Australia Crane Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Australia Crane Market Overview:

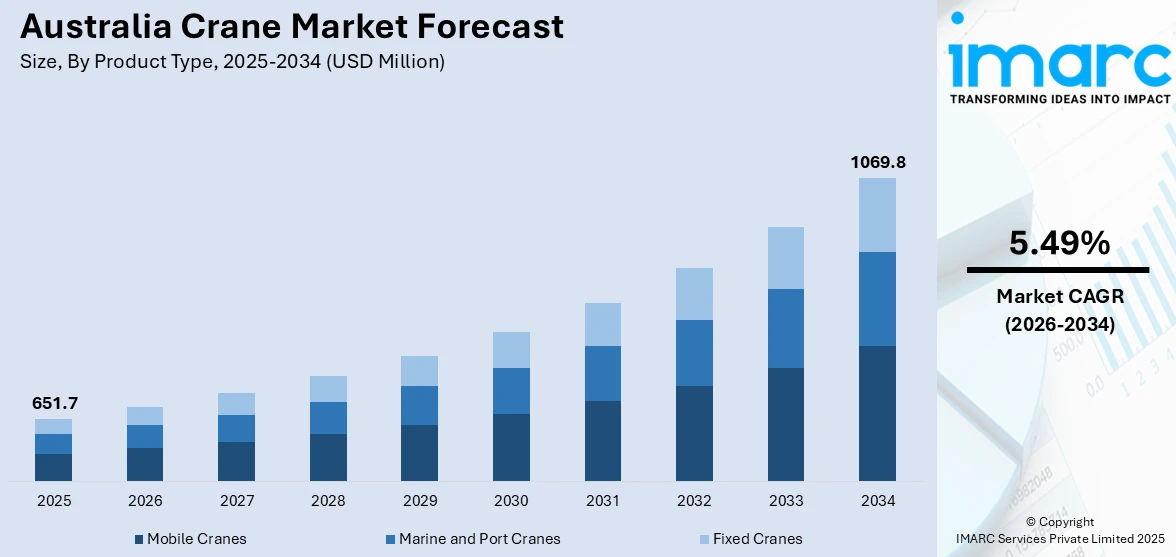

The Australia crane market size reached USD 651.7 Million in 2025. Looking forward, the market is expected to reach USD 1,069.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.49% during 2026-2034. Infrastructure development, mining activities, commercial construction, renewable energy projects, and government investments are some of the factors propelling the growth of the market. Urbanization, demand for high-rise buildings, and adoption of advanced lifting technologies also support market growth, alongside the increasing need for efficient material handling and operational safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 651.7 Million |

| Market Forecast in 2034 | USD 1,069.8 Million |

| Market Growth Rate 2026-2034 | 5.49% |

Key Trends of Australia Crane Market:

Increased Demand for Heavy-Lift Cranes in Infrastructure Projects

The Australia crane market is witnessing a growing demand for high-capacity crawler cranes, particularly in response to the surge in large-scale infrastructure developments such as port expansions. With multiple coastal upgrades underway, there is a greater need for machines that offer enhanced lifting performance, precision, and reliability in complex environments. High-tonnage crawler cranes are increasingly favored for their ability to support continuous operations in challenging construction settings, especially where reach and stability are critical. The use of advanced lifting equipment is becoming more prominent as project timelines tighten and safety standards rise. Offshore logistics, material handling, and foundation work are among the key areas driving this shift. This shift also signals stronger integration of imported heavy-duty crane models that meet stringent Australian compliance standards while offering the versatility required in high-value infrastructure construction across the country, which further contributes to the growth of Australia crane market share. For example, in April 2024, SANY delivered two brand-new crawler cranes, SCC3200A-1 and SCC2000A, to Australia for participation in expanding port construction projects.

To get more information on this market Request Sample

Broader Equipment Lineups Catering to Specialized Lifting Needs

In Australia, the crane market is seeing an expansion in hydraulic crawler crane offerings to address increasingly complex construction and infrastructure demands. Manufacturers are introducing newer models across varying lifting capacities, reflecting the growing preference for machines tailored to specific job site requirements. The introduction of multiple models within a single series indicates a focus on scalability and operational flexibility. These cranes typically feature improved fuel efficiency, advanced control systems, and easier maintenance, which are key factors for contractors aiming to reduce downtime and improve cost-effectiveness. The rollout of machines with varying capacities, from mid-range to high tonnage, allows operators to better match equipment to the scale of each project, whether in urban developments, energy projects, or transport infrastructure. This shift highlights an industry-wide move toward providing precision-engineered solutions that align with the evolving needs of Australia’s construction sector. For instance, in December 2023, Kobelco Construction Machinery launched three new G-4 series hydraulic crawler cranes, i.e., CKE900G-4, CKE1350G-4, and CKE2500G-4, enhancing its product lineup for the Australian market.

Growth Drivers of Australia Crane Market:

Expansion of Infrastructure and Transport Projects

The Australia crane market demand is escalated by the continued growth in large-scale infrastructure and transport projects throughout the country. Government-supported investment in public infrastructure, such as road networks, rail systems, bridges, and airports, is generating steady demand for numerous forms of cranes, particularly tower cranes and mobile cranes. Large urban projects like the Sydney Metro, Melbourne Airport Rail Link, and national highway corridor upgrades need the heavy lifting and sensitive material handling capabilities of cranes to be on the job site. The varied and harsh Australian landscapes, city to remote outback, demand a broad spectrum of crane technologies to address various environmental and logistical issues. Additionally, construction deadlines for such ventures are frequently tight, adding to the call for extremely productive lifting solutions. With long-term infrastructure projects a priority for both federal and state governments, the need for advanced, high-reliability crane equipment keeps increasing, driving the industry's growth path.

Growth in Mining and Resource Sector Activity

The region’s position on the world stage as a major exporter of minerals and natural resources contributes largely to Australia crane market growth and development, especially in Western Australia, Queensland, and the Northern Territory. Mining activities tend to be located in remote and difficult-to-reach areas, necessitating heavy cranes for the construction process, equipment installation, and regular maintenance. The renewed demand for commodities, fueled by worldwide infrastructure growth and renewable energy shifts, is triggering new mining developments and expansions of current facilities. Cranes are needed for the initial construction phase and for operations such as moving bulky equipment, erecting processing plants, and supporting on-site infrastructure. The special working conditions of the Australian mining industry, like severe heat, dust, and heavy loads, have driven the demand for tough, high-performance cranes with sophisticated safety features. Mining firms also are increasingly embracing automation and telematics in lifting gear to enhance efficiency and minimize risk, driving growth in advanced crane solutions optimized for Australia's resource industry.

Growing Demand for Urban High-Rise and Industrial Construction

According to the Australia crane market analysis, city population growth, especially in urban centers such as Sydney, Melbourne, Brisbane, and Perth, is resulting in a surge of high-rise residential and commercial complexes. Such vertical building projects necessitate custom crane solutions, such as tower cranes and luffing jib cranes, which can operate under constrained, dense city locations. The trend toward mixed-use development and mega-developments also boosts the size and complexity of lifting tasks. To complement residential and office skyscrapers, increased development of industrial parks, logistics centers, and data centers, particularly in suburbs and regional locations, is driving demand for crawler cranes and mobile cranes. Developers and contractors are increasingly focusing on construction speed and safety, resulting in greater adoption of modular construction and prefabricated elements, which are highly dependent on cranes. Coupled with hard building regulations and the requirement for accuracy in managing materials, this inner-city construction boom provides long-term growth prospects for crane rental companies and suppliers in Australia.

Australia Crane Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type and application.

Product Type Insights:

- Mobile Cranes

- Marine and Port Cranes

- Fixed Cranes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes mobile cranes, marine and port cranes, and fixed cranes.

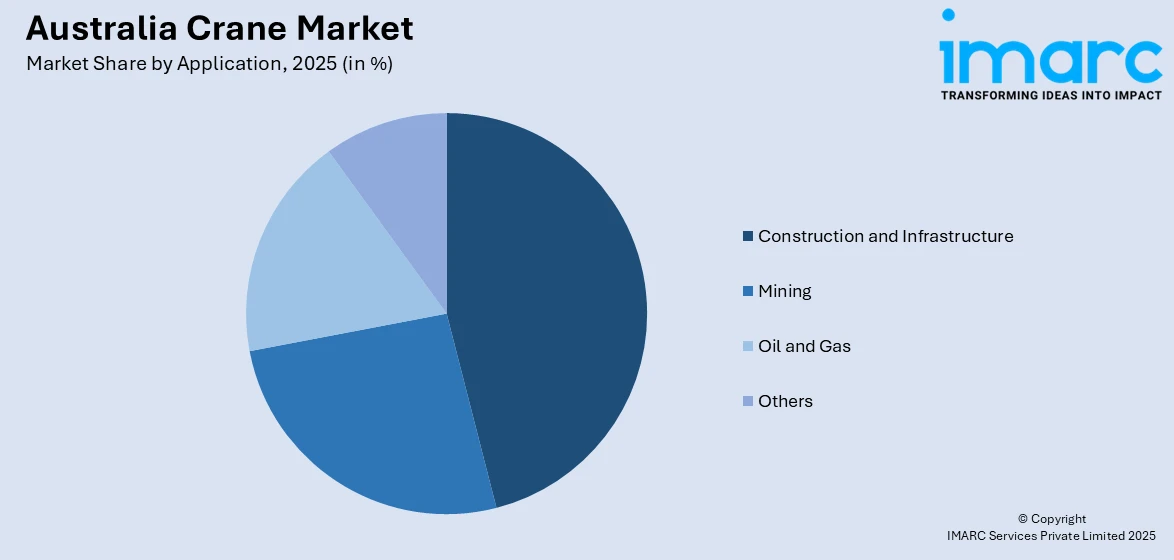

Application Insights:

Access the comprehensive market breakdown Request Sample

- Construction and Infrastructure

- Mining

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction and infrastructure, mining, oil and gas, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Crane Market News:

- In October 2024, Franna, a key player in Australia’s crane market, was the platinum sponsor at the 2024 CICA National Conference held in Adelaide from 17–19 October. The company showcased its latest models, i.e., the AT40 Series 2 and MAC25 Series 5, highlighting upgrades in power, safety, and efficiency. This move reinforced Franna’s leadership in pick-and-carry cranes and its focus on setting higher performance standards in the Australian market.

Australia Crane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mobile Cranes, Marine and Port Cranes, Fixed Cranes |

| Applications Covered | Construction and Infrastructure, Mining, Oil and Gas, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia crane market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia crane market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia crane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia crane market was valued at USD 651.7 Million in 2025.

The Australia crane market is projected to exhibit a CAGR of 5.49% during 2026-2034.

The Australia crane market is expected to reach a value of USD 1069.8 Million by 2034.

Key trends in Australia crane market include increasing adoption of automated and telematics-enabled cranes, growth in crane rentals over ownership, and rising use of compact, high-capacity models for urban projects. Sustainability and safety innovations, along with demand for versatile lifting solutions in mining and infrastructure, are also shaping the market landscape.

The Australia crane market is driven by large-scale infrastructure projects, booming urban high-rise construction, and expansion in the mining and resource sectors. Demand for advanced, durable cranes is rising due to complex site requirements, remote operations, and a shift toward modular building methods, fueling sustained growth across key regions and industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)