Australia Domestic Air Cargo Transport Market Size, Share, Trends and Forecast by Service Type, Cargo Type, Aircraft Type, End Use Industry, and Region, 2025-2033

Australia Domestic Air Cargo Transport Market Overview:

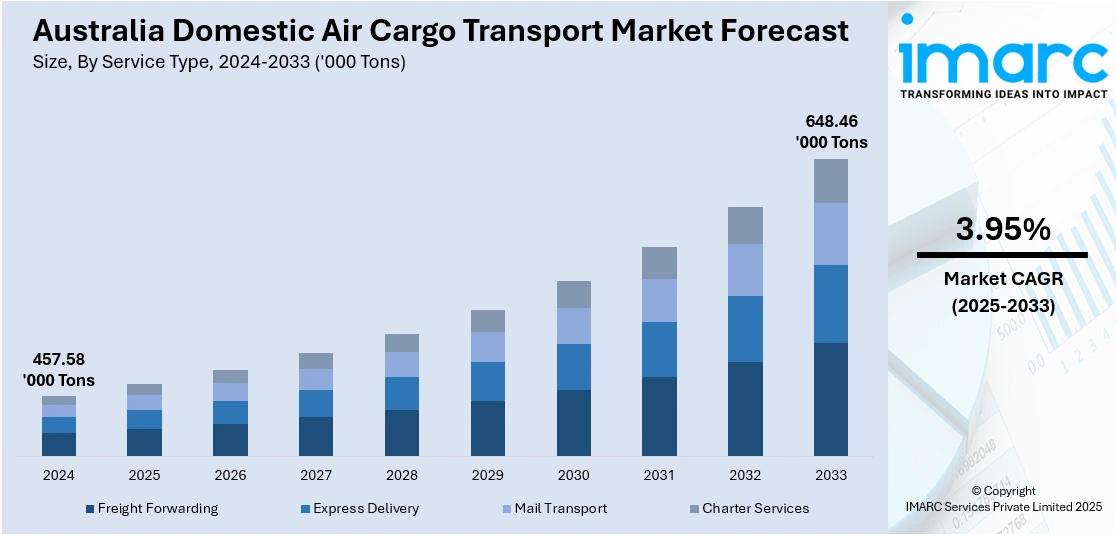

The Australia domestic air cargo transport market size reached 457.58 Thousand Metric Tons in 2024. Looking forward, IMARC Group expects the market to reach 648.46 Thousand Metric Tons by 2033, exhibiting a growth rate (CAGR) of 3.95% during 2025-2033. The industry is growing due to the growing demand for speed-based delivery services, particularly in e-commerce. Advances in technology and infrastructure are enhancing the Australia domestic air cargo transport market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 457.58 Thousand Metric Tons |

| Market Forecast in 2033 | 648.46 Thousand Metric Tons |

| Market Growth Rate 2025-2033 | 3.95% |

Australia Domestic Air Cargo Transport Market Trends:

E-commerce Expansion Leading Growth

The fast expansion of the online shopping market in Australia has played a vital role in the domestic air cargo transport industry. As customers increasingly move towards speedier delivery, the demand for speedy and reliable air cargo transportation has increased. This is driven by the rising per capita volume of parcels and products being shipped throughout the country. E-commerce giants and retailers alike are also joining forces with carriers to provide timely and safe deliveries of their products. The companies are concentrating on improving last-mile delivery capabilities and optimizing air freight operations in order to address the needs of online consumers. The development of same-day and next-day delivery services, especially, has fueled the need for more frequent and agile air cargo transport. In addition, the demand for perishable products, pharmaceuticals, and fresh produce has generated the need for specialized airfreight services, increasing dedicated airfreight routes. The increased demand is likely to drive market growth, with logistics firms investing in technology, infrastructure, and automation to aid e-commerce demands.

To get more information on this market, Request Sample

Technological Innovations in Logistics

Technological development is revolutionizing the face of the Australian domestic air cargo transport industry. Digitization and automation are becoming drivers of efficiency, with intelligent technologies being incorporated into air cargo handling. The use of AI, IoT, and real-time tracking technologies is enabling logistics companies to improve visibility, optimize inventory management, and minimize costs. Drones and autonomous vehicles are also being considered for last-mile delivery, further optimizing operations. Another innovation is blockchain technology being used to provide secure and transparent transactions across the supply chain. Such innovation not only increases efficiency but also customer satisfaction through more precise delivery windows. With such innovations, air cargo operators are able to handle volatile demand as well as enhance response times to market changes. As technology advances, it is anticipated that it will drive the Australia domestic air cargo transport market growth, laying the groundwork for more responsive and more affordable logistics solutions.

Australia Domestic Air Cargo Transport Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on service type, cargo type, aircraft type, and end use industry.

Service Type Insights:

- Freight Forwarding

- Express Delivery

- Mail Transport

- Charter Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes freight forwarding, express delivery, mail transport, and charter services.

Cargo Type Insights:

- General Cargo

- Perishable Goods

- Pharmaceuticals and Healthcare Products

- Electronics and High-Value Goods

- E-commerce Shipments

- Automotive Parts and Machinery

A detailed breakup and analysis of the market based on the cargo type have also been provided in the report. This includes general cargo, perishable goods, pharmaceuticals and healthcare products, electronics and high-value goods, e-commerce shipments, and automotive parts and machinery.

Aircraft Type Insights:

- Dedicated Freighters

- Passenger Belly Cargo

- UAVs (Drones)

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes dedicated freighters, passenger belly cargo, and UAVs (drones).

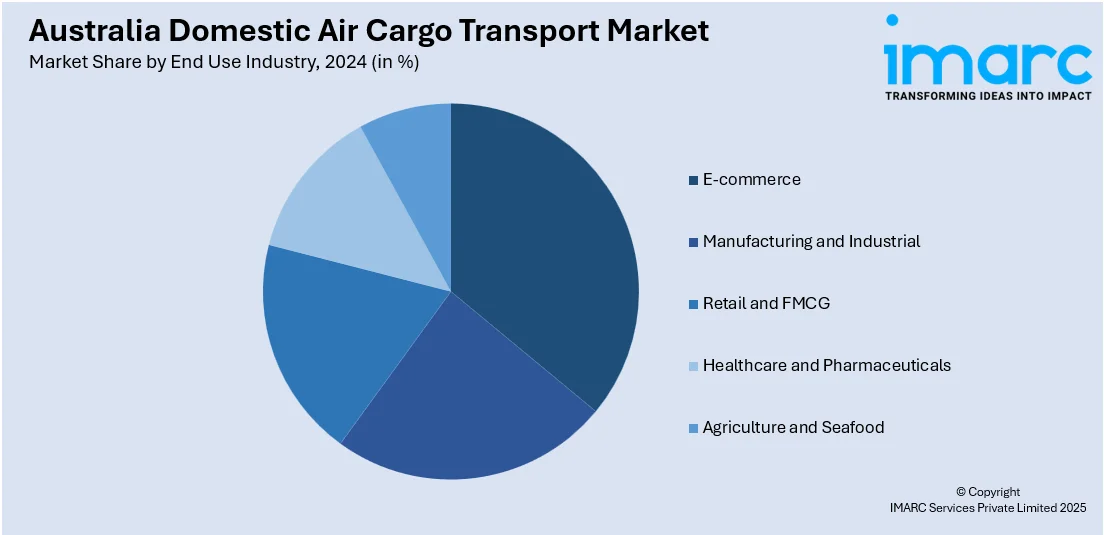

End Use Industry Insights:

- E-commerce

- Manufacturing and Industrial

- Retail and FMCG

- Healthcare and Pharmaceuticals

- Agriculture and Seafood

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes e-commerce, manufacturing and industrial, retail and FMCG, healthcare and pharmaceuticals, and agriculture and seafood.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Domestic Air Cargo Transport Market News:

- March 2025: Swissport expanded its air cargo handling operations in Australia with new facilities in Melbourne and Sydney, and a planned Auckland opening. The expansion, featuring temperature-controlled spaces and advanced equipment, enhances operational efficiency, supporting the growing domestic air cargo demand and improving service quality.

- October 2024: Qantas Freight expanded its digital distribution channel by partnering with cargo.one, offering seamless booking and quoting for air cargo services. This collaboration enhances Qantas' domestic air cargo network, increases capacity, and boosts the flexibility of Australia’s freight transport market.

Australia Domestic Air Cargo Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Freight Forwarding, Express Delivery, Mail Transport, Charter Services |

| Cargo Types Covered | General Cargo, Perishable Goods, Pharmaceuticals and Healthcare Products, Electronics and High-Value Goods, E-commerce Shipments, Automotive Parts and Machinery |

| Aircraft Types Covered | Dedicated Freighters, Passenger Belly Cargo, UAVs (Drones) |

| End Use Industries Covered | E-commerce, Manufacturing and Industrial, Retail and FMCG, Healthcare and Pharmaceuticals, Agriculture and Seafood |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia domestic air cargo transport market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia domestic air cargo transport market on the basis of service type?

- What is the breakup of the Australia domestic air cargo transport market on the basis of cargo type?

- What is the breakup of the Australia domestic air cargo transport market on the basis of aircraft type?

- What is the breakup of the Australia domestic air cargo transport market on the basis of end use industry?

- What is the breakup of the Australia domestic air cargo transport market on the basis of region?

- What are the various stages in the value chain of the Australia domestic air cargo transport market?

- What are the key driving factors and challenges in the Australia domestic air cargo transport market?

- What is the structure of the Australia domestic air cargo transport market and who are the key players?

- What is the degree of competition in the Australia domestic air cargo transport market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia domestic air cargo transport market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia domestic air cargo transport market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia domestic air cargo transport industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)