Australia Diesel Generator Market Size, Share, Trends and Forecast by Capacity, Application, Mobility, End User, and Region, 2025-2033

Australia Diesel Generator Market Overview:

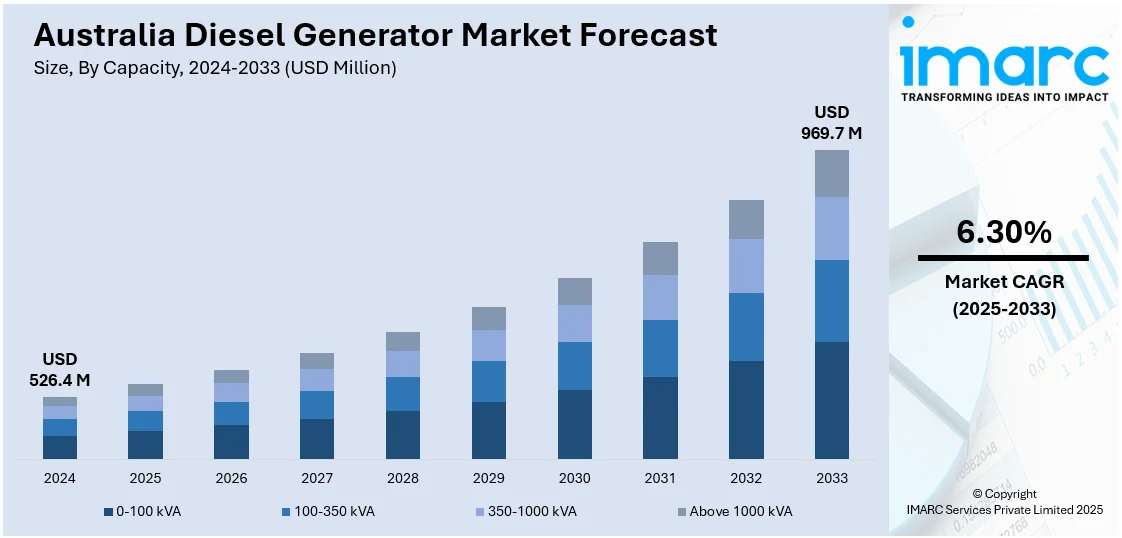

The Australia diesel generator market size reached USD 526.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 969.7 Million by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. The increasing demand for reliable backup power, rising frequency of extreme weather events, growing mining and construction activities, expanding off-grid energy requirements, and infrastructure development in remote regions, favorable government initiatives, rising commercial power consumption, and heightened concerns over grid reliability and energy security are propelling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 526.4 Million |

| Market Forecast in 2033 | USD 969.7 Million |

| Market Growth Rate 2025-2033 | 6.30% |

Australia Diesel Generator Market Trends:

Growing Demand from Construction Sectors

The robust construction activities in the country are a significant factor augmenting Australia diesel generator market share. According to an industry report, as part of the 2024–25 Budget, the Australian Government has allocated USD 16.5 Billion toward new and existing infrastructure projects. This substantial investment is directed at expanding national assets, including roads, bridges, rail networks, and public facilities. These large-scale developments often require temporary or supplemental power solutions during both the construction and operational phases. In this context, diesel generators play a critical role by offering reliable, high-capacity power in areas where grid access may be limited or unstable. Their mobility, ease of deployment, and fuel availability make them particularly well-suited for supporting continuous operations across widespread and evolving project sites. As infrastructure works intensify across urban and remote locations, demand for diesel generator systems is expected to remain strong, driven by the need for power resilience, equipment compatibility, and fast installation.

To get more information on this market, Request Sample

Expansion of Off-Grid and Hybrid Power Systems in Remote Areas

Remote communities, mining camps, agricultural operations, and tourism facilities in Australia's interior regions are turning to off-grid and hybrid power systems to meet their energy needs. Diesel generators remain a core component of these setups due to their reliability, ease of transport, and independence from centralized infrastructure. Diesel gensets continue to play a stabilizing role, particularly during periods of low renewable generation or peak demand, which is providing an impetus to Australia diesel generator market growth. The hybridization trend involves pairing diesel generators with battery storage and renewables to optimize fuel usage, reduce operational costs, and lower emissions. Also, government-backed rural electrification programs and clean energy transition initiatives are encouraging the adoption of hybrid microgrids, where diesel acts as a backup or balancing agent. The ability to remotely monitor and manage diesel generator performance also improves system efficiency and reliability in isolated locations.

Increased Frequency of Extreme Weather Events and Grid Instability

Australia's exposure to bushfires, cyclones, floods, and heatwaves is increasing the demand for reliable backup power systems, particularly diesel generators. As these extreme weather events grow in frequency and severity, they cause recurrent blackouts and strain the national grid, especially in rural and regional areas. Diesel generators are often deployed in residential communities, emergency shelters, healthcare facilities, and utility substations to maintain the continuity of essential services during outages. These units provide immediate power restoration and are valued for their autonomous operation and fuel storage capabilities, which ensure performance during extended grid downtimes. The integration of diesel gensets into disaster preparedness strategies, including community resilience plans and emergency services protocols, highlights their critical role. Additionally, insurance and regulatory frameworks increasingly mandate backup power solutions for commercial and industrial buildings, which is creating a positive Australia diesel generator market outlook.

Australia Diesel Generator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on capacity, application, mobility, and end user.

Capacity Insights:

- 0-100 kVA

- 100-350 kVA

- 350-1000 kVA

- Above 1000 kVA

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes 0-100 kVA, 100-350 kVA, 350-1000 kVA, and above 1000 kVA.

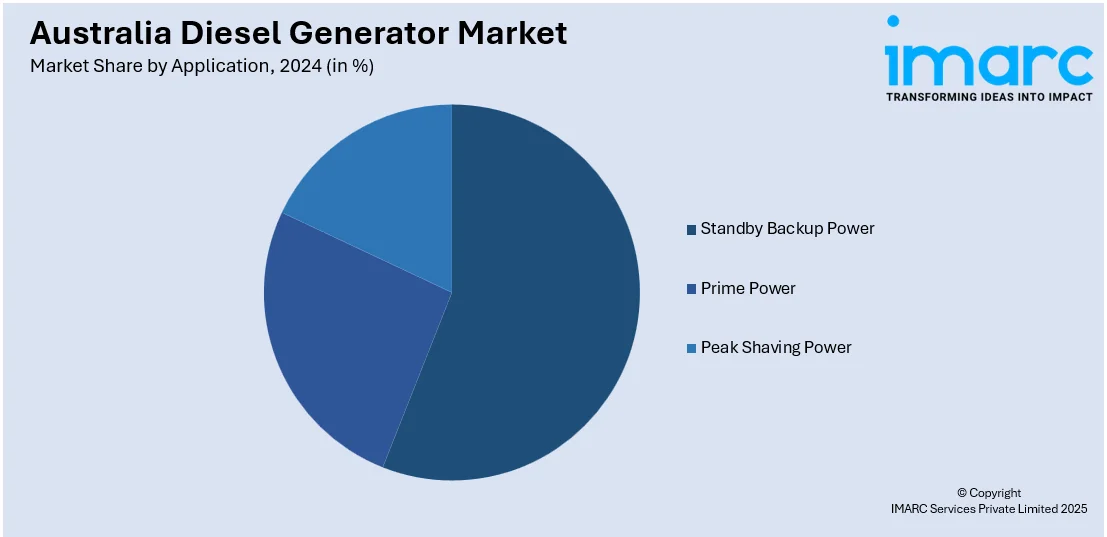

Application Insights:

- Standby Backup Power

- Prime Power

- Peak Shaving Power

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes standby backup power, prime power, and peak shaving power.

Mobility Insights:

- Stationary

- Portable

The report has provided a detailed breakup and analysis of the market based on the mobility. This includes stationary and portable.

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Diesel Generator Market News:

- On July 18, 2024, Power Equipment announced an exclusive distribution agreement with Australian generator manufacturer Eniquest, expanding its product offerings across Australia, New Zealand, and the South Pacific. The partnership includes the distribution of Eniquest's Husky, Ranger, and Stockman diesel generator models, known for their high efficiency—achieving 93–95% through Yanmar engines and permanent magnet alternators—and robust design.

- On December 2, 2024, the South Australian government announced plans to reactivate two mothballed diesel-powered generators in Port Lincoln and Snuggery to mitigate potential electricity shortfalls during the summer. This decision follows delays in the EnergyConnect interconnector project with New South Wales, which has compromised grid reliability and led to a projected 200 MW supply deficit. Energy Minister Tom Koutsantonis is advocating for regulatory changes to empower the Australian Energy Market Operator (AEMO) to mandate the recommissioning of decommissioned generators during peak demand periods.

Australia Diesel Generator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Capacities Covered | 0-100 kVA, 100-350 kVA, 350-1000 kVA, Above 1000 kVA |

| Applications Covered | Standby Backup Power, Prime Power, Peak Shaving Power |

| Mobilities Covered | Stationary, Portable |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia diesel generator market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia diesel generator market on the basis of capacity?

- What is the breakup of the Australia diesel generator market on the basis of application?

- What is the breakup of the Australia diesel generator market on the basis of mobility?

- What is the breakup of the Australia diesel generator market on the basis of end user?

- What is the breakup of the Australia diesel generator market on the basis of region?

- What are the various stages in the value chain of the Australia diesel generator market?

- What are the key driving factors and challenges in the Australia diesel generator market?

- What is the structure of the Australia diesel generator market and who are the key players?

- What is the degree of competition in the Australia diesel generator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia diesel generator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia diesel generator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia diesel generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)