Australia Data Center Market Size, Share, Trends and Forecast by Component, Type, Enterprise Size, End User, and Region, 2026-2034

Australia Data Center Market Size and Share:

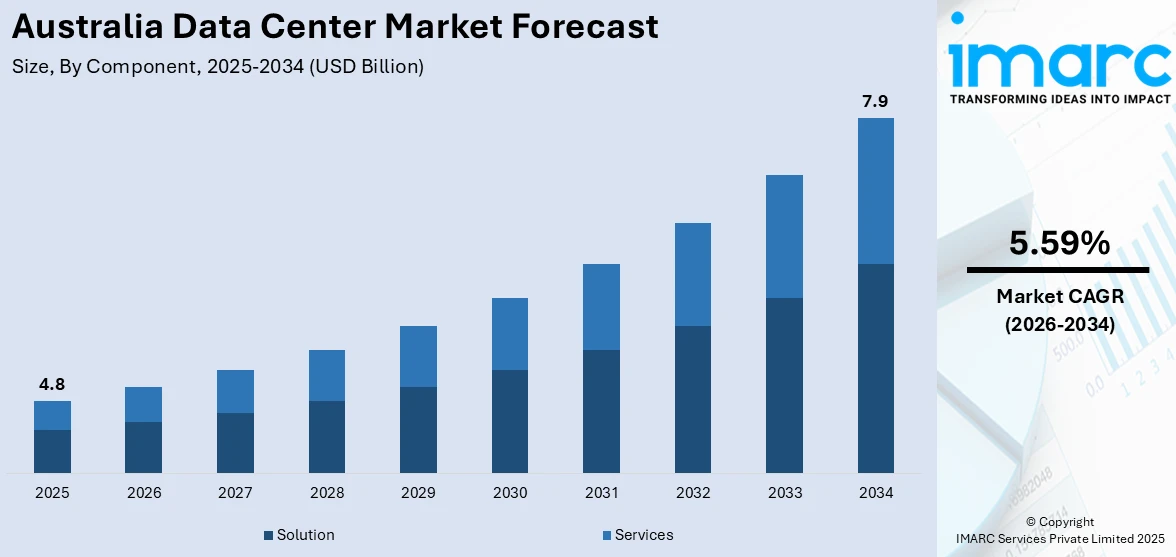

The Australia data center market size was valued at USD 4.8 Billion in 2025. Looking forward, the market is expected to reach USD 7.9 Billion by 2034, exhibiting a CAGR of 5.59% from 2026-2034. The Australia data center market share is expanding, driven by rising cloud adoption, increasing digital transformation and strong demand for edge computing. Expanding investments from global players, renewable energy integration, and government initiatives for data localization are shaping the industry. Enhanced connectivity and advanced infrastructure are positioning Australia as a critical regional hub for data services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2034 | USD 7.9 Billion |

| Market Growth Rate (2026-2034) | 5.59% |

The market growth is mainly driven by the rising demand for cloud computing and digital transformation across various industries. Businesses nowadays are adopting cloud solutions to enhance scalability and cost efficiency while government initiatives supporting digital infrastructure development further drive the market growth. The rise in internet penetration and a surge in data consumption are also playing a crucial role, prompting companies to invest in advanced data storage and processing facilities to meet evolving requirements. According to industry reports, as of early 2024, Australia had 25.21 million internet users resulting in a penetration rate of 94.9%. The overall engagement over social media platforms reached 20.80 million users, which represents 78.3% of the population. Furthermore, there were 33.59 million active mobile cellular connections exceeding the total population by 126.4%.

To get more information on this market Request Sample

The proliferation of artificial intelligence, big data analytics and the Internet of Things (IoT) is offering a favorable Australia data center market outlook. For instance, in June 2024, Equinix announced an AU$240 million investment to expand its data centres in Sydney and Melbourne by expanding to 4,175 cabinets, which aims to support growing demands for AI infrastructure amid widespread enterprise adoption of AI technologies while emphasizing sustainability through advanced cooling and waste reduction initiatives. These technologies require robust infrastructure leading to higher investments in hyperscale and edge data centers. Australia's geographic advantage as a regional hub for Asia-Pacific connectivity, coupled with favorable climate conditions for energy-efficient operations also makes it an attractive location for data center developments fostering consistent market expansion.

Key Trends of Australia Data Center Market:

Rising Focus on Sustainability

Sustainability is a major focus in the Australia data center market with operators increasingly adopting renewable energy sources and energy efficient designs. Solar, wind, and hydroelectric power are being integrated to minimize reliance on fossil fuels. Advanced cooling technologies, such as liquid cooling and free air systems, are reducing energy consumption while maintaining operational efficiency. For instance, in May 2024, OVHcloud launched its third data centre in Sydney, utilizing advanced water-cooling technology to address growing demands for sustainable high-performance cloud solutions. This facility is a part of a broader Asia Pacific expansion aims to support businesses’ computing needs while maintaining a low environmental impact and carbon footprint. Many data centers are pursuing certifications like LEED and Green Star to demonstrate their environmental commitment. Sustainability initiatives not only reduce carbon footprints but also align with corporate social responsibility goals making green data centers a preferred choice for environmentally conscious enterprises and investors in Australia.

Widespread Cloud Adoption

The surge in cloud adoption is reshaping the Australia data center market as businesses across industries migrate to cloud-based solutions for enhanced flexibility and scalability. For instance, in August 2024, Atturra broadened its sovereign cloud offerings with a new setup at NextDC's S3 data center in Sydney. This project seeks to improve cloud storage and AI services responding to the growing demand from clients and underscoring Atturra's dedication to strong and localized IT solutions. Organizations are leveraging public, private and hybrid cloud models to streamline operations, reduce costs and support remote work environments. Hybrid cloud infrastructures are particularly in demand offering a balance between on-premises control and cloud-based scalability. This growth is driven by advancements in AI, big data analytics and SaaS applications requiring robust and adaptable data center infrastructures. According to the Australia data center market forecast, as digital transformation accelerates the demand for secure, efficient, and scalable cloud-enabled facilities, the demand for data center continues to rise across Australia.

Expansion of Edge Computing

The growth of edge computing in Australia’s data center sector is being driven by the swift adoption of IoT devices and the implementation of 5G networks. For example, in April 2024, the Australian government revealed its intention to enhance its standing in quantum and edge computing through an $18 million investment aimed at establishing Quantum Australia. This collaboration will bring together universities and industry specialists to transform cutting-edge research into practical applications, strengthening the country's leadership in advanced technology across multiple sectors. As these technologies produce vast volumes of data that need real-time analysis, edge data centers are vital in reducing latency by handling data nearer to its origin. This ability is essential for areas such as self-driving cars, intelligent urban environments, and industrial automation where quick decision-making is crucial. The need for localized data processing is rising as companies aim to enhance user experience, lower bandwidth expenses, and adhere to regulatory standards for data storage and privacy.

High Social Media Usage

The increasing use of social media in Australia is driving data center operators to enhance infrastructure and adopt advanced technologies to meet rising demands. High levels of social media engagement have led to a significant increase in data traffic, creating the need for faster and more efficient processing capabilities. This is accelerating the adoption of edge computing, which processes information closer to the source, reducing latency and improving service quality across various industries. As consumers and businesses prioritize seamless digital interactions and real-time data availability, investments in modernized facilities are expanding to strengthen the operational efficiency of data centers. These advancements are vital in managing the growing data loads and ensuring reliable services. The importance of robust data management infrastructure is further emphasized by the ongoing digital transformation in the country. According to the IMARC Group, the Australia digital transformation market size reached USD 18.5 billion in 2024, highlighting the demand for advanced solutions to support the nation’s evolving digital ecosystem.

Growth Drivers of Australia Data Center Market:

Data Sovereignty and Compliance

Australia’s heightened data privacy and security laws including the Australian Privacy Principles (APP) are fueling the demand for local data centers. These regulations require that the personal data of Australian citizens is stored and processed domestically ensuring adherence to privacy legislation. As organizations face the pressures of compliance with these rules the necessity for data centers that provide local storage and meet regulatory standards is critical. This is particularly true for sectors such as banking, healthcare, and government which handle sensitive information and need robust security measures to fulfill their legal obligations. Concerns regarding data sovereignty and the imperative to safeguard consumer privacy are significant factors driving investment in Australian data center development.

5G Deployment

The introduction of 5G networks throughout Australia is boosting the need for data centers that offer high bandwidth and ultra-low latency. 5G technology facilitates faster data transmission, enhanced connectivity, and accommodates a substantial increase in the number of connected devices from smartphones to IoT solutions. To manage this surge in data effectively data centers must have high-capacity infrastructure that can process large quantities of information swiftly. The rising demand for real-time applications like autonomous vehicles, smart cities, and telemedicine necessitates localized data processing near end-users making edge data centers increasingly vital. As 5G continues to develop the infrastructure of data centers will be essential for delivering fast and efficient services.

Digital Transformation

Digital transformation is transforming different industries across Australia forcing companies to invest in their IT infrastructure in order to stay competitive. Cloud computing, big data analytics, artificial intelligence (AI), and the Internet of Things (IoT) adoption in different industries like finance, healthcare, and retail require strong data storage and processing capabilities. As companies move to cloud-based systems the need for secure, scalable, and high-performance data centers becomes increasingly necessary. The shift towards digital transformation across industries like e-commerce and healthcare is fueling steady expansion in data creation and storage requirements. Data centers are thus becoming mandatory to manage and process massive amounts of information to enable businesses to address increasing requirements for data security, speed, and reliability.

Opportunities of Australia Data Center Market:

Rising Adoption of Remote Work Culture

The global transition to remote work and increased digital transformation is significantly influencing the demand for cloud infrastructure leading to considerable growth prospects for data centers in Australia. With a growing number of businesses embracing cloud solutions the necessity for scalable, secure, and dependable data storage and processing capabilities has surged. As organizations depend more on digital tools for communication, collaboration, and overall operations data centers become vital in supporting these technologies. The rise in remote work has also resulted in higher data generation which calls for more resilient infrastructure. Data centers that can provide high availability, minimal latency, and robust security are in high demand to cater to businesses adopting digital transformation and remote work strategies.

Partnerships with Global Players

Australia’s advantageous position in the Asia-Pacific region presents numerous opportunities for local data center operators to partner with global technology leaders looking to expand their reach in this area. As companies such as Amazon, Google, and Microsoft aim to enhance their data center networks local operators can secure long-term contracts and establish themselves as vital components of these companies' supply chains. These collaborations benefit both parties: global firms gain access to a dependable and compliant infrastructure in a rapidly growing region while local operators enhance their capabilities and service offerings. This trend of international growth allows Australian data centers to scale their operations, adopt advanced technologies, and establish themselves as regional centers for global companies targeting the Asia-Pacific market.

Regional Expansion

Expanding data center services beyond Australia’s key urban areas offers a notable growth opportunity, particularly as digital infrastructure in regional locations continues to advance. While most data centers are concentrated in major cities like Sydney and Melbourne, there is an increasing demand for localized infrastructure in underserved regions. This regional expansion enables businesses to address the rising need for data processing and storage in areas where digital access is improving. By constructing facilities in regional hubs, data center operators can deliver lower-latency services, alleviate the burden on already crowded metropolitan areas, and take advantage of government incentives that promote infrastructure development. According to the Australia data center market analysis, as industries such as agriculture, mining, and regional healthcare undergo digital transformation, regional data centers will become crucial for efficient and secure data management.

Challenges of Australia Data Center Market:

High Energy Costs

Australia's considerable energy expenses pose a notable challenge for the data center sector as these facilities require substantial amounts of electricity for their operations, cooling mechanisms, and server reliability. With increasing energy prices operators encounter higher operational expenditures potentially affecting their profitability particularly for data centers that consume large quantities of energy. This issue is especially prominent in areas like Sydney and Melbourne where energy rates are typically elevated. To address these rising costs many data centers are adopting energy-efficient technologies, renewable energy options, and advanced cooling solutions. However, the initial investment needed for these sustainable initiatives can be significant and in the short-term escalating energy prices remain a strain on the financial viability of numerous data center operators.

Infrastructure and Land Unavailability

The challenge of finding suitable land for data center development is significant in Australia particularly in major cities such as Sydney and Melbourne. As urbanization increases land prices in these urban centers continue to escalate making it tough for data center operators to locate affordable spaces for new facilities. Furthermore, metropolitan areas often deal with zoning and planning restrictions which complicate development efforts. For operators looking to expand or establish new centers obtaining land in these sought-after locations can be both time-consuming and expensive. While regional areas offer possibilities for growth, they typically come with the added challenge of ensuring the necessary connectivity and infrastructure to support data center operations resulting in further logistical difficulties.

Regulatory and Compliance Issues

The Australian data center industry encounters intricate regulatory and compliance hurdles particularly concerning data sovereignty and privacy. The Australian Privacy Principles (APP) mandate that organizations manage sensitive data in strict accordance with regulations often requiring significant investments in security infrastructure and continuous monitoring. Data centers must guarantee that all data stored and processed aligns with local laws necessitating regular updates to their operational practices and technology. Operators face various state and federal regulations that can differ in their requirements and enforcement. Failure to comply can lead to severe penalties making it essential for data center operators to remain informed and adjust their processes to the dynamic regulatory environment. This regulatory burden frequently adds to operational complexity and costs.

Australia Data Center Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia data center market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on component, type, enterprise size, and end user.

Analysis by Component:

- Solution

- Services

The solution segment in the Australia data center market encompasses physical and virtual infrastructure supporting data storage, processing, and management. Key elements include servers, storage systems, networking equipment and power systems designed for optimal efficiency. With the growing adoption of cloud computing and big data analytics organizations are investing in scalable and secure infrastructure. Data center solutions are also integrating advanced technologies such as AI-driven monitoring tools to enhance operational performance. The demand for modular data centers is rising driven by their flexibility and rapid deployment capabilities making solutions a critical component in addressing Australia's expanding digital needs.

The services segment in the market includes consulting, maintenance, and managed services essential for seamless operation and optimization of data centers. These services ensure high availability, efficient resource utilization, and compliance with data security regulations. Managed service providers offer end-to-end solutions including remote monitoring, disaster recovery and IT infrastructure management to reduce operational complexities. With the increasing adoption of hybrid IT environments demand for professional services to design and implement tailored data center strategies is rising. Service providers are also emphasizing energy-efficient practices helping organizations align with sustainability goals while maintaining operational excellence.

Analysis by Type:

- Colocation

- Hyperscale

- Edge

- Others

The colocation segment in the Australia data center market offers shared infrastructure solutions where businesses lease space, power, and cooling for their servers within third-party facilities. This model is ideal for organizations seeking cost-efficiency and scalability without investing in building their data centers. With Australia's growing emphasis on digital transformation colocation providers are expanding their footprints to meet rising demand. These facilities often come equipped with robust security measures and redundant systems ensuring high uptime and reliability. Colocation services are particularly appealing to SMEs and enterprises needing flexibility and access to advanced technologies without the burden of infrastructure management.

The hyperscale segment in the market refers to large-scale facilities designed to support extensive computing, storage, and networking requirements. Hyperscale data centers cater primarily to cloud service providers, large enterprises, and global tech firms. These facilities are optimized for high energy efficiency and operational scalability often integrating renewable energy sources to align with sustainability goals. Australia's growing adoption of cloud-based solutions, AI, and big data analytics is driving the demand for hyperscale data centers. Companies, such as AWS, Microsoft, and Google, are heavily investing in expanding their hyperscale operations reflecting the country’s rising role in the global digital ecosystem.

The edge segment in the market focuses on localized data processing closer to users to minimize latency and enhance performance. Edge data centers are critical for applications requiring real-time processing, such as IoT, autonomous vehicles, and AR/VR. With Australia's widespread geography, edge facilities enable efficient content delivery and connectivity in remote regions. These compact data centers are strategically placed to support industries like telecommunications, healthcare, and logistics. As 5G networks expand the importance of edge computing is growing driving investments in decentralized infrastructure to meet the increasing need for low-latency and high-performance data processing across the country.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises in the Australia data center market demand robust and scalable infrastructure to support extensive data storage, processing, and management needs. These organizations typically require high-performance computing, advanced security solutions and seamless connectivity to manage complex operations and large-scale digital transformation initiatives. Many large enterprises opt for dedicated or hybrid data center solutions to ensure maximum control and compliance with stringent industry regulations. With increasing reliance on cloud technologies, artificial intelligence and big data analytics large enterprises are driving investments in state-of-the-art facilities that offer superior uptime, energy efficiency and advanced disaster recovery capabilities to sustain critical business functions.

Small and medium enterprises in the market seek cost-effective and flexible solutions to meet their growing digital needs. SMEs typically prefer colocation or managed services enabling them to leverage cutting-edge infrastructure without heavy capital expenditure. These businesses benefit from scalable solutions that accommodate evolving demands, particularly as they adopt cloud services, e-commerce platforms, and remote work environments. SMEs are increasingly turning to data center providers for enhanced cybersecurity, reliable connectivity, and simplified IT management. As digital transformation accelerates, SMEs in Australia are contributing to the demand for tailored affordable data center solutions that ensure operational efficiency and business growth.

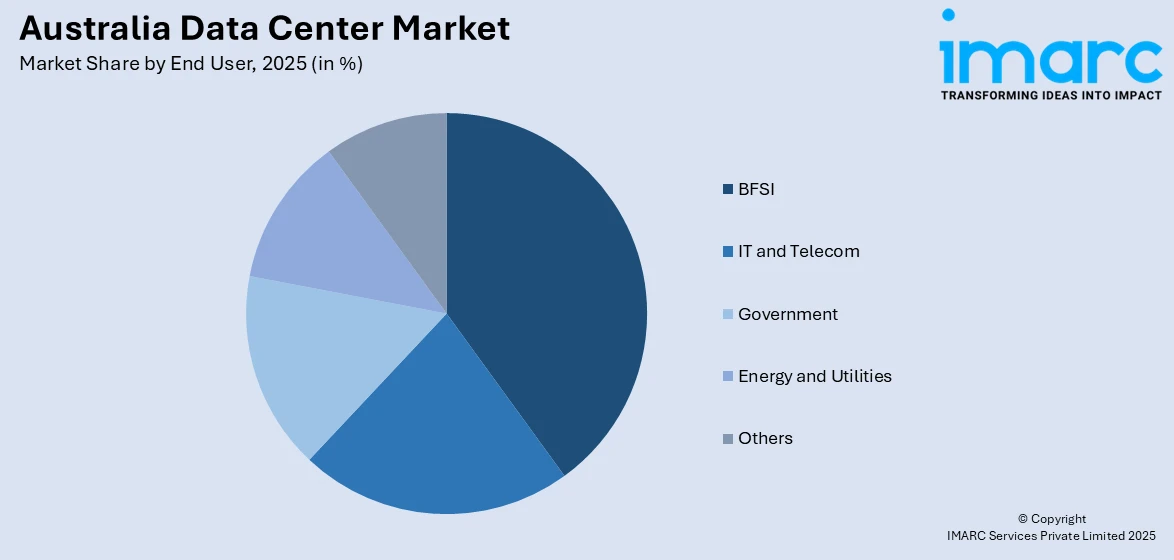

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

The BFSI sector in the Australia data center market relies on secure and efficient data centers to handle massive transaction volumes, customer data and regulatory compliance. Financial institutions utilize advanced storage, disaster recovery and real-time analytics solutions to ensure uninterrupted services. Data centers provide robust cybersecurity measures to protect sensitive financial data from breaches. The growing adoption of digital banking and fintech solutions further drives demand for high-performance infrastructure that supports scalability ensuring seamless customer experience and operational reliability.

The IT and telecom sector drives a significant demand in the market fueled by the rapid adoption of cloud computing, IoT and 5G technologies. These industries rely on data centers for efficient content delivery, network management and application hosting. Hyperscale and edge data centers play a pivotal role in ensuring low latency and uninterrupted services. As digital transformation accelerates across industries, IT and telecom companies continue to expand data center usage to support their extensive connectivity, storage, and operational requirements.

Government agencies in Australia utilize data centers to enhance service delivery secure sensitive information and manage large-scale public databases. These facilities support e-governance initiatives enabling streamlined processes and improved citizen engagement. Data centers help government entities achieve scalability and efficiency while adhering to strict compliance and security standards. With the increasing adoption of cloud-based solutions and smart city projects governments are investing in advanced data center infrastructure to support digitalization and ensure robust disaster recovery capabilities.

The energy and utilities sector in the Australia data center market leverages data centers for real-time monitoring, grid optimization and predictive analytics. These facilities support the integration of renewable energy sources and efficient resource management. By adopting advanced data center technologies energy companies can enhance operational efficiency, reduce costs, and improve decision-making processes. The sector's growing focus on sustainability and smart energy systems drives demand for reliable and energy-efficient data center solutions tailored to their unique operational needs.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

This region leads the market driven by Sydney’s status as a key data center hub. With a robust digital infrastructure, significant cloud adoption and proximity to major financial institutions the area attracts hyperscale facilities. Government investments in IT modernization and initiatives like the Canberra Data Center further boost growth. The region benefits from strong connectivity and access to renewable energy making it a preferred location for global and domestic data center operators.

Victoria, anchored by Melbourne, is a major player in the Australia data center market with a focus on financial services and digital innovation. Its well-established tech ecosystem supports data center growth, particularly for colocation and managed services. Tasmania complements this with its access to renewable energy attracting operators aiming for sustainable practices. Together, these regions cater to diverse industry demands providing high-performance solutions for enterprises while emphasizing energy efficiency and green technology adoption.

Queensland is emerging as a key regional data center market in Australia driven by its growing tech sector and increasing adoption of cloud-based solutions. Brisbane serves as the focal point offering strategic connectivity to northern regions and Asia-Pacific markets. The state’s focus on smart city initiatives and digital infrastructure expansion enhances demand. With investments in edge facilities to improve local access and low-latency performance Queensland is positioning itself as a rising data center destination.

Northern Territory and South Australia offer unique opportunities in the Australia data center market focusing on regional connectivity and sustainable solutions. South Australia’s capital Adelaide is advancing as a tech hub with investments in renewable energy-powered data centers. The Northern Territory focuses on enhancing connectivity to remote areas leveraging edge data centers. These regions benefit from government support for digital infrastructure projects aligning with broader national efforts to ensure equitable access to data services.

Western Australia is gaining momentum in the data center market driven by Perth’s strategic location for international connectivity, especially with Asia-Pacific. The region’s mining and energy sectors contribute significantly to the demand for robust data management and analytics solutions. Investments in submarine cables and edge facilities enhance its appeal. Western Australia’s focus on renewable energy integration aligns with industry trends making it a promising market for operators prioritizing sustainability and regional data processing capabilities.

Competitive Landscape:

The Australia data center market is marked by intense competition among global and local operators driven by the rapid growth of cloud computing, digital transformation, and the demand for sustainable solutions. Operators focus on expanding their footprint through advanced facilities and innovative technologies such as modular data centers and AI-driven operations. Sustainability is a key differentiator with companies emphasizing renewable energy integration to meet environmental goals. The market also sees competition in service offerings including colocation, managed services, and edge computing. Strategic partnerships and acquisitions strengthen connectivity catering to industries like finance, telecom, and government. For instance, in September 2024, Blackstone acquired Australian data center operator AirTrunk for approximately $16.12 billion capitalizing on rising demand for cloud and AI infrastructure. As the largest data center platform in the Asia Pacific AirTrunk enhances Blackstone's $55 billion global data center portfolio. The competiton to offer low-latency, secure, and scalable solutions positions the market as dynamic and innovation-driven.

The report provides a comprehensive analysis of the competitive landscape in the Australia data center market with detailed profiles of all major companies, including:

- ADC

- AirTrunk Operating Pty Ltd

- CDC Data Centres Pty Ltd

- Digital Realty Trust

- Equinix, Inc.

- Fujitsu Australia

- Macquarie Technology Group

- Nextdc Ltd

- Telstra Corporation Limited

Latest News and Developments:

- December 2024: DCI announced the inauguration of its new data center Adelaide 02 in Kidman Park, South Australia with an AU$70 million investment. This facility enhances the region's digital infrastructure, thus increasing the total capacity to 5.4MW.

- September 2024: NextDC announced the launch of its A1 Adelaide data center in South Australia, marking the city's first Tier IV facility. Spanning 3,000 sqm with a 5MW IT capacity, it supports AI workloads and connects over 750 cloud providers.

- September 2024: Cloud Carrier declared the launch of its Southern Highlands Data Campus (SHDC) which portrays a new era for eco-friendly and energy efficient data centers.

- September 2024: Zscaler launched the novel co-located data center in Perth to provide better support to customers in the region to further solidify its ero Trust cybersecurity postures.

- October 2023: Microsoft announced huge digital infrastructure, skilling, and cybersecurity investments in Australia aimed at helping the nation seize the artificial intelligence era to strengthen economic competitiveness, generate high-value employment, and defend the nation against the growing danger of cyber attacks.

Australia Data Center Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Colocation, Hyperscale, Edge, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Users Covered | BFSI, IT And Telecom, Government, Energy and Utilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | ADC, AirTrunk Operating Pty Ltd, CDC Data Centres Pty Ltd, Digital Realty Trust, Equinix, Inc., Fujitsu Australia, Macquarie Technology Group, Nextdc Ltd, Telstra Corporation Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia data center market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia data center market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A data center is a dedicated facility housing computing infrastructure such as servers, storage systems, and networking equipment. It supports data storage, processing, and management for various applications, including cloud computing, big data analytics, IoT, and enterprise IT services.

The Australia data center market was valued at USD 4.8 Billion in 2025.

IMARC estimates the Australia data center market to exhibit a CAGR of 5.59% during 2026-2034.

The market is driven by rising cloud adoption, increasing digital transformation, growing demand for edge computing, government support for data localization, and investments in sustainable, energy-efficient infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)