Australia Diagnostic Imaging Market Size, Share, Trends and Forecast by Modality, Application, End User, and Region, 2025-2033

Australia Diagnostic Imaging Market Overview:

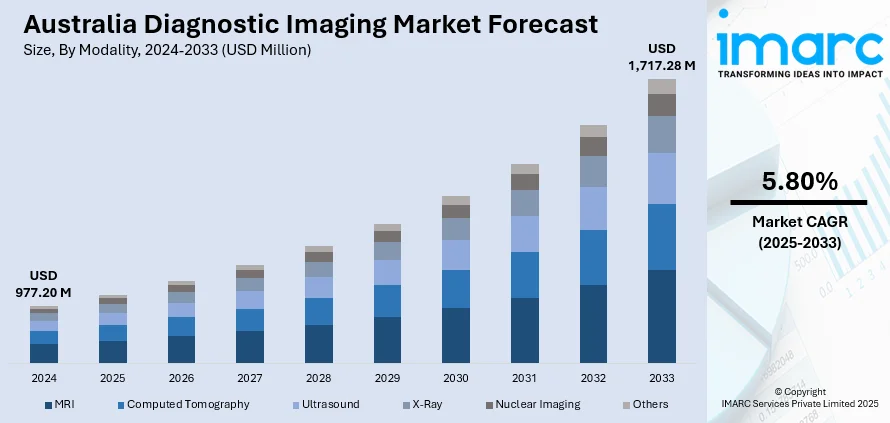

The Australia diagnostic imaging market size reached USD 977.20 Million in 2024. Looking forward, the market is projected to reach USD 1,717.28 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is expanding steadily, driven by advancements in medical imaging technologies for accuracy, efficiency, and safety of diagnostic procedures, increased demand for early disease detection, and growing prevalence of chronic conditions. Government initiatives supporting digital health and improved diagnostic access further contribute to the Australia diagnostic imaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 977.20 Million |

| Market Forecast in 2033 | USD 1,717.28 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Key Trends of Australia Diagnostic Imaging Market:

Advancements in Imaging Technology

Rapid technological innovation in diagnostic imaging is a key driver of market growth in Australia. The integration of AI, 3D imaging, PET-CT, MRI, and low-dose radiation systems has improved the accuracy, efficiency, and safety of diagnostic procedures. These advancements enable earlier and more precise detection of conditions such as cancer, cardiovascular disease, and neurological disorders. Australia's robust R&D ecosystem and openness to adopting cutting-edge solutions further support this trend. The incorporation of digital tools, such as teleradiology and cloud-based imaging platforms, also enhances data sharing and remote diagnostics. As both public and private providers invest in next-generation equipment, demand continues to rise across both urban and regional healthcare settings. For instance, in February 2025, the US Advanced Research Projects Agency for Health (ARPA-H) awarded an up to US$16.4m (A$25m) development contract to Micro-X, an Australian X-ray technology business, to create the first full-body mobile CT in history. The Platform Accelerating Rural Access to Distributed and Integrated Medical Care (PARADIGM) initiative of the US Government agency awarded the contract to build a portable, lightweight whole body CT scan.

To get more information on this market, Request Sample

Rising Incidence of Chronic and Age-Related Diseases

The Australia diagnostic imaging market growth is also driven by the increasing burden of chronic diseases, such as cancer, diabetes, and cardiovascular conditions, combined with an aging population, which is significantly boosting demand for diagnostic imaging in Australia. Elderly patients typically require more frequent monitoring and imaging to manage degenerative diseases and comorbidities. Diagnostic imaging plays a crucial role in early detection, staging, and treatment planning, particularly in oncology and cardiovascular care. As life expectancy increases and lifestyle-related conditions become more prevalent, health services are under pressure to provide accurate, timely diagnoses. Imaging services are essential for preventive care and ongoing disease management, making them indispensable to Australia’s healthcare strategy and a key driver of imaging service expansion. For instance, in March 2025, leading the way in AI-powered intraoperative imaging worldwide, Body Vision Medical reported that the Therapeutic Goods Administration (TGA) in Australia has approved their LungVision advanced imaging system. The company's goal to increase early and accurate lung cancer diagnosis globally has reached a major milestone with this approval.

Growth of Portable and Point-of-Care Imaging

The rising adoption of portable and point-of-care imaging systems is revolutionizing diagnostic processes throughout Australia. Compact ultrasound machines and mobile X-ray devices are being increasingly utilized in outpatient clinics, emergency rooms, and rural or remote healthcare settings where comprehensive imaging facilities may be lacking. These mobile options facilitate quicker diagnoses at the bedside, minimizing the need for patient transfers and improving response times in critical care scenarios. Their adaptability accommodates diverse applications, including obstetrics, musculoskeletal evaluations, and trauma assessments. As the call for decentralized and responsive healthcare intensifies, so does the dependence on these technologies. This transition is playing a significant role in the growth of Australia diagnostic imaging market demand, particularly in areas with limited access.

Growth Drivers of Australia Diagnostic Imaging Market:

Healthcare Infrastructure Expansion

The growth of healthcare infrastructure across Australia is crucial for the advancement of the diagnostic imaging market. New hospitals, outpatient centers, and regional health clinics are being established to manage increasing patient numbers and enhance access to advanced medical services. These new facilities frequently have dedicated radiology departments equipped with state-of-the-art imaging technologies such as MRI, CT, and ultrasound systems. Both government and private sector investments are particularly directed toward underserved regions, bolstering healthcare capabilities in rural and remote areas. The increased availability of diagnostic imaging reduces patient travel times, aids in early disease detection, and allows for better integration of imaging services into everyday care. This extensive network growth is a primary driver of expansion within the Australian diagnostic imaging sector.

Government Healthcare Funding

Strong governmental support through subsidies and reimbursement programs is significantly improving access to diagnostic imaging services in Australia. Medicare, the national public health program, covers a broad spectrum of imaging procedures, minimizing out-of-pocket costs for patients and promoting timely diagnoses. Funding also backs bulk-billing practices, ensuring that vulnerable groups, including seniors and rural residents, receive equitable access to imaging technologies. The introduction of item numbers for newer imaging methods has further broadened the range of services eligible for reimbursement. Moreover, capital grants for upgrading radiology equipment and digital infrastructure enhance service quality and operational efficiency. These financial supports elevate patient outcomes and drive demand and innovation within the Australian diagnostic imaging market.

Integration with Precision Medicine

According to Australia diagnostic imaging market analysis, the incorporation of imaging technologies with precision medicine is a key trend transforming healthcare delivery. Diagnostic imaging supplies essential data that shapes personalized treatment strategies, especially in fields such as oncology, cardiology, and neurology. Advanced imaging methods, like PET-CT and functional MRI, enable healthcare providers to identify diseases at a molecular level, monitor treatment responses, and customize interventions based on individual patient biology. As the healthcare paradigm shifts toward a more tailored approach, imaging is increasingly utilized alongside genetic and laboratory data to inform clinical choices. This integration promotes collaboration among radiologists and specialists, encourages investment in cutting-edge equipment, and accelerates the implementation of AI and data analytics tools within medical imaging processes.

Opportunities of Australia Diagnostic Imaging Market:

Expansion of Tele-radiology Services

The increasing acceptance of digital health technologies is fostering the growth of tele-radiology services in Australia. This model enables diagnostic images, such as X-rays, CT scans, and MRIs, to be sent electronically to radiologists located off-site, facilitating quicker interpretation and reporting. Tele-radiology helps eliminate geographical barriers, especially in rural and remote regions where on-site radiologists may be scarce. Additionally, it supports after-hours reporting and second opinions, thereby enhancing both the speed and quality of care. With improved broadband access and digital healthcare platforms, tele-radiology can minimize diagnostic delays and streamline resource allocation. As healthcare providers seek scalable and efficient solutions, tele-radiology is poised to play a crucial role in improving accessibility and operational efficiency in diagnostic imaging services throughout Australia.

Public-Private Partnerships for Rural Access

Public-private partnerships (PPPs) are emerging as a strategic approach to enhance access to diagnostic imaging services in underserved and remote areas of Australia. Government agencies are collaborating with private diagnostic companies and healthcare providers to co-invest in initiatives such as mobile imaging units, remote diagnostic centers, and subsidized service delivery. These partnerships help to bridge gaps in infrastructure and resources, ensuring that rural populations receive prompt diagnostic assistance. Often, these collaborations include funding for technology upgrades, workforce training, and tele-imaging platforms for remote assessments. PPPs expand the geographic reach of imaging services and also alleviate pressure on urban centers. As healthcare equity becomes a national priority, these partnerships will play a crucial role in ensuring consistent and high-quality access to imaging services across the country.

Personalized and Preventive Healthcare

Australia's healthcare system is experiencing a significant shift towards personalized and preventive care, opening up considerable opportunities in diagnostic imaging. As awareness of early disease detection grows, both patients and providers are increasingly relying on imaging to identify risks before symptoms develop. Advanced technologies such as 3D mammography, low-dose CT scans, and molecular imaging facilitate more accurate diagnoses and monitoring of conditions like cancer, cardiovascular diseases, and neurological disorders. Imaging is also becoming integral to the development of individualized treatment plans, particularly in oncology and genetic medicine. This emphasis on prevention rather than reaction is encouraging more routine scans and follow-ups, driving demand for accessible, high-resolution imaging technologies. The inclusion of diagnostics in wellness and screening programs further reinforces this trend.

Challenges of Australia Diagnostic Imaging Market:

High Equipment and Maintenance Costs

The introduction of advanced diagnostic imaging technologies, including MRI, CT, and PET-CT scanners, poses a significant financial challenge for many healthcare providers across Australia. These machines require considerable initial investment and also generate ongoing operational and maintenance expenses. Smaller clinics and facilities in rural areas often find it hard to justify such expenditures, which restricts access to quality imaging services outside major urban centers. Furthermore, the rapid advancement in technology can render equipment obsolete more quickly, compelling providers to make repeated investments to maintain competitiveness. Consequently, these financial challenges act as major barriers to the widespread adoption and fair distribution of imaging services.

Shortage of Skilled Radiologists and Technicians

The diagnostic imaging sector in Australia faces a persistent shortage of qualified radiologists, medical imaging technologists, and sonographers. Although the demand for imaging services is increasing due to an aging population and broader clinical applications, the supply of skilled professionals is not keeping up. This imbalance results in heavier workloads, extended reporting times, and potential burnout among existing staff. The problem is particularly pronounced in rural and remote areas, where attracting and retaining talented professionals is complicated by limited resources and lifestyle considerations. Bridging this workforce gap is vital for ensuring timely and precise diagnostics throughout the healthcare system.

Access Disparities in Rural and Remote Regions

Geographical and infrastructural obstacles significantly impede access to diagnostic imaging services for individuals residing in Australia's rural and remote areas. Many of these regions lack permanent imaging facilities, necessitating that patients travel long distances to urban centers for even basic scans. Such situations lead to delays in diagnosis, treatment, and follow-up, further widening health disparities. While mobile imaging units and tele-radiology have made some strides, they are not sufficiently widespread to fully address the issue. Developing sustainable, regionally tailored solutions remains an urgent priority for achieving equitable access to healthcare through diagnostic imaging.

Australia Diagnostic Imaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on modality, application, and end user.

Modality Insights:

- MRI

- Low and Mid Field MRI Systems

- High Field MRI Systems

- Very High and Ultra High Field MRI Systems

- Computed Tomography

- Low-end Scanners

- Mid-range Scanners

- High-end Scanners

- Ultrasound

- 2D Ultrasound

- 3D Ultrasound

- Others

- X-Ray

- Analog Systems

- Digital Systems

- Nuclear Imaging

- Positron Emission Tomography (PET)

- Single Photon Emission Computed Tomography (SPECT)

- Others

The report has provided a detailed breakup and analysis of the market based on the modality. This includes MRI (Low and Mid Field MRI Systems, High Field MRI Systems, and Very High and Ultra High Field MRI Systems), Computed Tomography (Low-end Scanners, Mid-range Scanners, and High-end Scanners), Ultrasound (2D Ultrasound, 3D Ultrasound, and Others), X-Ray (Analog Systems and Digital Systems), Nuclear Imaging (Positron Emission Tomography (PET) and Single Photon Emission Computed Tomography (SPECT)), and others.

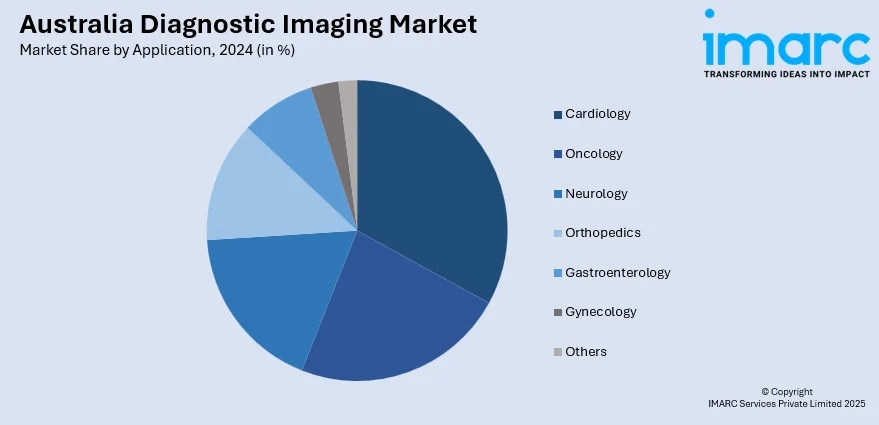

Application Insights:

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cardiology, oncology, neurology, orthopedics, gastroenterology, gynecology, and others.

End User Insights:

- Hospitals

- Diagnostic Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, diagnostic centers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Diagnostic Imaging Market News:

- In February 2025, Coreline Soft announced its new FDA approval and launch in Australia. After allying with a significant medical device supplier, the South Korean medical imaging AI startup Coreline Soft has arrived in Australia.

- In February 2025, Sydney Neuroimaging Analysis Centre (SNAC) partnered with North Shore Radiology to enhance MRI capabilities using SNAC's AI-driven brain analysis tool, iQ-Solutions. This collaboration aims to improve early detection and monitoring of conditions like multiple sclerosis and cognitive dysfunction through advanced quantitative neuroimaging techniques.

- In October 2024, FUJIFILM Australia installed the country's first Fujifilm Open MRI machine at Altus Medical Imaging in Gladesville, NSW. Designed to enhance patient comfort and accessibility, the Aperto Lucent Open MRI aims to improve MRI experiences, especially for those with claustrophobia. The clinic offers comprehensive diagnostic services in Sydney.

- In October 2024, AZmed partnered with Healthinc to enhance AI adoption in radiology across Australia and New Zealand. This collaboration aims to integrate AZmed’s Rayvolve® AI Suite with Healthinc’s radiology systems, improving diagnostic accuracy and efficiency. The partnership highlights a commitment to advancing AI-driven solutions for better patient outcomes.

Australia Diagnostic Imaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modalities Covered |

|

| Applications Covered | Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology, Others |

| End Users Covered | Hospitals, Diagnostic Centers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia diagnostic imaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia diagnostic imaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia diagnostic imaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diagnostic imaging market in Australia was valued at USD 977.20 Million in 2024.

The Australia diagnostic imaging market is projected to exhibit a compound annual growth rate (CAGR) of 5.80% during 2025-2033.

The Australia diagnostic imaging market is expected to reach a value of USD 1,717.28 Million by 2033.

The Australia diagnostic imaging market is witnessing increased adoption of AI-assisted image interpretation, growth in hybrid imaging systems, and integration with electronic health records. There is also a notable rise in demand for mobile imaging units and tele-radiology to improve access in remote and regional areas.

Key growth drivers include an aging population with rising chronic disease incidence, greater awareness about early diagnosis benefits, and government support through Medicare subsidies. Additionally, advancements in imaging technology and increased investment in healthcare infrastructure are accelerating market expansion across public and private sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)