Australia Cruise Market Size, Share, Trends and Forecast by Type, and Region, 2025-2033

Australia Cruise Market Overview:

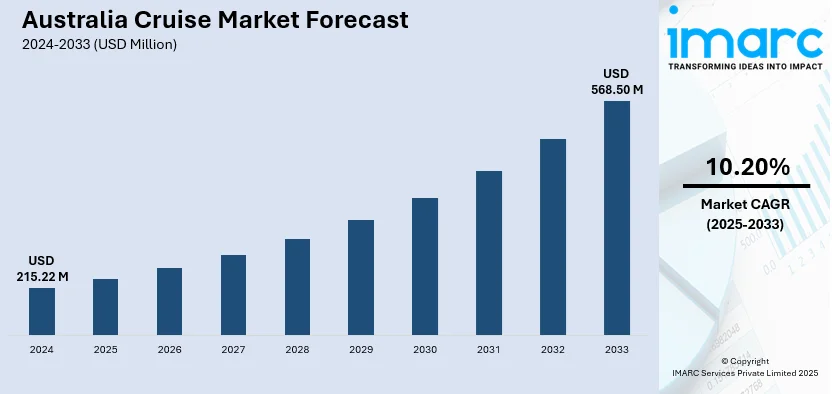

The Australia cruise market size reached USD 215.22 Million in 2024. Looking forward, the market is expected to reach USD 568.50 Million by 2033, exhibiting a growth rate (CAGR) of 10.20% during 2025-2033. The market is driven by rising disposable incomes, increased interest in domestic and international cruise tourism, expanding cruise infrastructure, and enhanced offerings in luxury and expedition cruises.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 215.22 Million |

| Market Forecast in 2033 | USD 568.50 Million |

| Market Growth Rate 2025-2033 | 10.20% |

Key Trends of Australia Cruise Market:

Rising Demand for Domestic Cruises

A combination of shifting travel patterns and a strong desire for local vacation experiences is driving up demand for domestic cruises in Australia. Particularly in the aftermath of the pandemic, Australians are opting for local cruises in order to experience coastal areas without having to deal with the inconveniences of international travel. From 2022–2023 to 2023–2024, the total economic output from cruise tourism grew by a significant 49.7%, from $5.6 billion to $8.4 billion. This increase is the consequence of a strong recovery in cruise activity, which has increased expenditure by cruise lines as well as by passengers and crew. In addition, there were around 75 cruise ships in operation, reflecting a 27.1% increase in the number of cruise ships visiting Australian ports. Passenger capacity increased by 25.8% to 88,454, while crew capacity rose by 29.9% to 40,829, showing a positive outlook for market growth. Aside from that, the flexibility of domestic routes and easy access from major ports like Sydney, Melbourne, and Brisbane are key drivers of this expansion. For example, Victoria's cruise industry continues to expand, with a total economic output of $637 million due to increased cruise ship voyages across the state.

To get more information on this market, Request Sample

Luxury and Expedition Cruises Gaining Popularity

In Australia, wealthy tourists looking for immersive, one-of-a-kind experiences that provide more individualized services and access to less-visited locations are driving a noticeable trend towards luxury and expedition cruises. With travelers placing a greater value on upscale facilities, unique experiences, and customized itineraries that provide more adventure and cultural insights, this trend is greatly expanding the cruise industry. Since 2010, the number of new luxury ships produced every five years has increased by 30%, indicating a boom in the luxury cruise market, according to the Cruise Lines International Association (CLIA). By 2028, around 100 new luxury ships are anticipated. In addition, expedition cruising has had strong growth, increasing by 70% since 2019. For instance, reservations for 2024 by Cunard rose 23% in 2023, breaking its record year bookings. Relative to 2023, the cruise company had 73,000 more passengers from January through October. In addition, 36% of cruise passengers are younger than 40, and the average cruiser is currently 46, representing a shift toward younger markets. To appeal to this demographic, cruise companies are experimenting with more athletic activities (hiking, kayaking), which is driving market expansion. Furthermore, eco-conscious tourists find luxury cruises' emphasis on sustainability appealing, which supports the market's expansion.

Growth Factors of Australia Cruise Market:

Expanding Port Infrastructure and Regional Connectivity

Australia’s cruise market is benefiting significantly from ongoing investments in port infrastructure and regional connectivity. Major ports such as Sydney, Brisbane, Cairns, and Fremantle have undergone expansions and upgrades, enabling them to accommodate larger, modern cruise ships. These developments not only improve passenger boarding experiences but also encourage cruise lines to include more Australian destinations in their itineraries. Enhanced port accessibility fosters the growth of multi-destination cruises, particularly around coastal and regional towns, which were previously underserved. In turn, this expansion supports regional tourism, generates local employment, and diversifies cruise offerings beyond traditional city stops. These infrastructure improvements have positioned Australia as an increasingly attractive hub for both domestic and international cruise operators looking to scale their routes and services, which is driving the Australia cruise market demand.

Growing Interest Among First-Time Cruisers

The Australian cruise industry is seeing a surge in first-time passengers, largely driven by targeted marketing campaigns, enticing travel deals, and upgraded onboard experiences. Cruise companies are actively tapping into new demographics, particularly younger travelers and middle-aged professionals, by highlighting the value, convenience, and diverse entertainment options available at sea. Enhanced amenities such as specialty dining, high-speed Wi-Fi, wellness programs, and themed events are reshaping perceptions of cruising, attracting travelers who may have previously overlooked this segment. In addition, flexible itineraries and shorter cruise durations cater well to first-timers hesitant to commit to long voyages. This influx of new customers contributes to increased passenger volume while also helping establish long-term customer relationships, which strengthens brand loyalty and supports the expansion of the market base for future growth.

Rising Middle-Class Travel Spending

Australia’s expanding middle class is playing a vital role in propelling the Australia cruise market growth. With rising disposable incomes, more Australians are seeking premium yet cost-effective travel experiences that combine relaxation, exploration, and convenience. Cruises offer excellent value for money through all-inclusive packages covering accommodation, meals, entertainment, and excursions, making them an appealing choice for budget-conscious yet experience-driven consumers. The accessibility of domestic departures further boosts participation, as it eliminates the need for international flights. Moreover, middle-income travelers are increasingly interested in multi-generational holidays, and cruises cater perfectly to this need with activities for all age groups. As the middle-class population continues to grow, their increased travel spending is expected to remain a consistent and influential driver of demand across the Australian cruise industry.

Opportunities of Australia Cruise Market:

Expansion into Themed and Niche Cruises

Australia's cruise market presents substantial opportunities through the development of themed and niche cruise experiences tailored to specific interests. Cruise operators are increasingly curating unique voyages such as culinary expeditions, wine-tasting cruises, wellness retreats, wildlife safaris, and music or cultural festivals at sea. These specialized offerings appeal to travelers seeking more personalized and immersive experiences, helping cruise lines differentiate themselves in a competitive market. Themed cruises also encourage repeat travel by attracting loyal interest-based communities who prefer curated content and like-minded social environments. By aligning cruise themes with popular lifestyle trends, operators can engage niche audiences and strengthen customer retention. According to the Australia cruise market analysis, these experiences often command premium pricing and attract high-value passengers, driving both revenue growth and brand loyalty in the evolving Australian cruise sector.

Cruise Tourism Integration with Land-Based Attractions

Integrating cruise itineraries with land-based tourism experiences presents a valuable opportunity to enhance the overall travel experience and stimulate local economies. Collaborations between cruise lines and regional tourism boards, tour operators, and cultural institutions allow passengers to enjoy extended shore excursions, heritage tours, adventure activities, and local culinary experiences. This holistic approach transforms cruise holidays into comprehensive travel packages, increasing passenger satisfaction while driving greater tourist spending in destination ports. Such integration not only strengthens the cruise value proposition but also supports regional development by spreading economic benefits to local businesses, artisans, and service providers. For Australia—with its diverse landscapes, Indigenous heritage, and coastal charm—this model deepens engagement and encourages longer stays, positioning the cruise sector as a powerful contributor to tourism growth.

Penetration into Untapped Demographics

Targeting underserved demographic groups offers strong potential for expanding Australia cruise market share. Solo travelers, younger adults, multicultural communities, and first-generation cruisers are increasingly being recognized as viable and profitable segments. Cruise operators are adapting their offerings with more flexible pricing, shorter itineraries, modern onboard entertainment, and culturally inclusive services to meet these groups' preferences. For example, solo cabins, digital booking platforms, social events, and regionally themed menus help make cruises more attractive and accessible to new audiences. By promoting inclusivity and customization, cruise brands can cultivate loyalty among previously overlooked consumers. This strategic shift not only diversifies the passenger base but also ensures long-term growth by responding to evolving social and cultural trends shaping Australia’s broader travel landscape.

Economic Impact of Australia Cruise Market:

Boost to Local Tourism and Hospitality Sectors

Cruise tourism significantly contributes to the local economy by driving spending in restaurants, retail outlets, cultural sites, and hotels. When cruise ships dock at Australian ports, passengers often explore the area, generating income for small businesses and service providers. Cities like Sydney, Brisbane, and Cairns benefit from increased tourist footfall, leading to further investment in public amenities, waterfront development, and visitor infrastructure. These enhancements not only serve cruise passengers but also improve the overall tourist experience, making destinations more appealing to all types of travelers. Seasonal and homeport cruises also encourage pre- and post-cruise stays, extending the tourism cycle and increasing average visitor spend. Ultimately, cruise tourism strengthens the financial health of port cities and surrounding regions through consistent, high-volume visitor flow.

Employment Generation Across Multiple Industries

The cruise industry plays a vital role in job creation across Australia, contributing significantly to both direct and indirect employment. Jobs are created in sectors such as hospitality, transport, travel agencies, port services, and supply chain logistics. For instance, hotels, tour guides, shuttle services, and food suppliers all benefit from the influx of cruise passengers and crew members. Port authorities and terminal operators also require staff to manage embarkation, customs, and security. Moreover, businesses involved in ship provisioning and maintenance add further employment layers. As cruise activity expands, these jobs provide stability, especially in coastal and regional areas that may rely heavily on tourism. The ripple effect of cruise-driven employment enhances community livelihoods and contributes to regional economic sustainability and resilience.

Support for Small and Regional Enterprises

Cruise stopovers create vital commercial opportunities for small businesses and regional entrepreneurs. Local tour operators, craft sellers, farmers’ markets, and cultural performers benefit from shore excursions that introduce passengers to authentic, community-based experiences. Unlike other tourism models, cruise itineraries often bring consistent, high-volume visitation to smaller ports that may not attract independent travelers. These visits offer reliable income streams, helping sustain jobs and stimulate micro-economies in coastal towns. By showcasing local heritage, cuisine, and natural attractions, small enterprises can gain visibility and build long-term brand value. Additionally, cruise lines increasingly seek partnerships with regional vendors to source fresh produce and souvenirs, reinforcing local supply chains. This model ensures broader, more inclusive economic distribution beyond large metropolitan centers.

Australia Cruise Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and region.

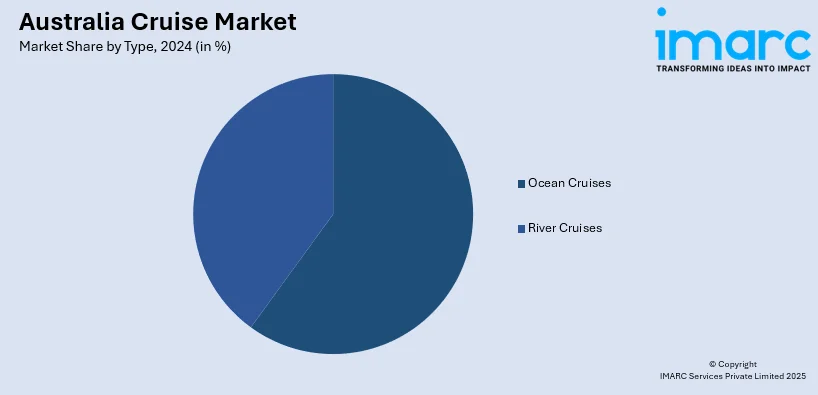

Type Insights:

- Ocean Cruises

- River Cruises

The report has provided a detailed breakup and analysis of the market based on the type. This includes ocean and river cruises.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cruise Market News:

- October 2024: Carnival Cruise Line introduced Carnival Encounter and Carnival Adventure to its fleet, expanding cruise portfolio in Australia. The program now features sailings from Brisbane on the Carnival Encounter and seasonally the Carnival Luminosa, as well as sailings from Sydney on the Carnival Adventure and Carnival Splendor.

- June 2024: Carnival Corporation announced moves to consolidate P&O Cruises Australia into Carnival Cruise Line to maximize guest capacity and streamline its portfolio of brands. This will see eight new ships join the Carnival Cruise Line fleet, following the successful rebranding of three ships from its sister business, Costa Cruises.

- March 2024: Australian billionaire Clive Palmer unveiled the Titanic II design, a contemporary cruise ship that will provide an authentic Titanic experience. Blue Star Line will enjoy an authentic Titanic experience by providing passengers with a ship of the same cabin layout and interior as the Titanic ship but with 21st-century technology, today's safety standards, and navigation techniques.

Australia Cruise Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ocean Cruises, River Cruises |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cruise market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cruise market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cruise industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cruise market in Australia was valued at USD 215.22 Million in 2024.

The Australia cruise market is projected to exhibit a CAGR of 10.20% during 2025-2033.

The Australia cruise market is projected to reach a value of USD 568.50 Million by 2033.

The Australia cruise market is shifting toward younger demographics, with millennials and Gen Z driving demand for short, affordable “seacations.” Expedition and luxury cruises to remote regions like the Kimberley are gaining popularity. Sustainability, personalized experiences, and themed cruises are emerging as key trends shaping future consumer preferences and itineraries.

Robust domestic tourism, increasing disposable income, and upgraded port infrastructure are major growth catalysts. The affordability of short cruises appeals amid rising living costs, enhanced marketing by cruise lines, growing interest in luxury and adventure travel, and strong support from travel agents further contribute to the market’s accelerated expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)