Australia Dialysis Equipment Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Australia Dialysis Equipment Market Overview:

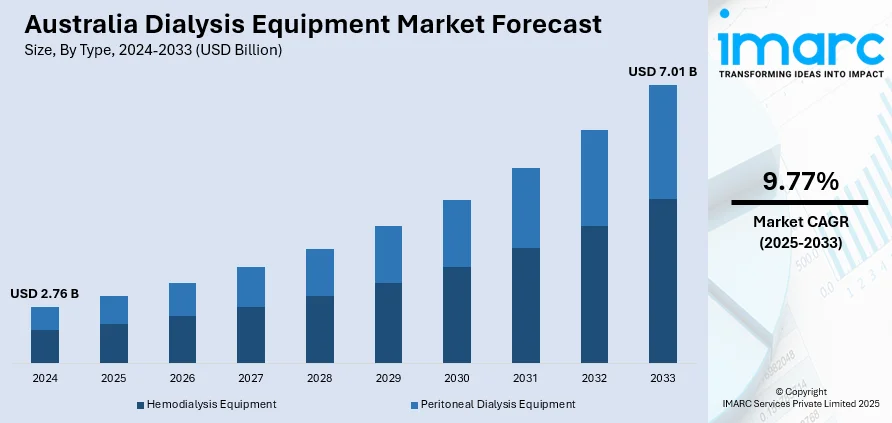

The Australia dialysis equipment market size reached USD 2.76 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.01 Billion by 2033, exhibiting a growth rate (CAGR) of 9.77% during 2025-2033. The market is driven by rising cases of kidney disorders, growing awareness about renal care, advancements in medical technologies, and increasing demand for home dialysis and improved healthcare infrastructure. Key players focus on innovation and strategic partnerships to enhance their presence. These factors collectively influence the competitive dynamics of the Australia dialysis equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.76 Billion |

| Market Forecast in 2033 | USD 7.01 Billion |

| Market Growth Rate 2025-2033 | 9.77% |

Australia Dialysis Equipment Market Trends:

Rising Prevalence of Chronic Kidney Disease (CKD)

The growing incidence of chronic kidney disease (CKD) is a major driver of the dialysis equipment market in Australia. Increased cases of CKD are largely due to diabetes, hypertension, obesity, and aging. With the progression of kidney disease, it becomes necessary for many patients to undergo dialysis to take over the kidneys’ crucial tasks. Campaigns to raise health awareness and the use of detection programs have contributed to a rise in the number of those receiving treatment. The rise in CKD is causing the healthcare system extra strain, encouraging its leaders to invest in dialysis equipment and technologies. With more people having CKD, more dialysis equipment is needed in both hospitals and at home.

To get more information of this market, Request Sample

Technological Advancements in Dialysis Equipment

Continuous innovations in dialysis equipment technology are significantly enhancing treatment efficiency, safety, and patient comfort, thereby driving market growth in Australia. There are now machines available with simple features, automation, compact sizes for use in homes and better cleaning filters. Because more people are seeking care at home, wearable dialysis devices and portable hemodialysis machines are being more widely noticed. By using modern monitoring tools and connecting devices, patients can receive treatments that can be closely followed and improved in real time. These technological improvements not only streamline clinical operations but also reduce treatment times and enhance patient compliance. As healthcare providers and patients increasingly adopt these modern devices, demand for technologically advanced dialysis equipment continues to accelerate throughout Australia.

Growth in Home Dialysis Adoption

There is a rising preference for home dialysis in Australia due to the convenience, flexibility, and cost-effectiveness it offers compared to in-center dialysis. With healthcare systems promoting patient-centric care and encouraging decentralized treatment models, home dialysis is gaining broader acceptance. Patients benefit from better quality of life, fewer hospital visits, and increased autonomy in managing their condition. Government policies, subsidies, and educational programs are also supporting this transition by empowering patients with training and support. Furthermore, advances in compact and easy-to-use dialysis machines are making home-based treatment more accessible. This shift toward home dialysis not only helps reduce healthcare facility burden but also contributes significantly to the Australia dialysis equipment market growth.

Australia Dialysis Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Hemodialysis Equipment

- Hemodialysis Machines

- n-Center Hemodialysis Machines

- Home Based Hemodialysis Machines

- Hemodialysis Consumables

- Dialyzers

- Dialysate

- Access Products

- Others

- Hemodialysis Machines

- Peritoneal Dialysis Equipment

- Peritoneal Dialysis Equipment Type

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

- Peritoneal Dialysis Product

- Cyclers

- Fluids

- Others

- Peritoneal Dialysis Equipment Type

The report has provided a detailed breakup and analysis of the market based on the type. This includes hemodialysis equipment [hemodialysis machines (n-center hemodialysis machines and home-based hemodialysis machines) and hemodialysis consumables (dialyzers, dialysate, access products, and others)] and peritoneal dialysis equipment [peritoneal dialysis equipment type (continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD)) and peritoneal dialysis product (cyclers, fluids, and others)].

End User Insights:

- Dialysis Centers and Hospitals

- Home Healthcare

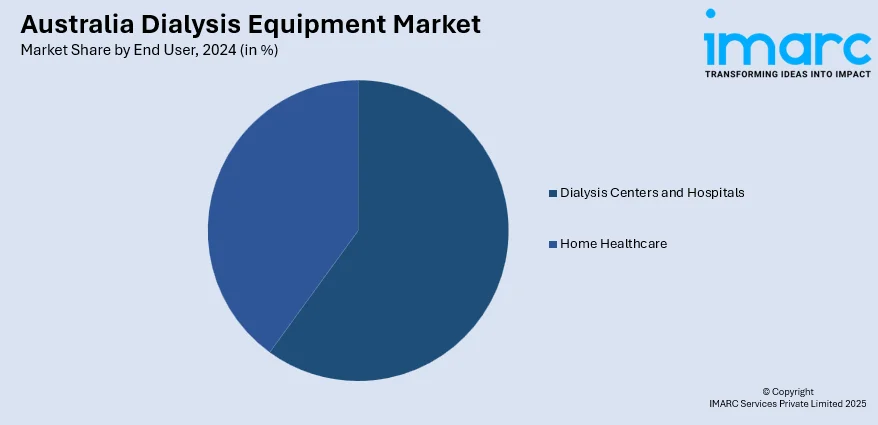

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes dialysis centers and hospitals and home healthcare.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Dialysis Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Users Covered | Dialysis Centers and Hospitals, Home Healthcare |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia dialysis equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia dialysis equipment market on the basis of type?

- What is the breakup of the Australia dialysis equipment market on the basis of end user?

- What is the breakup of the Australia dialysis equipment market on the basis of region?

- What are the various stages in the value chain of the Australia dialysis equipment market?

- What are the key driving factors and challenges in the Australia dialysis equipment market?

- What is the structure of the Australia dialysis equipment market and who are the key players?

- What is the degree of competition in the Australia dialysis equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia dialysis equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia dialysis equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia dialysis equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)