presents significant export opportunities, particularly in Asia-Pacific markets where premium alcohol consumption is increasing rapidly. Australia's reputation for quality wine production creates positive brand associations that benefit spirits exports, while the country's clean, green image appeals to international consumers seeking authentic, sustainable products. Free trade agreements with key markets reduce barriers to entry, while Australian craft spirits' unique flavor profiles using native ingredients create strong differentiation in crowded international markets. Luxury tourism from key markets provides opportunities for international visitors to discover Australian craft spirits, creating brand ambassadors who continue purchasing upon returning home. Strategic partnerships with international distributors, participation in global spirits competitions, and digital marketing campaigns can significantly expand market reach.

Technology Integration and Digital Commerce Development

Digital transformation opportunities abound in direct-to-consumer sales, virtual tasting experiences, and e-commerce platforms that enable craft distilleries to reach broader audiences while maintaining personal connections with customers. Advanced analytics allow producers to understand consumer preferences, optimize production planning, and develop targeted marketing strategies. According to the Australia craft spirits market analysis, virtual reality tours, online masterclasses, and subscription services create new revenue streams while building brand loyalty. Social media platforms enable storytelling, brand building, and community engagement that traditional advertising cannot achieve. Blockchain technology offers authentication opportunities for premium products, while mobile apps can enhance visitor experiences at distilleries through interactive tours, personalized recommendations, and seamless purchasing options that bridge physical and digital customer journeys.

Collaboration and Cross-Industry Partnerships

Strategic partnerships with hospitality venues, restaurants, wine producers, and tourism operators create opportunities for market expansion through co-marketing initiatives and cross-promotion strategies. Collaborations with local farmers for ingredient sourcing, cooperatives for distribution, and shared facilities for small producers reduce operational costs while maintaining quality standards. Partnership opportunities with international spirits companies provide access to global distribution networks, marketing expertise, and capital investment while preserving local brand identity. Educational institution collaborations can develop specialized distilling programs, research initiatives, and innovation projects that advance industry knowledge. Retail partnerships, festival participations, and corporate event catering expand market reach while building brand recognition across diverse consumer segments through experiential marketing approaches.

Challenges of Australia Craft Spirits Market:

Regulatory Complexity and Excise Tax Burden

The Australian craft spirits industry faces significant challenges from complex regulatory frameworks and high excise tax rates that disproportionately impact small producers compared to large-scale manufacturers. Excise duties on spirits are among the highest globally, creating substantial cost pressures that limit pricing flexibility and market competitiveness. Licensing requirements, compliance costs, and regulatory reporting obligations consume valuable resources that small distilleries could otherwise invest in production, marketing, or expansion activities. Regular changes to tax structures, including automatic indexation increases, create uncertainty in business planning and profitability projections. State-by-state variations in regulations, licensing requirements, and operational restrictions complicate multi-state operations and distribution strategies, while international export regulations add additional complexity for distilleries seeking global market expansion opportunities.

Intense Competition and Market Saturation Risks

The rapid growth in craft distillery numbers has intensified competition within the Australian market, creating challenges in brand differentiation, customer acquisition, and market share retention. Large multinational spirits companies with substantial marketing budgets and established distribution networks pose significant competitive threats to smaller craft producers. Consumer attention fragmentation across numerous new brands makes marketing more expensive and less effective, requiring innovative approaches to stand out in crowded markets. Price competition pressures margins while premium positioning becomes increasingly difficult to maintain as supply exceeds demand in certain segments. Retail shelf space limitations, distributor relationship challenges, and consumer loyalty building require substantial investment in marketing and relationship management that many small producers struggle to afford sustainably.

Supply Chain Vulnerabilities and Production Scaling Challenges

Craft distilleries face significant challenges in securing consistent, high-quality ingredient supplies at reasonable costs, particularly for specialty grains, unique botanicals, and Australian-grown raw materials. Seasonal variations in agricultural inputs, climate change impacts on crop yields, and competition from larger buyers create supply uncertainty and cost volatility. Scaling production while maintaining quality standards and artisanal character requires substantial capital investment in equipment, facilities, and skilled personnel that many craft producers cannot easily access. Quality control consistency, batch-to-batch variation management, and production efficiency optimization become increasingly complex as operations expand. Additionally, skilled distilling talent shortages, training requirements for specialized equipment, and knowledge transfer challenges limit growth potential for many craft distilleries seeking to expand their operations and market presence.

Australia Craft Spirits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Whiskey

- Vodka

- Gin

- Rum

- Brandy

- Liqueur

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes whiskey, vodka, gin, rum, brandy, liqueur, and others.

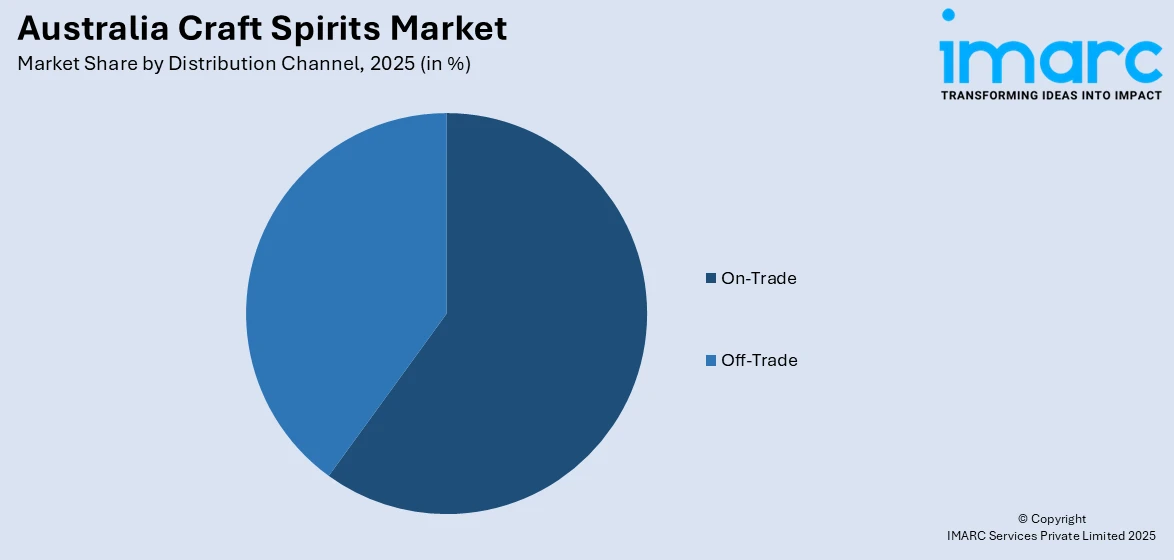

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- On-Trade

- Off-Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade and off-trade.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Craft Spirits Market News:

- In January 2025, Tin Shed Distilling Co launched its new distillery venue in Nairne, Adelaide Hills, transforming a 19th-century bacon factory into a vibrant cultural hub. The site offers whisky, gin, and rum tastings, guided tours, and retail, paired with smokehouse BBQ and four live music performances weekly—showcasing South Australia’s creative talent and enriching the craft spirits experience.

Australia Craft Spirits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Whiskey, Vodka, Gin, Rum, Brandy, Liqueur, Others |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia craft spirits market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia craft spirits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia craft spirits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia craft spirits market was valued at USD 736.3 Million in 2025.

The Australia craft spirits market is projected to exhibit a CAGR of 22.62% during 2026-2034.

The Australia craft spirits market is projected to reach a value of USD 4,858.0 Million by 2034.

The market experiences rapid growth driven by premium artisanal product demand, sustainable local production methods, and experiential lifestyle integration. Consumer sophistication, native botanical utilization, and distillery tourism create distinctive market positioning, while craft spirits become lifestyle products offering authentic connections and memorable experiences.

The Australia craft spirits market is driven by rising consumer sophistication, government tourism support, and innovative production techniques utilizing native ingredients. Premium preference trends, regulatory support initiatives, and export market opportunities further accelerate adoption across diverse demographic segments nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)