Australia Digital Transformation Market Report by Type (Solution, Service), Deployment Mode (Cloud-based, On-premises), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), End Use Industries (BFSI, Manufacturing, Government, Healthcare, IT and Telecom, and Others), and Region 2025-2033

Australia Digital Transformation Market Overview:

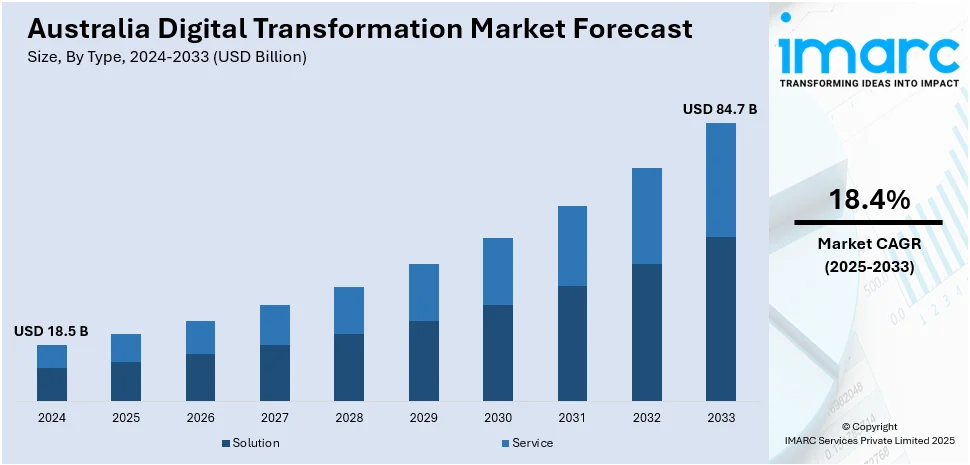

The Australia digital transformation market size reached USD 18.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 84.7 Billion by 2033, exhibiting a growth rate (CAGR) of 18.4% during 2025-2033. The steadily increasing demand for advanced technologies like AI and cloud computing, the rising need for enhanced operational efficiency, government initiatives supporting digital innovation, growing cybersecurity, concerns, and the rise in remote work culture and digital services are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 84.7 Billion |

| Market Growth Rate 2025-2033 | 18.4% |

Australia Digital Transformation Market Trends:

Rising Government Initiatives and Support

Government policies and funding programs in Australia encourage digital innovation and infrastructure development, which is accelerating adoption across various sectors. For instance, the Government of Australia commits to developing whole-of-government policies and frameworks to guide government entities on how to safely engage with emerging data and digital technologies, along with fostering a culture of data and digital innovation. The government is committed to finding new ways to ensure decision-makers have the right information and advice when considering new data and digital investments for the APS. The Government aims to strengthen data and digital investment advice and governance in the APS, including through the Digital and ICT Oversight Framework (IOF), to inform consideration of investment proposals and assurance of projects. BuyICT.gov.au provides a direct platform for the industry to showcase products and services, bid for projects, and find government clients. It allows government entities and businesses to partner to develop innovative solutions to problems and help build industry capability.

To get more information on this market, Request Sample

Growing Demand for Cloud Services and AI

Businesses are increasingly investing in cloud computing and artificial intelligence (AI) to enhance operational efficiency, scalability, and data-driven decision-making. For instance, in October 2024, Microsoft announced major digital infrastructure, skilling, and cybersecurity investments in Australia to help the nation seize the artificial intelligence (AI) era to strengthen its economic competitiveness, create high-value jobs, and protect the nation from the increasing threat of cyberattacks. Microsoft intends to invest A$5 billion in expanding its hyper-scale cloud computing and AI infrastructure in Australia over the next two years, the single largest investment in its forty-year history in the country. This investment is also expected to grow Microsoft’s local data center footprint from 20 sites to a total of 29 spread across Canberra, Melbourne, and Sydney. To realize the full potential of this new digital infrastructure investment, Microsoft is working with TAFE NSW towards establishing a Microsoft Datacentre Academy in Australia. The company will also extend its global skills programs to help more than 300,000 Australians gain the capabilities they need to thrive in a cloud and AI-enabled economy.

Australia Digital Transformation Market News:

In September 2025, professional services firm Deloitte secured a strategic alliance with Canva, combining the Australian-origin design platform with its digital transformation expertise. Deloitte highlighted that in delivering consistent and unified branding and content, the alliance would enable seamless collaboration across the client’s different business units to boost productivity while also reducing costs.

In June 2025, 10x Banking, the transformational cloud-native SaaS core banking platform announced a new alliance with Deloitte Australia to further strengthen cooperation in delivering technology-enabled transformation to mutuals.

Australia Digital Transformation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, deployment mode, enterprise size, and end use industry.

Type Insights:

- Solution

- Analytics, Artificial Intelligence and Machine Learning

- Extended Reality (XR)

- IoT

- Industrial Robotics

- Blockchain

- Additive Manufacturing/3D Printing

- Cybersecurity

- Cloud and Edge Computing

- Others

- Service

- Professional Services

- Integration and Implementation

The report has provided a detailed breakup and analysis of the market based on the type. This includes solution (analytics, artificial intelligence and machine learning, extended reality (XR), IoT, industrial robotics, blockchain, additive manufacturing/3D printing, cybersecurity, cloud and edge computing, and others) and service (professional services and integration and implementation).

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

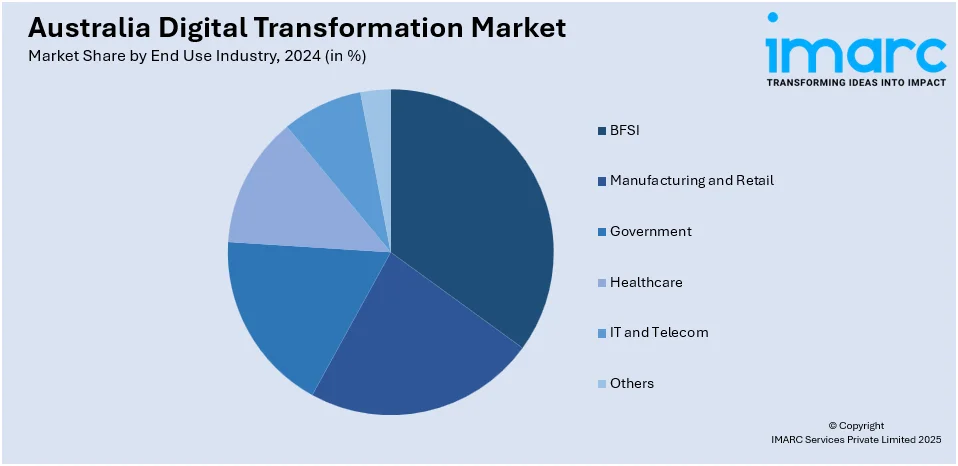

End Use Industry Insights:

- BFSI

- Manufacturing and Retail

- Government

- Healthcare

- IT and Telecom

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, manufacturing and retail, government, healthcare, IT and telecom, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Digital Transformation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Deployment Modes Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Use Industries Covered | BFSI, Manufacturing, Government, Healthcare, IT and Telecom, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia digital transformation market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia digital transformation market?

- What is the breakup of the Australia digital transformation market on the basis of type?

- What is the breakup of the Australia digital transformation market on the basis of deployment mode?

- What is the breakup of the Australia digital transformation market on the basis of enterprise size?

- What is the breakup of the Australia digital transformation market on the basis of end use industry?

- What are the various stages in the value chain of the Australia digital transformation market?

- What are the key driving factors and challenges in the Australia digital transformation?

- What is the structure of the Australia digital transformation market and who are the key players?

- What is the degree of competition in the Australia digital transformation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia digital transformation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia digital transformation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia digital transformation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)