Australia DNA Testing Market Size, Share, Trends and Forecast by Product Type, Technology, Application, and Region, 2025-2033

Australia DNA Testing Market Overview:

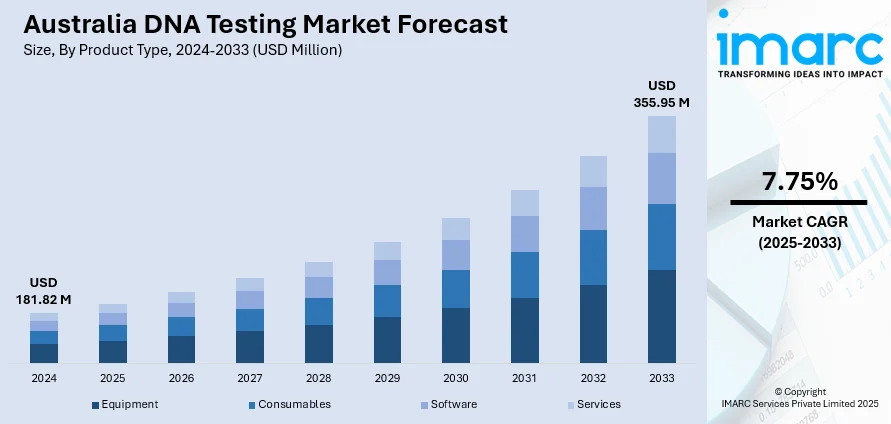

The Australia DNA testing market size reached USD 181.82 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 355.95 Million by 2033, exhibiting a growth rate (CAGR) of 7.75% during 2025-2033. The sector is fueled by growing consumer interest in heritage and health information, expanding awareness of inherited ailments, widespread use of DNA profiling in forensic work, and burgeoning applications in personalized medicine. These factors greatly drive the booming Australia DNA testing market share in clinical and consumer applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 181.82 Million |

| Market Forecast in 2033 | USD 355.95 Million |

| Market Growth Rate 2025-2033 | 7.75% |

Australia DNA Testing Market Trends:

Expansion of Preventive Healthcare through Genetic Screening

Preventive healthcare in Australia is increasingly embracing DNA testing as a critical tool for early disease risk assessment. Public and private healthcare providers are integrating genetic screening into routine check-ups, allowing for proactive management of inherited conditions such as cancer, cardiovascular disorders, and metabolic diseases. This integration reflects a paradigm shift from reactive to predictive care, where individuals are empowered to make informed lifestyle and medical decisions based on their genetic makeup. Government support for population-level screening programs further enhances adoption. For instance, as per industry reports, the Australian government has banned life insurance companies from using genetic test results in underwriting decisions, aiming to encourage early testing and preventive healthcare. The change addresses fears of discrimination and supports public health. Advocates and insurers back the move, which is set to boost genetic testing confidence nationwide. As healthcare systems aim to reduce long-term costs and improve patient outcomes, this trend substantially contributes to Australia DNA testing market growth, establishing genetic screening as a cornerstone of future medical care and public health initiatives.

To get more information on this market, Request Sample

Rise of Direct-to-Consumer (DTC) DNA Testing Services

The surge in direct-to-consumer (DTC) genetic testing in Australia marks a significant development in the DNA testing market. Companies are offering increasingly sophisticated home testing kits that analyze ancestry, health risks, and lifestyle traits without the need for physician involvement. This convenience, coupled with declining costs and digital delivery of results, appeals to tech-savvy and health-conscious consumers. Data privacy assurances and transparent reporting practices are improving public trust. Furthermore, consumers often seek follow-up medical advice based on test results, bridging consumer genomics with clinical care. For instance, in May 2025, LifeXDNA expanded its at-home genetic methylation testing services to major Australian cities including Sydney and Brisbane. The kits analyze over 85 million genetic variants, providing over 700 personalized health, nutrition, and wellness reports. This expansion meets growing demand for precise health insights, reflecting rising interest in personalized genetic testing nationwide. As the public becomes more engaged in managing their health, the growing popularity of DTC services stands out as a primary engine driving Australia DNA testing market growth and accessibility.

Australia DNA Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on product type, technology, and application.

Product Type Insights:

- Equipment

- DNA Analyzers

- PCR (Polymerase Chain Reaction) Machines

- Sequencers

- Electrophoresis Systems

- Others

- Consumables

- Reagents and Kits

- PCR Consumables

- Primers

- Probes

- DNA Extraction Kits

- Sample Collection Devices

- Others

- Software

- Data Analysis Software

- Laboratory Information Management System (LIMS)

- Genetic Analysis Software

- Bioinformatics Software

- Others

- Services

- Testing Services

- Genetic Testing

- Forensic Testing

- Others

- Data Interpretation Services

- Consultation Services

- Genetic Counseling

- Laboratory Services

- Sample Processing

- DNA Sequencing Services

- Others

- Testing Services

The report has provided a detailed breakup and analysis of the market based on the product type. This includes equipment (DNA analyzers, PCR (Polymerase Chain Reaction) machines, sequencers, electrophoresis systems, and others), consumables (reagents and kits, PCR consumables (primers and probes), DNA extraction kits, sample collection devices, and others), software (data analysis software, laboratory information management system (LIMS), genetic analysis software, bioinformatics software, and others), services (testing services (genetic testing, forensic testing, and others), data interpretation services, consultation services (genetic counseling), laboratory services (sample processing and DNA sequencing services), and others.

Technology Insights:

- Polymerase Chain Reaction (PCR) Based

- In-Situ Hybridization

- Microarray

- Next-Generation Sequencing (NGS) DNA Diagnosis

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes polymerase chain reaction (PCR) based, in-situ hybridization, microarray, and next-generation sequencing (NGS) DNA diagnosis

Application Insights:

- Newborn DNA Screening

- Pre-Natal DNA Carrier Screening

- Oncology Diagnostics and Histopathology

- Pre-Implantation Diagnosis

- Infectious Disease Diagnostics

- Pharmacogenomics Diagnostic Testing

- Identify Diagnostics and Forensic

- Others

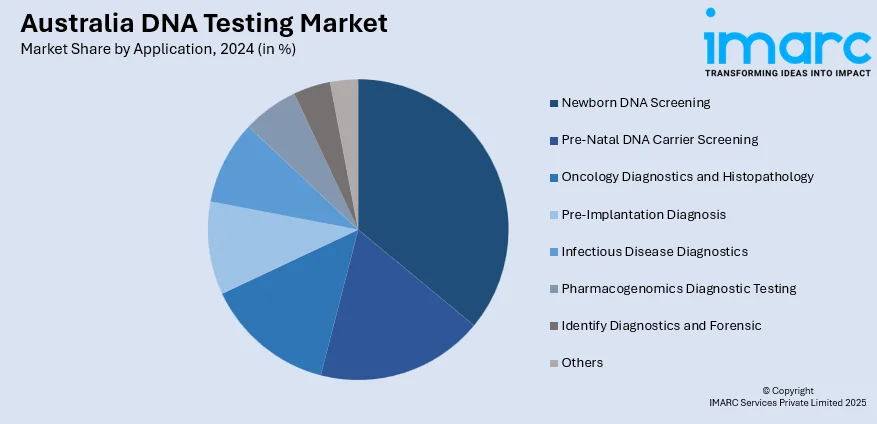

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes newborn DNA screening, pre-natal DNA carrier screening, oncology diagnostics and histopathology, pre-implantation diagnosis, infectious disease diagnostics, pharmacogenomics diagnostic testing, identify diagnostics and forensic, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia DNA Testing Market News:

- In May 2025, DNA testing firm 23andMe was acquired by Regeneron Pharmaceuticals for $256 million. The deal includes commitments to protect user data privacy. It will now aid Regeneron’s drug development efforts.

Australia DNA Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Technologies Covered | Polymerase Chain Reaction (PCR) Based, In-Situ Hybridization, Microarray, Next-Generation Sequencing (NGS) DNA Diagnosis |

| Applications Covered | Newborn DNA Screening, Pre-Natal DNA Carrier Screening, Oncology Diagnostics and Histopathology, Pre-Implantation Diagnosis, Infectious Disease Diagnostics, Pharmacogenomics Diagnostic Testing, Identify Diagnostics and Forensic, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia DNA testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia DNA testing market on the basis of product type?

- What is the breakup of the Australia DNA testing market on the basis of technology?

- What is the breakup of the Australia DNA testing market on the basis of application?

- What is the breakup of the Australia DNA testing market on the basis of region?

- What are the various stages in the value chain of the Australia DNA testing market?

- What are the key driving factors and challenges in the Australia DNA testing market?

- What is the structure of the Australia DNA testing market and who are the key players?

- What is the degree of competition in the Australia DNA testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia DNA testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia DNA testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia DNA testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)