Australia Dialysis Market Size, Share, Trends and Forecast by Type, Product and Services, End User, and Region, 2025-2033

Australia Dialysis Market Overview:

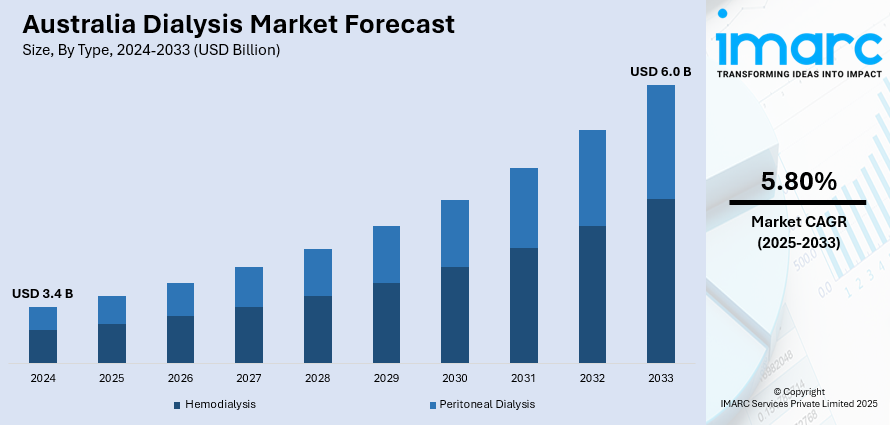

The Australia dialysis market size reached USD 3.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market share is driven by the rising aging population, rising prevalence of chronic kidney disease, and increased awareness of early diagnosis. Technological advancements, government support for home dialysis, and growing investments from private providers also contribute to market growth by enhancing access, convenience, and quality of care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.4 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Dialysis Market Trends:

Integration of Digital Health Technologies

Digital health innovation is emerging as a cornerstone in Australia dialysis market outlook. With technology advances in telemedicine, remote monitoring, and data analytics, both patients and clinicians now possess tools that boost care coordination and individualized therapy. Wearable sensors, cloud platforms, and mobile apps aid in monitoring fluid levels, vital signs, and adjusting treatment regimes in real-time. This integration minimizes hospital visits, facilitates early detection of complications, and enhances overall patient involvement. It also aids clinicians in making evidence-based decisions. As these technologies become more accessible and easier to use, their role in routine dialysis care will increase, in line with wider healthcare objectives of digitization and proactive disease management.

To get more information on this market, Request Sample

Shift Toward Home-Based Dialysis

Australia is increasingly focusing on home-based dialysis treatments, such as peritoneal dialysis and home hemodialysis, with 9% of kidney failure patients receiving hemodialysis at home in 2022, according to the Australian Institute of Health and Welfare. This Australia dialysis market trends promotes patient autonomy, improves quality of life, and reduces hospital strain. Home dialysis allows patients to adjust treatment schedules to fit personal routines, offering greater comfort and flexibility. Healthcare providers are supporting this shift with educational programs, telehealth services, and home visits. Policymakers encourage home dialysis for its potential to lower healthcare costs and alleviate pressure on in-center resources. However, successful adoption depends on patient eligibility, caregiver support, and proper training, all of which continue to receive focused attention and investment in the Australia dialysis market forecast.

Expansion of Private Dialysis Providers

The functions of private dialysis providers are growing throughout Australia, supplementing the public health system. They provide specialized services, frequently in patient-focused models, reduced wait times, and access to advanced technology. Private facilities are also meeting demand in underserved areas, closing geographic gaps in the availability of dialysis. Their expansion is indicative of a movement towards diversified care provision, with public-private partnerships increasing the efficiency of the overall system thus bolstering the Australia dialysis market growth. Private providers promote competition and innovation, which stimulate all parties to raise the quality of services. With the maturation of the market, collaboration and regulation will be critical to promoting equity, affordability, and uniformity in care standards.

Australia Dialysis Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product and services, and end user.

Type Insights:

- Hemodialysis

- Conventional Hemodialysis

- Short Daily Hemodialysis

- Nocturnal Hemodialysis

- Peritoneal Dialysis

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hemodialysis (conventional hemodialysis, short daily hemodialysis, and nocturnal hemodialysis) and peritoneal dialysis (continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD)).

Product and Services Insights:

- Services

- Equipment

- Dialysis Machines

- Water Treatment Systems

- Others

- Consumables

- Dialyzers

- Catheters

- Others

- Dialysis Drugs

The report has provided a detailed breakup and analysis of the market based on the product and services. This includes services, equipment (dialysis machines, water treatment systems, and others), consumables (dialyzers, catheters, and others), and dialysis drugs.

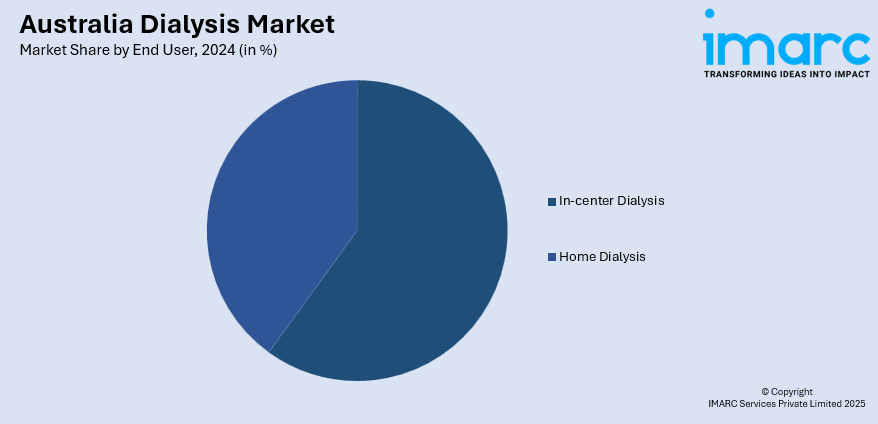

End User Insights:

- In-center Dialysis

- Home Dialysis

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes in-center dialysis and home dialysis.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Dialysis Market News:

- In March 2025, Proteomics International launched Promarker®D, a predictive blood test for diabetic kidney disease, in Australia. Unveiled on World Kidney Day, the test identifies at-risk type 2 diabetes patients up to four years before symptoms appear, enabling early intervention. Initially available in Western Australia and the Northern Territory, PromarkerD aims to improve patient outcomes and reduce the burden of kidney disease, marking a major step in Proteomics' global expansion.

- In June 2024, Australia opened a new renal dialysis clinic in Coober Pedy as part of a $73.2 million initiative to improve care for First Nations people with severe kidney disease. Operated by the Purple House, the clinic will initially support around eight patients weekly, potentially doubling during peak times. This effort aims to enhance access to essential healthcare and close the health gap affecting Indigenous communities, according to Assistant Minister Malarndirri McCarthy.

Australia Dialysis Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Products and Services Covered |

|

| End Users Covered | In-center Dialysis, Home Dialysis |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia dialysis market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia dialysis market on the basis of type?

- What is the breakup of the Australia dialysis market on the basis of product and services?

- What is the breakup of the Australia dialysis market on the basis of end user?;

- What is the breakup of the Australia dialysis market on the basis of region?

- What are the various stages in the value chain of the Australia dialysis market?

- What are the key driving factors and challenges in the Australia dialysis market?

- What is the structure of the Australia dialysis market and who are the key players?

- What is the degree of competition in the Australia dialysis market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia dialysis market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia dialysis market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia dialysis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)