Australia Diagnostic Labs Market Size, Share, Trends and Forecast by Provider Type, Test Type, Sector, End User, and Region, 2025-2033

Australia Diagnostic Labs Market Overview:

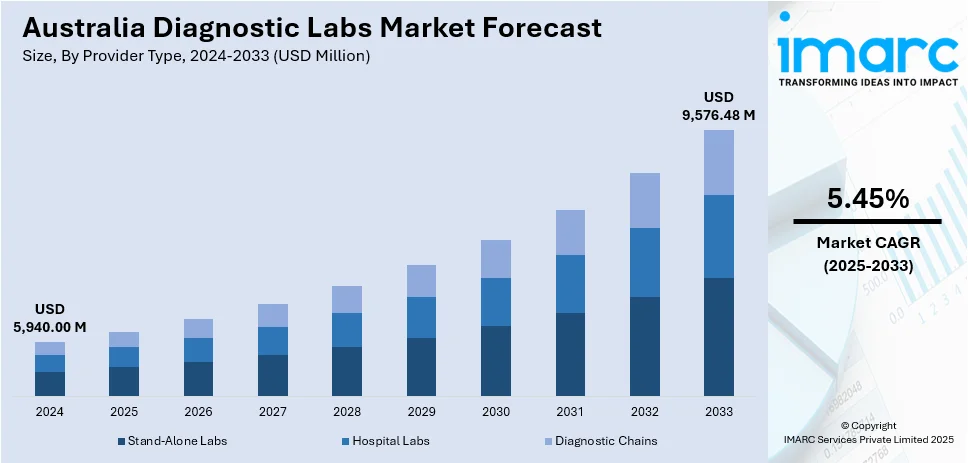

The Australia diagnostic labs market size reached USD 5,940.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,576.48 Million by 2033, exhibiting a growth rate (CAGR) of 5.45% during 2025-2033. The market is driven by an emerging focus on early detection of disease, increased demand for individualized healthcare, and heightened public awareness about preventive care measures. The evolution of diagnostic technology, such as molecular testing and digital pathology, making results more accurate and quicker, the occurrence of chronic illnesses, government incentives for healthcare facilities and broad access to both public and private diagnostic services are also contributing to the Australia diagnostic labs market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,940.00 Million |

| Market Forecast in 2033 | USD 9,576.48 Million |

| Market Growth Rate 2025-2033 | 5.45% |

Australia Diagnostic Labs Market Trends:

Integration of Advanced Technologies

Australian medical laboratories are increasingly recognizing the need for advanced technology to enhance the accuracy and speed of test results. For instance, in the regions employing artificial intelligence (AI) or machine learning algorithms, image analysis has become quite straightforward and enables rapid and more accurate diagnosis. Next-generation sequencing (NGS) and liquid biopsy have transformed genetic testing to detect cancers at early stages and also for vast other molecular applications. With these technologies, patient outcomes are further enhanced while also making Australia one of the most leading countries facilitating diagnostic innovations worldwide.

To get more information on this market, Request Sample

Increased Point-of-Care Testing

In Australia, there is a growing shift toward point-of-care testing (POCT), which is a fast and simple diagnostics method, compared to traditional testing methods. POCT allows healthcare providers to conduct tests at or close to the site of patient care, thus minimizing the time to receive results and facilitating clinical decision-making in real-time. It finds its significance in rural and remote regions where the access to central laboratories might be difficult. For instance, in the COVID-19 POC Testing program, according to industry reports, the Australian government invested a total of USD 27 million. This investment had an exceptionally high pay-off. An independent review of the program commissioned by the government published a report in July 2023. The implementation of POCT also receives support from the advances in the development of portable diagnostic devices and mobile health technologies, further augmenting the accessibility and quality of healthcare services in the country.

Focus on Preventive Healthcare

Preventive medicine is becoming increasingly popular in Australia, with diagnostic labs playing an essential part in detecting diseases at the early stages and monitoring health. According to a report by the Australian Academy of Health & Medical Sciences, nearly 40% of the disease burden in Australia can be prevented, with estimates indicating that each dollar spent on preventive health can save more than USD 14 in health care and associated expenses. Hence, routine screenings and health check-ups are becoming increasingly integral parts of public health measures, with a view to finding possible health concerns before they progress to more serious diseases. While such a preventive approach enhances the health outcomes of individuals, it also saves long-term healthcare expenditure. Diagnostic labs are now increasing their activities to cover more preventive tests as the country concentrates on encouraging people to be healthier and better, which further fuels the Australia diagnostic labs market growth.

Australia Diagnostic Labs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on provider type, test type, sector, and end user.

Provider Type Insights:

- Stand-Alone Labs

- Hospital Labs

- Diagnostic Chains

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes stand-alone labs, hospital labs, and diagnostic chains.

Test Type Insights:

- Pathology

- Radiology

The report has provided a detailed breakup and analysis of the market based on the test type. This includes pathology and radiology.

Sector Insights:

- Urban

- Rural

The report has provided a detailed breakup and analysis of the market based on the sector. This includes urban and rural.

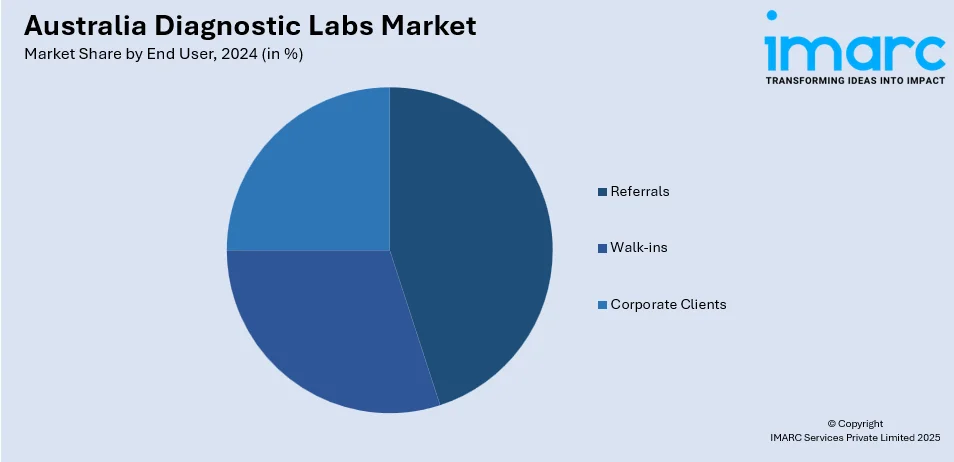

End User Insights:

- Referrals

- Walk-ins

- Corporate Clients

The report has provided a detailed breakup and analysis of the market based on the end user. This includes referrals, walk-ins, and corporate clients.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Diagnostic Labs Market News:

- In November 2024, prominent diagnostic firm Australian Clinical Labs became part of the national deployment of the interoperable eRequests solution developed by Magentus, broadening its total reach to nearly 90% of Australia's pathology laboratories. The collaboration between Magentus and Australian Clinical Labs introduces more than 1300 additional collection centers and 9 million possible testing instances to the eRequests network, expanding the solution's accessibility to almost nine out of ten testing locations across the country after implementations with Sonic Healthcare and Healius.

- In August 2024, BCAL Diagnostics, headquartered in Sydney, Australia, created a subsidiary in the United States and was poised to start operations from its North Carolina lab on September 2nd. The move into the US is crucial for the company to build a presence in the US market before the introduction of their breast cancer blood screening solution, BREASTEST, anticipated in 2025. The US program additionally provides BCAL with a chance to speed up and confirm new products based on US patient-centered data while acquiring insights into the US diagnostics market.

Australia Diagnostic Labs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Provider Types Covered | Stand-Alone Labs, Hospital Labs, Diagnostic Chains |

| Test Types Covered | Pathology, Radiology |

| Sectors Covered | Urban, Rural |

| End Users Covered | Referrals, Walk-ins, Corporate Clients |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia diagnostic labs market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia diagnostic labs market on the basis of provider type?

- What is the breakup of the Australia diagnostic labs market on the basis of test type?

- What is the breakup of the Australia diagnostic labs market on the basis of sector?

- What is the breakup of the Australia diagnostic labs market on the basis of end user?

- What is the breakup of the Australia diagnostic labs market on the basis of region?

- What are the various stages in the value chain of the Australia diagnostic labs market?

- What are the key driving factors and challenges in the Australia diagnostic labs?

- What is the structure of the Australia diagnostic labs market and who are the key players?

- What is the degree of competition in the Australia diagnostic labs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia diagnostic labs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia diagnostic labs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia diagnostic labs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)