Australia Crawler Crane Market Size, Share, Trends and Forecast by Type, Capacity, End User, and Region, 2025-2033

Australia Crawler Crane Market Overview:

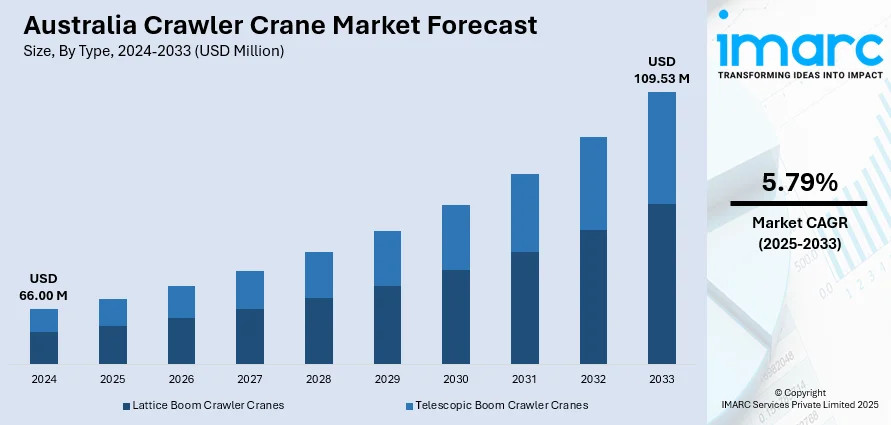

The Australia crawler crane Market size reached USD 66.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 109.53 Million by 2033, exhibiting a growth rate (CAGR) of 5.79% during 2025-2033. The market is consistently expanding due to growing infrastructure construction, mining activities, and renewable energy sectors. Technological improvement, coupled with the growing inclination toward wet hire services, is optimizing efficiency and improving safety. Sustained demand from urban and distant construction areas is consistently driving equipment deployment across various applications, thus playing a significant role in increasing the presence of Australia crawler crane market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 66.00 Million |

| Market Forecast in 2033 | USD 109.53 Million |

| Market Growth Rate 2025-2033 | 5.79% |

Australia Crawler Crane Market Trends:

Technological Development and Automation Integration

The Australian crawler crane industry is going through a remarkable shift fueled by technological innovations and integration of automation. Several companies are integrating more features like remote monitoring, telematics, and autonomous operation capability in their cranes. These developments make the cranes more efficient to operate, decrease downtime, and create safer working conditions on construction sites. The use of automated systems provides for optimal control and monitoring of crane operations, resulting in more accurate and efficient lifting operations. The integration of telematics also allows for the collection of real-time data and analysis, enabling predictive maintenance as well as minimizing equipment failure risks. With the increasing need for sophisticated infrastructure construction, the use of advanced crane technology is now a priority, making Australia a leader in crane technology across the Asia-Pacific region.

To get more information on this market, Request Sample

Sustainability and Compliance with Regulations

Owing to the heightened interest in environment concerns and regulatory requirements, the crawler crane industry in Australia is witnessing a shift toward environmentally friendly practices and national safety standard compliance. The National Construction Code (NCC) and the CraneSafe scheme require routine inspections and compliance with safety procedures to ensure cranes operate at their best. Manufacturers are emphasizing the production of environmentally friendly crawler cranes that reduce emissions and fuel consumption, in line with Australia's efforts towards lowering its carbon footprint. These green practices assist in the conservation of the environment while increasing the long-term sustainability of the construction sector by enforcing safe and responsible use of equipment. The focus on sustainability and regulation is a sign of a larger movement toward responsible construction, which further fuels the Australia crawler crane market growth.

Labor Dynamics and Operational Efficiency

Australian crawler crane operations are also determined by labor dynamics and a desire for operational efficiency. The crane sector encounters labor shortages challenges, especially in far-flung locations where massive infrastructure projects are being carried out. To combat these challenges, there is a growing trend of wet hire models whereby crane owners supply both the machinery and qualified crane operators to ensure that projects continue unabated despite labor shortcomings. This method not only reduces the effect of labor shortages but also raises the efficiency of operations by ensuring that heavy machines are handled by experienced workers who know the unique needs of each project. As the need for complex infrastructure projects increases, the combination of skilled labor and state-of-the-art crane technology is the key to successful project execution.

Australia Crawler Crane Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, capacity, and end user.

Type Insights:

- Lattice Boom Crawler Cranes

- Telescopic Boom Crawler Cranes

The report has provided a detailed breakup and analysis of the market based on the type. This includes lattice boom crawler cranes and telescopic boom crawler cranes.

Capacity Insights:

- Below 50 Metric Tons

- 50 to 250 Metric Tons

- 250 to 450 Metric Tons

- More than 450 Metric Tons

A detailed breakup and analysis of the market based on the capacity has also been provided in the report. This includes below 50 metric tons, 50 to 250 metric tons, 250 to 450 metric tons, and more than 450 metric tons.

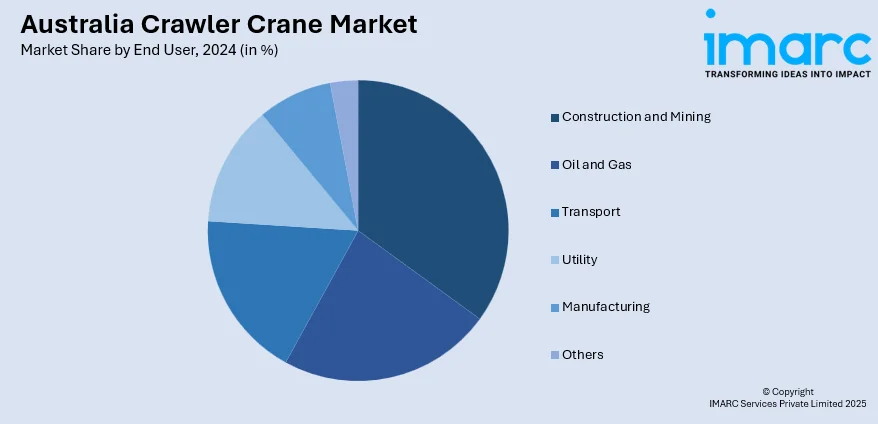

End User Insights:

- Construction and Mining

- Oil and Gas

- Transport

- Utility

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes construction and mining, oil and gas, transport, utility, manufacturing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Crawler Crane Market News:

- In November 2023, the first six Kobelco lattice boom crawler cranes were delivered to Borger Crane Hire and Rigging Services by the Australian Kobelco distributor, Baden Davis Crane Connection. The newest cranes have two CKE1800s, which are crawlers with a 180t capacity, and four Kobelco CKS2500s, which are crawlers with a 250t capacity.

Australia Crawler Crane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lattice Boom Crawler Cranes, Telescopic Boom Crawler Cranes |

| Capacities Covered | Below 50 Metric Tons, 50 to 250 Metric Tons, 250 to 450 Metric Tons, More Than 450 Metric Tons |

| End Users Covered | Construction and Mining, Oil and Gas, Transport, Utility, Manufacturing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Soouthern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia crawler crane market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia crawler crane market on the basis of type?

- What is the breakup of the Australia crawler crane market on the basis of capacity?

- What is the breakup of the Australia crawler crane market on the basis of end user?

- What is the breakup of the Australia crawler crane market on the basis of region?

- What are the various stages in the value chain of the Australia crawler crane market?

- What are the key driving factors and challenges in the Australia crawler crane market?

- What is the structure of the Australia crawler crane market and who are the key players?

- What is the degree of competition in the Australia crawler crane market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia crawler crane market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia crawler crane market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia crawler crane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)