Australia Cybersecurity Market Report by Component (Solutions, Services), Deployment Type (Cloud-based, On-premises), User Type (Large Enterprises, Small and Medium Enterprises), Industry Vertical (IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, and Others), and Region 2025-2033

Australia Cybersecurity Market Size and Share:

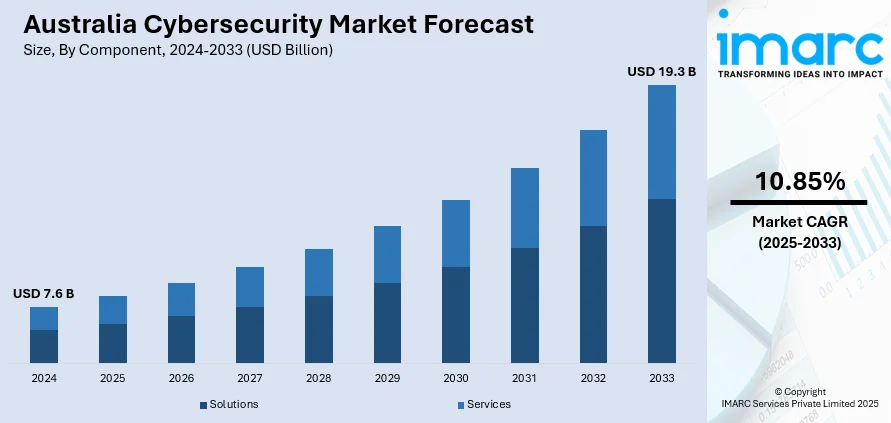

- The Australia cybersecurity market size reached USD 7.6 Billion in 2024. The market is expected to reach USD 19.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.85% during 2025-2033.

- The increasing cyber threats, such as ransomware and data breaches, the rising digital transformation across businesses, government initiatives for cybersecurity frameworks, regulatory compliance requirements, and the widespread adoption of cloud services and remote work environments are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.6 Billion |

| Market Forecast in 2033 | USD 19.3 Billion |

| Market Growth Rate 2025-2033 | 10.85% |

Australia Cybersecurity Market Analysis:

- Australia's cybersecurity industry is changing fast as a result of growing digital uptake across industries like finance, healthcare, and critical infrastructure.

- Cybersecurity has been prioritized by the government through plans like the Australian Cyber Security Strategy 2023–2030, intended to grow national cyber resilience.

- Governments and private institutions are spending heavily on cloud security, zero-trust architecture, and AI-powered threat detection to fight more advanced cyber threats.

- Cyber-attacks like the Optus and Medibank data breaches have raised national consciousness and stimulated regulatory reactions, particularly around data protection.

- The economy is faced with a skills gap, which has stimulated cooperation between industry, universities, and training providers to reskill the labor force.

- Small and medium-sized businesses (SMEs) are increasingly the target of cybersecurity efforts, as they usually lack resources but are exposed to similar risks as large corporations.

- Regional threats such as foreign-state cyber activities in the Asia-Pacific region also contribute to the demand for more robust national cyber defense measures.

To get more information of this market, Request Sample

Key Trends of Australia Cybersecurity Market:

Increasing Cyber Threats

- The rise in sophisticated cyberattacks, including ransomware and data breaches, has heightened the need for robust cybersecurity measures across both private and public sectors to protect sensitive data and critical infrastructure.

- According to a survey titled Cybercrime of Australia 2023 of 13,887 computer users conducted in early 2023 in Australia, it was found that in the 12 months before the survey, 27% of respondents had been a victim of online abuse and harassment, 22% had been a victim of malware, 20% had been a victim of identity crime and misuse, and 8% had been a victim of fraud and scams. The survey published on the Australian Institute of Criminology official website further states that overall, 47% of respondents experienced at least one cybercrime in the 12 months before the survey, and nearly half of all victims reported experiencing more than one type of cybercrime. 34% of respondents had experienced a data breach.

- Cybercrime victimization was not evenly distributed, with certain sections of the community more likely to have been a victim, and certain online activities associated with a higher likelihood of victimization. This is further influencing the Australia cybersecurity market demand.

Rising Digital Transformation and Cloud Adoption

- The growing shift toward digital transformation, cloud services, and remote work environments increases the attack surface, prompting businesses and government agencies to invest heavily in advanced cybersecurity solutions to safeguard their digital assets.

- According to industry reports, Australia has been put under the spotlight as becoming a top ten digital economy and society by 2030.

- This comes after the launch of its digital economy strategy in 2021 where the Australian government proposed a $1.2 billion investment plan to support Australia’s digital growth and global competitive ranking, post which public cloud spending in Australia is now expected to grow by 83% from A$12.2bn in 2022 to A$22.4bn in 2026.

- According to the IDC, Australia is expected to spend on AI systems to grow as high as $3.6 billion by 2025, reaching an annual growth rate of 24.4% between 2020-2025, which further contributes to the growth of the Australia cybersecurity market share.

Growth Drivers of Australia Cybersecurity Market:

Government Initiatives and Strategic Investments

- The Australian government has been active in improving the country's cybersecurity position through strategic initiatives and heavy investments.

- In 2023, the Australian Cyber Security Strategy for 2023–2030 was released by the government, with a huge allocation of funds directed at strengthening cybersecurity capabilities in different fields. The strategy focuses on coordination among government agencies, industry players, and academia to meet the growing cyber threats and vulnerabilities.

- Moreover, the government has undertaken reforms to enhance cybersecurity legislation, specifically regarding critical infrastructure industries like energy, water, and healthcare. These pieces of legislation impose more stringent security practices and reporting standards, protecting critical services from cyberattacks.

- In addition, investments in small and medium businesses (SMEs) have also been initiated to improve their cybersecurity resilience, such as the creation of initiatives such as voluntary cyber health checks to evaluate and strengthen their security position.

Digital Transformation and Cloud Adoption

- According to the Australia cybersecurity market analysis, the region’s accelerated digital evolution and extensive use of cloud computing have vastly increased the attack surface, fueling the need for sophisticated cybersecurity solutions.

- The move to cloud-based systems and hybrid IT environments has brought with it new challenges in the management and security of data. Organizations are moving towards multi-cloud models to maximize scalability and minimize costs but also have brought in openings for vulnerabilities in data movement and access control.

- To combat these challenges, there is increasing interest in zero-trust architectures, SASE models, and cloud-native security tools that grant real-time visibility and control. Data encryption, tokenization, and workload segmentation are becoming common features in cloud security solutions.

- The complexity of managing compliance, visibility, and breach response across splintered infrastructures is driving demand for integrated cybersecurity solutions optimized for dynamic, cloud-centric operations.

Rise of AI-Based Cybersecurity Solutions

- The growing complexity of cyber-attacks, such as AI-based threats and advanced persistent threats, has fueled the use of artificial intelligence (AI) in cybersecurity in Australia.

- AI-based solutions are being used by organizations to improve threat detection, automate response, and forecast potential vulnerabilities. For example, AI-based applications are used to detect anomalies in network traffic, detect phishing attempts, and react to incidents in real-time.

- This advancement in technology enhances the effectiveness of cybersecurity operations and solves the increasing shortage of professional cybersecurity experts by automating repetitive tasks.

- Additionally, the use of AI in cybersecurity is in alignment with regulatory requirements that call for sophisticated security features to safeguard sensitive information as well as national security. With ongoing advances in cyber threats, AI-based cybersecurity solutions are likely to be instrumental in securing Australia's digital infrastructure.

Challenges of Australia Cybersecurity Market:

Talent and Skills Shortage

- Australia is facing a sharp shortage of skilled cybersecurity professionals, a challenge driven by the quick digital transition across sectors.

- The demand for cybersecurity professionals has outraced supply, creating a competitive environment within and between organizations to hire and retain skilled talent. This shortage is the most severe in advanced areas like threat intelligence, incident response, and security architecture.

- Training centers and schools are working to close this gap; the speed of skill acquisition, though, is not enough to satisfy the increasing demands of the industry. As a result, organizations find it challenging to execute and sustain effective cybersecurity practices, making crucial systems vulnerable and data to attacks.

- This talent shortage can be addressed by a combined effort of government, business, and education institutions to invest in training, upskilling, and developing entry points for prospective workers into the cybersecurity industry.

Complex Regulatory Landscape

- While navigating Australia's complicated and changing cybersecurity regulatory landscape is a major challenge facing organizations.

- The advent of strict data protection legislation, including the Privacy Act 1988 amendments, and industry-specific regulations requires ongoing compliance activities. Organizations need to remain updated with these regulatory reforms to prevent possible penalties and damage to their reputation.

- Yet, the ever-changing nature of these regulations, in combination with the absence of standard frameworks for industries, makes compliance procedures more challenging.

- Small and medium-sized businesses (SMEs), specifically, do not have the means to invest in compliance activities and thus are more exposed to cyber threats.

- To counteract these obstacles, there is a call for enhanced guidelines, industry-specific standards, and support mechanisms to aid organizations in becoming and remaining compliant.

Evolving Threat Landscape

- The cybersecurity threat landscape in Australia is becoming increasingly sophisticated, with cybercriminals employing advanced tactics such as artificial intelligence (AI)-driven attacks, deepfake technology, and targeted phishing campaigns.

- These emerging threats represent serious risks to public and private sector entities, including providers of critical infrastructure.

- For example, the Australian Cyber Security Centre (ACSC) reported an increase in cyber breaches against essential services such as energy, water, and transport sectors.

- The quick transition to remote work and digital services has increased the attack surface, presenting increased opportunities for cyber attackers to take advantage of vulnerabilities.

- Organizations need to embrace proactive cybersecurity measures, such as sharing threat intelligence, advanced threat detection technologies, and incident response planning, to better address these emerging threats.

Australia Cybersecurity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, deployment type, user type, and industry vertical.

Component Insights:

- Solutions

- Identity and Access Management (IAM)

- Infrastructure Security

- Governance, Risk and Compliance

- Unified Vulnerability Management Service Offering

- Data Security and Privacy Service Offering

- Others

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (identity and access management (IAM), infrastructure security, governance, risk and compliance, unified vulnerability management service offering, data security and privacy service offering, and others) and services (professional services and managed services).

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

User Type Insights:

- Large Enterprises

- Small and Medium Enterprises

The report has provided a detailed breakup and analysis of the market based on the user type. This includes large enterprises and small and medium enterprises.

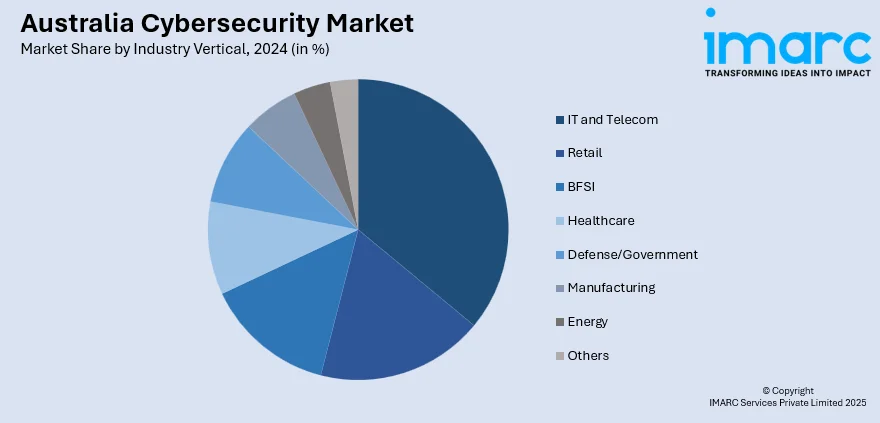

Industry Vertical Insights:

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes IT and telecom, retail, BFSI, healthcare, defense/government, manufacturing, energy, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cybersecurity Market News:

- In July 2024, the Australian Government disclosed plans to establish a highly secure cloud service for its intelligence agencies in a $2 billion partnership with US technology firm Amazon. This advanced platform, scheduled for completion by the end of the decade, is designed to boost information-sharing capabilities within Australia’s security sector. The project will involve constructing three data centers in Australia, designed to house the nation’s most sensitive intelligence information. For security reasons, the exact location of these facilities will remain undisclosed.

- In March 2024, AUCloud acquired three Australian IT service providers for a total of $30 million. The first of these is Sydney-based cyber consultancy PCG Cyber, which specializes in government security advice and operations, for $15 million, consisting of $11.9 million in cash, $2.5 million in shares, and a deferred cash consideration of $625,000.

Australia Cybersecurity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | Cloud-based, On-premises |

| User Types Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cybersecurity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cybersecurity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cybersecurity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia cybersecurity market was valued at USD 7.6 Billion in 2024.

The Australia cybersecurity market is projected to exhibit a CAGR of 10.85% during 2025-2033.

The Australia cybersecurity market is expected to reach a value of USD 19.3 Billion by 2033.

Australia's cybersecurity market trends include AI-based threat detection adoption, increased demand for zero-trust architecture, and growth in cloud security. Government programs, public-private collaboration, and an emphasis on protection of critical infrastructure are defining the landscape. Remote work and digitalization continue to reshape security priorities in all segments.

Australia's cybersecurity market is driven by expanding digital transformation, heightened cyberattacks on crucial infrastructure, and more stringent government laws. High-profile hacks have heightened demand for advanced security technologies, while remote work trends and cloud adoption further drive investment. Public-private collaborations and national strategies also drive cybersecurity innovation and resilience.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)