Australia Die Casting Market Size, Share, Trends and Forecast by Process, Raw Material, Application, and Region, 2025-2033

Australia Die Casting Market Overview:

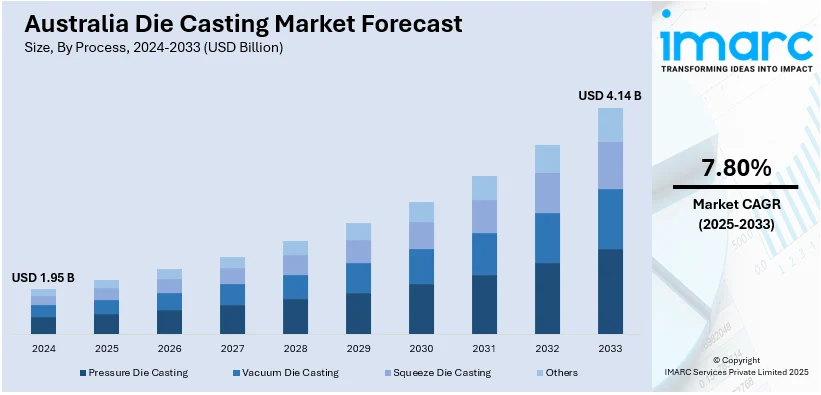

The Australia die casting market size reached USD 1.95 Billion in 2024. Looking forward, the market is expected to reach USD 4.14 Billion by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. The market is driven by the rising demand for die-casting products in major industries such as the automobile, aerospace, and consumer electronics. Apart from this, the expanding need for high-strength and lightweight products in these industries has prompted greater adoption rates of die casting technologies. In line with this, ongoing technological developments in automation and developing more efficient die-casting processes are also increasing the Australia die casting market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 4.14 Billion |

| Market Growth Rate 2025-2033 | 7.80% |

Key Trends of Australia Die Casting Market:

Rising Demand for Lightweight Materials in the Automotive Industry

The automotive industry in Australia is increasingly adopting die casting to meet the increased demand for lightweight material that lowers fuel consumption and greenhouse gas emissions. Die-cast aluminum is gaining popularity as a material of choice to produce engine blocks, transmission parts, and structural parts due to its strength-to-weight ratio. As per industry reports, the sales of battery electric vehicles, plug-in hybrids, and fuel cell electric vehicles in Australia increased by 14%, rising from 98,000 units in 2023 to 112,000 units in 2024. The country's growing adoption of electric vehicles (EVs) also increases the demand for die-cast parts, as lighter-weight material contributes significantly to efficient EV battery performance and functionality. With the automotive sector moving forward with greater emphasis on clean mobility solutions, die-cast aluminum helps manufacturers meet regulatory requirements and customer demand for fuel-efficient vehicles. This trend is also propelled by technological advancements that enable helps to maintain high quality standards.

To get more information on this market, Request Sample

Technological Advancements in Die Casting Processes

Technological advances in die casting processes, particularly the use of automation and Industry 4.0 technologies, are positively impacting the Australia die casting market growth. Automation and artificial intelligence (AI) enable manufacturers to automate the die casting process, leading to effective and precise manufacturing, minimizing defects, and enhancing product quality. Robotic assembly and handling, coupled with sophisticated simulation software for design and process optimization, minimize production cycles and costs. Apart from this, there are advancements in the form of new technologies, such as high-pressure die casting and cold chamber die casting, that are broadening the material range and widening the applications of die-cast components. All these are highly useful to high-performance markets like aerospace and electronics, where there are high-performance demands, reliability, and accuracy being highly critical. Compatibility with other sophisticated monitoring systems also provides real-time quality control through ease of automating, which further contributes to growth in Australia die casting market demand.

Growing Adoption of Die Casting in Aerospace and Electronics Sectors

The aerospace and electronics industries increasingly rely on die casting to satisfy the rising demand for lightweight, high-performance, and complicated components. Die-cast aluminum and magnesium alloys are extensively employed in the aerospace industry in producing lightweight yet durable components such as engine components, brackets, and housings. The need for aerospace components to be durable and precise is driving the use of die-casting technologies that can create parts with complex geometries without sacrificing their strength-to-weight ratios. In the electronics industry as well, die casting is pivotal to the production of enclosures, connectors, and other products that need structural integrity as well as electrical conductivity. The growing demand for more compact, power-efficient products in consumer electronics, telecom, and other industries has also fueled demand for die-casting products even further. As these sectors are continuously expanding boundaries and developing innovative technologies, the need for high-quality die-casting components with complex designs and improved mechanical properties is bound to increase, giving a boost to the market.

Growth Drivers of Australia Die Casting Market:

Regional EV Momentum and Automotive Lightweighting

Australia's die casting industry is being led strongly by the locally generic trend within the motor vehicle industry toward lightweight material for structures, particularly aluminum and magnesium alloys. Sales of electric vehicles (EVs) and plug-in hybrids in Australia have spiked in recent years, creating demand for components that provide strength without additional weight. Die-cast magnesium and aluminum components employed in structural body components such as pillars, suspension domes, mirror housings and motor casings, fill this requirement nicely, particularly in high-end models shipping to the Australian market. Large OEMs based in or selling to Australia are increasingly drawing on locally manufactured die-casting products to meet increasingly stringent emissions and fuel efficiency requirements. A unique element in the region is the development of large magnesium capacity projects, such as federal backing for Magnium Australia to construct a local magnesium plant based on indigenous CSIRO‑patented technology. This constitutes infrastructure that renders Australia partially independent in providing lightweight alloy feedstock, marking off the regional supply chain from others. The local availability of alloys in addition to increasing EV uptake domestically strengthens demand for high‑pressure die‑cast components, which further supports the die casting segment within Australia's automotive value chain.

Government Innovation Policies, Local R&D and Automation Incentives

According to the Australia die casting market analysis, another primary driver of growth in the sector arises from active government encouragement of innovation, advanced manufacturing, and research. Initiatives like R&D tax offsets are persuading Australian companies to spend on automation, robotics, precision machining and next‑gen die casting equipment. The incentive system promotes take-up of high‑pressure, vacuum and semi‑solid die casting technologies, decreasing defects, enhancing surface finish, and allowing production of intricate shapes. These publicly supported policies correlate with wider national initiatives to advance a move toward advanced manufacturing rather than low‑value labor-intensive manufacture. Further, Australia's relatively small yet technologically advanced foundry industry is in the habit of reinforcing automation over manpower to some extent due to high labor and energy costs. The emphasis on automation reduces per‑unit defect rate and facilitates assured quality, an outcome especially attractive in aerospace, defense and precision engineering industries. Coupled with positive trade agreements (facilitating export of high‑tech cast products) and innovation grants, this provides fertile ground for domestic die casting companies to expand and differentiate themselves on the world stage, rendering Australia's die casting industry more competitive and future‑proof.

Cross‑Sector Demand from Mining, Aerospace and Infrastructure

A third unique driver is Australia's varied industrial base, where die-casting need has extended beyond automotive to aerospace, electronics, mining equipment and infrastructure hardware to suit the region. Australia's mining industry, particularly in Western Australia and South Australia, has produced demand for corrosion-resistant die-cast housings, connectors and components for harsh-duty equipment. At the same time, local aerospace and defense production growth, fostered partially by strategic supply chain diversification and local involvement in global defense initiatives, has stimulated interest in high-performance alloy die-cast parts precision-produced. Furthermore, extensive infrastructure and urbanization projects in Australia demand heavy-duty parts for construction equipment, air conditioning units, telecommunication enclosures and electrical accessories, whereas die casting provides material efficiency, complex geometry and durability, and thus is perfectly suited. These domestic sectoral demands flow into expansion in Australia‑specific die casting ability, which stimulates foundries to pursue advanced casting techniques and material developments. The combined impact is a wide base of domestic demand across industries that distinguishes uniquely Australia's die casting market and separates it from globally automobile trend–driven markets.

Australia Die Casting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on process, raw material, and application.

Process Insights:

- Pressure Die Casting

- Vacuum Die Casting

- Squeeze Die Casting

- Others

The report has provided a detailed breakup and analysis of the market based on the process. This includes pressure die casting, vacuum die casting, squeeze die casting, and others.

Raw Material Insights:

- Aluminum

- Magnesium

- Zinc

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes aluminum, magnesium, and zinc.

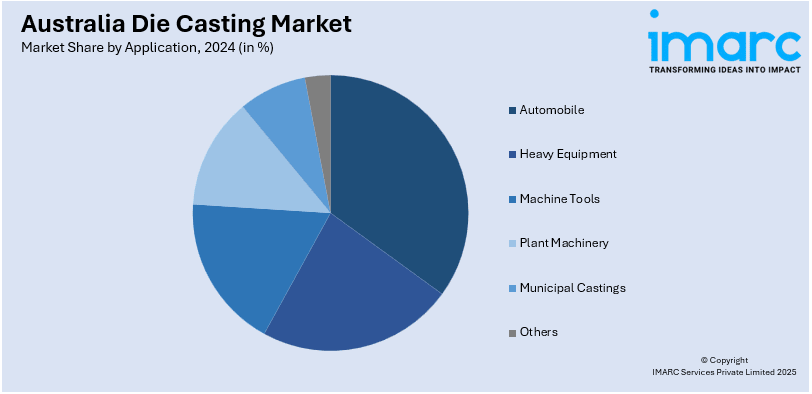

Application Insights:

- Automobile

- Body Parts

- Engine Parts

- Transmission Parts

- Others

- Heavy Equipment

- Construction

- Farming

- Mining

- Machine Tools

- Plant Machinery

- Chemical Plants

- Petroleum Plants

- Thermal Plants

- Paper

- Textile

- Others

- Municipal Castings

- Valves and Fittings and Pipes

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automobile (body parts, engine parts, transmission parts, and others), heavy equipment (construction, farming, and mining), machine tools, plant machinery (chemical plants, petroleum plants, thermal plants, paper, textile, and others), municipal castings (valves and fittings and pipes), and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Die Casting Market News:

- On May 20, 2025, Nissan Australia announced that its Casting Australia Plant (NCAP) in Dandenong South, Victoria, has officially received the 'Australian Made' certification after 43 years of operation. This designation permits the use of the green and gold kangaroo logo on 25 vehicle components and six bullbars produced at the facility, which manufactures over 1.2 million parts annually for global markets, including components for electric, hybrid, and internal combustion engine vehicles. The certification underscores the plant's significant role in Australia's automotive manufacturing sector.

Australia Die Casting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Others |

| Raw Materials Covered | Aluminum, Magnesium, Zinc |

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia die casting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia die casting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia die casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia die casting market was valued at USD 1.95 Billion in 2024.

The Australia die casting market is projected to exhibit a CAGR of 7.80% during 2025-2033.

The Australia die casting market is expected to reach a value of USD 4.14 Billion by 2033.

The Australia die casting market trends include increased adoption of aluminum and magnesium alloys for lighter, stronger components; rising integration of automation and precision casting technologies; a growing focus on electric vehicle and aerospace applications; and expanded demand across mining equipment and infrastructure sectors.

Key drivers of the Australia die casting market include rising demand for lightweight components in electric vehicles, government incentives for advanced manufacturing, local sourcing of aluminum and magnesium, and strong cross-industry needs from mining, aerospace, and infrastructure sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)