Australia Driver Assistance Systems Market Size, Share, Trends and Forecast by Type, Technology, Vehicle Type, and Region, 2025-2033

Australia Driver Assistance Systems Market Overview:

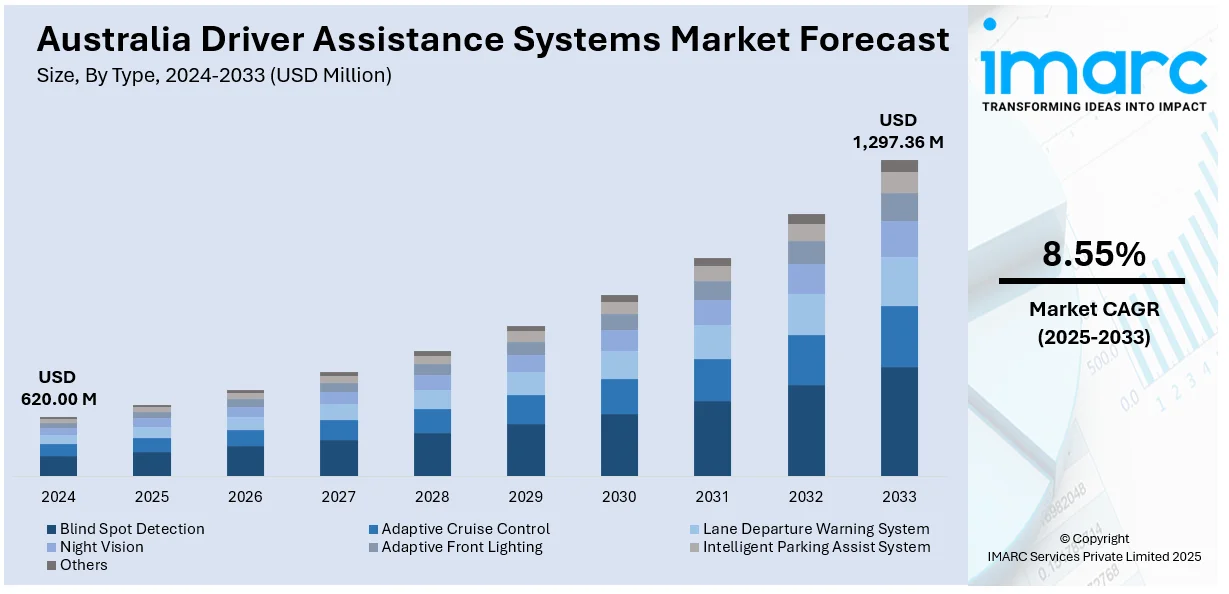

The Australia driver assistance systems market size reached USD 620.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,297.36 Million by 2033, exhibiting a growth rate (CAGR) of 8.55% during 2025-2033. Rising road accidents, stricter government vehicle safety regulations, and increased adoption of electric vehicles (EVs) and autonomous vehicles (AVs) are fostering the market growth. Apart from this, fleet upgrades in the logistics sector, original equipment manufacturer (OEM) investment in advanced driver assistance systems (ADAS) integration, availability of artificial intelligence (AI)-based sensors, improved automotive supply chains boosting new vehicle sales, and stronger demand for automated safety features in both passenger and commercial vehicles are boosting the Australia driver assistance systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 620.00 Million |

| Market Forecast in 2033 | USD 1,297.36 Million |

| Market Growth Rate 2025-2033 | 8.55% |

Australia Driver Assistance Systems Market Trends:

Rising Concerns Over Road Safety

Australia’s roads remain among the world’s most challenging, prompting a surge in demand for Advanced Driver Assistance Systems (ADAS) to curb fatalities and serious injuries. During the 12 months ending March 2025, there were 1,284 road deaths nationally—a 1.2 percent increase over the previous year—and a fatality rate of 4.7 deaths per 100,000 people, despite a marginal 0.6 percent improvement in per-capita risk. Vulnerable road users, including pedestrians and cyclists, accounted for 483 of those deaths, marking a 3.9% rise and underscoring the urgency of collision-mitigation technologies. Moreover, the second half of 2023 proved Australia’s deadliest six-month spell since 2010, with 677 fatalities, a 7.3 % year-on-year increase that spotlighted the persistence of unsafe driving practices and deteriorating road conditions. These stark numbers are driving both manufacturers and consumers toward vehicles equipped with lane-departure warnings, automatic emergency braking, adaptive cruise control, and 360-degree camera systems, which is further driving the Australia driver assistance systems market growth.

To get more information on this market, Request Sample

Government Regulations and Incentives

The Australian government has responded to the road safety crisis by mandating critical ADAS features through the Australian Design Rules (ADRs) and targeted incentive programs. Under ADR 98/00, as of March 2025, every new vehicle sold in Australia must include car-to-car Autonomous Emergency Braking (AEB), aligning local standards with United Nations Regulation 152 and the European Union’s safety requirements. Complementing the AEB mandate, ADR 113/00 will require all new electric, hybrid, and hydrogen vehicles to be fitted with Acoustic Vehicle Alerting Systems (AVAS) from November 2025. This measure addresses the pedestrian safety gap created by near-silent powertrains; modelling forecasts it will avert 68 fatalities, 2,675 serious injuries, and 2,962 minor injuries by 2060, saving the Australian community an estimated USD 208 million. In addition to these mandates, federal and state incentive schemes, such as rebates for vehicles with high ANCAP safety ratings and funding for road-safety infrastructure upgrades, further encourage ADAS uptake.

Increasing Consumer Preference for High-End and Technologically Equipped Vehicles

Contemporary Australian car buyers are not only safety-conscious but also tech-savvy, driving automakers to expand ADAS features beyond luxury segments into mainstream models. According to a nationally representative survey of 1,000 adult Australians conducted by Savvy in September 2023, 52 percent of respondents identified 360-degree surround-view cameras as a “must-have” for their next vehicle, while 50 percent prioritized blind-spot monitoring. This shift is exemplified by the Mitsubishi ASX, which added AEB, lane-keep assist, and forward-collision warning to its standard equipment list in 2024, boosting its ANCAP rating from four to five stars and contributing to a 15% sales uptick in the first quarter post-upgrade. As Australians increasingly equate vehicular technology with personal safety and convenience, the mass-market democratization of ADAS functions appears set to accelerate, creating a virtuous circle of consumer demand, manufacturer supply, and ultimately safer roads nationwide.

Australia Driver Assistance Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, technology, and vehicle type.

Type Insights:

- Blind Spot Detection

- Adaptive Cruise Control

- Lane Departure Warning System

- Night Vision

- Adaptive Front Lighting

- Intelligent Parking Assist System

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blind spot detection, adaptive cruise control, lane departure warning system, night vision, adaptive front lighting, intelligent parking assist system, and others.

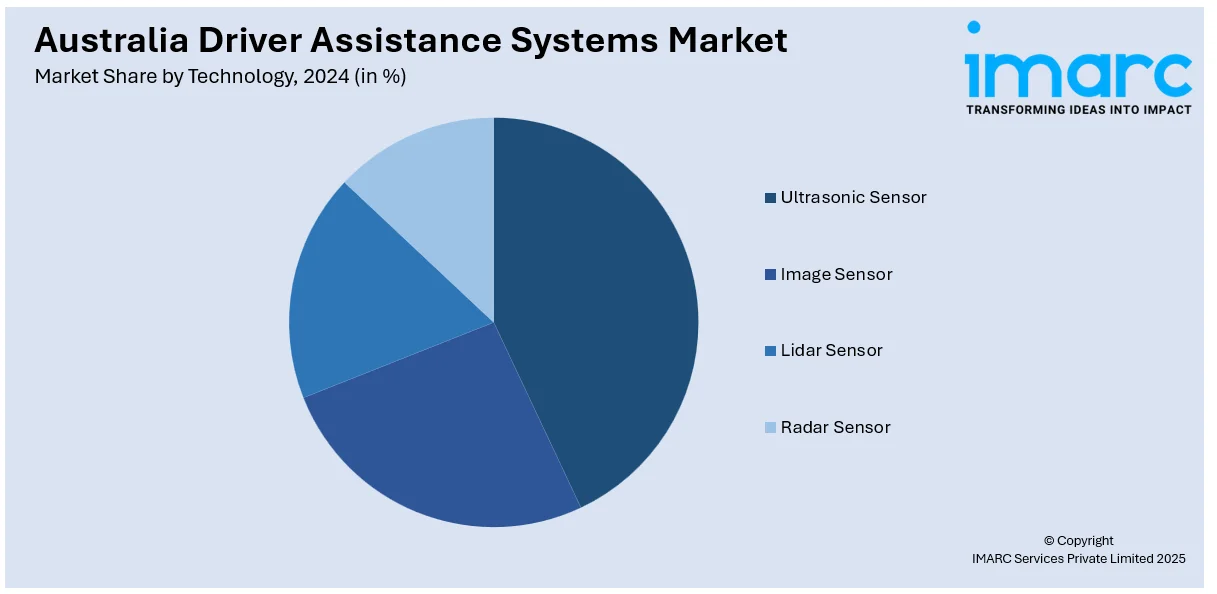

Technology Insights:

- Ultrasonic Sensor

- Image Sensor

- Lidar Sensor

- Radar Sensor

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes ultrasonic sensor, image sensor, lidar sensor, and radar sensor.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, and heavy commercial vehicles.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Driver Assistance Systems Market News:

- In 2024, Mercedes-Benz showcased its new adaptive cruise control with automatic lane change in Melbourne. The feature, already available in Europe, is pending regulatory approval for Australian roads. It uses radar and camera systems to assist in overtaking and navigation on motorways.

Australia Driver Assistance Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blind Spot Detection, Adaptive Cruise Control, Lane Departure Warning System, Night Vision, Adaptive Front Lighting, Intelligent Parking Assist System, Others |

| Technologies Covered | Ultrasonic Sensor, Image Sensor, Lidar Sensor, Radar Sensor |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia driver assistance systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia driver assistance systems market on the basis of type?

- What is the breakup of the Australia driver assistance systems market on the basis of technology?

- What is the breakup of the Australia driver assistance systems market on the basis of vehicle type?

- What is the breakup of the Australia driver assistance systems market on the basis of region?

- What are the various stages in the value chain of the Australia driver assistance systems market?

- What are the key driving factors and challenges in the Australia driver assistance systems market?

- What is the structure of the Australia driver assistance systems market and who are the key players?

- What is the degree of competition in the Australia driver assistance systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia driver assistance systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia driver assistance systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia driver assistance systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)