Australia Digital Diabetes Management Market Size, Share, Trends and Forecast by Product Type, Device Type, and Region, 2025-2033

Australia Digital Diabetes Management Market Overview:

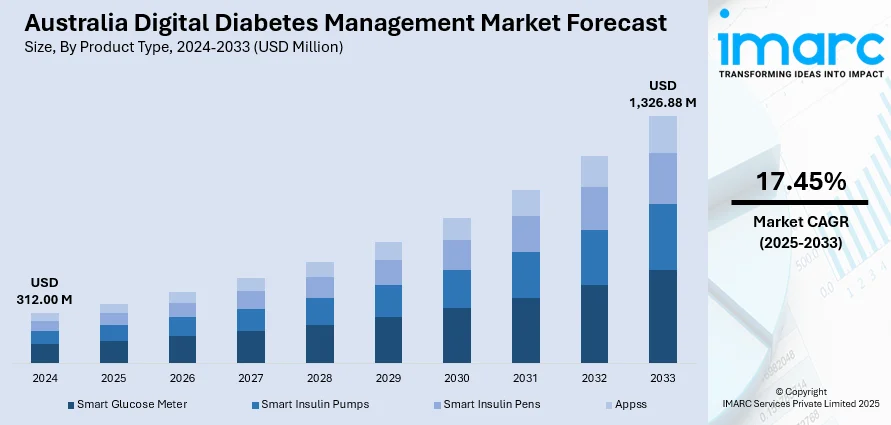

The Australia digital diabetes management market size reached USD 312.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,326.88 Million by 2033, exhibiting a growth rate (CAGR) of 17.45% during 2025-2033. The market is transforming with the increasing uptake of mobile health apps, wearables, and telemedicine platforms. These technologies provide patients enhanced monitoring, tailored care, and timely interventions, improving diabetes management outcomes. Healthcare professionals are increasingly incorporating digital technologies into their treatment regimens, providing more convenience and accessibility. Demand for these innovations will increase, driving market share in the Australia digital diabetes management market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 312.00 Million |

| Market Forecast in 2033 | USD 1,326.88 Million |

| Market Growth Rate 2025-2033 | 17.45% |

Australia Digital Diabetes Management Market Trends:

Rise in Continuous Glucose Monitoring (CGM) Usage

Continuous glucose monitoring (CGM) is rapidly gaining traction in Australia's diabetes care landscape. These systems enable users to monitor glucose levels in real time, providing greater convenience and control over the traditional approach. Increased awareness of CGM's advantages, including better daily glucose control and reduced frequency of hypoglycemic events, is responsible for its wider use. Integration with other wearable devices and smartphones has made it more accessible for people to monitor, and healthcare professionals can now provide more customized care using common digital data. Government programs and wider use in clinical practice have also made CGMs a trusted device, allowing people with diabetes to take a more active and informed part in managing their condition.

To get more information on this market, Request Sample

Adoption of AI and Predictive Analytics

Artificial Intelligence (AI) and predictive analytics are revolutionizing diabetes care in Australia by analyzing patterns in glucose levels, physical activity, and dietary habits. These technologies enable early detection of potential issues, offering customized recommendations and real-time insights that empower both patients and healthcare providers to make quicker, smarter decisions. This approach fosters proactive care, helping to prevent serious complications and improving overall management. A recent example is the University of Virginia’s clinical trial, launched in February 2025, which tests the AI-powered "Bolus Priming System with Reinforcement Learning" (BPS_RL) for Type 1 Diabetes. Integrated with the Automated Insulin Delivery Adaptive NETwork (AIDANET), this system includes a phone app, Dexcom glucose monitor, and Tandem insulin pump to improve insulin delivery and blood sugar control. As digital platforms evolve, AI is reshaping diabetes care, shifting from reactive treatment to prevention-focused, more intuitive, and responsive strategies.

Growth in Smart Insulin Delivery Devices

Smart insulin pumps are increasingly becoming a standard component of diabetes care thus aiding the Australia digital diabetes management market growth. The devices assist with automating and optimizing insulin delivery, minimizing human error, and streamlining daily life. Patients appreciate attributes such as dosage history, reminders, and compatibility with mobile apps that provide instant feedback and prevent risky glucose surges or plunges. Smart insulin pumps are highly compatible with the digital health revolution, allowing remote monitoring and telemedicine consultations. With the transition of healthcare to personalized and networked solutions, smart insulin pumps are perceived as a practical progression toward more control, fewer complications, and greater autonomy for individuals with diabetes.

Australia Digital Diabetes Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and device type.

Product Type Insights:

- Smart Glucose Meter

- Smart Insulin Pumps

- Smart Insulin Pens

- Appss

The report has provided a detailed breakup and analysis of the market based on the product type. This includes smart glucose meter, smart insulin pumps, smart insulin pens, and appss.

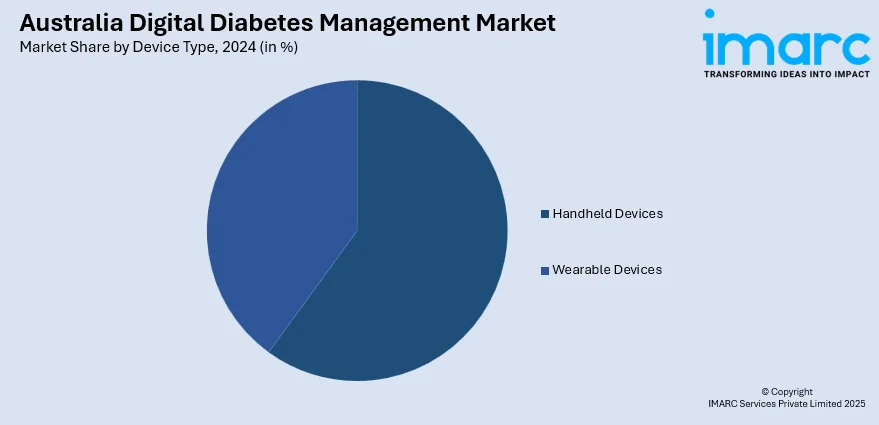

Device Type Insights:

- Handheld Devices

- Wearable Devices

A detailed breakup and analysis of the market based on the device type have also been provided in the report. This includes handheld devices and wearable devices.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Digital Diabetes Management Market News:

- In March 2025, Insulet expanded its Omnipod® 5 Automated Insulin Delivery System to Australia, making it the first tubeless AID system compatible with Dexcom G6 and G7. The system will soon launch in Belgium, Canada, and Switzerland. Omnipod 5 uses SmartAdjust™ technology to automatically adjust insulin delivery every five minutes, improving diabetes management by preventing highs and lows. The system is waterproof, discreet, and wearable, offering convenience and better clinical outcomes for users.

- In February 2025, Dexcom launched its Dexcom ONE+ continuous glucose monitoring (CGM) system in Australia, specifically designed for people with Type 2 diabetes. This wearable device provides real-time glucose readings, which are automatically transmitted to a compatible smart device or optional receiver. The Dexcom ONE+ aims to enhance diabetes management by offering greater convenience, real-time insights, and improved control over glucose levels, marking a significant step in digital health innovation for Australian users.

- In August 2024, DDM Health, a UK-based provider of digital health interventions, launched its AI-driven Gro Health platform in Australia, supported by a REDI Fellowship. The platform offers personalized, behavior-change solutions for managing chronic conditions like type 2 diabetes, obesity, and cardiovascular disease. With a focus on accessibility and scalability, Gro Health aims to improve health outcomes and reduce socioeconomic burdens by supporting patient self-management of these conditions.

Australia Digital Diabetes Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Smart Glucose Meter, Smart Insulin Pumps, Smart Insulin Pens, Appss |

| Device Types Covered | Handheld Devices, Wearable Devices |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia digital diabetes management market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia digital diabetes management market on the basis of product type?

- What is the breakup of the Australia digital diabetes management market on the basis of device type?

- What is the breakup of the Australia digital diabetes management market on the basis of region?

- What are the various stages in the value chain of the Australia digital diabetes management market?

- What are the key driving factors and challenges in the Australia digital diabetes management market?

- What is the structure of the Australia digital diabetes management market and who are the key players?

- What is the degree of competition in the Australia digital diabetes management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia digital diabetes management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia digital diabetes management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia digital diabetes management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)