Australia Diesel Engine Market Size, Share, Trends and Forecast by Power Rating, End User, and Region, 2026-2034

Australia Diesel Engine Market Overview:

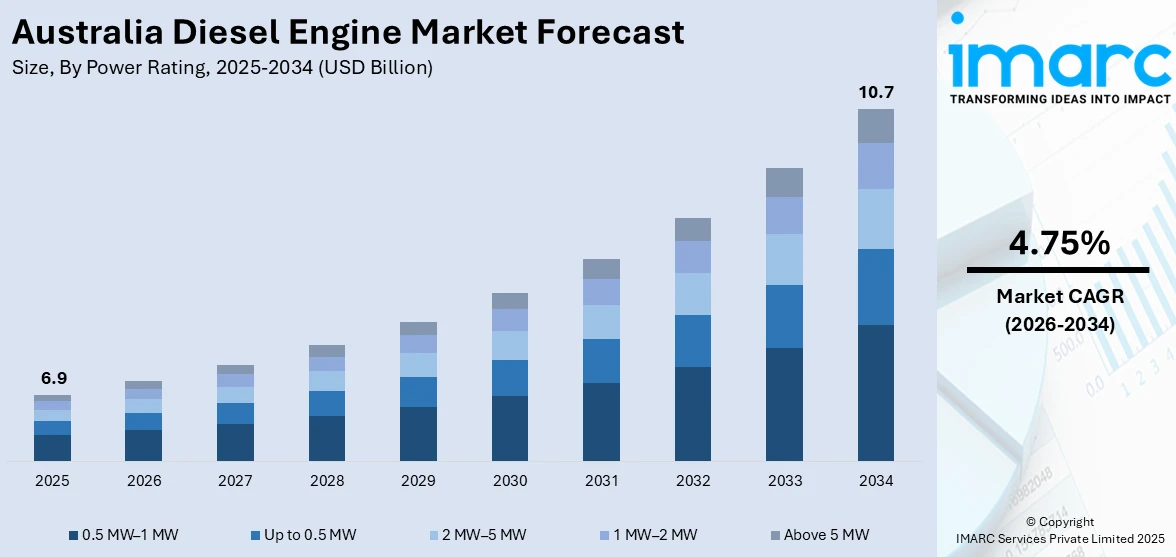

The Australia diesel engine market size reached USD 6.9 Billion in 2025. Looking forward, the market is projected to reach USD 10.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.75% during 2026-2034. Rising demand in the mining sector, increasing use in agricultural machinery, and expansion of road freight and logistics are propelling the market growth. Furthermore, preference for diesel engines in large commercial vehicles, and availability of aftermarket servicing and parts are accelerating the market growth. Apart from this, improvements in diesel engine efficiency and emissions control technologies, and limited penetration of alternative fuels in heavy-duty applications are contributing to the Australia diesel engine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.9 Billion |

| Market Forecast in 2034 | USD 10.7 Billion |

| Market Growth Rate 2026-2034 | 4.75% |

Key Trends of Australia Diesel Engine Market:

Mining Sector Growth

Australia's mining sector continues to be a cornerstone of the national economy and a significant driver of diesel engine demand across the country. Remote and off-grid mining operations rely extensively on diesel-powered equipment, including haul trucks, excavators, drilling rigs, and generators, to ensure uninterrupted and efficient operations, even in the most challenging terrains and harsh environmental conditions. The sustained global demand for critical resources such as iron ore, lithium, coal, and gold has intensified mining activity, resulting in a growing requirement for high-capacity diesel gensets and technologically advanced engine solutions. Additionally, the adoption of larger-scale mining projects and the expansion of existing mines have increased the need for reliable, durable, and high-performance diesel machinery. Diesel engines not only support operational continuity but also enhance productivity and cost-efficiency in remote locations. This reliance on diesel technology presents substantial growth opportunities for engine and genset manufacturers, positioning Australia as a key market for innovative diesel solutions in the mining sector.

To get more information on this market Request Sample

Agricultural Machinery Demand

Diesel engines are at the heart of Australia's agricultural sector, with an enormous fleet of equipment servicing farm operations. Diesel's reliability and efficiency account for why the industry relies so much on diesel fuel, especially where there is no other source of energy available in far-off regions of farming. Efforts to enhance the energy efficiency of farm equipment have shown that enormous savings in diesel consumption can be achieved through measures such as proper machinery selection, staff training, and routine maintenance. These measures lower the operating cost and enable the sustainability of the agricultural sector, underpinning the long-term demand for diesel engines in agriculture. As a result, diesel remains crucial for the agricultural sector, ensuring sustained demand for high-performance, energy-efficient machinery.

Freight and Logistics Expansion

The expansion of Australia's freight and logistics sector makes a significant contribution to demand for diesel engines, primarily due to the country's extensive distances and heavy use of road transport. The domestic freight task has increased strongly over the few decades, with road and rail freight now representing most domestic freight activity. Especially, road freight has seen enormous increases, with New South Wales seeing an estimated 86 billion ton kilometers in 2023–24, a record high. This type of growth demands a solid fleet of diesel-powered trucks and trailers to haul commodities efficiently across the country. The transport and logistics industry contributes over USD 50 billion per annum to the Australian economy and directly employs around 250,000 people, making it economically significant. Their adoption of diesel engines for power and efficiency by the industry assures their continued hegemony in Australia's freight and logistics operations.

Growth Drivers of Australia Diesel Engine Market:

Energy and Power Generation Needs

In Australia, diesel engines are essential for the energy and power generation industry, especially for backup systems and off-grid uses. Remote areas, mining operations, and rural communities often depend on diesel generators to ensure a consistent electricity supply where grid access is inadequate or unreliable. The preference for diesel engines stems from their dependability, strong performance, and capacity to run continuously under heavy loads. These engines are vital for critical services like hospitals, industrial functions, and telecommunications, promoting operational stability during power interruptions. The increasing industrial growth and the rising need for reliable energy solutions are leading to greater adoption of diesel generators. This demand for dependable backup and decentralized power solutions continues to drive long-term growth, enhancing overall usage across commercial, industrial, and residential sectors.

Preference for Fuel Efficiency and Durability

In Australia, diesel engines are preferred for their exceptional fuel efficiency, longevity, and resilience when compared to gasoline engines. Both businesses and consumers are on the lookout for economical engine solutions that can lower fuel costs while delivering high performance in demanding applications, including transportation, construction, and agriculture. The extensive operational lifespan of diesel engines reduces the frequency of replacements and lowers maintenance expenses, making them suitable for challenging industrial and commercial settings. Australia diesel engine market demand is bolstered by these benefits, as end-users value engines that offer dependable performance over long durations, particularly for trucks, mining vehicles, and off-road equipment. Innovations in diesel engine technology, such as enhanced combustion efficiency and improved emission control, are increasing their attractiveness and leading to wider adoption across various industries.

Government Infrastructure Projects

Government funding in infrastructure development is playing a substantial role in increasing the demand for diesel engines in Australia. Projects such as road construction, port expansions, and urban development heavily rely on machinery and vehicles that predominantly run on diesel engines due to their strength and reliability. Construction equipment like excavators, loaders, cranes, and trucks is heavily dependent on diesel engines for efficient operation in continuous and demanding conditions. Public sector investments also indirectly boost demand in related industries, including logistics, transport, and mining, which utilize diesel machinery to support infrastructure initiatives. With a focus on modernizing and expanding transport and urban networks, diesel engines continue to be crucial for project execution. This ongoing infrastructure development ensures sustained growth in the uptake of diesel engines across commercial and industrial applications.

Government Policies for Australia Diesel Engine Market:

Emission and Environmental Regulations

The Australian government has established rigorous emission and environmental regulations aimed at minimizing the effects of diesel engines on air quality and climate change. These policies are designed to cap greenhouse gas emissions, nitrogen oxide (NOx), and particulate matter from commercial and industrial diesel engines. To ensure compliance, manufacturers and operators must invest in cleaner technologies, advanced emission control systems, and optimized engine designs. These regulations foster environmental sustainability while also stimulating innovation in engine efficiency and exhaust management. Users of diesel engines in the transport, construction, and power generation sectors are adjusting to these standards to satisfy legal obligations and corporate sustainability objectives. By promoting cleaner operations, these regulations are influencing the market and guiding the shift toward environmentally responsible diesel technologies.

Fuel Quality Standards

Fuel quality standards in Australia require low-sulfur diesel and other cleaner fuel formulations to promote more effective combustion and reduced environmental effects. These standards enhance engine performance, lower maintenance expenses, and decrease harmful emissions. According to Australia diesel engine market analysis, compliance with fuel quality regulations is spurring the demand for engines that are compatible with advanced diesel fuels, leading to technological upgrades in both vehicles and machinery. Fuel quality policies also align with broader environmental objectives by reducing air pollution and contributing to improvements in public health. Adhering to these standards benefits industries such as transport, mining, and agriculture by facilitating the use of reliable, high-performing engines while allowing businesses to achieve sustainability targets. Overall, fuel regulations are a significant factor influencing diesel engine adoption and market dynamics.

Incentives for Cleaner and Efficient Engines

The Australian government provides a variety of incentives to promote the adoption of cleaner, energy-efficient diesel engines and hybrid technologies. Subsidies, tax breaks, and grant programs lower initial expenses for businesses that invest in low-emission machinery and vehicles. These incentives encourage the utilization of advanced diesel engines that offer better fuel efficiency, reduced operational costs, and lower environmental impacts. Industries, including transportation, mining, construction, and agriculture, gain from embracing more sustainable technologies while maintaining productivity. Additionally, incentives stimulate innovation among engine manufacturers, driving the development of hybrid diesel systems, emission control technologies, and highly efficient engines. By endorsing cleaner and more efficient engines, these government initiatives play a crucial role in supporting long-term market expansion, environmental sustainability, and the competitiveness of Australia’s diesel engine industry.

Australia Diesel Engine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on power rating and end user.

Power Rating Insights:

- 0.5 MW–1 MW

- Up to 0.5 MW

- 2 MW–5 MW

- 1 MW–2 MW

- Above 5 MW

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes 0.5 MW–1 MW, up to 0.5 MW, 2 MW–5 MW, 1 MW–2 MW, and above 5 MW.

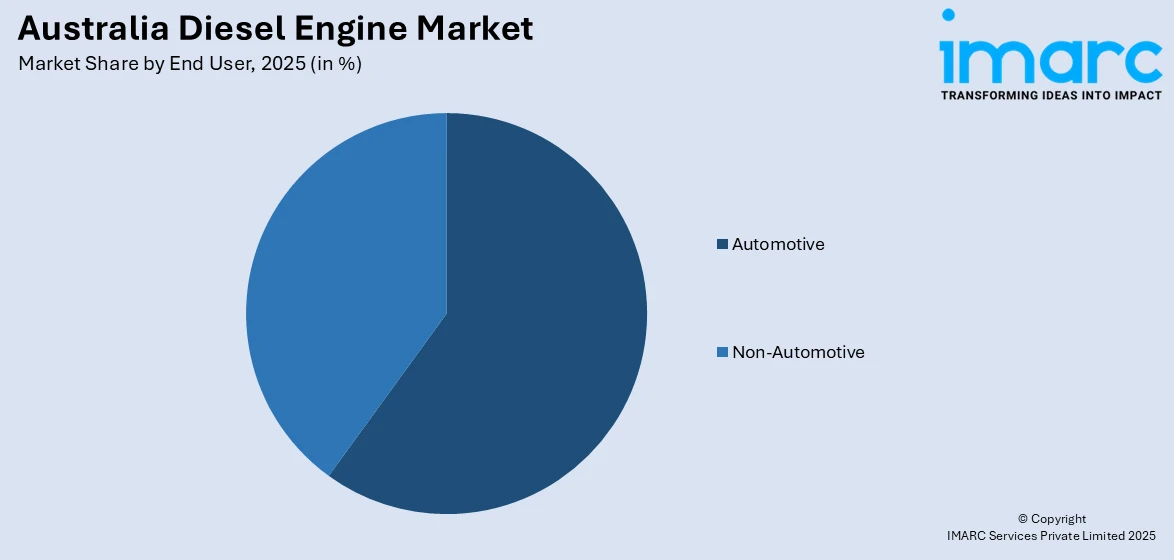

End User Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- On-Road

- Light Vehicles

- Medium/Heavy Trucks

- Light Trucks

- Off-Road

- On-Road

-

- Industrial/Construction Equipment

- Agriculture Equipment

- Marine Applications

- Non-Automotive

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive [on-road (light vehicles, medium/heavy trucks, and light trucks) and off-road (industrial/construction equipment, agriculture equipment, and marine applications)] and non-automotive.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Diesel Engine Market News:

- In 2025, Rio Tinto conducted a four-week trial using a 20% renewable diesel blend across its Pilbara iron ore operations. Partnering with Neste and Viva Energy, the trial utilized 10 million liters of renewable diesel derived from used cooking oil, reducing Scope 1 emissions by approximately 27,000 tons.

- In 2024, BHP began a 12-month trial of a battery electric Toyota Hilux at its Port Hedland iron ore loading port in Western Australia. This initiative is part of BHP's broader strategy to electrify its fleet of 5,000 vehicles and reduce operational emissions by 30% by 2030.

Australia Diesel Engine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Ratings Covered | 0.5 MW–1 MW, Up to 0.5 MW, 2 MW–5 MW, 1 MW–2 MW, Above 5 MW |

| End Users Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia diesel engine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia diesel engine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia diesel engine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diesel engine market in Australia was valued at USD 6.9 Billion in 2025.

The Australia diesel engine market is projected to exhibit a compound annual growth rate (CAGR) of 4.75% during 2026-2034.

The Australia diesel engine market is expected to reach a value of USD 10.7 Billion by 2034.

The Australia diesel engine market is witnessing trends such as adoption of cleaner, low-emission engines, integration of hybrid and fuel-efficient technologies, and increased use in off-grid power generation. Growing infrastructure projects, mining activities, and technological innovations in engine performance are also shaping market demand.

Market growth is driven by rising demand from transportation, construction, and mining sectors, along with expanding agricultural mechanization. Energy generation needs, government infrastructure investments, and preference for durable, fuel-efficient engines further support adoption, while technological advancements and off-grid power solutions enhance the overall Australia diesel engine market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)