Australia Digital Signage Market Size, Share, Trends and Forecast by Type, Component, Technology, Application, Location, Size, and Region, 2026-2034

Australia Digital Signage Market Size and Share:

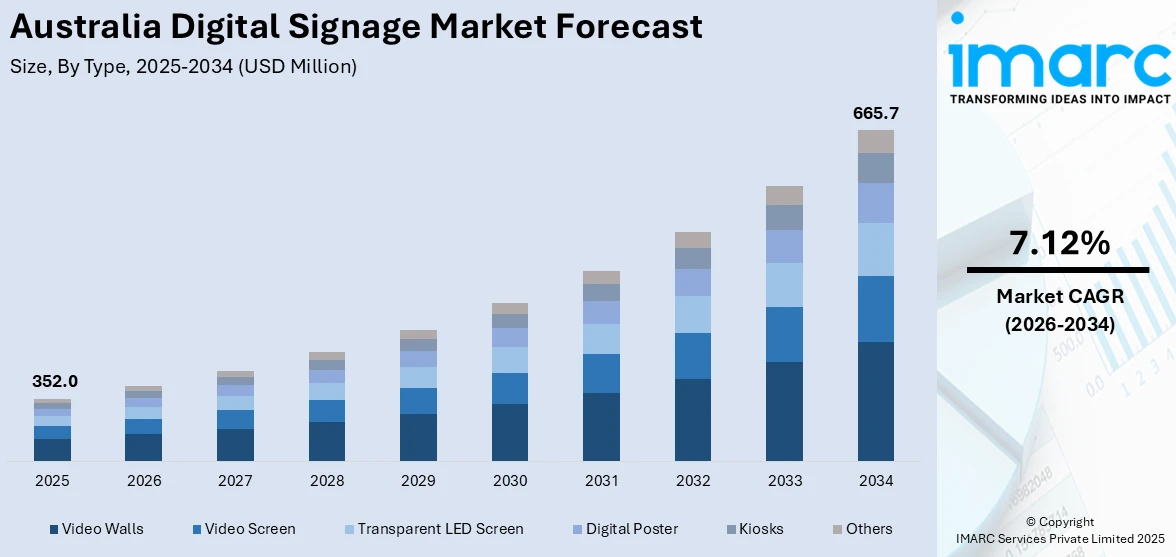

The Australia digital signage market size reached USD 352.0 Million in 2025. Looking forward, the market is expected to reach USD 665.7 Million by 2034, exhibiting a growth rate (CAGR) of 7.12% during 2026-2034. The market is growing due to rising demand for interactive and personalized customer experiences, particularly in retail and hospitality. Advancements in AI, cloud-based solutions, and real-time content management are expanding the Australia digital signage market share. Additionally, businesses are adopting digital signage for cost-effective advertising, enhanced engagement, and seamless omnichannel integration, fueling market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 352.0 Million |

| Market Forecast in 2034 | USD 665.7 Million |

| Market Growth Rate 2026-2034 | 7.12% |

Key Trends of Australia Digital Signage Market:

Integration of AI and Data-Driven Personalization in Digital Signage

Artificial intelligence (AI) is transforming the market by enabling hyper-personalized and context-aware content delivery. Thus, this is significantly supporting the Australia digital signage market growth. A research report from the IMARC Group indicates that the artificial intelligence market in Australia was valued at USD 2,072.7 Million in 2024. It is projected to grow to USD 7,761.0 Million by 2033, reflecting a compound annual growth rate (CAGR) of 15.17% from 2025 to 2033. AI-powered analytics track audience demographics, behavior, and engagement metrics, allowing businesses to assemble tailored ads and messages in real time. For example, retailers use facial recognition and heat mapping methods to improve store layouts and marketing plans. Also, programmatic advertising is on the rise, as well as automating placements via predictive analytics. Improved interactivity is benefiting from advances in voice and gesture recognition technologies, particularly in hospitality and entertainment spaces. With continued advancements in AI technology and shifts in data privacy legislation, organizations are expected to adopt smart digital signage solutions as smart digital signage solutions to drive customer engagement and operational efficiency.

To get more information of this market Request Sample

Growth of Cloud-Based Digital Signage Solutions

Cloud-based digital signage is gaining traction in Australia due to its scalability, cost-efficiency, and remote management capabilities. Businesses across industries including hospitality, healthcare, and corporate sectors are adopting cloud platforms to centrally control content across multiple displays without extensive hardware investments. This trend is further accelerated by the increasing demand for dynamic content updates, such as real-time promotions, emergency alerts, and social media integrations. Cloud solutions also offer enhanced security and analytics, allowing businesses to monitor performance and optimize campaigns effectively. With the rise of hybrid work environments, organizations are using digital signage for internal communications, further creating a positive Australia digital signage market outlook. 36% of Australians are working from home full time, compared to just 5% before the COVID-19 pandemic. This change is mainly due to hybrid working arrangements that better accommodate women, caregivers, and disabled individuals. Hybrid employees also have 33% lower turnover rates and report 8% greater job satisfaction, demonstrating the lift from remote work on productivity. As remote work transforms the ways in which individuals interact with brands, it creates fresh opportunities for Australia’s digital signage industry to engage with audiences outside traditional office environments. As internet infrastructure improves and 5G becomes more widespread, cloud-based digital signage is expected to dominate the Australian market, offering flexibility and innovation for businesses of all sizes.

Growth Drivers of Australia Digital Signage Market:

Expanding Retail and Transportation Sectors

Australia’s digital signage market is witnessing significant growth due to rising adoption in the retail and transportation sectors. The use of digital displays to enrich in-store experiences, increase the impact of promotion, and produce engaging visual merchandise is one of the ways retailers are using to make their stores enticing to customers. Likewise, transport terminals like rail stations, bus terminals, and airports are also taking advantage of digital signage to display real-time information, to help people navigate, and to create advertisements, enhancing terminal efficiency and the convenience of the traveler. This sector has been experiencing a massive outbreak in the use of digital displays due to the need to facilitate a smooth flow of communication and instant information delivery. The growing focus on enhancing customer satisfaction, optimizing space utilization, and delivering dynamic messaging is encouraging both public and private sector players to invest in advanced signage solutions, ultimately expanding the market footprint across urban and semi-urban regions.

Surge in Smart City Initiatives

The Australian government’s increasing emphasis on smart city development is creating substantial opportunities for digital signage integration across public spaces. These initiatives aim to improve urban infrastructure by embedding technology into everyday functions such as traffic management, environmental monitoring, and public communication. Digital signage is playing a vital role in these transformations by delivering real-time data, weather alerts, emergency broadcasts, and civic information through strategically placed displays. Urban planners are incorporating these systems to enhance citizen engagement and improve service accessibility. The use of digital displays in bus shelters, city centers, and public buildings supports interactive and responsive urban environments, which further drives the Australia digital signage market demand. As investment continues in smart infrastructure, the demand for intelligent and scalable signage systems is expected to rise, positioning digital signage as a foundational tool in smart urban ecosystems.

Declining Hardware Costs and Display Advancements

Continuous advancements in display technology have led to a significant reduction in the cost of digital signage hardware, especially LED, OLED, and LCD screens. These innovations have improved display resolution, brightness, durability, and energy efficiency, making digital signage solutions more affordable and accessible across various sectors. Small and medium-sized enterprises, which previously considered digital signage cost-prohibitive, are now increasingly investing in these systems to enhance their brand visibility and customer engagement. Additionally, modular display designs and lower installation complexities are encouraging adoption even in non-traditional environments such as schools, local councils, and fitness centers. As hardware becomes more cost-effective and performance-oriented, it is helping accelerate the digital transformation of communication strategies across industries, thereby driving the overall expansion of Australia’s digital signage market.

Opportunities in Australia Digital Signage Market:

Growth in Digital Out-of-Home (DOOH) Advertising

The transition from traditional static billboards to dynamic digital out-of-home (DOOH) advertising is transforming Australia’s advertising landscape. Brands are increasingly using digital displays in high-traffic locations, such as transit stations, shopping districts, and urban centers, to deliver real-time, high-impact content that captures attention and enhances brand visibility. These digital formats allow for flexible messaging, including time-sensitive promotions, location-based targeting, and event-triggered updates. The ability to remotely manage and update content has made DOOH a preferred medium for advertisers seeking greater responsiveness and audience engagement. Moreover, the integration of scheduling software and performance analytics enables advertisers to optimize campaigns in real time. As consumer interaction with outdoor media continues to evolve, DOOH advertising offers significant potential for growth in the digital signage market.

Integration with IoT and Sensor-Based Systems

The integration of Internet of Things (IoT) technology and sensor-based systems is enhancing the intelligence and interactivity of digital signage in Australia. These systems enable displays to deliver hyper-contextual, real-time content based on environmental or user-specific triggers. For example, sensors in retail stores can track foot traffic or queue lengths, prompting signage to adjust messages accordingly. In public spaces, sensors monitoring air quality, temperature, or noise levels can trigger relevant alerts or informational content on nearby displays. According to the Australia digital signage market analysis, this level of automation and responsiveness enhances user experience and operational efficiency. As cities and businesses adopt more connected systems, demand for smart signage solutions capable of adapting to real-world inputs is rising. This convergence of digital signage with IoT is paving the way for more responsive, data-driven communication platforms.

Expansion into Healthcare and Education Sectors

Digital signage is gaining strong traction in Australia’s healthcare and education sectors, driven by the need for efficient communication and enhanced user experiences. Hospitals are adopting digital displays for patient check-ins, waiting room information, emergency alerts, and wayfinding, helping improve operational workflows and reduce staff burden. Similarly, educational institutions are using signage across campuses to share class schedules, campus news, event promotions, and safety announcements. These systems offer a dynamic and centralized method for information dissemination, enhancing both accessibility and visibility. The growing digitization of these sectors, coupled with the need for real-time updates and audience-specific messaging, is opening up new opportunities for signage providers. As awareness of these benefits spreads, wider adoption is expected, making healthcare and education vital growth areas for the market.

Challenges in Australia Digital Signage Market:

High Initial Investment and Maintenance Costs

While the cost of digital signage hardware like screens and media players has declined, the overall upfront investment, including installation, network setup, and software integration, remains substantial. These initial costs can be a hurdle for small to medium-sized businesses, educational institutions, and nonprofit organizations with tight budgets. Additionally, ongoing maintenance expenses such as software updates, hardware servicing, and system monitoring add to the total cost of ownership. Custom installations, especially those in outdoor or high-traffic environments, often require durable, weather-resistant displays and complex cabling, further driving up expenses. The need for professional technical support to ensure consistent performance increases long-term costs. As a result, cost-related concerns continue to slow down adoption in certain segments, despite growing awareness of digital signage’s benefits.

Content Creation and Management Complexities

One of the major operational challenges in the digital signage market is developing and managing engaging, location-specific, and brand-consistent content across multiple screens and locations. Businesses often struggle to produce dynamic content regularly due to limited creative resources, a lack of expertise in multimedia production, or the absence of dedicated content teams. Ensuring timely updates, aligning messages with marketing strategies, and customizing content based on demographics or environment adds further complexity. Additionally, using multiple content management systems (CMS) or dealing with software that lacks user-friendly interfaces can slow down workflows and increase the risk of outdated or irrelevant content being displayed. Without a streamlined and efficient content strategy, even the most advanced digital signage infrastructure may fail to deliver its intended impact on audience engagement and brand communication.

Regulatory and Privacy Concerns

As digital signage becomes more interactive and data-driven, concerns surrounding privacy and regulatory compliance are becoming increasingly prominent. When integrated with technologies like cameras, motion sensors, or facial detection, signage systems may inadvertently collect or process personal information, triggering legal obligations under Australia’s Privacy Act and Australian Privacy Principles (APPs). Businesses must ensure transparency, obtain proper consent, and implement safeguards to avoid breaching privacy laws. In parallel, advertising content must comply with national standards to avoid misleading claims or culturally insensitive messaging. These dual pressures, data protection and content regulation, require companies to carefully balance innovation with compliance. Failing to do so can result in reputational damage, regulatory fines, or consumer backlash. As privacy awareness grows, navigating this evolving legal landscape has become a critical operational challenge for digital signage providers.

Australia Digital Signage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, component, technology, application, location, and size.

Type Insights:

- Video Walls

- Video Screen

- Transparent LED Screen

- Digital Poster

- Kiosks

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes video walls, video screen, transparent LED screen, digital poster, kiosks, and others.

Component Insights:

- Hardware

- Software

- Service

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and service.

Technology Insights:

- LCD/LED

- Projection

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes LCD/LED, projection, and others.

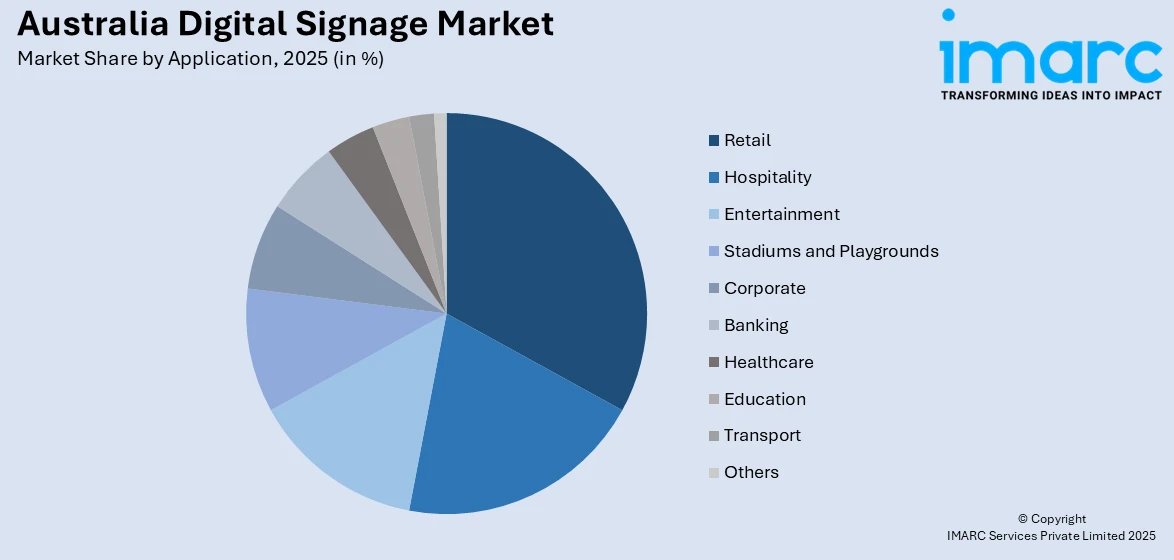

Application Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Hospitality

- Entertainment

- Stadiums and Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transport

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail, hospitality, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education, transport, and others.

Location Insights:

- Indoor

- Outdoor

The report has provided a detailed breakup and analysis of the market based on the location. This includes indoor and outdoor.

Size Insights:

- Below 32 Inches

- 32 to 52 Inches

- More than 52 Inches

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes below 32 inches, 32 to 52 inches, and more than 52 inches.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Digital Signage Market News:

- December 17, 2024: FRAMEN and VIOOH introduced programmatic DOOH screens to co-working spaces in major Australian cities with an inaugural Virgin Australia campaign. With 65% of outdoor ad revenue digital and DOOH for driving brand awareness up to 30% and purchase intent 15%, it holds the potential for major growth for targeted food and other retail signage. As advertisers increasingly adopt data-driven, location-based approaches, Australia’s digital signage market is well-positioned for more innovative and engaging campaigns in the food service industry.

- September 24, 2024: Mandoe Media launched AI Magic Create in Australia, a powered digital signage platform that leverages artificial intelligence to create tailored content using OpenAI’s ChatGPT in under two minutes. It has already been noted that Street Taste in Victoria has seen a 15 percent increase in sales due to the tool, with future targets of improved daily sales by 30 percent and repeat orders by 33 percent. Mandoe’s innovation has the potential to up-end content creation in the digital signage industry, with a client list of over 6,000 Australian businesses.

Australia Digital Signage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Video Walls, Video Screen, Transparent LED Screen, Digital Poster, Kiosks, Others |

| Components Covered | Hardware, Software, Service |

| Technologies Covered | LCD/LED, Projection, Others |

| Applications Covered | Retail, Hospitality, Entertainment, Stadiums and Playgrounds, Corporate, Banking, Healthcare, Education, Transport, Others |

| Locations Covered | Indoor, Outdoor |

| Sizes Covered | Below 32 Inches, 32 to 52 Inches, More than 52 Inches |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia digital signage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia digital signage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia digital signage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital signage market in Australia was valued at USD 352.0 Million in 2025.

The Australia digital signage market is projected to exhibit a CAGR of 7.12% during 2026-2034.

The Australia digital signage market is projected to reach a value of USD 665.7 Million by 2034.

The key trends in the Australia digital signage market include growing adoption of AI-powered content personalization, cloud-based management platforms, and interactive touchless technologies such as gesture and voice control. The market is also witnessing a shift toward high-efficiency LED and OLED displays, with a strong focus on sustainability and outdoor visibility.

Key growth drivers of Australia’s digital signage market include expanding deployment across retail, transport hubs, and smart-city infrastructure; falling hardware costs from LED/OLED advancements; rising demand for engaging, real-time interactive content; AI-powered analytics for personalized ads; and increasing adoption of cloud-based CMS systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)