Australia Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End Use Industry, and Region, 2025-2033

Australia Drones Market Size and Share:

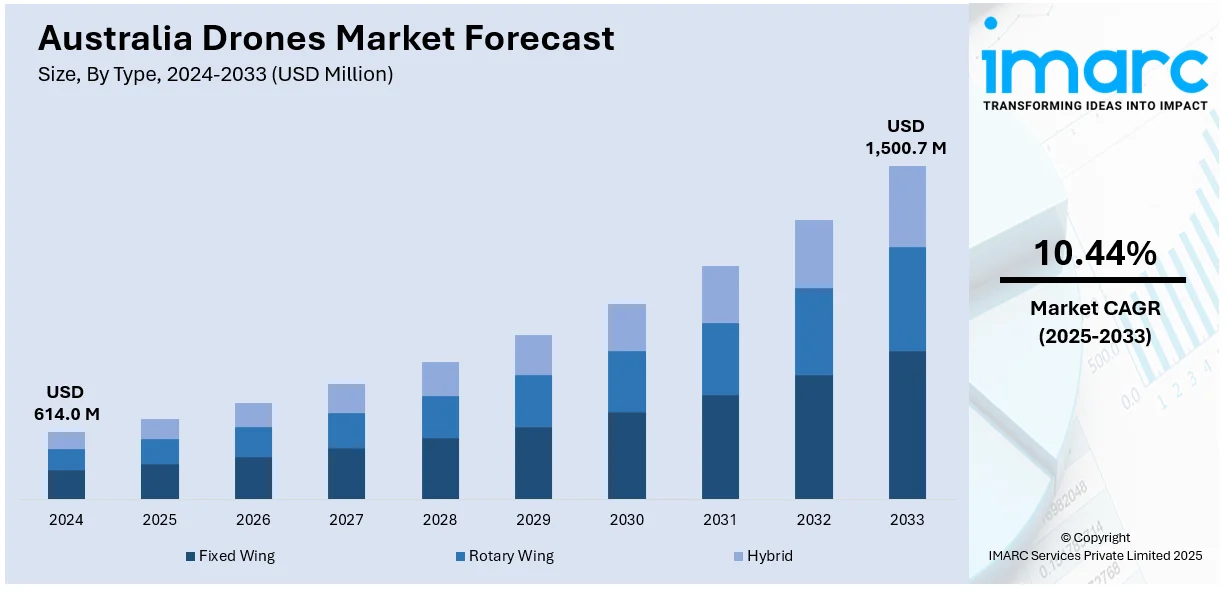

The Australia drones market size reached USD 614.0 Million in 2024. Looking forward, the market is expected to reach USD 1,500.7 Million by 2033, exhibiting a growth rate (CAGR) of 10.44% during 2025-2033. The advancements in autonomous technology, increasing demand for UAVs in defense, agriculture, and logistics, government investments in drone infrastructure, rising adoption of BVLOS operations, and expanding commercial applications across industries, enhancing operational efficiency and cost-effectiveness are expanding the Australia drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 614.0 Million |

| Market Forecast in 2033 | USD 1,500.7 Million |

| Market Growth Rate 2025-2033 | 10.44% |

Key Trends of Australia Drones Market:

Rising Adoption of Drones in Agriculture and Infrastructure Development

The Australia drones market demand is significantly driven by the increased adoption in agriculture and infrastructure sectors. Farmers can use drones to precisely apply pesticides, reducing costs and maintaining soil health. Additionally, drones with sophisticated multispectral sensors allow for detailed crop monitoring and effective resource management, which greatly boosts agricultural productivity. Farmers are leveraging drones for precision farming, crop monitoring, and pesticide spraying, enhancing productivity while reducing costs. The Australian government is also encouraging drone usage in large-scale infrastructure projects for surveying, mapping, and inspection, ensuring efficiency and safety in construction processes. With advancements in artificial intelligence (AI) and data analytics, drones are providing real-time insights, optimizing decision-making for both farmers and engineers. Additionally, regulatory support, such as easing restrictions on commercial drone operations, is further accelerating market expansion. The integration of 5G networks is expected to enhance drone capabilities, allowing real-time data transmission and improved autonomous operations. As demand for smart farming and sustainable construction grows, the drone industry in Australia is poised for substantial development, transforming traditional operational methods across key economic sectors.

To get more information of this market, Request Sample

Increasing Investments in Military and Law Enforcement Drone Technologies

The Australian government is significantly increasing investments in drone technology for military and law enforcement applications, driving the growth of the defense drone segment. For instance, Australia announced a significant boost in defense spending on March 27, 2025, including AUD 21 Billion (about USD 13.8 Billion) to establish a Guided Weapons and Explosive Ordnance Enterprise and AUD 74 billion (around USD 48.5 Billion) to purchase long-range strike missiles. The objective of this effort is to improve Australia's defense capabilities in reaction to China's military advancements and to alleviate worldwide supply constraints that have been made worse by the crisis in Ukraine. Drones are being deployed for surveillance, border security, and reconnaissance missions, enhancing national security capabilities. The Australian Defense Force (ADF) is actively integrating advanced unmanned aerial vehicles (UAVs) equipped with high-resolution imaging, thermal sensors, and AI-powered analytics for intelligence gathering and threat detection. Law enforcement agencies are also expanding drone usage for crowd monitoring, search-and-rescue missions, and traffic management. With growing geopolitical tensions and security threats, Australia is strengthening its drone capabilities through collaborations with domestic and international defense contractors, which is positively impacting Australis drones market outlook. The push for locally manufactured military drones is further boosting research and development (R&D) efforts within the country. As security challenges evolve, the demand for high-tech surveillance drones is expected to increase, solidifying Australia’s position as a key player, according to the Australia drones market analysis.

Increased Use of Drones in Emergency and Disaster Management

A major trend defining the Australia drones market is growing use of drones for disaster relief and emergency response. Natural disasters like bushfires, floods, and cyclones, frequently occur in the nation, so drones have emerged as a vital means of achieving real-time situational awareness and quick response. Emergency agencies in Australian states are moving towards incorporating drones to evaluate damage, track victims, and monitor changing danger without endangering staff. During the destructive bushfires, for example, drones have been employed to demarcate fire boundaries, identify hotspots, and assist firefighting tactics. In flood areas, they identify stranded communities and damaged infrastructure, facilitating faster relief delivery. The capacity of drones to reach remote or hazardous spaces complements well the geographic challenges of Australia, where expansive and sparsely populated areas tend to slow down traditional emergency response. As drone technology advances further, its incorporation into public safety practices in Australia is anticipated to deepen, underpinning its presence within national resilience policy.

Growth Factors of Australia Drones Market:

Government Support and Regulatory Incentives

The expansion of the drones market in Australia is mostly due to the active encouragement and support of the government in promoting the adoption of drones in a variety of industries. The Civil Aviation Safety Authority (CASA) has established wide-ranging but convenient regulations for drone usage, which facilitate easy participation in the market by both commercial and recreational users. This. clarity in regulations enhances confidence with businesses to incorporate drone technology into operations from the logistics of delivery to infrastructure inspection. Furthermore, Australia's government continues to make investments in research and development programs aimed at encouraging domestic innovation in drones, especially through grants and funding for startups and universities. Programs such as the National Emerging Aviation Technologies Policy aim to establish a safe, competitive, and innovative drone environment. By creating specialized testing environments and regulatory sandboxes, Australia establishes itself as an innovative country where drone technology can grow, drawing local and foreign investments into the growing drone sector.

Geographic Diversity and Industrial Applications

Australia's distinctive and large geography plays a significant role in the need for drone solutions across various sectors. From the outback mining deposits of Western Australia to New South Wales and Victoria's vast agricultural plains, drones present a cost-efficient, easy-to-use solution for data capture, surveying, and monitoring difficult-to-reach locations. In mining applications, drones are now being used more widely for site mapping, inventory management, and safety checks, which improve the efficiency of operations and decrease human exposure. Similarly, in agricultural use, drones enable precision agriculture through crop observation, soil inspection, and self-spraying systems. Australia's environmental and forestry departments also make use of drones to monitor biodiversity and ecological shift. This vast array of industrial uses—coupled with the logistical hindrances of the size of the country—naturally fosters demand for drone-based technology, reinforcing ongoing investment, innovation, and market expansion within the region.

Advances in Local Innovation and Technology

Another vital factor fueling growth in Australia’s drone market is the rise in domestic innovation and technology development. Australian universities and research institutions are deeply involved in cutting-edge drone research, focusing on areas such as autonomous navigation, AI integration, and environmental sensing. Collaborations between academia, industry players, and government agencies have led to the emergence of a robust drone startup ecosystem. Local businesses are creating customized drone solutions for Australian requirements—bushfire tracking, marine monitoring, and farming automation. Moreover, Australia's strategic emphasis on supporting local manufacturing and minimizing dependence on imports finds support in the drone industry, which has localized solutions and lower supply chain reliance working to its advantage. Australia's existing strengths in aerospace and defense also facilitate the development of high-end drone systems, making Australia both a user and a producer in the international drone market. These locally developed innovations facilitate local market growth and present export opportunities for Australian drone technology.

Opportunities of Australia Drones Market:

Farm Transformation via Drone Technology

The expansive agricultural terrain of Australia offers a perfect chance for drone technology to transform agriculture. Advanced sensor-fitted drones make precision agriculture possible, enabling farmers to track crop health, soil quality, and irrigation requirements with greater accuracy than ever before. The technology allows for targeted interventions, making the best use of resources and maximizing yield. In regions like Victoria, where agriculture is a significant economic driver, the adoption of drones can lead to substantial cost savings and increased productivity. Moreover, drones assist in pest control and disease management by providing real-time data, enabling timely responses to emerging threats. The integration of drones into farming operations boosts efficiency and supports sustainable practices by minimizing chemical usage and reducing environmental impact. As food demand increases and environmental pressure mounts, drones present a scalable solution to address such challenges, making Australia a leader in agricultural technology.

Improvements in Environmental Monitoring and Conservation

Australia's varied ecosystems and endemic wildlife require efficient monitoring and conservation approaches. Drones have become indispensable assets in such initiatives, with aerial views that play a significant role in determining environmental well-being. For example, organizations such as Wildlife Drones focus on employing drone-borne radio telemetry to monitor threatened species, providing information that is not easily available with conventional approaches. Such drones can reach isolated or dangerous zones, gathering information without disrupting wildlife, which is critical for conservation initiatives. Moreover, drones allow monitoring of bushfires, providing an immediate assessment and response to limit the impact. The use of drones in environmental management not only improves data gathering but also backs up preventive actions in the conservation of Australia's natural heritage. With climate change picking up speed, the use of drones to monitor the environment is more vital than ever, providing an economical and effective way of protecting biodiversity and healthy ecosystems.

Strategic Investment in Defense and National Security

The strategic location of Australia in the Indo-Pacific region highlights the need for strong national security. The government has identified the need to increase its defense capabilities, specifically in the use of drone technology. Investments are being directed towards the development of sophisticated unmanned aerial systems (UAS) that can conduct surveillance, reconnaissance, and even offensive operations. These developments are geared towards strengthening Australia's defense stance in the face of increasing regional tensions and changing security threats. By putting emphasis on local drone design and production, Australia hopes to lessen dependence on overseas technology and achieve the sovereignty of its defense facilities. Additionally, the incorporation of drones in defense operations holds out the promise of greater operational efficiency, minimizing risks to people, and improved situational awareness. As the geopolitical balance changes, Australia's focus on developing drone capabilities indicates a strategic strategy in addressing national security and regional stability.

Australia Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

The report has provided a detailed breakup and analysis of the market based on the payload. This includes <25 Kilograms, 25-170 Kilograms, and >170 Kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

A detailed breakup and analysis of the market based on the point of sale have also been provided in the report. This includes Original Equipment Manufacturers (OEM) and aftermarket.

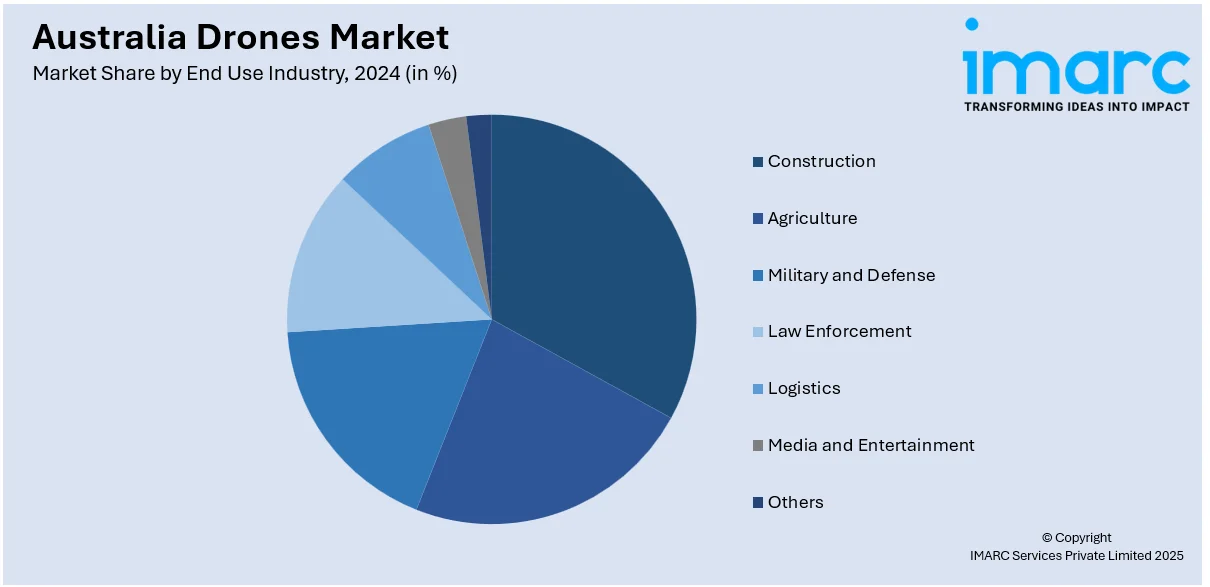

End Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Drones Market News:

- On August 21, 2024, three Australian businesses—AMSL Aero, Boresight, and Grabba Technologies—were given contracts worth $6.6 Million by the Advanced Strategic Capabilities Accelerator (ASCA) as part of the Sovereign Uncrewed Aerial Systems (UAS) Challenge. Each company was given $2.2 Million to produce 100 general-purpose UAS and bring their drone prototypes up to production standards. By establishing a sovereign drone manufacturing capability, this program seeks to address supply chain and security issues related to commercial drones.

- On June 13, 2024, the Australian government stated that AUD 13 Million (USD 8.45 Million), will be made available in federal financing as part of Round 2 of the Emerging Aviation Technology Partnerships initiative. Supporting research studies on improved beyond visual line of sight (BVLOS) drone operations, electric aircraft charging systems, airspace regulation, hydrogen-powered aircraft, and cargo drone operations is the goal of this program.

Australia Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Point of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia drones market was valued at USD 614.0 Million in 2024.

The Australia drones market is expected to reach a value of USD 1,500.7 Million by 2033.

The Australia drones market is projected to exhibit a CAGR of 10.44% during 2025-2033.

Australia's drone market is growing significantly, fueled by the proactive support of the government through regulatory development and funding measures has provided a favorable environment for drone embracement in other sectors. Sectors like agriculture, mining, logistics, and emergency services are starting to incorporate drone technology to make operations more efficient and safer. Developments in technology, especially in automation and artificial intelligence, are making drones capable of carrying out sophisticated tasks autonomously, which is also broadening their uses.

Australia's drone market development is fueled by favorable government policies, varied industrial uses, and the country's expansive, remote geography. Industries such as agriculture, mining, and emergency services are enhanced by drone efficiency. Strong local innovation and research efforts also remain key drivers of technology development and commercial deployment in the Australian market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)