Australia Crop Protection Chemicals Market Size, Share, Trends and Forecast by Product Type, Origin, Crop Type, Form, Mode of Application, and Region, 2025-2033

Australia Crop Protection Chemicals Market Overview:

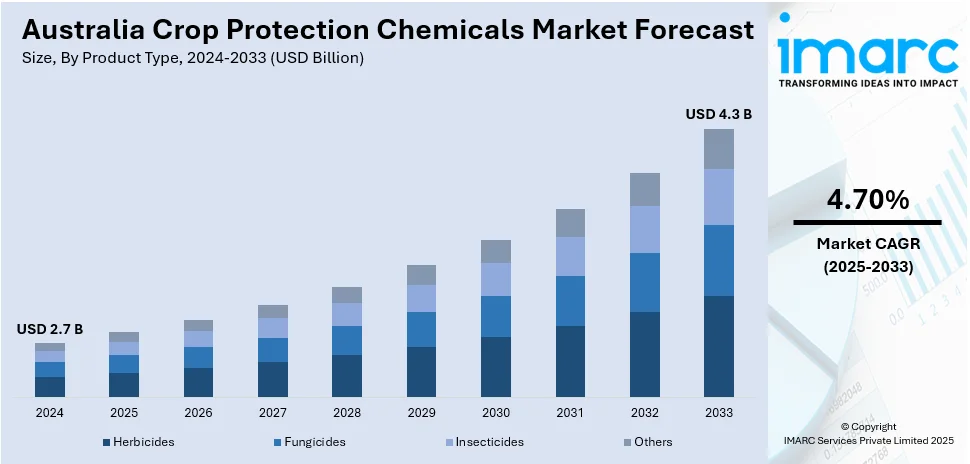

The Australia crop protection chemicals market size reached USD 2.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The market is fueled by the growing demand for sustainable agriculture, horticultural output, and the embracing of innovative agrochemical products. Favorable weather conditions, favorable regulatory policies, and demands for greater crop yields are boosting the industry's optimistic outlook and growing percentage in varied agriculture areas, strengthening the Australia crop protection chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.7 Billion |

| Market Forecast in 2033 | USD 4.3 Billion |

| Market Growth Rate 2025-2033 | 4.70% |

Australia Crop Protection Chemicals Market Trends:

Higher Demand for Sustainable Agricultural Practices

The increasing emphasis on sustainable agriculture is having a tremendous impact on crop protection chemicals' growth in Australia. Farmers are highly embracing integrated pest management (IPM) and environmentally sound practices that find a balance between productivity and ecological integrity. The trend is encouraging the use of selective and biodegradable crop protection products more, which leaves less environmental residue and promotes long-term soil health. Also, low-impact agricultural input awareness programs and government support for low-impact agricultural inputs are promoting the use of newer, safer formulations. These changes are part of a larger trend toward environmentally friendly farming in the country's varied agricultural landscapes. Australia crop protection chemicals market outlook will gain from this changing preference for sustainable solutions, leading to steady market growth. For instance, In April 2024, BASF fungicide Revystar®, driven by Revysol® Active, was approved by APVMA for application on Australian canola, wheat, barley, and oat crops, delivering superior disease control and resistance management. Moreover, with sustainability a leading priority, crop protection chemicals focused on ecological farming objectives will be favored to capture the market, making Australia a leader in the use of agrochemical technology responsibly.

To get more information on this market, Request Sample

Increased Application of Precision Agriculture Technologies

The growing adoption of precision agriculture technology in Australian agriculture is fueling demand for crop protection chemicals customized to new equipment and methods. Satellite mapping, GPS-guided application systems, and drone-spraying technology are increasing precision and efficiency of chemical use. These technologies make targeted application possible, minimizing waste, and ensuring maximum coverage and efficacy. Consequently, there is a mounting demand for crop protection formulations that are compatible with such technologies and adaptable to variable rate application methods. For example, in November 2024, the 5th Ag Formulation & Application Technology Congress (FAT 2024) was organized, covering agrochemical formulation technologies, market trends, and regulatory updates. It drew more than 350 delegates, such as companies like Blossum (Australia). Furthermore, this trend is promoting the development of region-specific chemical solutions tailored to agronomic requirements. Additionally, as digital agriculture goes mainstream, Australia crop protection chemicals market share is likely to rise, particularly among tech-embracing farmers. This technological convergence is not only improving productivity but also strengthening the position of contemporary crop protection in the achievement of higher yields and responding to the distinct challenges of Australia's extensive and diverse farmlands.

Increase in Horticulture and High-Value Crops

The boosting production of horticultural and high-value crops like grapes, citrus fruits, nuts, and vegetables in Australia is driving demand for specialized crop protection chemicals. The crops are more vulnerable to diseases and pests and need intensive management during the growing cycle. Thus, there is greater dependence on fungicides, insecticides, and herbicides specifically designed for sensitive and high-value crops. The trend is complemented by Australia's high export orientation, which requires high-quality produce that satisfies international phytosanitary standards. Premium crop quality drives the demand for advanced protection solutions, and hence Australia crop protection chemicals market growth is greatly influenced by this expansion, as chemical intensity of use tends to be greater in horticulture than broadacre crops. With consumer tastes inclining toward natural, clean-label produce, growers are tapping both bio-based and traditional crop protection products to address requirements. The segment remains a strong market driver and innovation engine.

Australia Crop Protection Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product type, origin, crop type, form, and mode of application.

Product Type Insights:

- Herbicides

- Fungicides

- Insecticides

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes herbicides, fungicides, insecticides, and others.

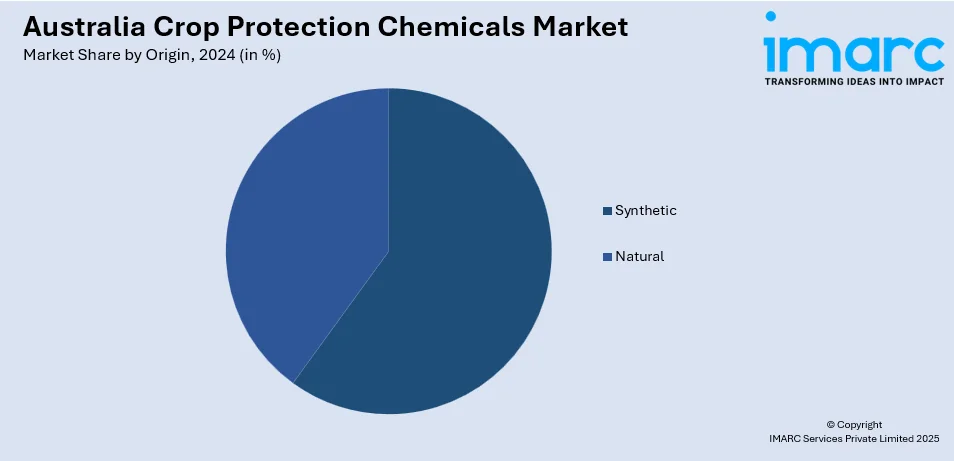

Origin Insights:

- Synthetic

- Natural

A detailed breakup and analysis of the market based on the origin have also been provided in the report. This includes synthetic and natural.

Crop Type Insights:

- Cereal and Grains

- Fruits and Vegetables

- Oilseed and Pulses

- Others

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereal and grains, fruits and vegetables, oilseed and pulses, and others.

Form Insights:

- Liquid

- Solid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid.

Mode of Application Insights:

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the mode of application. This includes foliar spray, seed treatment, soil treatment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Crop Protection Chemicals Market News:

- In February 2025, Nufarm Australia announced a deal with KingAgroot, an agricultural biotechnology firm in China, for the development of Flufenoximacil, a novel broad-spectrum non-selective herbicide. The two firms are working towards registration in the Australian market towards the end of the decade, providing a major innovation for Australia's crop protection industry.

- In May 2024, BASF launched its new insecticide, Cimegra®, to Australian producers. With the innovative active ingredient Broflanilide®, it delivers strong, lasting control of stubborn pests such as Diamondback moth, with no resistance problems reported. Cimegra's unique formulation gives farmers efficient, versatile pest control for Brassica crops, leading to improved resistance management and crop protection.

Australia Crop Protection Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Herbicides, Fungicides, Insecticides, Others |

| Origins Covered | Synthetic, Natural |

| Crop Types Covered | Cereal and Grains, Fruits and Vegetables, Oilseed and Pulses, Others |

| Forms Covered | Liquid, Solid |

| Mode of Applications Covered | Foliar Spray, Seed Treatment, Soil Treatment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia crop protection chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia crop protection chemicals market on the basis of product type?

- What is the breakup of the Australia crop protection chemicals market on the basis of origin?

- What is the breakup of the Australia crop protection chemicals market on the basis of crop type?

- What is the breakup of the Australia crop protection chemicals market on the basis of form?

- What is the breakup of the Australia crop protection chemicals market on the basis of mode of application?

- What is the breakup of the Australia crop protection chemicals market on the basis of region?

- What are the various stages in the value chain of the Australia crop protection chemicals market?

- What are the key driving factors and challenges in the Australia crop protection chemicals?

- What is the structure of the Australia crop protection chemicals market and who are the key players?

- What is the degree of competition in the Australia crop protection chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia crop protection chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia crop protection chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia crop protection chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)