Australia Dental Consumables Market Size, Share, Trends and Forecast by Product, Treatment, Material, End User, and Region, 2025-2033

Australia Dental Consumables Market Overview:

The Australia dental consumables market size reached USD 650.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,007.50 Million by 2033, exhibiting a growth rate (CAGR) of 4.99% during 2025-2033. The market is growing due to rising demand for advanced digital dentistry solutions, including CAD/CAM systems and 3D-printed materials. Increasing emphasis on infection control is escalating sales of single-use and sterilization products. Additionally, an aging population and higher dental awareness drive preventive and restorative care needs. Government healthcare investments and technological advancements are further expanding the Australia dental consumables market share, fostering innovation and competition.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 650.00 Million |

| Market Forecast in 2033 | USD 1,007.50 Million |

| Market Growth Rate 2025-2033 | 4.99% |

Australia Dental Consumables Market Trends:

Increasing Adoption of Digital Dentistry Technologies

The market is experiencing a significant shift toward digital dentistry, driven by advancements in CAD/CAM systems, 3D printing, and intraoral scanners. Dentists are increasingly adopting digital workflows to improve precision, reduce turnaround times, and enhance patient outcomes. This trend is enhancing demand for digitally compatible consumables, such as 3D-printed resins, milling blocks, and high-performance ceramics for crowns and bridges. Additionally, the growing preference for same-day restorations is accelerating the use of chairside CAD/CAM systems, further propelling the need for compatible materials. The rise of teledentistry and AI-powered diagnostics is also influencing purchasing decisions, as clinics invest in consumables that integrate seamlessly with digital platforms. A systematic review and meta-analysis of teledentistry in Australia showed its effectiveness as a caries screening tool with an average sensitivity of 69.7% and specificity of 97.4%. The review highlighted the role of teledentistry in maximizing the accessibility of healthcare, especially for rural and remote communities, with some recognition of diverse clinician opinions and potential cost savings. Due to the positive patient feedback, teledentistry has the ability to foster greater acceptance, especially in the dental consumables sector, through enhanced accessibility to care and prompt diagnosis. As more Australian dental practices modernize their operations, suppliers are expanding their digital product portfolios, further supporting the Australia dental consumables market growth.

.webp)

To get more information on this market, Request Sample

Rising Demand for Infection Control and Single-Use Products

Infection prevention remains a top priority in Australian dental practices, leading to increased demand for high-quality infection control consumables. The COVID-19 pandemic raised awareness of cross-contamination risks, prompting stricter compliance with sterilization protocols. In 2023, Australia recorded over 1.5 million cases of notifiable infectious diseases, with COVID-19 accounting for over 837,000 of these cases. The contribution of infectious diseases, including respiratory and gastrointestinal infections, remains high, as can be seen in the rising numbers of hospitalizations for diseases such as influenza and lower respiratory tract infections. With the increasing relevance of infection prevention, especially in the dental environment, incorporating measures such as vaccination and hygiene protocols is a must to prevent the spread of disease and improve the outcomes of the patient. Disposable products such as masks, gloves, syringe tips, and sterilization pouches are now essential purchases for clinics. Additionally, there is a growing preference for single-use instruments to minimize infection risks, driving sales of pre-sterilized, disposable scalers, mirrors, and probes. Manufacturers are responding by introducing eco-friendly, biodegradable alternatives to address sustainability concerns without compromising safety. Regulatory bodies such as the Australian Dental Association (ADA) continue to enforce stringent hygiene standards, further supporting market growth. As dental practices prioritize patient and staff safety, the infection control segment is expected to expand steadily, with innovation in antimicrobial materials and sustainable disposables shaping future trends.

Australia Dental Consumables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, treatment, material, and end user.

Product Insights:

- Dental Burs

- Whitening Material

- Dental Biomaterial

- Dental Anesthetics

- Crowns and Bridges

- Dental Implants

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes dental burs, whitening material, dental biomaterial, dental anesthetics, crowns and bridges, dental implants, and others.

Treatment Insights:

- Orthodontic

- Endodontic

- Periodontic

- Prosthodontic

A detailed breakup and analysis of the market based on the treatment have also been provided in the report. This includes orthodontic, endodontic, periodontic, and prosthodontic.

Material Insights:

- Metals

- Polymers

- Ceramics

- Biomaterials

The report has provided a detailed breakup and analysis of the market based on the material. This includes metals, polymers, ceramics, and biomaterials.

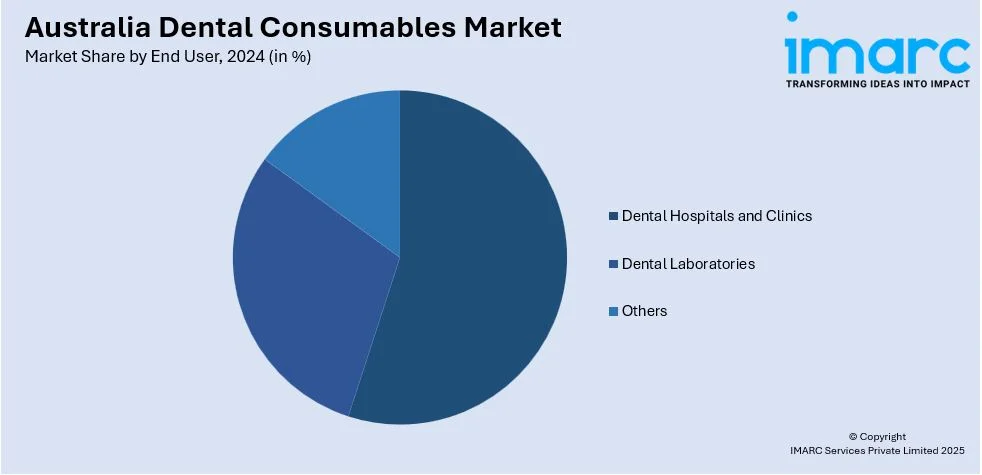

End User Insights:

- Dental Hospitals and Clinics

- Dental Laboratories

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes dental hospitals and clinics, dental laboratories, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Dental Consumables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Dental Burs, Whitening Material, Dental Biomaterial, Dental Anesthetics, Crowns and Bridges, Dental Implants, Others |

| Treatments Covered | Orthodontic, Endodontic, Periodontic, Prosthodontic |

| Materials Covered | Metals, Polymers, Ceramics, Biomaterials |

| End Users Covered | Dental Hospitals and Clinics, Dental Laboratories, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia dental consumables market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia dental consumables market on the basis of product?

- What is the breakup of the Australia dental consumables market on the basis of treatment?

- What is the breakup of the Australia dental consumables market on the basis of material?

- What is the breakup of the Australia dental consumables market on the basis of end user?

- What is the breakup of the Australia dental consumables market on the basis of region?

- What are the various stages in the value chain of the Australia dental consumables market?

- What are the key driving factors and challenges in the Australia dental consumables market?

- What is the structure of the Australia dental consumables market and who are the key players?

- What is the degree of competition in the Australia dental consumables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia dental consumables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia dental consumables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia dental consumables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)