Australia Die Casting Components Market Size, Share, Trends and Forecast by Component Type, Material Type, Process Type, Sales Channel, End Use Industry, and Region, 2026-2034

Australia Die Casting Components Market Summary:

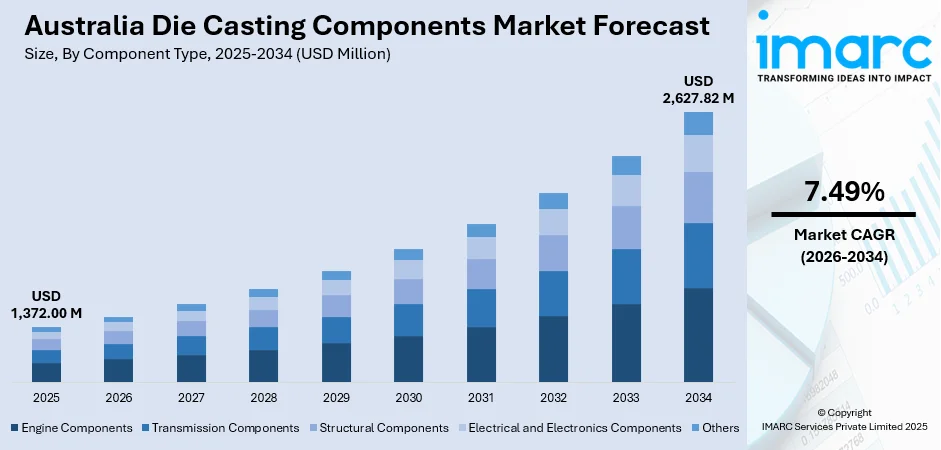

The Australia die casting components market size was valued at USD 1,372.00 Million in 2025 and is projected to reach USD 2,627.82 Million by 2034, growing at a compound annual growth rate of 7.49% from 2026-2034.

The Australia die casting components market is witnessing a strong growth due to the booming automotive industry, especially the increased use of electric vehicles, which need lightweight parts. The growth in construction projects in residential and commercial projects is generating some demand in precision metal parts, whereas the growth in the mining sector is also creating a demand in high-performance, durable die-cast parts utilized in heavy machinery and equipment.

Key Takeaways and Insights:

- By Component Type: Engine components dominate the market with a share of 30% in 2025, driven by the automotive industry's demand for precision-engineered engine blocks, cylinder heads, and transmission housings that require superior dimensional accuracy.

- By Material Type: Aluminum die castings leads the market with a share of 50% in 2025, owing to aluminum's superior strength-to-weight ratio, corrosion resistance, and excellent thermal conductivity, making it ideal for automotive and electronics applications.

- By Process Type: High-Pressure Die Casting (HPDC) represents the largest segment with a market share of 55% in 2025, attributed to its effectiveness in mass manufacturing complex shapes with high durability and excellent dimensional precision.

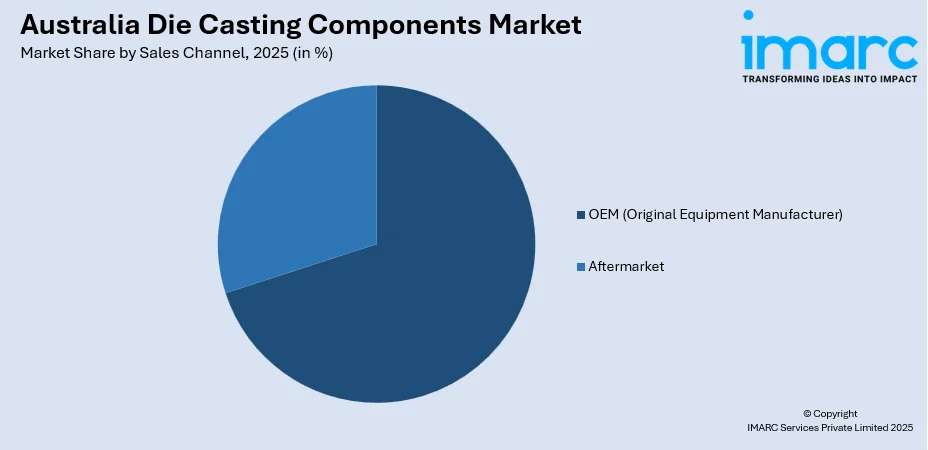

- By Sales Channel: OEM (Original Equipment Manufacturer) accounts for the largest share of 70% in 2025, reflecting the strong demand from automotive manufacturers and industrial equipment producers for custom-designed components.

- By End Use Industry: Automotive holds the largest share of 50% in 2025, driven by the sector's increasing adoption of die-cast components for lightweight vehicle manufacturing and electric vehicle production.

- Key Players: The Australia die casting components market exhibits moderate competitive intensity, with established domestic manufacturers competing alongside international players. Key industry participants include specialized die casting firms, automotive component suppliers, and integrated manufacturing companies that serve diverse end-use sectors, including automotive, aerospace, mining, and consumer goods industries.

To get more information on this market, Request Sample

The Australian die casting components market is undergoing a massive change due to changes in technology and the changing demands in the industry. The trend towards the use of lightweight materials in the manufacture of automobiles, accompanied by the move towards the use of electric vehicles, has increased the use of advanced die casting technologies. The mining industry in Australia still requires strong die-cast parts for high-powered machines, such as drilling and loaders, and conveyor systems, which are fueled by the current investment and the increase in activity. The construction industry's expansion, with work projected to reach USD 588 Billion in 2033, is further supporting market growth through increased demand for structural fittings, window frames, and architectural components. Local manufacturers are responding by investing in automation and precision casting technologies to meet international quality standards while supporting domestic supply chain resilience.

Australia Die Casting Components Market Trends:

Growing Adoption of Electric Vehicles Driving Lightweight Component Demand

The Australian automotive industry is experiencing a significant shift toward electric vehicles, creating substantial demand for lightweight die-cast components. Electric vehicle sales in Australia increased by approximately 24.4% in the first half of 2025 compared to the same period in 2024, with EVs accounting for over 12.1% of all new vehicle sales. This transition is driving the adoption of aluminum and magnesium die-cast parts for battery housings, motor casings, and structural components that optimize vehicle range and performance.

Integration of Automation and Industry 4.0 Technologies

Australian die-casting manufacturers are progressively adopting automation, AI, and IoT technologies to modernize production processes. These advancements enable real-time monitoring of casting parameters, predictive maintenance, and improved quality control. Firms are also leveraging simulation-based design and precision tooling to optimize yields and lower per-unit costs. This digital transformation enhances operational efficiency and strengthens competitiveness, helping domestic manufacturers better contend with imports from the Asia-Pacific region while meeting rising demand for high-quality, cost-effective die-cast components.

Focus on Sustainable Manufacturing and Recyclable Materials

The Australian die casting industry is embracing sustainable manufacturing practices in response to environmental regulations and corporate sustainability goals. Die-cast aluminum and magnesium components are gaining preference due to their recyclable nature and lower carbon footprint compared to alternative materials. Manufacturers are implementing closed-loop recycling systems and adopting energy-efficient processes to meet the requirements of the National Construction Code 2025 and align with Australia's broader sustainability objectives. By 2035, Australia plans to significantly enhance its circular economy, reimagining the ways resources are utilized, repurposed, and renewed throughout the nation. This initiative represents a move toward minimizing waste by design, continuously recirculating materials, and creating durable products built for longevity.

Market Outlook 2026-2034:

The Australia die casting components market is poised for sustained growth over the forecast period, supported by robust demand from automotive, construction, and mining sectors. The ongoing transition toward electric mobility and the government's emphasis on domestic manufacturing capability are expected to create significant opportunities for industry participants. Infrastructure investments exceeding USD 17 billion allocated for transport corridors in the 2025-26 federal budget will drive demand for precision die-cast components across construction and industrial applications. The market generated a revenue of USD 1,372.00 Million in 2025 and is projected to reach a revenue of USD 2,627.82 Million by 2034, growing at a compound annual growth rate of 7.49% from 2026-2034.

Australia Die Casting Components Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component Type | Engine Components | 30% |

| Material Type | Aluminum Die Castings | 50% |

| Process Type | High-Pressure Die Casting (HPDC) | 55% |

| Sales Channel | OEM (Original Equipment Manufacturer) | 70% |

| End Use Industry | Automotive | 50% |

Component Type Insights:

- Engine Components

- Transmission Components

- Structural Components

- Electrical and Electronics Components

- Others

The Engine Components segment dominates with a market share of 30% of the total Australia die casting components market in 2025.

Engine components represent the largest segment within the Australia die casting components market, driven by the automotive industry's continuous demand for precision-engineered parts that enhance vehicle performance and fuel efficiency. Die-cast engine blocks, cylinder heads, and intake manifolds are preferred for their superior dimensional accuracy and ability to withstand high temperatures and mechanical stress. The growing electric vehicle market is further expanding this segment's scope to include motor housings and power electronics enclosures.

The transition toward lightweight vehicle manufacturing has positioned die-cast aluminum engine components as critical enablers of improved fuel economy and reduced emissions. Australian manufacturers are investing in advanced high-pressure die casting equipment to produce complex engine components with minimal porosity and enhanced mechanical properties. The Nissan Casting Australia Plant in Victoria produces over 1.2 million engine and powertrain components annually for both domestic and international markets, demonstrating the segment's strategic importance.

Material Type Insights:

- Aluminum Die Castings

- Zinc Die Castings

- Magnesium Die Castings

- Others

The Aluminum Die Castings segment leads with a share of 50% of the total Australia die casting components market in 2025.

Aluminum die castings dominate the Australian market due to the material's exceptional combination of lightweight properties, corrosion resistance, and excellent thermal conductivity. The automotive sector extensively utilizes aluminum die-cast components for transmission housings, engine parts, and structural elements, driven by stringent fuel efficiency requirements and emissions regulations. The Australia aluminum extrusion market size reached USD 2.7 Billion in 2024. Looking forward, the market to reach USD 5.4 Billion by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033. Aluminum's recyclability aligns with sustainability initiatives across manufacturing industries.

The segment's growth is further supported by increasing demand from electronics and telecommunications sectors requiring heat sinks and enclosures with superior thermal management properties. Australian foundries are adopting advanced aluminum alloys and high-pressure die casting technologies to produce components meeting international quality standards. The mining equipment sector also relies on aluminum die castings for their ability to deliver lightweight yet durable components capable of withstanding harsh operational environments.

Process Type Insights:

- High-Pressure Die Casting (HPDC)

- Low-Pressure Die Casting (LPDC)

- Gravity Die Casting

- Others

The High-Pressure Die Casting (HPDC) segment holds the largest share of 55% of the total Australia die casting components market in 2025.

High-pressure die casting commands the largest share of the Australian market due to its effectiveness in producing complex geometries with excellent surface finish and dimensional precision. The process involves injecting molten metal at high velocity and pressure into precision molds, enabling the production of thin-walled components with superior mechanical properties. Automotive and electronics manufacturers prefer HPDC for high-volume production of components requiring minimal post-processing. For instance, in May 2025, the Nissan Casting Australia Plant (NCAP) officially received the Australian Made certification, with all towbars and both high- and low-pressure aluminium castings manufactured at NCAP now proudly holding this prestigious accreditation.

The segment is benefiting from technological advancements in automation and real-time process monitoring that enhance production efficiency and reduce defect rates. Australian manufacturers are investing in advanced HPDC equipment capable of handling larger castings for electric vehicle structural components and integrated battery housings. The ability to achieve tight tolerances and consistent quality makes HPDC the preferred choice for applications demanding high reliability and performance.

Sales Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- OEM (Original Equipment Manufacturer)

- Aftermarket

The OEM segment accounts for the highest revenue with a 70% share of the total Australia die casting components market in 2025.

The OEM segment dominates the Australian die casting components market, reflecting strong demand from automotive manufacturers, industrial equipment producers, and electronics companies requiring custom-designed components integrated into their products. OEM relationships involve long-term supply agreements and close collaboration on product development, enabling die casting suppliers to optimize component designs for specific applications.

Australian OEM demand is supported by government initiatives promoting domestic manufacturing and supply chain resilience. The emphasis on sovereign capability development, particularly in defense and aerospace sectors, has strengthened relationships between die casting manufacturers and original equipment producers. Companies are investing in engineering capabilities and quality management systems to meet stringent OEM specifications and certification requirements.

End Use Industry Insights:

- Automotive

- Aerospace and Defense

- Industrial Machinery

- Electrical and Electronics

- Consumer Goods

- Others

The Automotive segment exhibits clear dominance with a 50% share of the total Australia die casting components market in 2025.

The automotive industry represents the largest end-use segment for die casting components in Australia, driven by the sector's continuous pursuit of lightweight, fuel-efficient, and performance-oriented vehicles. For instance, the Australia automotive market size was valued at 1.22 Million Units in 2024. Looking forward, the market is expected to reach 2.50 Million Units by 2033, exhibiting a CAGR of 7.60% from 2025-2033. Die-cast components are extensively used in powertrain systems, body structures, and interior applications where weight reduction directly translates to improved fuel economy and reduced emissions. The accelerating transition to electric vehicles is creating additional demand for die-cast battery enclosures, motor housings, and charging system components.

Australian automotive component manufacturers are adapting to the electric vehicle transition by developing specialized die casting capabilities for EV-specific applications. The Nissan Casting Australia Plant in Dandenong South, which received Australian Made certification in May 2025, produces high-pressure die-cast aluminum components for both conventional and electric powertrains, serving global markets. The segment's growth is further supported by favorable trade agreements and the New Vehicle Efficiency Standard, driving automakers toward lightweight component solutions.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The market is fueled by a concentration of automotive, aerospace, and defense industries in these regions, driving demand for high-precision die-cast components. Rapid urban infrastructure development and industrial expansion in New South Wales create a steady need for durable, lightweight metal parts. Adoption of advanced manufacturing technologies, including automation and IoT, further supports production efficiency and market growth.

Victoria and Tasmania benefit from a strong automotive and machinery manufacturing base. The presence of precision engineering firms and growing aerospace and renewable energy sectors drives demand for high-quality die-cast components. Investments in smart manufacturing, digital design, and simulation-based tooling enhance production capabilities, enabling local suppliers to compete effectively against imported parts while supporting sustainable industrial growth.

Queensland’s industrial growth, particularly in mining, construction, and transport equipment, is a key driver for die-cast components. The demand for durable, corrosion-resistant, and lightweight parts is increasing in heavy machinery and automotive applications. Technological adoption, including AI-assisted design and automated production lines, improves efficiency and reduces costs, allowing manufacturers to meet regional infrastructure and industrial expansion requirements.

The mining, defense, and aerospace sectors in the Northern Territory and South Australia drive die-cast demand. Heavy machinery and military equipment require precision-engineered components, supporting local manufacturing. Ongoing infrastructure projects and regional industrial development increase market potential, while automation and digital tooling adoption enhance production quality and operational efficiency, helping suppliers maintain competitiveness against imported components.

Western Australia’s market is primarily driven by mining, construction, and transportation sectors, which require high-performance die-cast components for heavy equipment and vehicles. Rising investment in industrial automation, AI-enabled quality control, and IoT integration optimizes manufacturing processes. This regional focus on technologically advanced, durable components strengthens local production capabilities and helps address supply demands from both domestic industries and export markets.

Market Dynamics:

Growth Drivers:

Why is the Australia Die Casting Components Market Growing?

Rising Demand for Lightweight Materials in Electric Vehicle Manufacturing

The accelerating adoption of electric vehicles in Australia is creating substantial demand for lightweight die-cast components that optimize battery efficiency and extend driving range. Electric vehicle sales reached record levels in the first half of 2025, with EVs accounting for over 12.1% of all new vehicle sales, up from approximately 10% in the previous year. For instance, in May 2025, BYD, among the globe’s rapidly expanding automakers, introduced yet another budget-friendly electric vehicle poised to join its increasingly diverse range of EV offerings. This transition is driving manufacturers to invest in advanced aluminum and magnesium die casting technologies capable of producing complex structural components, battery housings, and motor enclosures. The government's implementation of the New Vehicle Efficiency Standard is compelling automakers to increase their EV offerings, creating sustained long-term demand for lightweight die-cast components that meet stringent performance requirements.

Expansion of Construction and Infrastructure Projects

Australia's construction sector is experiencing robust growth, with the Australian Construction Industry Forum projecting construction work to reach USD 334 billion in 2024-25. This expansion is creating significant demand for die-cast components used in building hardware, structural fittings, window frames, door handles, and lighting fixtures. The 2025-26 federal budget allocated approximately USD 17.1 billion for transport infrastructure, while major projects including METRONET, Sydney Metro, and Melbourne Metro Tunnel continue to drive demand for precision metal components. Die casting provides these building products with superior strength, corrosion resistance, and intricate designs essential for modern architectural applications and sustainable construction practices.

Growing Mining Sector Investment and Equipment Requirements

Australia's mining industry continues to drive demand for robust die-cast components used in heavy equipment, drilling machinery, and processing systems. The Australia mining equipment market size reached USD 1.5 Billion in 2025. Looking forward, the market is projected to reach USD 2.3 Billion by 2034, exhibiting a growth rate (CAGR) of 5.15% during 2026-2034, indicating sustained capital expenditure on equipment requiring durable die-cast parts. Die-cast components deliver the strength, precision, and wear resistance essential for machinery operating in demanding mining environments. The transition toward battery-electric and autonomous mining equipment is creating additional opportunities for die casting manufacturers, as these systems require specialized lightweight components for improved efficiency. Major mining equipment contracts, such as Epiroc's AUD 350 million autonomous equipment order in April 2025, demonstrate the sector's commitment to advanced machinery incorporating die-cast components.

Market Restraints:

What Challenges the Australia Die Casting Components Market is Facing?

Rising Raw Material Costs and Supply Chain Volatility

The Australian die casting industry faces persistent challenges from fluctuating prices of key raw materials including aluminum, zinc, and magnesium. Energy-intensive materials like aluminum and copper are experiencing cost pressures due to elevated electricity prices, which increased by over 23% year-on-year. Supply chain disruptions and currency fluctuations affecting imported materials continue to impact manufacturer margins and production planning.

Skilled Labor Shortages and Workforce Challenges

The die casting industry is experiencing difficulties attracting and retaining skilled workers, particularly for specialized roles in tooling, process engineering, and quality control. The broader construction and manufacturing sectors require substantial additional workers to meet demand, creating competition for technical talent. Wages in the manufacturing sector continue to rise as companies compete for qualified personnel capable of operating advanced die casting equipment and automation systems.

Competition from Lower-Cost International Manufacturers

Australian die casting manufacturers face competitive pressure from lower-cost producers in the Asia-Pacific region, where labor and operational costs are significantly reduced. This price competition impacts profitability and can constrain investment in technology upgrades. Manufacturers must differentiate through quality, lead times, and customer service while managing cost structures to remain competitive against imported components.

Competitive Landscape:

The Australia die casting components market exhibits moderate competitive intensity, with established domestic manufacturers operating alongside international players and specialized regional suppliers. Key industry participants are investing in automation, precision casting technologies, and sustainable manufacturing practices to strengthen their market positions. Companies are focusing on vertical integration, quality certifications, and engineering capabilities to differentiate their offerings and meet stringent OEM requirements. Strategic partnerships between local manufacturers and global technology providers are strengthening domestic production capabilities and enhancing competitiveness against imports. The market structure favors companies with strong technical expertise, established customer relationships, and the flexibility to serve diverse end-use industries including automotive, mining, aerospace, and consumer goods sectors.

Recent Developments:

- May 2025: Nissan Casting Australia Plant in Dandenong South, Victoria, received official Australian Made certification for its aluminum die castings and towbars. The facility produces over 1.2 million parts annually, including components for electric vehicles, hybrids, and conventional powertrains, serving as the global sole supplier for 40 different components.

- April 2025: Epiroc secured its largest contract for autonomous and electric surface mining equipment in Australia, valued at AUD 350 million over five years. The contract demonstrates growing demand for advanced mining machinery incorporating precision die-cast components and supports the industry's transition toward electrification.

- January 2024: Bradken PTY Ltd., a major Australian foundry and casting company based in New South Wales, acquired foundry land and facilities in Peru from Funtec to expand its steel casting operations for the mining sector. The move supports growth in mill liner production and strengthens Australia's foundry sector presence in global mining supply chains.

Australia Die Casting Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Engine Components, Transmission Components, Structural Components, Electrical and Electronics Components, Others |

| Material Types Covered | Aluminum Die Castings, Zinc Die Castings, Magnesium Die Castings, Others |

| Process Types Covered | High-Pressure Die Casting (HPDC), Low-Pressure Die Casting (LPDC), Gravity Die Casting, Others |

| Sales Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| End Use Industries Covered | Automotive, Aerospace and Defense, Industrial Machinery, Electrical and Electronics, Consumer Goods, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia die casting components market size was valued at USD 1,372.00 Million in 2025.

The Australia die casting components market is expected to grow at a compound annual growth rate of 7.49% from 2026-2034 to reach USD 2,627.82 Million by 2034.

Engine components held the largest share at 30% in 2024, driven by the automotive industry's demand for precision-engineered engine blocks, cylinder heads, and powertrain components requiring superior dimensional accuracy and thermal resistance.

Key factors driving the Australia die casting components market include rising demand for lightweight components in electric vehicles, expansion of construction and infrastructure projects, growing mining sector investment, and increasing adoption of advanced die casting technologies for precision manufacturing.

Major challenges include rising raw material costs and energy prices, skilled labor shortages across the manufacturing sector, competition from lower-cost international manufacturers, supply chain volatility affecting material availability, and the capital-intensive nature of upgrading to advanced die casting technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)