Australia Cryptocurrency Exchange Market Size, Share, Trends and Forecast by Exchange Type, Cryptocurrency Type, User Type, Revenue Model, Trading Service, and Region, 2025-2033

Australia Cryptocurrency Exchange Market Size and Share:

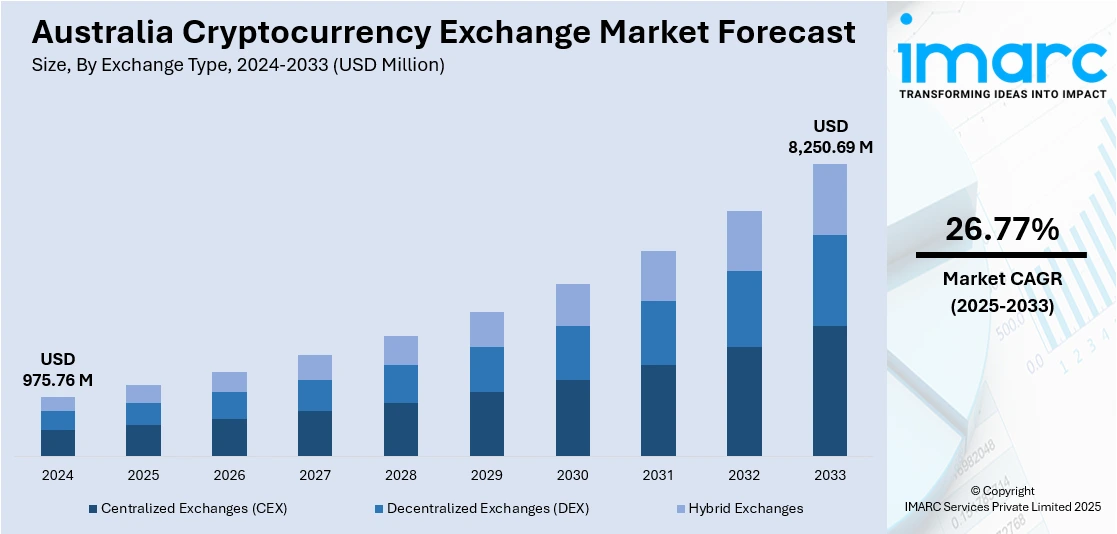

The Australia cryptocurrency exchange market size reached USD 975.76 Million in 2024. Looking forward, the market is projected to reach USD 8,250.69 Million by 2033, exhibiting a growth rate (CAGR) of 26.77% during 2025-2033. The market is expanding quickly, fueled by growing take-up of automated trading solutions like OKX's cutting-edge bots and growing institutional investing, with exchanges like Kraken providing sophisticated derivatives. It is evident from the growing Australia cryptocurrency exchange market share, drawing in various investor segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 975.76 Million |

| Market Forecast in 2033 | USD 8,250.69 Million |

| Market Growth Rate 2025-2033 | 26.77% |

Key Trends of Australia Cryptocurrency Exchange Market:

Adoption of Innovative Trading Tools

The Australian market for cryptocurrency exchange has experienced a significant movement towards automating, spurred by the need for convenient and efficient trading platforms. As Australians look for means to improve their experience trading, platforms have adapted to provide trading tools that make the trading process easier. In February 2025, OKX Australia introduced two innovative bots, the Spot Grid Bot and DCA Martingale Bot, that enable users to automate their strategies, trade 24/7, and better manage risks. The bots let users input specific parameters to buy and sell cryptocurrencies based on specific price ranges, providing an automated approach to trading. With the advent of such bots, Australian trading volumes have doubled, which is a testimony to the increasing popularity of automated tools. The trend indicates a larger phenomenon in the market where investors seek ways to reap maximum returns with minimal human intervention. Such innovations are not only improving the experience of users but also reducing the barriers to the entry of new traders into the market. As platforms adopt such features, Australia's crypto market will continue to develop, drawing a broader and broader variety of participants and fueling increased growth in the sector.

To get more information on this market, Request Sample

Institutional Investment and Regulatory Compliance

The Australian digital currency exchange industry has grown appealing to institutional investors, especially since the entry of sophisticated trading products and a robust regulatory environment. In November 2024, Kraken launched its licensed crypto derivatives product catering to wholesale clients, which was a major milestone in the platform's growth in the Australian market. This new offering enables institutional investors to trade crypto-based derivatives without necessarily holding the underlying assets, with multi-collateral support and a range of risk management options. Kraken's emphasis on regulatory compliance and strict adherence to local regulation contributed to its reputation as a reliable platform for institutional investors. The development was also seen as part of a larger trend of institutional investors seeking advanced financial products as the Australia cryptocurrency exchange market growth emerged. Through the offering of these advanced trading features and the provision of regulatory compliance, Kraken is helping to further build out Australia's crypto infrastructure, and the country becomes an increasingly viable destination for international investors. With institutional investment increasing, the market can be expected to see further liquidity and innovation, solidifying Australia's position as a major player in the international crypto ecosystem.

Growing Retail Participation Driving Market Expansion

Retail investor engagement is significantly contributing to the growth of Australia’s cryptocurrency exchange landscape. Particularly among younger individuals, there is a rising fascination with digital assets for their high return potential, convenient access through mobile applications, and robust online community support. The increasing influence of crypto personalities, along with educational resources and social media conversations, has made crypto trading more approachable for the average person. In response, many local exchanges have developed user-friendly interfaces, reduced fees, and beginner-focused tools to streamline the onboarding experience. This wave of interest from retail investors is not confined to leading cryptocurrencies like Bitcoin and Ethereum; altcoins and stablecoins are also on the rise. As more people explore alternative investment avenues, retail participation remains a significant driver of increasing Australia cryptocurrency exchange market demand.

Growth Drivers of Australia Cryptocurrency Exchange Market:

Increasing Digital Asset Adoption Fuels Exchange Usage

The rising acceptance of cryptocurrencies as legitimate financial instruments is greatly enhancing activity in Australia's cryptocurrency exchange market. As digital assets move from being niche to becoming mainstream, a larger number of Australians are utilizing crypto for both investment and transactional needs. Retail investors are showing increasing interest in Bitcoin, Ethereum, and various alternative tokens, while businesses are starting to explore cryptocurrency payments for greater flexibility and lower transaction costs. The integration of crypto wallets with mobile banking applications and the employment of blockchain technology for remittances and cross-border payments are making digital assets more widely accessible. This broadening adoption for personal and commercial purposes is fostering the growth of local exchanges, amplifying the demand for secure, dependable, and regulation-compliant trading platforms.

Supportive Fintech Ecosystem Enhances Market Integration

Australia's advanced and innovation-focused fintech landscape is crucial in bolstering the cryptocurrency exchange market. The country is home to a growing array of blockchain startups, digital payment firms, and API-based financial services, which facilitate the seamless integration of cryptocurrency trading tools and offerings. This collaboration between fintech companies and crypto exchanges leads to enhanced trading infrastructures, quicker transaction processes, and better user experiences. Financial institutions are increasingly implementing blockchain-based solutions to achieve greater efficiency and transparency. With robust technical capabilities and active venture capital engagement, Australia's fintech ecosystem is fast-tracking the development of the crypto economy. These synergies are expected to further solidify the foundation for digital asset trading, according to Australia cryptocurrency exchange market analysis.

Improved Regulatory Clarity Strengthens Investor Confidence

The Australian government's dedication to establishing a regulatory framework for digital assets has considerably boosted market stability and investor trust. The clearer guidelines surrounding cryptocurrency taxation, exchange licensing, anti-money laundering (AML), and consumer protections have streamlined participation for both individuals and institutions. This legal clarity diminishes uncertainty and ensures that exchanges function under established standards, enhancing transparency and safety for users. Regulatory bodies such as ASIC and AUSTRAC are actively monitoring crypto-related activities and enforcing compliance, helping to eliminate fraudulent entities and bolster credibility. As regulations continue to adapt, a more secure and scalable environment for the growth of digital asset trading in Australia is anticipated.

Opportunities of Australia Cryptocurrency Exchange Market:

Blockchain Integration with Traditional Finance

A significant opportunity in Australia’s cryptocurrency exchange landscape is the merging of blockchain with established financial systems. This combination allows for quicker, more transparent, and cost-effective financial services, such as cross-border payments, settlements, and identity verification. With an increasing number of banks and fintech companies investigating blockchain solutions, crypto exchanges have the potential to facilitate interoperability between fiat and digital currencies. This integration can boost user trust and enhance adoption, while also encouraging innovations like crypto-backed loans and tokenized assets. A smooth integration will optimize transaction processes and attract a broader base of institutional and retail investors. By linking traditional finance with decentralized technologies, Australian exchanges can significantly enhance their role in the evolving financial ecosystem.

Rise of Web3 and DeFi Projects

The rise of Web3 and decentralized finance (DeFi) initiatives presents considerable growth prospects for Australian cryptocurrency exchanges. As the internet transitions towards decentralization, themes of user control and peer-to-peer transactions are gaining prominence. Local exchanges can aid in the development of DeFi by listing native tokens, providing DeFi wallet services, and enabling access to decentralized applications (dApps). Engagement with Web3 ecosystems also permits exchanges to investigate new revenue streams such as staking, governance participation, and liquidity provisioning. Moreover, collaboration with decentralized platforms can drive innovation and establish user trust through transparency and decreased reliance on intermediaries. By positioning themselves as gateways to Web3, Australian exchanges can broaden their offerings and attract a new wave of tech-savvy users.

Cross-Border Payment Solutions

Australian crypto exchanges are well-placed to take advantage of the increasing demand for quick, low-cost cross-border payment services. Conventional remittance options are frequently slow and costly, particularly for those sending funds to or from remote locations. Cryptocurrencies allow for almost instantaneous global transactions with significantly reduced fees. By developing user-friendly interfaces for crypto-to-fiat conversions and integrating with global digital wallets, exchanges can cater to both individuals and small enterprises seeking effective international payment solutions. This promotes financial inclusion and drives adoption among migrant communities and exporters. As global trade and digital commerce continue to grow, crypto-enabled cross-border payment systems will be essential to Australia’s digital economy, offering long-term growth potential for local exchanges.

Challenges of Australia Cryptocurrency Exchange Market:

Cybersecurity and Fraud Risks

As the cryptocurrency sector in Australia continues to grow, the challenges posed by cybersecurity threats and fraud risks remain significant. Exchanges are prime targets for cyberattacks due to the substantial volumes of digital assets they hold. The threat landscape is always evolving, encompassing everything from phishing schemes and malware to advanced hacking endeavors. To sustain user confidence, it is essential to invest continually in sophisticated security measures such as multi-factor authentication, cold storage solutions, regular audits, and real-time monitoring systems. Any security breach can result in considerable financial losses, damage to reputation, and increased regulatory scrutiny. Furthermore, inexperienced users may fall victim to fraudulent activities and impersonation scams. To stay competitive and maintain credibility, exchanges must emphasize strong cybersecurity protocols and maintain transparent communication, assuring users of the safety of their assets and personal information.

Volatility and Market Speculation

A significant challenge within the cryptocurrency exchange market is the pronounced price volatility. Frequent and unpredictable changes in asset values can dissuade more cautious investors and businesses from engaging in the market. This volatility is typically fueled by speculative trading, shifts in market sentiment, regulatory developments, and overarching macroeconomic factors. While some traders may gain from short-term investments, others may incur substantial losses, leading to diminished confidence in the market. For exchanges, this necessitates a careful balance of user expectations while providing tools such as stop-loss options, educational materials, and diversified investment opportunities to help alleviate risks. Effectively managing the repercussions of volatility is crucial for ensuring long-term viability and user retention in Australia's dynamic cryptocurrency space.

Banking Restrictions and Fiat Access Issues

A significant operational challenge for cryptocurrency exchanges in Australia is the limited collaboration from traditional banking entities. Many banks have shown hesitance in facilitating transactions involving digital assets, citing concerns about regulatory ambiguity, fraud, and potential compliance issues. This often results in delays in transactions, limited fiat access, or even the closure of accounts. Such restrictions impair the liquidity and overall functionality of crypto platforms, complicating users' ability to easily transfer funds between fiat and cryptocurrency. These challenges can also deter institutional investors and inhibit market growth. To address this, exchanges must establish robust compliance measures and cultivate transparent relationships with banking institutions. Building trust and showcasing accountability could lead to improved fiat access and broader participation in the market.

Australia Cryptocurrency Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on exchange type, cryptocurrency type, user type, revenue model, and trading service.

Exchange Type Insights:

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Hybrid Exchanges

The report has provided a detailed breakup and analysis of the market based on the exchange type. This includes centralized exchanges (CEX), decentralized exchanges (DEX), and hybrid exchanges.

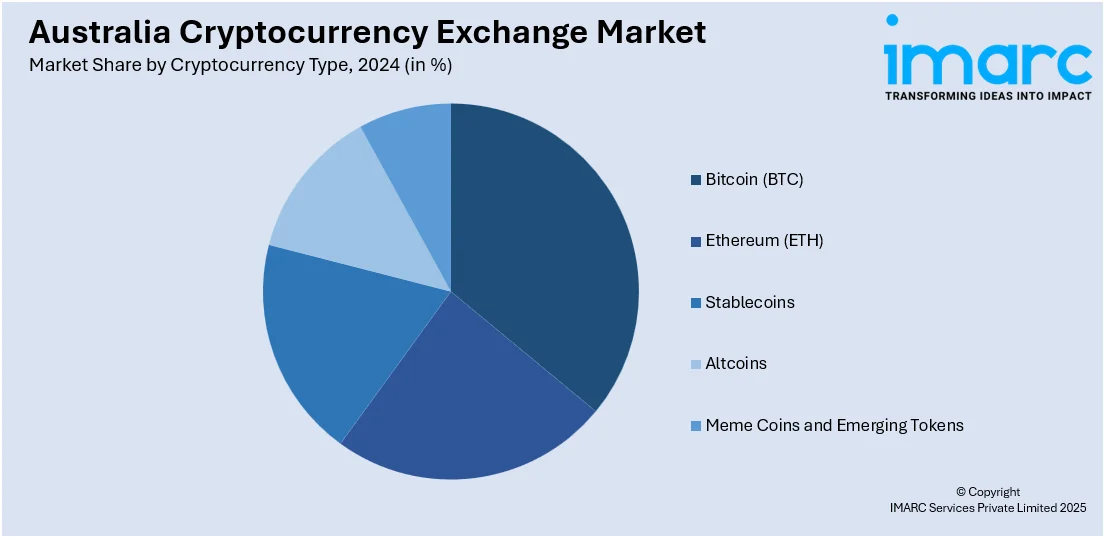

Cryptocurrency Type Insights:

- Bitcoin (BTC)

- Ethereum (ETH)

- Stablecoins

- Altcoins

- Meme Coins and Emerging Tokens

The report has provided a detailed breakup and analysis of the market based on the cryptocurrency type. This includes bitcoin (BTC), ethereum (ETH), stablecoins, altcoins, and meme coins and emerging tokens.

User Type Insights:

- Retail Traders

- Institutional Investors

- High-Frequency Traders

A detailed breakup and analysis of the market based on the user type have also been provided in the report. This includes retail traders, institutional investors, and high-frequency traders.

Revenue Model Insights:

- Transaction Fees

- Subscription-Based Models

- Listing Fees

- Staking and Yield Farming Services

A detailed breakup and analysis of the market based on the revenue model have also been provided in the report. This includes transaction fees, subscription-based models, listing fees, and staking and yield farming services.

Trading Services Insights:

- Spot Trading

- Futures and Derivatives Trading

- Margin Trading

- Peer-to-Peer (P2P) Trading

A detailed breakup and analysis of the market based on the trading services have also been provided in the report. This includes spot trading, futures and derivatives trading, margin trading, and peer-to-peer (P2P) trading.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cryptocurrency Exchange Market News:

- May 2025: Swyftx acquired Easy Crypto, New Zealand's largest crypto exchange, expanding its footprint across the ANZ region with 1.1Million sign-ups. The acquisition consolidates Swyftx's position as a major regional player, accelerating its growth into new products and markets, boosting competition and innovation.

- March 2025: WhiteBIT, Europe's largest crypto exchange by traffic, launched in Australia, registering with AUSTRAC. This expansion aimed to meet growing demand for cryptocurrencies, providing Australian investors with secure transactions and new trading tools, further developing the local crypto market infrastructure.

Australia Cryptocurrency Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Exchange Types Covered | Centralized Exchanges (CEX), Decentralized Exchanges (DEX), Hybrid Exchanges |

| Cryptocurrency Types Covered | Bitcoin (BTC), Ethereum (ETH), Stablecoins, Altcoins, Meme Coins and Emerging Tokens |

| User Types Covered | Retail Traders, Institutional Investors, High-Frequency Traders |

| Revenue Models Covered | Transaction Fees, Subscription-Based Models, Listing Fees, Staking and Yield Farming Services |

| Trading Services Covered | Spot Trading, Futures and Derivatives Trading, Margin Trading, Peer-to-Peer (P2P) Trading |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cryptocurrency exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cryptocurrency exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cryptocurrency exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cryptocurrency exchange market in Australia was valued at USD 975.76 Million in 2024.

The Australia cryptocurrency exchange market is projected to exhibit a compound annual growth rate (CAGR) of 26.77% during 2025-2033.

The Australia cryptocurrency exchange market is expected to reach a value of USD 8,250.69 Million by 2033.

The key trend of the Australia cryptocurrency exchange market include increased mobile trading adoption, growing institutional participation, development of regulated crypto products, and expanding support for altcoins. There is also a notable shift toward user-friendly platforms, AI-driven trading tools, and environmentally conscious blockchain initiatives, which is accelerating the market growth.

Key growth drivers include rising digital asset ownership, expanding fintech adoption, increasing blockchain education, and government efforts to modernize financial infrastructure. Strong demand for alternative investments, enhanced digital payment ecosystems, and growing entrepreneurial interest in crypto innovations are also fueling market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)