Australia E-Axle Market Size, Share, Trends and Forecast by Component Type, Vehicle Type, Drive Type, and Region, 2025-2033

Australia E-Axle Market Overview:

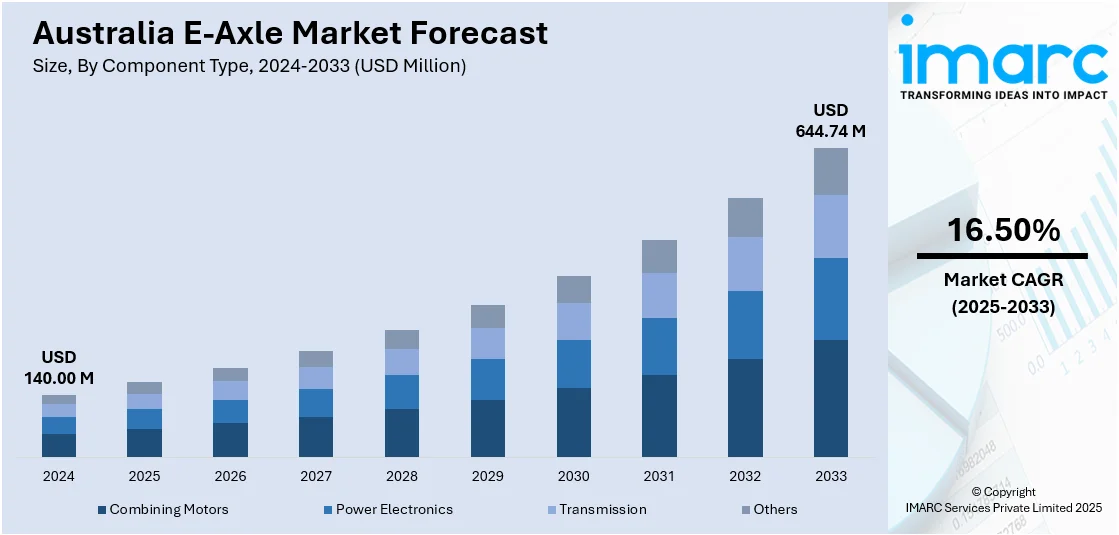

The Australia e-axle market size reached USD 140.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 644.74 Million by 2033, exhibiting a growth rate (CAGR) of 16.50% during 2025-2033. The market is being driven by rising electric and hybrid vehicle adoption, supportive government policies, technological advancements in powertrain systems, and increasing demand for efficient, low-emission transportation solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 140.00 Million |

| Market Forecast in 2033 | USD 644.74 Million |

| Market Growth Rate 2025-2033 | 16.50% |

Australia E-Axle Market Trends:

Surge in EV Adoption Backed by National EV Strategy

Australia's electric vehicle (EV) market is experiencing rapid growth, fueled by the National Electric Vehicle Strategy introduced by the government in 2023. This strategy aims to accelerate the deployment of EV infrastructure, offer tax incentives, and achieve zero-emissions targets. In 2023, EV sales in Australia soared by over 120% year-on-year, with around 90,000 new EV registrations, a significant increase from 40,000 in 2022. By 2030, EVs are projected to account for 50% of new car sales, driving the demand for advanced components like E-axles, which integrate the motor, power electronics, and transmission into a single, compact unit. Leading automakers such as Tesla, BYD, and Hyundai are expanding their EV portfolios, while local investments, like the proposed Gigafactory in Victoria, will boost domestic production and R&D. Additionally, state-specific incentives, such as Victoria’s AUD 3,000 EV rebate, combined with a growing network of public charging stations expected to exceed 5,000 by 2025, are further catalyzing the market growth.

To get more information on this market, Request Sample

Technological Innovations in Powertrain Efficiency

Advancements in e-axle technology, particularly in power density, thermal management, and materials science, are driving significant transformations in Australia's e-axle market, improving both EV performance and efficiency. Manufacturers are increasingly focused on developing lightweight and compact E-axles to meet growing performance demands and sustainability goals. This shift is fueled by innovations such as silicon carbide-based inverters, enhanced gear systems, and advanced cooling solutions, which improve torque output, extend driving range, and reduce energy loss. Leading companies like Bosch and ZF Friedrichshafen are introducing next-generation e-axles with up to 500 Nm torque and 300 kW power output, enabling manufacturers to produce high-performance, energy-efficient EVs. Furthermore, the surging adoption of aluminum and composite materials in e-axle housings further reduces vehicle weight by up to 30%, enhancing range and supporting Australia’s goals of reducing lifecycle emissions in the automotive sector, thereby impelling the market growth.

Australia E-Axle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component type, vehicle type, and drive type.

Component Type Insights:

- Combining Motors

- Power Electronics

- Transmission

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes combining motors, power electronics, transmission, and others.

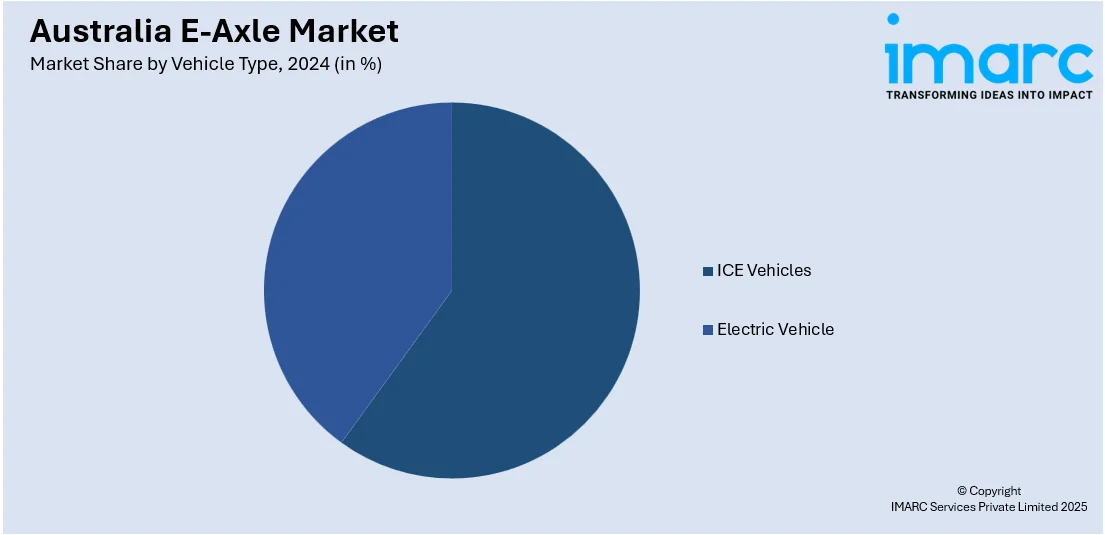

Vehicle Type Insights:

- ICE Vehicles

- Passenger Vehicle

- Commercial Vehicle

- Electric Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes ICE vehicles (passenger vehicle and commercial vehicle) and electric vehicle.

Drive Type Insights:

- Forward Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

The report has provided a detailed breakup and analysis of the market based on the drive type. This includes forward wheel drive, rear wheel drive, and all wheel drive.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia E-Axle Market News:

- September 2024: AVL introduced a compact e-axle designed for long-haul trucks up to 40 tons. This e-axle meets the requirements of the electromobility market, offering low weight, high performance, maximum efficiency, and a service life of 1.5 million kilometers.

- August 2024: Unipart Group Australia acquired the former Schaeffler Rail Bearing reconditioning business in Auburn, New South Wales. This acquisition enhances Unipart's capabilities in e-axle component services within the Australian market.

- May 2024: Daimler Truck launched a range of all-electric trucks in Australia, including the Mercedes-Benz eActros, Fuso eCanter, and eEconic. These vehicles feature advanced e-axle technology, integrating the electric motor into the drive axle to reduce weight and enhance efficiency. With up to 300 km of range, zero emissions, and class-leading safety features, they are designed for urban distribution and waste management.

Australia E-Axle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Combining Motors, Power Electronics, Transmission, Others |

| Vehicle Types Covered |

|

| Drive Types Covered | Forward Wheel Drive, Rear Wheel Drive, All Wheel Drive |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia e-axle market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia e-axle market on the basis of component type?

- What is the breakup of the Australia e-axle market on the basis of vehicle type?

- What is the breakup of the Australia e-axle market on the basis of drive type?

- What is the breakup of the Australia e-axle market on the basis of region?

- What are the various stages in the value chain of the Australia e-axle market?

- What are the key driving factors and challenges in the Australia e-axle market?

- What is the structure of the Australia e-axle market and who are the key players?

- What is the degree of competition in the Australia e-axle market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia e-axle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia e-axle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia e-axle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)