Australia Dynamic Load Management Systems Market Size, Share, Trends and Forecast by Component, Application, Technology, Deployment Mode, End User, and Region, 2025-2033

Australia Dynamic Load Management Systems Market Overview:

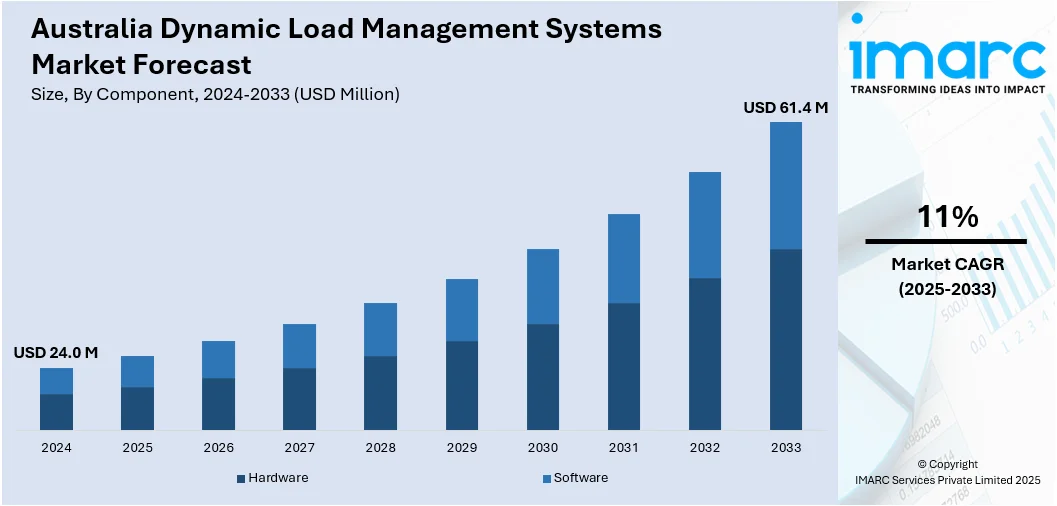

The Australia dynamic load management systems market size reached USD 24.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 61.4 Million by 2033, exhibiting a growth rate (CAGR) of 11% during 2025-2033. The rising usage of electric vehicles (EVs) in Australia is impelling the growth of the market. Apart from this, the infusion of renewable energy sources, like solar and wind power, into the country’s grid is driving the need for proper load management setups. Moreover, government regulations and policies focused on enhancing energy efficiency and decreasing carbon emissions are expanding the Australia dynamic load management systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.0 Million |

| Market Forecast in 2033 | USD 61.4 Million |

| Market Growth Rate 2025-2033 | 11% |

Australia Dynamic Load Management Systems Market Trends:

Increasing Usage of Electric Vehicles (EVs)

The heightened use of electric vehicles (EVs) in Australia is impelling the growth of the market. As the market for EVs keeps growing, the demand for effective charging infrastructure is rising. Dynamic load management systems are playing a vital role in smoothing the distribution of electricity to charging stations for avoiding grid overloads, facilitating efficient allocation of energy during peak charging times. Utilities are always looking to keep up with the added energy demand from EV expansion. At the same time, dynamic load management systems are providing real-time monitoring and control of energy usage, allowing EVs to be integrated into the current grid with minimal disruption. With the rising number of EVs on the roads, Australian government and private enterprises are investing in smart grid solutions to improve the charging experience as well as attend to energy efficiency issues, which makes dynamic load management systems a critical element in managing this change. The IMARC Group predicts that the Australia EV market size is expected to reach USD 171.6 Billion by 2033.

To get more information on this market, Request Sample

Integration of Renewable Energy Sources

The infusion of renewable energy sources, like solar and wind power, into Australia's grid is driving the need for dynamic load management systems. As the penetration of intermittent renewable energy sources grows, the grid cannot keep up with balancing supply and demand. Dynamic load management systems are facilitating the management of the variability and uncertainty of renewable energy generation by adjusting the allocation of power across sectors. This system is enabling immediate reaction to fluctuations in energy supply, improving the stability of the grid and reducing the likelihood of shortages or overloads. By optimizing the use of renewable energy and preventing wastage, a dynamic load management system is facilitating Australia's shift towards a more sustainable energy system. Utility firms and corporations are increasingly embracing smart grid technologies to maximize the incorporation of renewables, which is, in turn, driving the need for dynamic load management system solutions.

Government Policies and Regulatory Support

Government regulations and policies focused on enhancing energy efficiency and decreasing carbon emissions are contributing to the Australia dynamic load management systems market growth. The government of Australia is actively enforcing rules that promote the use of smart grid solutions and energy management tools. For instance, in 2024, the Australian Energy Market Commission (AEMC) declared a final regulation mandating the installation of smart meters throughout the National Electricity Market (NEM) by 2030. This initiative is planned to update Australia’s energy infrastructure and speed up the shift to renewable energy sources. Smart meters play a crucial role in facilitating a linked, efficient energy system and reaching net zero goals. These regulations are driving utilities and private organizations to make investments in technologies that can maximize energy consumption across sectors. A dynamic load management system is viewed as an imperative tool in attaining energy efficiency goals, where demand response programs are implemented efficiently. In addition, government policies for incentives on renewable energy schemes and energy storage systems are encouraging the integration of dynamic load management systems within residential and commercial sectors.

Australia Dynamic Load Management Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application, technology, deployment mode, and end user.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

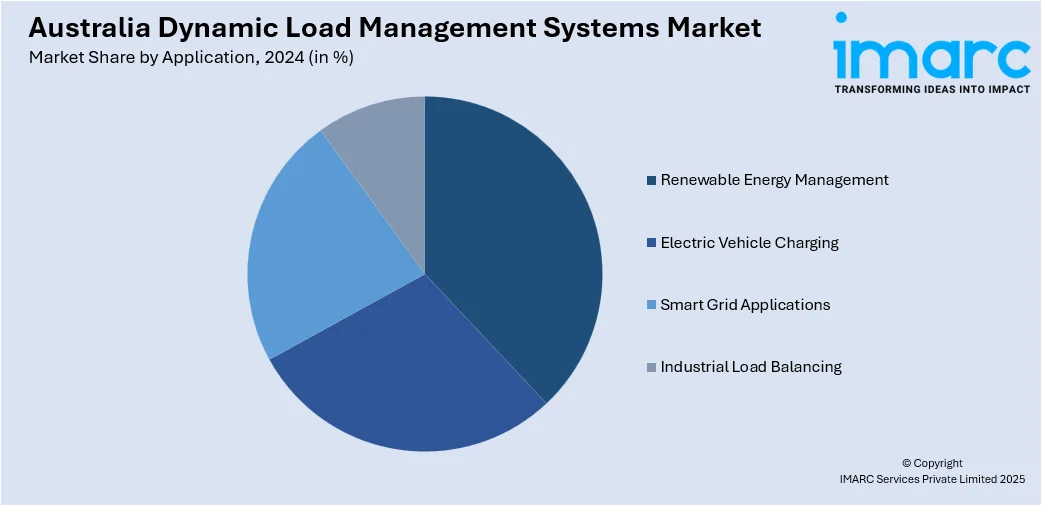

Application Insights:

- Renewable Energy Management

- Electric Vehicle Charging

- Smart Grid Applications

- Industrial Load Balancing

The report has provided a detailed breakup and analysis of the market based on the application. This includes renewable energy management, electric vehicle charging, smart grid applications, and industrial load balancing.

Technology Insights:

- Cloud-based Solutions

- IoT-enabled Devices

- Artificial Intelligence Integration

The report has provided a detailed breakup and analysis of the market based on the technology. This includes cloud-based solutions, IoT-enabled devices, and artificial intelligence integration.

Deployment Mode Insights:

- On-premises

- Cloud-based Deployment

- Hybrid Deployment

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises, cloud-based deployment, and hybrid deployment.

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Dynamic Load Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Applications Covered | Renewable Energy Management, Electric Vehicle Charging, Smart Grid Applications, Industrial Load Balancing |

| Technologies Covered | Cloud-based Solutions, IoT-enabled Devices, Artificial Intelligence Integration |

| Deployment Modes Covered | On-premises, Cloud-based Deployment, Hybrid Deployment |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia dynamic load management systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia dynamic load management systems market on the basis of component?

- What is the breakup of the Australia dynamic load management systems market on the basis of application?

- What is the breakup of the Australia dynamic load management systems market on the basis of technology?

- What is the breakup of the Australia dynamic load management systems market on the basis of deployment mode?

- What is the breakup of the Australia dynamic load management systems market on the basis of end user?

- What is the breakup of the Australia dynamic load management systems market on the basis of region?

- What are the various stages in the value chain of the Australia dynamic load management systems market?

- What are the key driving factors and challenges in the Australia dynamic load management systems market?

- What is the structure of the Australia dynamic load management systems market and who are the key players?

- What is the degree of competition in the Australia dynamic load management systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia dynamic load management systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia dynamic load management systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia dynamic load management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)