Australia Dental Insurance Market Size, Share, Trends and Forecast by Type, Demographics, Coverage, End User, and Region, 2026-2034

Australia Dental Insurance Market Summary:

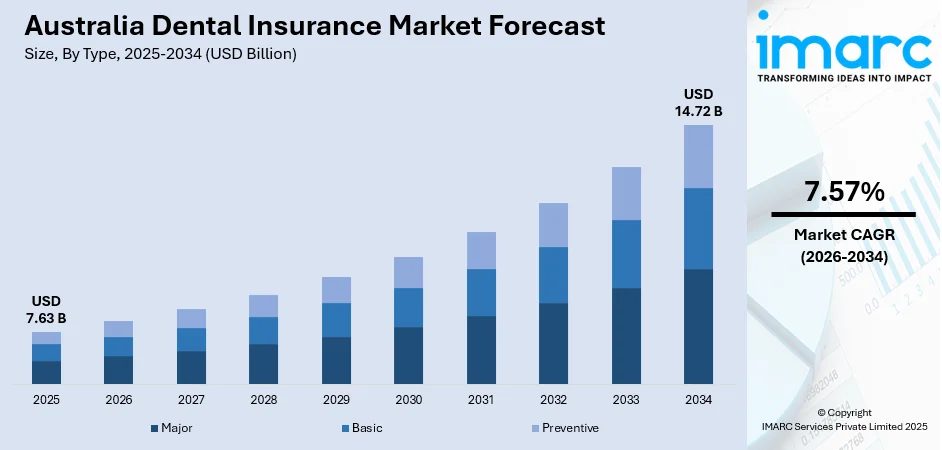

The Australia dental insurance market size was valued at USD 7.63 Billion in 2025 and is projected to reach USD 14.72 Billion by 2034, growing at a compound annual growth rate of 7.57% from 2026-2034.

The market is experiencing robust growth driven by increasing awareness about preventive dental care, rising dental treatment costs, and the growing integration of digital health solutions into insurance offerings. The aging Australian population, which requires more frequent and complex dental services, continues to fuel demand for comprehensive insurance coverage. Additionally, corporate adoption of dental benefits as employee retention tools strengthens the employer-sponsored segment.

Key Takeaways and Insights:

- By Type: Preventive dental insurance dominates the market with a share of 50% in 2025, driven by consumer preference for routine care coverage including check-ups, cleanings, and fluoride treatments that prevent costly future procedures.

- By Demographics: Adults lead the market with a share of 60% in 2025, supported by Australians demanding general treatment policies and growing awareness of oral health connections to overall wellbeing.

- By Coverage: Dental preferred provider organizations represent the largest segment with a market share of 50% in 2025, offering policyholders greater flexibility through unrestricted provider choice and partial coverage for out-of-network services without primary dentist requirements.

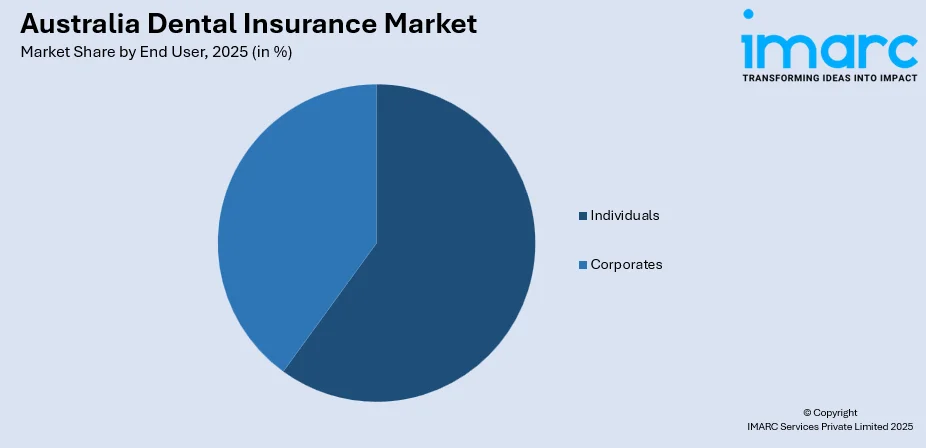

- By End User: Corporates lead the market with a share of 62% in 2025, supported by Australians demanding general treatment policies and growing awareness of oral health connections to overall wellbeing.

- Key Players: The market exhibits moderate competitive intensity with major insurers competing alongside regional providers across diverse price segments.

To get more information on this market, Request Sample

The Australian dental insurance landscape is undergoing significant transformation as insurers address affordability concerns through strategic network partnerships and digital innovation. In July 2024, nib launched its No Gap dental program covering 1.2 million eligible members across over 250 participating practices nationwide. An appointment at a nib No Gap dentist, for a check-up, scaling, cleaning, fluoride application, when necessary, along with bitewing and panoramic x-rays, incurs no expenses for eligible members throughout Australia. The program demonstrates how insurers are leveraging provider agreements to reduce financial barriers while maintaining service quality. Simultaneously, private health are paying for dental benefits, representing a major percentage of dental expenditure as individuals increasingly recognize the value of insurance protection against escalating treatment costs for out-of-pocket expenses.

Australia Dental Insurance Market Trends:

Expansion of No Gap Provider Networks

Health insurers are aggressively expanding no gap dental networks to enhance value propositions and reduce member out-of-pocket costs for preventive services. This trend reflects consumer demand for predictable expenses and greater accessibility to routine care without financial deterrents. In 2025, The Special Needs Dental Clinic of Dental Health Services was inaugurated, establishing a new standard for inclusive and accessible dental care. Inaugurated by Health Infrastructure Minister and Health Minister, this is the first clinic in WA specifically designed to offer dental care for patients who might face challenges in accessing regular dental services due to developmental, intellectual, or physical disabilities. Patients may also be evaluated from their car if they are unable or resistant to enter the clinic.

Accelerated Digital Transformation and Teledentistry Integration

The dental insurance sector is rapidly adopting digital platforms and teledentistry capabilities to streamline administrative processes and expand service accessibility. Insurers are implementing electronic health records systems that facilitate seamless communication between dental providers and payers while improving claims processing accuracy and speed. Digital tools enable real-time benefit verification, automated appointment reminders, and mobile applications for instant claims tracking, enhancing member experience and operational efficiency. Teledentistry services have emerged as valuable components of insurance offerings, particularly for preliminary consultations, follow-up care, and patient education in remote or underserved regions. These virtual dental assessments reduce travel requirements for policyholders while enabling early problem detection and triage, ultimately supporting preventive care strategies that align with insurer objectives to minimize expensive major treatment claims through proactive oral health management. In 2025, The Australian Taxation Office (ATO) disclosed that 32,850 Australians effectively applied to access their super to cover dental expenses in the last financial year, nearly tenfold the amount from six years prior.

Growing Emphasis on Preventive Care Initiatives

Private health insurers are intensifying focus on preventive dental benefits as cost-effective strategies for reducing long-term claim expenses while improving member health outcomes. This shift from reactive treatment coverage toward proactive prevention reflects broader healthcare industry trends emphasizing wellness and early intervention. The Australian Dental Association launched Dental Health Week in 2024 with concentrated messaging on gum health importance and connections between oral health and systemic wellness. Insurance providers are responding by enhancing coverage for routine examinations, professional cleanings, and fluoride treatments while educating members about preventive care value. Many funds now offer multiple 100 percent covered check-ups annually at preferred providers, eliminating financial barriers to regular dental visits. This preventive approach helps policyholders maintain optimal oral health through early issue detection, reducing the likelihood of expensive restorative procedures that strain both member finances and insurer claim reserves.

Market Outlook 2026-2034:

The Australia dental insurance market is positioned for sustained growth throughout the forecast period as demographic trends, technological advancements, and healthcare policy developments converge to expand coverage adoption. The market generated a revenue of USD 7.63 Billion in 2025 and is projected to reach a revenue of USD 14.72 Billion by 2034, growing at a compound annual growth rate of 7.57% from 2026-2034. Digital transformation initiatives including AI-powered diagnostics, automated claims processing, and teledentistry platforms will enhance operational efficiency while improving member experiences.

Australia Dental Insurance Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Preventive |

50% |

|

Demographics |

Adults |

60% |

|

Coverage |

Dental Preferred Provider Organizations |

50% |

|

End User |

Corporates |

62% |

Type Insights:

- Major

- Basic

- Preventive

Preventive dominates with a market share of 50% of the total Australia dental insurance market in 2025.

Preventive dental coverage dominates the Australian market as consumers increasingly recognize the value of routine care in maintaining long-term oral health while minimizing expensive treatment needs. This segment encompasses services including biannual check-ups, professional cleanings, plaque removal, fluoride applications, and diagnostic x-rays that identify problems in early stages when interventions remain relatively simple and affordable. Research demonstrates that individuals with preventive coverage maintain better oral health through regular professional monitoring and early intervention, avoiding costly restorative procedures.

Preventive dental insurance addresses complex and expensive treatments including crowns, bridges, dentures, root canal therapy, periodontics, and oral surgeries that often follow delayed preventive care or address serious oral health conditions. 5.2 million services received subsidies through the Australian Government’s Child Dental Benefits Schedule (Services Australia 2025), which assists in delivering essential dental care to qualifying children aged 2–17. This coverage tier typically requires extended 12-month waiting periods and features annual benefit caps that limit insurer liability for high-cost procedures.

Demographics Insights:

- Senior Citizens

- Adults

- Minors

Adults lead with a share of 60% of the total Australia dental insurance market in 2025.

Adult policyholders represent the dominant demographic segment as working-age Australians seek dental insurance through employer-sponsored plans and individual policies to manage oral health maintenance costs and protect against unexpected treatment expenses. 5.2 million services received subsidies through the Australian Government’s Child Dental Benefits Schedule (Services Australia 2025), which assists in delivering essential dental care to qualifying children aged 2–17. Adults face diverse dental care needs that benefit from comprehensive insurance protection.

Senior citizens constitute a growing demographic segment with substantial dental insurance needs driven by age-related oral health challenges including tooth loss, periodontal disease, and reduced manual dexterity affecting home care effectiveness. The Parliamentary Budget Office projects annual costs of $1.143 billion for 2.8 million eligible seniors under the proposed Seniors' Dental Benefits Schedule by 2025-2026, highlighting the significant financial burden that this demographic faces for necessary dental services. Aging populations retain more natural teeth than previous generations, increasing demand for complex treatments including implants, crowns, and extensive restorative work.

Coverage Insights:

- Dental Preferred Provider Organizations

- Dental Health Maintenance Organizations

- Dental Indemnity Plans

- Others

Dental preferred provider organizations exhibit a clear dominance with a 50% share of the total Australia dental insurance market in 2025.

Dental Preferred Provider Organizations represent the leading coverage model in Australia, offering policyholders flexibility to visit any licensed dentist while receiving higher benefit payments for services rendered by in-network providers who have negotiated fee agreements with insurers. This structure eliminates primary dentist requirements and referral prerequisites for specialist consultations that characterize more restrictive health maintenance organization models. PPO arrangements appeal to individuals valuing provider choice and treatment autonomy while still accessing cost savings through preferred network participation.

Members receive partial coverage even for out-of-network services, providing comprehensive protection regardless of dentist selection. Major insurers operate extensive PPO networks spanning thousands of dental practices across metropolitan and regional areas. In July 2024, nib's No Gap dental program expanded its No Gap network to 117 Pacific Smiles Dental centers. The two firms have maintained a strong collaborative relationship for over twenty years and presently hold a contract that lasts until May 2027.

End User Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Individuals

- Corporates

Corporates dominate with a market share of 62% of the total Australia dental insurance market in 2025.

Corporate dental insurance represents the dominant end-user segment as Australian employers increasingly offer dental benefits as strategic components of comprehensive employee compensation packages designed to attract talent, enhance retention, and support workforce health and productivity. Employer-sponsored plans provide significant advantages including group purchasing power that secures favorable premium rates, potential tax benefits where employer contributions qualify as pre-tax income reducing payroll and income tax liabilities, and simplified enrollment processes that encourage higher participation rates.

Organizations recognize that dental benefits contribute to employee satisfaction and demonstrate employer commitment to total wellbeing beyond basic medical coverage. In 2024, the Australian Competition and Consumer Commission (ACCC) has approved St Lukes Medical and Hospital Benefits Association to establish price capping agreements with dentists within its partner provider network. The authorization includes dental services in Tasmania, especially in regions where St Lukes intends to establish its clinics from 2024 to 2026. These price limits intend to offer St Lukes members routine and preventive dental care on a ‘no-gap’ or ‘known-gap’ basis, reducing out-of-pocket costs.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory and New South Wales represent the largest regional market, benefiting from high population concentrations in Sydney, Canberra, and surrounding metropolitan areas where dental insurance penetration rates exceed national averages. This region features extensive provider networks, diverse insurer competition, and relatively high household incomes supporting premium affordability. Urban concentration enables insurers to establish preferred provider relationships and no gap networks efficiently, as demonstrated by nib's July 2024 program launch covering over 90 percent of members within participating practice areas.

Victoria and Tasmania constitute a substantial market driven by Melbourne's large population base and strong private health insurance culture. The region features mature dental service infrastructure with established provider networks and competitive insurer presence. Tasmania's geographic isolation presents unique distribution challenges, though telehealth adoption helps address accessibility gaps for residents in remote areas.

Queensland represents a growing market propelled by population expansion in Brisbane, Gold Coast, and regional centers. The state's demographic profile includes significant retiree populations in coastal areas requiring extensive dental services, supporting robust insurance demand. Queensland's geographic diversity requires insurers to balance metropolitan network density with regional coverage accessibility.

Northern Territory and Southern Australia form a smaller combined market reflecting lower population density, though South Australia's Adelaide metropolitan area provides concentration supporting viable insurer operations. The Northern Territory demonstrates the lowest dentist availability at 36.0 full-time equivalents per 100,000 population, highlighting accessibility challenges that teledentistry and traveling provider services help address.

Western Australia represents a geographically dispersed market centered on Perth's metropolitan region. The state's mining industry supports relatively high household incomes enabling premium affordability, though rural and remote areas face provider scarcity requiring innovative service delivery models including mobile dental units and telehealth consultations.

Market Dynamics:

Growth Drivers:

Why is the Australia Dental Insurance Market Growing?

Aging Population and Increased Dental Service Requirements

Australia's demographic transformation toward an aging society fundamentally drives dental insurance market expansion as older Australians demonstrate substantially higher utilization rates and more complex treatment needs compared to younger cohorts. By 2064–65, almost 25% of the population is expected to be 65 years or older, creating a major financial and societal policy obstacle. The proportion of Australians aged 65 and over continues rising, with this demographic retaining more natural teeth than previous generations due to improved oral health practices and dental care access throughout their lifetimes. While increased tooth retention represents positive health outcomes, it simultaneously creates greater ongoing maintenance requirements and exposure to age-related conditions including periodontal disease, tooth decay, and restorative needs.

Corporate Adoption of Dental Benefits for Employee Retention

Australian employers are increasingly incorporating comprehensive dental insurance into employee benefit packages as strategic tools for attracting qualified talent, enhancing workforce retention rates, and demonstrating organizational commitment to total employee wellbeing in competitive labor markets. In the 2024, Australians took out over $1.4bn from their superannuation accounts for compassionate reasons, with a significant portion allocated to cover medical procedures such as dental care and weight loss treatments. Dental benefits contribute measurably to employee satisfaction and loyalty, particularly among families with children who value orthodontic coverage and working professionals who recognize oral health importance for career success and social confidence.

Rising Dental Care Costs and Financial Protection Demand

Escalating dental treatment expenses across preventive, restorative, and specialized services drive Australian consumers toward insurance protection as out-of-pocket costs for even routine care create significant household budget pressures that comprehensive coverage helps mitigate. The Australian Bureau of Statistics states that in 2023–24, 17.6% of individuals postponed or refrained from visiting a dental professional because of expenses. This situation worsened for individuals in regions of greatest socio-economic hardship (27.3%) or those with a chronic health issue (20.8%). Private health insurance provides critical financial protection enabling individuals to access necessary care without catastrophic expense impacts, directly address affordability barriers by eliminating out-of-pocket expenses for preventive services.

Market Restraints:

What Challenges the Australia Dental Insurance Market is Facing?

Extended Waiting Periods Delaying Treatment Access

Health insurance regulations permit extended waiting periods before policyholders can access dental benefits, creating significant barriers for individuals requiring immediate care while simultaneously discouraging new market entrants from purchasing coverage. Standard waiting periods range from two months for general dental services including check-ups, cleanings, and basic fillings to 12 months for major dental work encompassing crowns, bridges, dentures, root canals, and orthodontic treatments. These mandatory delays prevent consumers from obtaining insurance only when expensive treatment becomes necessary, protecting insurers from adverse selection risks where claims immediately exceed premium collections.

Coverage Gaps and Annual Benefit Limitations

Dental insurance policies feature annual maximum benefit limits and service-specific sub-limits that create substantial out-of-pocket expenses even for insured policyholders, constraining market appeal and value perception among cost-conscious consumers. Coverage exclusions for cosmetic procedures, certain orthodontic treatments, and advanced implant dentistry further limit policy comprehensiveness. These gaps between promised coverage and actual benefit payouts erode consumer confidence and satisfaction, particularly when unexpected dental emergencies or complex treatment needs exceed annual limits early in the benefit year, leaving policyholders financially exposed for remaining months until reset dates.

High Out-of-Pocket Expenses Despite Insurance Coverage

Despite maintaining dental insurance, Australian policyholders face substantial out-of-pocket expenses that diminish coverage value and discourage optimal preventive care utilization, constraining market growth potential. Out-of-pocket costs prove particularly burdensome for major dental procedures where benefit limits quickly exhaust, leaving policyholders facing thousands of dollars in expenses. This affordability challenge drives the one-third of Australians who delay or avoid needed dental care and the one-sixth who specifically cite cost as the barrier, demonstrating that even insured individuals struggle with dental expense management.

Competitive Landscape:

The Australia dental insurance market exhibits moderate competitive intensity with several major insurers controlling significant market share alongside regional funds and niche providers serving specialized segments. Market leadership concentrates among established brands, which collectively account maximum policyholders through extensive distribution networks, diverse product portfolios, and strong brand recognition. These dominant players compete on coverage comprehensiveness, provider network breadth, premium affordability, and service quality while investing heavily in digital transformation initiatives including mobile applications, automated claims processing, and teledentistry platforms. Competitive differentiation increasingly focuses on value-added services like no gap dental programs, preferred provider partnerships offering reduced fees, and preventive care incentives encouraging regular check-ups.

Australia Dental Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Major, Basic, Preventive |

| Demographics Covered | Senior Citizens, Adults, Minors |

| Coverages Covered | Dental Preferred Provider Organizations, Dental Health Maintenance Organizations, Dental Indemnity Plans, Others |

| End Users Covered | Individuals, Corporates |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia dental insurance market size was valued at USD 7.63 Billion in 2025.

The Australia dental insurance market is expected to grow at a compound annual growth rate of 7.57% from 2026-2034 to reach USD 14.72 Billion by 2034.

Preventive dental insurance dominates the market with 50% share, driven by the heightened preference for routine care coverage including check-ups, cleanings, and fluoride treatments that prevent costly future procedures while maintaining optimal oral health through regular professional monitoring and early intervention.

Key factors driving the Australia Dental Insurance market include the aging population requiring increased dental services with Parliamentary Budget Office projecting significant funding for eligible seniors and rising dental care costs creating the demand for financial protection as national expenditure increases with individuals directly funding major portion of total spending.

Major challenges include extended waiting periods for major dental work that delay treatment access and discourage new market entrants, coverage gaps and annual benefit limitations creating substantial out-of-pocket expenses despite insurance coverage, and high gap payments as average benefits per service represent only partial cost coverage leaving significant financial burdens that deter optimal preventive care utilization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)