Australia Digital Banking Market Size, Share, Trends and Forecast by Services, Deployment Type, Technology, Industry, and Region, 2025-2033

Australia Digital Banking Market Size and Share:

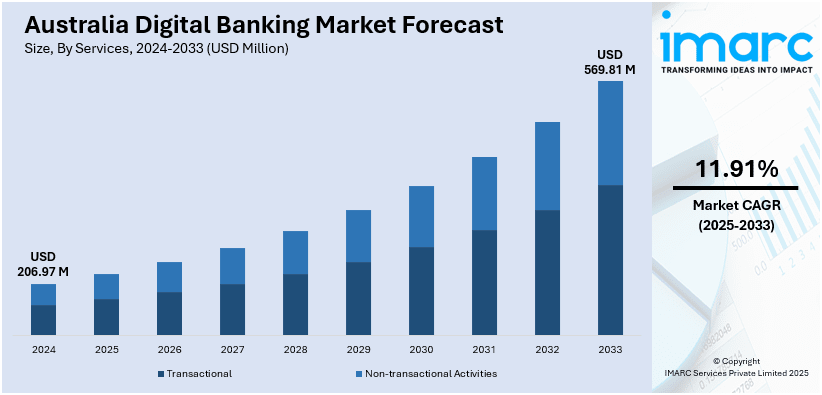

The Australia digital banking market size reached USD 206.97 Million in 2024. Looking forward, the market is expected to reach USD 569.81 Million by 2033, exhibiting a growth rate (CAGR) of 11.91% during 2025-2033. The market is expanding because of a rising focus on enhancing user experience through digital transformation, alongside ongoing technological advancements. Banks are prioritizing user-friendly features, mobile accessibility, and artificial intelligence (AI)-driven innovations to improve service efficiency, security, and personalization. These strategies foster user loyalty, attract a broader client base, and significantly contribute to the Australia digital banking market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 206.97 Million |

| Market Forecast in 2033 | USD 569.81 Million |

| Market Growth Rate 2025-2033 | 11.91% |

Key Trends of Australia Digital Banking Market:

Enhancing User Experience Through Digital Transformation

A major factor contributing to the expansion of the Australian digital banking sector is the persistent emphasis on improving user experience via digital transformation. With people becoming more demanding of smooth, intuitive, and efficient banking services, financial institutions are focusing on user-friendly features and interfaces in their digital solutions. The advancement of banking applications and websites, characterized by easier navigation, tailored features, and 24/7 assistance, is vital for fulfilling these expectations. By concentrating on streamlining banking procedures, banks can guarantee that individuals can easily access services whenever they need, enhancing overall satisfaction. Moreover, the addition of cutting-edge features like virtual cards, comprehensive financial tools, and user-friendly property management solutions enhances user involvement. These digital improvements not only meet the rising demand for mobile banking but also encourage stronger client loyalty by making banking more available and customized to personal preferences. As banks continue to invest in their digital platforms, improving both functionality and design, they are well-positioned to attract a larger user base and stay ahead in an increasingly competitive market. This transition towards digital-first banking is supporting the Australia digital banking market growth as organizations strive to deliver a seamless, comprehensive digital banking experience. In 2025, Bankwest launched a revamped banking app and website as part of its national digital growth strategy. Key features include a refreshed interface, dedicated property and money tabs, 24/7 support, and soon-to-launch virtual cards. This update supports Bankwest’s goal to become Australia’s favorite digital bank.

To get more information on this market, Request Sample

Technological Advancements and Innovation

Innovations in mobile banking applications, AI, machine learning (ML), and blockchain are at the forefront of digital transformation, enabling banks to enhance user experiences, streamline operations, and provide advanced services like personalized financial advice and automation. These technologies enhance operational efficiency while enabling banks to provide more tailored and smooth services, thus bolstering their competitive advantage in a crowded marketplace. A significant instance of this is the introduction of CommBiz Gen AI by Commonwealth Bank in 2025. Created in collaboration with AWS, this AI-driven messaging application provides instant, ChatGPT-like replies to business banking clients, optimizing payments and transactions. By integrating AI, the bank intends to deliver quicker, more secure, and tailored digital banking experiences. Additionally, improved security protocols like biometrics and two-factor authentication are crucial for fostering user trust and safeguarding sensitive financial information. As digital banking systems advance, they become more capable of addressing the rising need for secure, convenient, and efficient services, thereby serving a more tech-savvy demographic. According to the Australia digital banking market analysis, these technological advancements are vital for financial organizations as they aim to fulfill client demands and stay competitive in a swiftly evolving market.

Shift Toward Personalized Banking Solutions

A significant trend shaping the Australian digital banking market is the growing shift toward personalized banking experiences. Financial institutions are increasingly leveraging artificial intelligence (AI), machine learning, and data analytics to understand user behavior and preferences. This enables banks to offer tailored product recommendations, customized financial planning, and predictive insights for better money management. Customers now expect banking platforms to deliver the same level of personalization found in e-commerce or streaming services. As a result, banks are moving away from one-size-fits-all models and embracing data-driven strategies to build customer loyalty and engagement. This trend not only enhances user satisfaction but also improves cross-selling opportunities for banks. The focus on personalization is expected to intensify as digital maturity and data capabilities grow across the sector.

Growth Drivers of Australia Digital Banking Market:

Rise in Smartphone and Internet Penetration

One of the most prominent factors fueling the growth of digital banking in Australia is the widespread adoption of smartphones and high-speed internet access. With over 90% of Australians actively using smartphones, digital platforms have become the preferred medium for managing financial activities. Increasing reliance on mobile apps for everyday tasks—from online shopping to bill payments—has encouraged both traditional banks and fintech firms to optimize mobile-first banking experiences. Additionally, widespread 4G/5G availability and affordable data plans enable seamless access to digital banking services even in remote areas. This tech-enabled shift in consumer behavior is compelling banks to strengthen mobile platforms, invest in user-friendly app design, and introduce advanced features to meet growing expectations. As digital connectivity grows, so will banking digitization.

Changing Consumer Preferences and Banking Behavior

Consumer preferences in Australia have undergone a notable transformation, with a growing inclination toward convenience, transparency, and on-demand financial services. Younger demographics, in particular, prefer banking that aligns with their digital lifestyle —mobile, intuitive, and fast. This has compelled financial institutions to shift from branch-centric operations to digital-first models. Customers now expect real-time account updates, instant fund transfers, and proactive financial insights, accessible 24/7. Furthermore, the COVID-19 pandemic accelerated this behavioral shift, with more users adopting digital tools for transactions and account management. Banks that fail to meet these evolving expectations risk losing market share to agile fintech competitors. As user expectations for speed and personalization continue to evolve, Australia digital banking market demand is expected to surge, positioning digital banking to dominate the future of the country’s financial ecosystem.

Supportive Regulatory Environment and Open Banking Framework

Australia’s regulatory landscape has become increasingly favorable for digital banking growth, particularly with the introduction of the Consumer Data Right (CDR) and open banking framework. These initiatives aim to give consumers better control over their financial data and promote competition by enabling secure data sharing among accredited institutions. As a result, digital banks and fintechs can develop more tailored products and services by leveraging consumer data with permission. The Australian Prudential Regulation Authority (APRA) and the Australian Competition and Consumer Commission (ACCC) have also supported digital entrants by streamlining licensing processes. This supportive regulatory approach fosters innovation, enhances transparency, and increases trust in digital banking solutions. Over time, open banking is expected to unlock new revenue streams and reshape how financial services are delivered across the nation.

Australia Digital Banking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on services, deployment type, technology, and industry.

Services Insights:

- Transactional

- Cash Deposits and Withdrawals

- Fund Transfers

- Auto-Debit/Auto-Credit Services

- Loans

- Non-transactional Activities

- Information Security

- Risk Management

- Financial Planning

- Stock Advisory

The report has provided a detailed breakup and analysis of the market based on the services. This includes transactional (cash deposits and withdrawals, fund transfers, auto-debit/auto-credit services, and loans) and non-transactional activities (information security, risk management, financial planning, and stock advisory).

Deployment Type Insights:

- On-Premises

- Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud.

Technology Insights:

- Internet Banking

- Digital Payments

- Mobile Banking

The report has provided a detailed breakup and analysis of the market based on the technology. This includes internet banking, digital payments, and mobile banking.

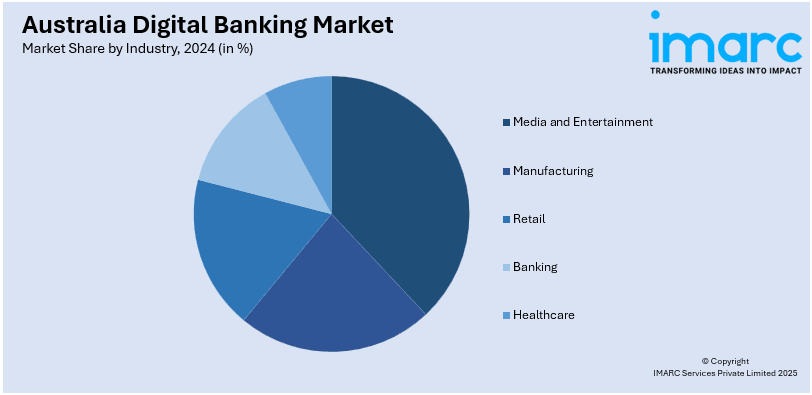

Industry Insights:

- Media and Entertainment

- Manufacturing

- Retail

- Banking

- Healthcare

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes media and entertainment, manufacturing, retail, banking, and healthcare.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Digital Banking Market News:

- In March 2025, Bankwest launched its new brand platform “Just Enough Bank” to position itself as a leading digital bank focused on simplicity and ease of use. Targeting busy Australians, the platform was co-designed with customer feedback to deliver practical, unobtrusive banking experiences.

- In February 2025, AMP introduced a new digital bank in Australia targeting underserved small and micro businesses. Powered by Starling Bank’s Engine platform, the bank offers features like numberless debit cards, cashflow tools, and fee-free currency conversion.

Australia Digital Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Deployment Types Covered | On-Premises, Cloud |

| Technologies Covered | Internet Banking, Digital Payments, Mobile Banking |

| Industries Covered | Media and Entertainment, Manufacturing, Retail, Banking, Healthcare |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia digital banking market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia digital banking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia digital banking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital banking market in Australia was valued at USD 206.97 Million in 2024.

The Australia digital banking market is projected to exhibit a CAGR of 11.91% during 2025-2033.

The Australia digital banking market is projected to reach a value of USD 569.81 Million by 2033.

Australia’s digital banking market is driven by growing smartphone penetration, enhanced internet infrastructure, and evolving consumer demand for convenient, real-time services. Supportive regulations like Open Banking, coupled with rising fintech collaboration, further accelerate innovation and led to widespread adoption across demographics.

Australia digital banking market is evolving with rapid mobile adoption, AI-driven personalization, and integrated financial services. Open banking enables seamless data-sharing partnerships, while cybersecurity remains critical. Fintech collaboration, embedded finance, and digital wallets are expanding user choice. Sustainability and regulatory frameworks further enhance trust and digital engagement.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)