Australia Diagnostic Testing Market Size, Share, Trends and Forecast by Test Type, Technology, Sample Type, Mode of Testing, Application, End User, and Region, 2025-2033

Australia Diagnostic Testing Market Overview:

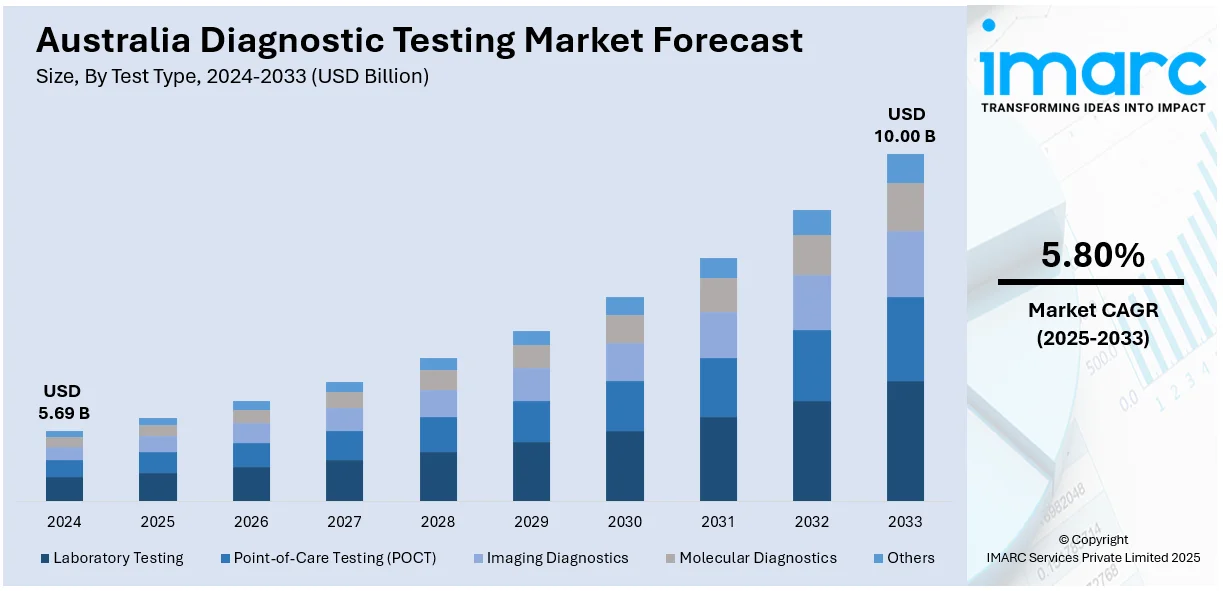

The Australia diagnostic testing market size reached USD 5.69 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.00 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is fueled by expanding demand for early and precise detection of diseases, accelerating usage of molecular and genomic technologies, rising emphasis on preventive medicine, and inclusion of digital and remote testing platforms. Furthermore, government encouragement of national screening programs, improvements in non-invasive testing methodologies, and requirements for affordable healthcare in rural settings also enhance market growth. All these factors individually increase the Australia diagnostic testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.69 Billion |

| Market Forecast in 2033 | USD 10.00 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Diagnostic Testing Market Trends:

Increased Demand for Genomic and Molecular Testing

Australia is going through an upsurge in the use of genomic and molecular testing with health systems shifting towards personalized medicine. Since they can identify genetic predispositions and genetic mutations associated with many diseases, these state-of-the-art testing techniques are increasingly being used in clinical diagnosis as well as for preventive measures. According to the reports, in May 2023, Australia released a long COVID diagnostic test based on immune biomarker analysis with 97% sensitivity, allowing individualized care and discrimination from related conditions in 22 Healius Pathology locations. Moreover, their uses are varied from oncology to unusual genetic disorders, enabling earlier diagnosis and more focused therapies. Greater government funding for genomics research and public education initiatives are fueling demand, and advances in accuracy and turnaround time for testing make these technologies more applicable to common use. The combination of next-generation sequencing and bioinformatics tools has also improved the capability of high-throughput screening with wider population coverage. Physicians are now being taught how to interpret advanced genetic information, which opens this technology to all levels of healthcare. As this arena continues to advance, diagnostic testing is being remade as a portal to personalized medicine and chronic disease management.

To get more information on this market, Request Sample

Imperatives of Digital Health and Remote Testing Platforms

Digital health integration is driving speedy change in Australia's healthcare provision, with special progress in remote and home-based testing services. Growing dependence on wearable health wearables, smartphone-detection diagnostic equipment, and telemedicine platforms has revolutionized patient access to diagnostic services. This change facilitates ongoing health monitoring, enhances rates of early detection, and reduces the necessity of in-office clinical visits. Patients in rural and underserved communities are reaping major benefits, with access to timely testing previously restricted by distance. For instance, in March 2024, Microba and Sonic Healthcare released MetaPanel™, Australia's first accredited metagenomic test for diagnosing 175 gastrointestinal pathogens in a single test, with improved accuracy and early detection by the national pathology network of Sonic Healthcare. Moreover, artificial intelligence (AI) platforms are now helping clinicians interpret results more efficiently and accurately. Government initiatives encouraging digital infrastructure and electronic health records have also facilitated this transition. The pandemic hastened the adoption of virtual health care services, which has continued due to ease and affordability. The technologies are redesigning healthcare engagement models whereby diagnostic testing assumes an even more direct and individualized role in continuous patient care and disease prevention.

Preventive Health and Population Screening

Australia diagnostic testing market growth is placing an emphasis on preventive health approaches, with large-scale population screening programs becoming key in healthcare planning. This forward-looking strategy emphasizes early disease detection and risk estimation, especially for diseases like cancer, cardiovascular disease, and diabetes. Screening programs are being broadened and optimized according to demographic requirements, with targeted outreach toward high-risk and under-screened populations. The amplified use of less invasive, more efficient screening tests has enhanced coverage rates, while electronic record-keeping provides continuity and follow-up. Preventative care campaigns also impact public behavior, motivating people to take control of their health through frequent checks. As the cost of healthcare increases with a growing population of older people, early intervention through screening provides long-term system efficiencies. This proactive approach puts diagnostic testing at the center of Australia's health management system, prioritizing detection rather than treatment and creating a culture of pre-emptive, community-level health monitoring.

Australia Diagnostic Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on test type, technology, sample type, mode of testing, application, and end user.

Test Type Insights:

- Laboratory Testing

- Point-of-Care Testing (POCT)

- Imaging Diagnostics

- Molecular Diagnostics

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes laboratory testing, point-of-care testing (POCT), imaging diagnostics, molecular diagnostics, and others.

Technology Insights:

- Immunoassay-Based

- PCR-Based

- Next Gen Sequencing

- Spectroscopy-Based

- Chromatography-Based

- Microfluidics

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes immunoassay-based, PCR-based, next gen sequencing, spectroscopy-based, chromatography-based, microfluidics, and others.

Sample Type Insights:

- Blood

- Urine

- Saliva

- Sweat

- Hair

- Others

The report has provided a detailed breakup and analysis of the market based on the sample type. This includes blood, urine, saliva, sweat, hair, and others.

Mode of Testing Insights:

- Prescription Based Testing

- OTC Testing

A detailed breakup and analysis of the market based on the mode of testing have also been provided in the report. This includes prescription based testing and OTC testing.

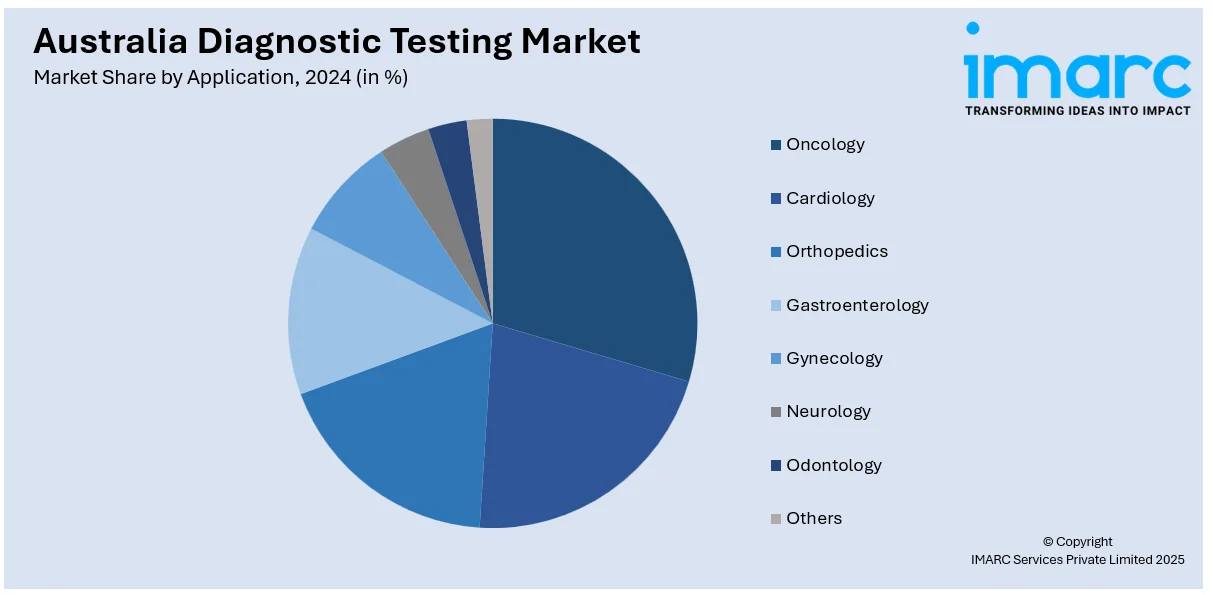

Application Insights:

- Oncology

- Cardiology

- Orthopedics

- Gastroenterology

- Gynecology

- Neurology

- Odontology

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes oncology, cardiology, orthopedics, gastroenterology, gynecology, neurology, odontology, and others.

End User Insights:

- Hospitals

- Diagnostic Center

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Homecare

- Blood Banks

- Research Labs and Institutes

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, diagnostic center, ambulatory surgical centers (ASCs), specialty clinics, homecare, blood banks, research labs and institutes, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Diagnostic Testing Market News:

- In March 2025, BCAL Diagnostics Limited introduced BREASTEST plus™, an innovative blood test to improve breast cancer screening for women with high breast density. From late March, the test will complement standard imaging techniques, helping improve early detection and diagnostic accuracy throughout Australia's health system.

- In May 2024, SK Telecom commercially launched its AI-based veterinary diagnostic service, X Caliber, in Australia. Co-developed with ATX Medical Solutions, X Caliber quickly and remotely analyzes pet X-rays. The service has been adopted by more than 100 Australian veterinary clinics, improving veterinary services in a nation boasting one of the world's highest pet ownership rates.

Australia Diagnostic Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Laboratory Testing, Point-of-Care Testing (POCT), Imaging Diagnostics, Molecular Diagnostics, Others |

| Technologies Covered | Immunoassay-Based, PCR-Based, Next Gen Sequencing, Spectroscopy-Based, Chromatography-Based, Microfluidics, Others |

| Sample Types Covered | Blood, Urine, Saliva, Sweat, Hair, Others |

| Mode of Testings Covered | Prescription Based Testing, OTC Testing |

| Applications Covered | Oncology, Cardiology, Orthopedics, Gastroenterology, Gynecology, Neurology, Odontology, Others |

| End Users Covered | Hospitals, Diagnostic Center, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Homecare, Blood Banks, Research Labs and Institutes, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia diagnostic testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia diagnostic testing market on the basis of test type?

- What is the breakup of the Australia diagnostic testing market on the basis of technology?

- What is the breakup of the Australia diagnostic testing market on the basis of sample type?

- What is the breakup of the Australia diagnostic testing market on the basis of mode of testing?

- What is the breakup of the Australia diagnostic testing market on the basis of application?

- What is the breakup of the Australia diagnostic testing market on the basis of end user?

- What is the breakup of the Australia diagnostic testing market on the basis of region?

- What are the various stages in the value chain of the Australia diagnostic testing market?

- What are the key driving factors and challenges in the Australia diagnostic testing?

- What is the structure of the Australia diagnostic testing market and who are the key players?

- What is the degree of competition in the Australia diagnostic testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia diagnostic testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia diagnostic testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia diagnostic testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)