Australia Dairy Ingredients Market Size, Share, Trends and Forecast by Product, Source, Form, Application, and Region, 2025-2033

Australia Dairy Ingredients Market Overview:

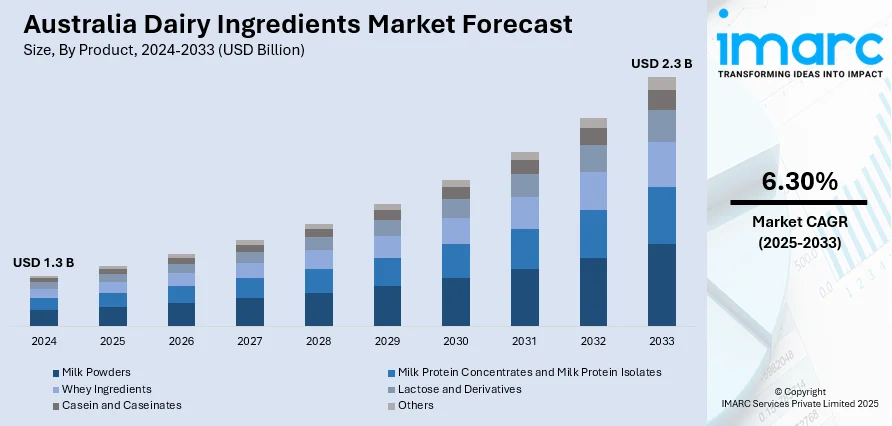

The Australia dairy ingredients market size reached USD 1.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. The market is driven by the growing consumer demand for functional, high-protein, and clean-label products, and rising number of social media platforms increasing dairy ingredients visibility and appeal to a digitally engaged and trend-conscious consumer base. Moreover, technology advancements in sustainable dairy production, such as climate-friendly milk products like "Eco-Milk" are also contributing to the Australia dairy ingredients market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Market Growth Rate 2025-2033 | 6.30% |

Australia Dairy Ingredients Market Trends:

Rise in Functional and Premium Dairy Foods

The market is witnessing a shift toward prioritization of functional health benefits. Ingredients with probiotics, prebiotics, and added nutrients such as omega-3 fatty acids are becoming popular among health-oriented consumers. This trend is reflected in the growing demand for probiotic yogurts and fortified milk powders, which appeal to consumers who are seeking to improve gut health and overall well-being. In addition, a trend toward higher-end dairy products, including artisanal cheeses and gourmet butters, is also developing as consumers are increasingly willing to invest on rich, high-quality, flavorful product offerings. The intersection of functional benefits and premium ingredients is hence fueling innovation in the dairy ingredients industry, which is leading manufacturers to create products that address the changing needs of Australian consumers.

To get more information on this market, Request Sample

Adoption of Sustainable and Ethical Dairy Practices

Sustainability and ethics are major factors influencing the market outlook. Consumers are increasingly concerned with the environmental and ethical consequences of their food consumption habits, and thus demand dairy products that are consistent with these values. For example, the launch of "Eco-Milk" in Tasmania, made from seaweed-based feed additives to lower methane emissions from cows, demonstrates an increasing desire for climate-friendly dairy. While, these innovations benefit the environment, they also appeal to a niche segment of consumers who are willing to invest more on products that help promote sustainability. In addition, consumers are increasingly concerned about ethical sourcing and animal welfare and hence demand transparency around the source and production of their dairy items. This is encouraging dairy manufacturers to change their ways to more sustainable modes and express their commitments to upholding ethical principles, which helps in ensuring brand loyalty as well as building consumer confidence.

Social Media Impact on Dairy Consumption Habits

Social media platforms are significantly driving the Australia dairy ingredients market growth. According to industry reports, social media remains a vital part of everyday life for Australians, as 20.9 million users, representing around 78% of the population, interact on an average of 6.5 various platforms each month and spend about one hour and 51 minutes daily on social media activities. Hence, food challenges and viral recipes have brought dairy ingredients such as cottage cheese into the mainstream, showcasing their flexibility and health benefits. Cottage cheese, for instance, has become a popular high-protein, low-fat ingredient, which has created demand, even leading to shortages at some grocery stores. This highlights the influence of social media in shaping consumer taste and food trends. Dairy manufacturers are taking notice of the influence of these platforms and are using them to connect with consumers, launch new products, and join in on social media food trends. By linking their marketing efforts to social media, dairy brands can hence increase their visibility and appeal to a digitally engaged and trend-conscious consumer base.

Australia Dairy Ingredients Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, source, form, and application.

Product Insights:

- Milk Powders

- Skimmed Milk Powders

- Whole Milk Powders

- Milk Protein Concentrates and Milk Protein Isolates

- Whey Ingredients

- Whey Protein Concentrate (WPC)

- Whey Protein Isolate (WPI)

- Hydrolyzed Whey Protein (HWP)

- Lactose and Derivatives

- Casein and Caseinates

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes milk powders (skimmed milk powders and whole milk powders), milk protein concentrates and milk protein isolates, whey ingredients (whey protein concentrate (WPC), whey protein isolate (WPI), and hydrolyzed whey protein (HWP)), lactose and derivatives, casein and caseinates, and others.

Source Insights:

- Milk

- Whey

The report has provided a detailed breakup and analysis of the market based on the source. This includes milk and whey.

Form Insights:

- Dry

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes dry and liquid.

Application Insights:

- Bakery and Confectionery

- Dairy Products

- Infant Milk Formula

- Sports and Clinical Nutrition

- Others

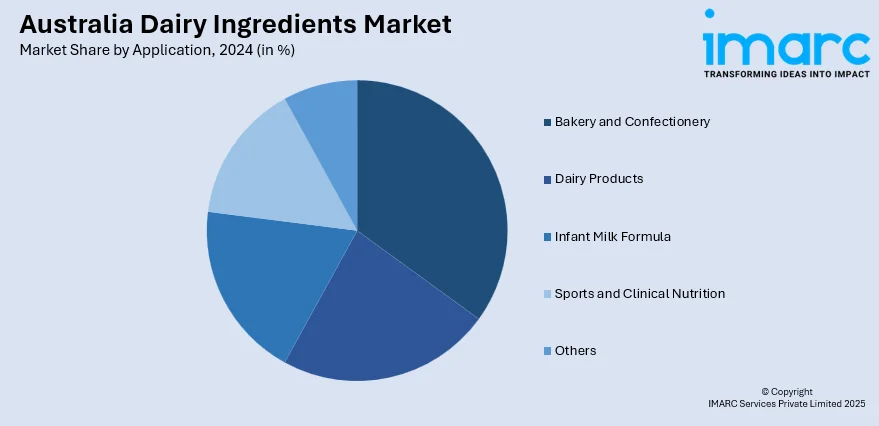

The report has provided a detailed breakup and analysis of the market based on the application. This includes bakery and confectionery, dairy products, infant milk formula, sports clinical nutrition, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Dairy Ingredients Market News:

- March 2025: King Island Dairy has been bought by a new Australian-owned entity led by Melbourne businessmen Nicholas Dobromilsky and Graeme Wilson from Canadian giant Saputo. The sale includes the dairy facilities, brand, on-site cheese store, and two local farms. Employees will transfer to the new owner, ensuring job security.

Australia Dairy Ingredients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Sources Covered | Milk, Whey |

| Forms Covered | Dry, Liquid |

| Applications Covered | Bakery and Confectionery, Dairy Products, Infant Milk Formula, Sports Clinical Nutrition, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia dairy ingredients market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia dairy ingredients market on the basis of product?

- What is the breakup of the Australia dairy ingredients market on the basis of source?

- What is the breakup of the Australia dairy ingredients market on the basis of form?

- What is the breakup of the Australia dairy ingredients market on the basis of application?

- What is the breakup of the Australia dairy ingredients market on the basis of region?

- What are the various stages in the value chain of the Australia dairy ingredients market?

- What are the key driving factors and challenges in the Australia dairy ingredients?

- What is the structure of the Australia dairy ingredients market and who are the key players?

- What is the degree of competition in the Australia dairy ingredients market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia dairy ingredients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia dairy ingredients market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia dairy ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)