Australia Dropshipping Market Size, Share, Trends and Forecast by Product, Type, Application, and Region, 2025-2033

Australia Dropshipping Market Size and Share:

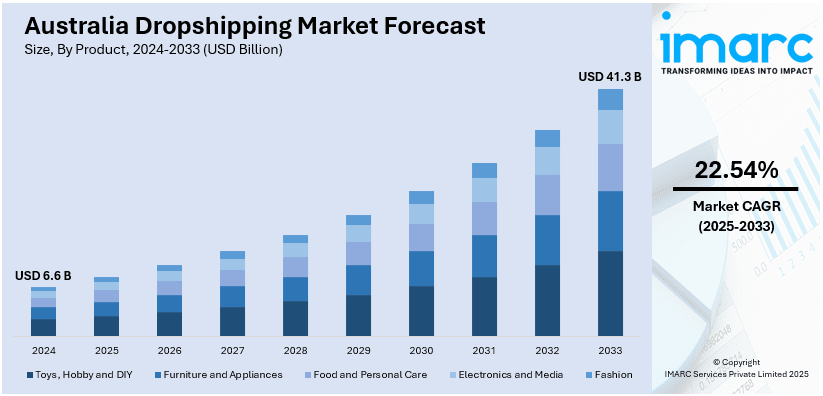

The Australia dropshipping market size reached USD 6.6 Billion in 2024. Looking forward, the market is expected to reach USD 41.3 Billion by 2033, exhibiting a growth rate (CAGR) of 22.54% during 2025-2033. The market is fueled by rising eCommerce adoption, demand for sustainable products, and the popularity of niche-specific stores. Consumers prioritize convenience, affordability, and fast shipping, while social media and influencer marketing drive trends. Additionally, low startup costs and global supplier access enable entrepreneurs to enter the market easily, augmenting the Australia dropshipping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.6 Billion |

| Market Forecast in 2033 | USD 41.3 Billion |

| Market Growth Rate 2025-2033 | 22.54% |

Key Trends of Australia Dropshipping Market:

Increasing Demand for Eco-Friendly and Sustainable Products

The significant shift toward eco-friendly and sustainable products is significantly supporting the Australia dropshipping market growth. Consumers are becoming more environmentally conscious, driving demand for items such as reusable household goods, biodegradable packaging, and ethically sourced fashion. An industry report revealed that 75% of Australians expect brands to take a clear stand on sustainability. Along with this, more than 40% of online shoppers search for ethical and green products. Over three-quarters of shoppers prefer locally sourced goods, and 47% show greater loyalty toward brands with sustainable return policies. Following data trends makes it a significant opportunity for dropshipping businesses in Australia to personally align their solution with the sustainable brand trend in a growing consumer base. Dropshippers who align with these values by offering green products or partnering with eco-conscious suppliers can gain a competitive edge. Additionally, businesses that emphasize transparency in their supply chains—such as carbon-neutral shipping or recyclable materials are more likely to build trust with Australian buyers. Social media platforms, particularly Instagram and TikTok, are amplifying this trend, with influencers promoting sustainable lifestyles. As a result, dropshippers who leverage eco-friendly marketing strategies and highlight sustainability in their product listings are well-positioned to capitalize on this growing market segment.

To get more information on this market, Request Sample

Rise of Niche-Specific Dropshipping Stores

The increasing shift from general stores to niche-specific e-commerce businesses is creating a positive Australia dropshipping market outlook. Rather than selling a broad range of unrelated products, successful dropshippers are focusing on specialized categories such as pet accessories, fitness gear, or home organization tools. This approach allows for targeted marketing, stronger brand identity, and higher customer loyalty. Google Trends data shows that niche-specific searches have increased in the past year. Niche stores also benefit from lower advertising costs, as they can tailor their campaigns to a specific audience. Platforms such as Facebook Ads and Google Shopping enable precise audience segmentation, improving conversion rates. With 21 million Facebook users in Australia and social media advertising spending projected at AUD 7.5 billion in 2025, Facebook Ads is an invaluable resource for digital marketers. 57% of Australians shop through social media, and 58% of all social commerce is through Facebook. For dropshipping businesses, targeted Facebook Ads are an excellent way to reach Australia's growing online shopping community. Furthermore, Australian consumers are more likely to trust a store that specializes in one area rather than a generic marketplace. By curating high-quality, in-demand products within a specific niche, dropshippers can enhance customer satisfaction and drive repeat sales in a competitive market.

Advantages of Australia Dropshipping Market:

Strategic Geographic Location and Time Zone Benefit

Australia's geographical location within the Asia-Pacific region offers a strategic benefit for dropshipping companies serving both local and overseas markets. Being relatively proximate to such major manufacturing centers as China, Vietnam, and other Southeast Asian nations affords Australian dropshippers the benefit of generally providing quicker shipping than European or North American counterparts. This closeness not only increases the efficiency of logistics but also cuts down shipping costs, allowing competitive pricing. Furthermore, the differential in time zones benefits entrepreneurs with suppliers in Asia. Orders placed in daytime in Australia can be shipped overnight by Asian manufacturers and result in hassle-free next-day processing. This organic coordination among supply chain partners makes sure that Australian dropshipping companies can sustain a faster responsiveness and customer satisfaction rate, particularly when providing express delivery services within the country.

High-Value Consumer Market with E-Commerce Maturity

Australia has a tech-smart populace with a robust preference for online purchases, thus very conducive ground for starting dropshipping businesses. The nation's shoppers are already used to online shopping, mobile payments, and multi-device browsing, offering an eager market for innovative and specialized online retailers. Australians also show a great deal of faith in online purchases, especially when there is a transparent shipping and returns policy. Such trust may be used by dropshippers in creating firm brand reputations without having physical stock. In addition, Australia's relatively high cost of living provides room for dropshippers to provide competitive substitutes for domestically purchased items. As most consumers look for cheap yet quality goods, dropshippers that specialize in market gaps—like environment-friendly products, personalized gadgets, or exercise gear—can thrive. This consumer receptiveness, together with efficient digital infrastructure and high internet penetration in the country, provides dropshippers with a strong basis to expand their businesses, which further increases the Australia dropshipping market demand.

Friendly Legal System and Business Environment

The Australian business landscape is characterized by transparency, stability, and friendliness towards small to medium businesses, including dropshipping ventures. The registration process of online business is easy, and the regulatory system fosters fair competition and consumer protection. This provides dropshippers with assurance that their business operations are protected under properly enforced laws. In addition, Australia Post and many private logistics providers have become friendly to e-commerce, providing customized solutions such as tracked shipping, built-in returns, and even carbon-neutral delivery. Popular payment gateways such as Afterpay and Zip Pay, extensively used in the country, provide dropshippers with a means to allow customers to make flexible payments, further increasing customer satisfaction. Furthermore, the easy access to co-working facilities, digital marketing firms, and e-commerce experts ensures there is sufficient help available for entrepreneurs to start and grow their dropshipping businesses. These elements come together to make a vibrant, low-hurdle setup where dropshippers can concentrate on building their brand and interacting with customers instead of operational challenges.

Growth Drivers of Australia Dropshipping Market:

Growth of Niche Consumer Demand and Lifestyle Trends

One of the most important growth drivers of the Australian dropshipping market is the demand for niche products that reflect changing consumer lifestyles. Australians have been keen on sustainability, wellness, and uniqueness—trends that complement dropshipping's capacity to serve micro-markets. For example, environmentally friendly products like biodegradable packaging, reusable domestic items, and sustainable fashion are in greater demand among city-dwelling Australians, especially in cities like Melbourne and Sydney where sustainability is prominent. Further, the nation's passion for outdoor adventures and fitness generates product opportunities in specialized equipment, exercise wear, and accessories. Dropshipping companies that access these niche passions can find an advantage by presenting carefully curated offers that larger retailers might miss. The nature of the dropshipping model allows entrepreneurs to make fast shifts to capture evolving tastes, allowing for rapid experimentation of new concepts and entry into emerging markets with less chance of overstocking.

Digital Integration and Adoption of Consumer Technology

According to the Australia dropshipping market analysis, the rapid level of digital penetration is a major contributor driving growth. The widespread adoption of smartphones, digital wallets, and e-commerce platforms by the population makes online shopping smooth and secure. Shoppers are using apps and websites to buy everything from groceries to high-end fashion items, and this familiarity with online shopping has carried over into a willingness to experiment with new brands—particularly those found through social media and sponsored content. Australians are technology-early-adopting consumers who are sensitive to product discovery innovations, tailored marketing, and customer service innovations. Integration with local platforms such as Shopify and collaboration with local couriers like Sendle and Australia Post enable smooth operations that are adapted to local expectations. Digital preparedness minimizes the resistance to online transactions and provides dropshipping companies with an optimized ecosystem in which to expand. Scaling a dropshipping operation in this setup is hence less about physical infrastructure and more about informed digital marketing and user experience.

Economic Changes and Remote Work Culture

The Australian economy and work culture have also recently undergone considerable change that has impacted the world of dropshipping. With more and more Australians working from home or looking for flexible working arrangements, people are increasingly looking for other sources of income or venturing into entrepreneurship, including dropshipping. This cultural transformation has motivated individuals to spend time learning about online business models, facilitated by the availability of digital education and e-commerce resources. Moreover, economic uncertainty and high living costs in large cities have driven both consumers and sellers to seek cheap answers to their needs—consumers search for low-cost yet quality products, and would-be entrepreneurs search for low-risk business activities. Dropshipping is well-suited to both demands. The Australian government and the Australian Taxation Office add incentives for people to try e-commerce with tools, grants, and advice offered to small e-tailers. This conjunction of work-at-home culture, economic pragmatism, and government assistance enables fertile soil for ongoing growth in the dropshipping market throughout Australia.

Australia Dropshipping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, type, and application.

Product Insights:

- Toys, Hobby and DIY

- Furniture and Appliances

- Food and Personal Care

- Electronics and Media

- Fashion

The report has provided a detailed breakup and analysis of the market based on the product. This includes toys, hobby and DIY, furniture and appliances, food and personal care, electronics and media, and fashion.

Type Insights:

- Same-Day Delivery

- Regional Parcel Carriers

- Heavy Goods Delivery

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes same-day delivery, regional parcel carriers, and heavy goods delivery.

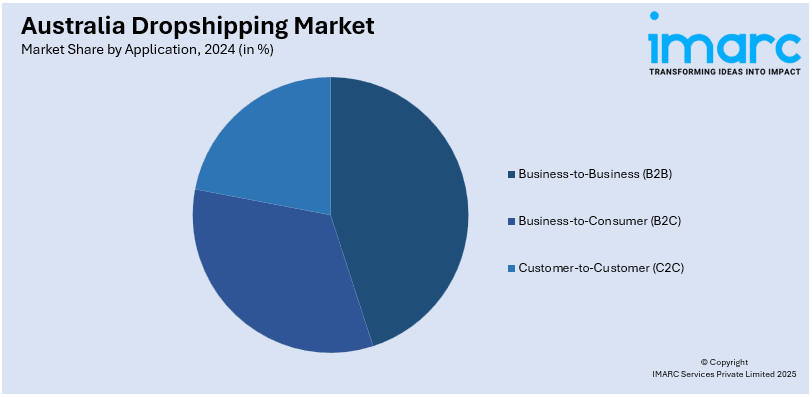

Application Insights:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Customer-to-Customer (C2C)

The report has provided a detailed breakup and analysis of the market based on the application. This includes business-to-business (B2B), business-to-consumer (B2C), and customer-to-customer (C2C).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Dropshipping Market News:

- In August 2024, Fiverr, the international freelance marketplace, revealed its purchase of AutoDS, a firm that offers subscription-based comprehensive solutions for dropshipping businesses. AutoDS provides solutions for product research and sourcing, inventory oversight, and automated order fulfillment. This purchase will improve Fiverr's eCommerce features and incorporate thousands of dropshippers into its platform. The purchase aligns with Fiverr's strategy to strengthen its position in website creation, eCommerce oversight, and social media advertising.

Australia Dropshipping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Toys, Hobby and DIY, Furniture and Appliances, Food and Personal Care, Electronics and Media, Fashion |

| Types Covered | Same-Day Delivery, Regional Parcel Carriers, Heavy Goods Delivery |

| Applications Covered | Business-to-Business (B2B), Business-to-Consumer (B2C), Customer-to-Customer (C2C) |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia dropshipping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia dropshipping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia dropshipping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia dropshipping market was valued at USD 6.6 Billion in 2024.

The Australia dropshipping market is projected to exhibit a CAGR of 22.54% during 2025-2033.

The Australia dropshipping market is expected to reach a value of USD 41.3 Billion by 2033.

Australia's dropshipping economy is fueled by increasing e-commerce adoption, an IT-savvy population, and growing demand for niche, lifestyle-focused products. The transition to remote work has fostered entrepreneurial interest, while geographic proximity to Asian suppliers guarantees efficient supply chain logistics. Accommodative digital infrastructure and flexible payment terms further enable business scalability.

The major trends of the Australia dropshipping market include growing inclination toward eco-friendly and sustainable products and shift from general stores to niche-specific e-commerce businesses. Rapid level of digital penetration, such as the widespread adoption of smartphones, digital wallets, and e-commerce platforms by the population, that makes online shopping smooth is a major contributor driving growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)