Australia E-Bike Battery Market Size, Share, Trends and Forecast by Battery Type, Battery Pack Position Type, and Region, 2025-2033

Australia E-Bike Battery Market Size and Share:

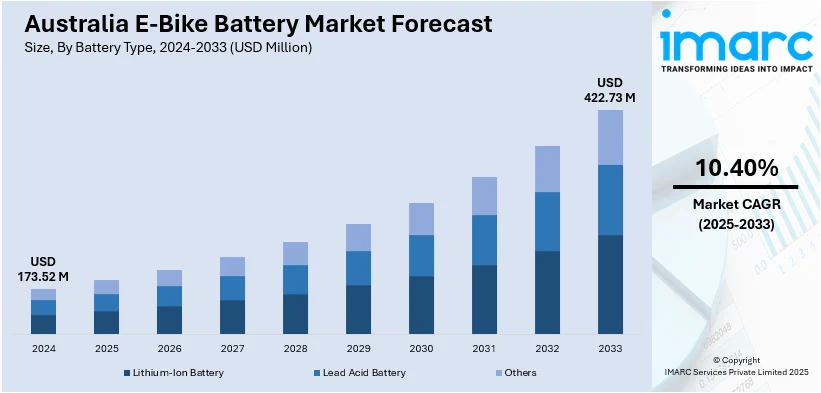

The Australia e-bike battery market size reached USD 173.52 Million in 2024. Looking forward, the market is projected to reach USD 422.73 Million by 2033, exhibiting a growth rate (CAGR) of 10.40% during 2025-2033. As urban congestion increases, e-bikes offer a flexible, eco-friendly solution for commuting, catalyzing the demand for advanced, long-lasting batteries. The rising variety of e-bike models, ranging from commuter bikes to mountain and cargo options, which require specialized batteries tailored to different needs, is further expanding the Australia e-bike battery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 173.52 Million |

| Market Forecast in 2033 | USD 422.73 Million |

| Market Growth Rate 2025-2033 | 10.40% |

Key Trends of Australia E-Bike Battery Market:

Growing Traffic Congestion

As urban areas become more populated, the issues of traffic jams, extended travel times, and scarce parking are escalating, making conventional means of transport less feasible for city residents. E-bikes present a practical solution to these challenges, delivering a flexible, environment-friendly option for short to medium-range trips. Due to their capacity to circumvent traffic, utilize smaller roads, and eliminate parking difficulties, e-bikes are emerging as a desirable choice for commuters looking for a quicker, more effective method to maneuver through crowded urban streets. The demand for affordable and sustainable transportation solutions in cities is driving the transition towards e-bikes, which offer a greener option compared to cars and public transit. The need for advanced-performance batteries that provide extended range and improved longevity is also increasing because of this transition. A prominent instance of this trend is Kawasaki’s introduction of its inaugural electric motorcycles in Australia in 2025, the Ninja e-1 and Z e-1. Tailored for city riders, these 125cc-class electric bicycles come with dual detachable batteries, various riding modes, and can reach a maximum speed of 99km/h. With a capacity of about 71km, these e-bikes address the rising demand for sustainable and effective transportation in urban settings. As urban areas continue to expand, the adoption of e-bikes is expected to rise, further catalyzing the demand for advanced, long-lasting batteries that can support the evolving needs of city commuters.

To get more information on this market, Request Sample

Increased Availability of E-Bike Models

The rising introduction of e-bike models with advanced features is contributing to the Australia e-bike battery market growth. As producers launch a wider variety of models, such as commuter bikes, mountain bikes, and cargo bikes, there is an increased demand for specialized batteries designed for each bike's specific purpose. For instance, long-distance touring bicycles typically need batteries with greater capacity to accommodate lengthy travels, whereas urban commuters might favor smaller, lighter models. The presence of such diverse e-bike choices is encouraging more users to adopt e-bikes, as they realize they can select a model that fits their requirements, whether for everyday travel or leisure activities. Following this trend, Segway-Ninebot introduced a new series of electric motorcycles in Australia in 2024, featuring models, such as the E300SE, E125S, and E110S. These bicycles accommodated a wide variety of riders, incorporating intelligent app connectivity, detachable batteries, and sophisticated safety features. The increase in e-bike options not only draws in new users but also elevates the need for various battery types to satisfy the diverse power requirements of these models. With e-bike manufacturers persistently innovating and launching new alternatives, the demand for high-performance batteries that can accommodate various e-bike designs is expanding, leading to the creation and acceptance of tailored battery solutions.

Advances in Battery Technology

Innovations in battery technology especially regarding lithium-ion batteries are significantly impacting the Australian e-bike battery sector. These advancements are concentrated on improving critical aspects like battery longevity, charging speed, and overall efficacy. Enhanced energy density permits extended rides on a single charge which is essential for users desiring dependable performance. Quick charging options are decreasing downtime allowing users to recharge their batteries promptly thus increasing the convenience of utilizing e-bikes for everyday travel. Furthermore, lighter and more compact designs are rendering e-bikes more accessible and practical. Consequently, these technological improvements are driving the demand for e-bike batteries in Australia, as consumers look for more efficient, cost-effective, and sustainable transportation choices fueling Australia e-bike battery market demand.

Growth Drivers of Australia E-Bike Battery Market:

Government Incentives and Policies

Government support in the form of subsidies, rebates, and investments in infrastructure plays a major role in promoting the adoption of e-bikes and their batteries in Australia. Policies to increase transportation options in an environmentally friendly manner, like tax credits for the purchase of e-bikes and provision of funds for cycling facilities, relieve consumers from the cost burden. Additionally, investments in charging points and special bike lanes enhance the convenience and ease of e-bike usage overall. These developments make e-bikes a more attractive choice to consumers, stimulating higher take-up in urban and suburban areas. As a result, the e-bike market and supporting battery industry keep growing. According to Australia e-bike battery market analysis, these government initiatives are vital for propelling the market's growth.

Rising Environmental Awareness

With increasing global environmental concerns, Australians are becoming more aware of their carbon footprints and are looking for sustainable alternatives to conventional vehicles. This movement towards eco-friendly transportation is a major factor driving the increasing popularity of e-bikes. E-bikes present a cleaner, greener alternative to fossil-fuel-driven cars, contributing to the reduction of urban pollution and reliance on non-renewable resources. As awareness about climate change and the importance of sustainable practices rises, a growing number of consumers are choosing e-bikes as an efficient, low-emission transport option. This heightened environmental awareness is boosting the demand for e-bikes and for the batteries that power them, as consumers seek sustainable and durable battery solutions that resonate with their eco-conscious values.

Declining Battery Prices

The drop in e-bike battery prices stands out as a crucial factor propelling market growth. As manufacturing scales up and technology improves, the production costs of lithium-ion batteries continue to decrease, making e-bikes more affordable for a broader array of consumers. Enhanced production methods and technological advancements allow battery manufacturers to cut costs while enhancing battery performance, including longer lifespans and quicker charging times. This shift makes e-bikes, which were initially seen as luxury items, more accessible to the average consumer. Thus, the reduced cost of batteries is significantly contributing to the overall adoption of e-bikes, further stimulating demand in the Australian market.

Opportunities of Australia E-Bike Battery Market:

Expansion of Charging Infrastructure

The development of charging infrastructure represents a vital opportunity to improve the accessibility and acceptance of e-bikes throughout Australia. As the popularity of e-bikes continues to rise, the demand for easily reachable and extensive charging stations becomes increasingly evident. By investing in both public and private charging facilities—such as those located in urban centers, transport hubs, and residential neighborhoods—the attractiveness of e-bikes is heightened. Consumers are more likely to choose e-bikes when they have straightforward access to charging options. This expansion alleviates range anxiety and positions e-bikes as a practical alternative to conventional cars for short commutes. An increase in charging stations can elevate e-bikes to a popular transportation choice, further boosting the demand for e-bike batteries.

Integration with Renewable Energy

Connecting e-bike batteries to renewable energy sources provides a sustainable approach to powering e-bikes, effectively decreasing their environmental impact. For instance, solar-powered charging stations can significantly reduce carbon footprints while delivering eco-friendly charging alternatives for e-bike users. This synergy can foster a completely sustainable cycle where e-bikes are energized by renewable resources, promoting efficiency and sustainability. By advocating for the integration of solar panels and other green technologies into charging infrastructure, both e-bike manufacturers and battery suppliers can play a role in the wider shift towards clean energy. Moreover, e-bikes powered by renewable energy present consumers with a green alternative to traditional vehicles, making them appealing to environmentally conscious individuals and bolstering the long-term sustainability of the market.

Partnerships with E-Bike Manufacturers

Establishing collaborations between battery producers and e-bike manufacturers offers considerable opportunities for creating specialized, high-performance batteries specifically designed for various e-bike models. By closely collaborating with e-bike producers, battery suppliers can gain insights into the distinct energy requirements of different e-bike designs and performance criteria. This partnership can lead to innovations in the development of lighter, more durable, and efficient batteries, enhancing the overall performance and user experience of e-bikes. Furthermore, such partnerships can create opportunities for joint marketing strategies and packaged sales, improving product visibility and attracting customers. As the e-bike market expands, providing tailored batteries that align with the changing needs of manufacturers and consumers will serve as a competitive advantage, driving innovation and facilitating deeper market penetration within the Australian e-bike battery industry.

Government Initiatives of Australia E-Bike Battery Market:

Incentive Programs for E-Bikes

Various Australian states have introduced rebate initiatives and financial assistance for individuals purchasing e-bikes, making them more affordable and accessible. These programs alleviate the financial burden associated with acquiring an e-bike, thereby fostering wider acceptance among different consumer demographics. As e-bikes gain popularity, the corresponding demand for e-bike batteries naturally rises. Consumers are encouraged to transition to sustainable transportation options, which positively influences the e-bike battery market. Additionally, these financial incentives promote the overall development of the e-bike ecosystem, enabling individuals to recognize the long-term cost advantages of opting for e-bikes instead of traditional vehicles.

Investment in Cycling Infrastructure

Government investment in cycling infrastructure is crucial for encouraging the use of e-bikes and, as a result, increasing the demand for e-bike batteries. This includes creating dedicated bike lanes, secure bike parking, and improved urban planning to enhance the safety and accessibility of cycling. As cities adapt to be more bike-friendly, e-bikes emerge as a more practical choice for commuting. Such infrastructure helps address some barriers to e-bike usage, including safety issues and insufficient parking options. Consequently, a larger number of individuals are likely to utilize e-bikes for everyday travel, boosting the demand for efficient and durable batteries to power these vehicles, which in turn stimulates growth in the e-bike battery sector.

Promotion of Sustainable Transportation

The Australian government is actively fostering eco-friendly transportation alternatives, such as electric vehicles (EVs) and e-bikes, as part of its wider environmental objectives. Initiatives like tax breaks, rebates, and subsidies for EVs and their components—like e-bike batteries—are motivating both producers and consumers to adopt clean energy solutions. This governmental backing is crucial in expediting the shift towards zero-emission transport, diminishing reliance on fossil fuels and reducing urban pollution. As more people opt for e-bikes as a convenient and environmentally friendly commuting option, the demand for e-bike batteries continues to grow. Such supportive measures create a favorable atmosphere for the e-bike market to flourish, contributing to sustained growth.

Challenges of Australia E-Bike Battery Market:

High Battery Costs

Despite advancements in battery technology, the expense of high-quality lithium-ion batteries remains a significant barrier for many prospective e-bike purchasers. These batteries are crucial for the performance and range of e-bikes, but their high production costs affect the overall pricing of the e-bike. This results in e-bikes being less accessible for the average consumer, especially when compared to more affordable options like traditional bicycles or electric scooters. Even though battery prices have been gradually declining, they still account for a substantial portion of the total e-bike cost. The high initial investment can discourage buyers, particularly when contrasted with the ongoing costs associated with conventional transportation methods, such as fuel and maintenance.

Battery Lifespan and Degradation

E-bike batteries, similar to all lithium-ion batteries, deteriorate over time, which reduces their capacity and efficiency. As a battery ages, its ability to retain a charge decreases, resulting in shorter riding distances and diminished power. This degradation poses a significant challenge for e-bike users, affecting the overall experience and value of the bike. Prospective buyers may worry about the long-term sustainability of e-bikes, given that battery replacement can be expensive. With most e-bike batteries having a lifespan of only 2-5 years, potential consumers might hesitate to buy if they are concerned about future costs. Furthermore, battery degradation can create performance inconsistencies, rendering e-bikes less reliable for everyday use and long-distance rides.

Recycling and Disposal Issues

The disposal and recycling of e-bike batteries are crucial environmental issues. Lithium-ion batteries include hazardous materials like lithium, cobalt, and nickel, which can be dangerous if not disposed of or recycled correctly. As e-bikes gain popularity, the number of batteries that reach the end of their life is increasing, resulting in a heightened need for sustainable recycling options. However, there are few facilities equipped to safely process these batteries. Without effective recycling systems, these batteries may be sent to landfills, contributing to pollution and waste of resources. In addition, improper disposal can lead to the release of toxic chemicals into the environment, underscoring the necessity for developing stronger recycling infrastructure to responsibly manage the lifecycle of e-bike batteries.

Australia E-Bike Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on battery type and battery pack position type.

Battery Type Insights:

- Lithium-Ion Battery

- Lead Acid Battery

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion battery, lead acid battery, and others.

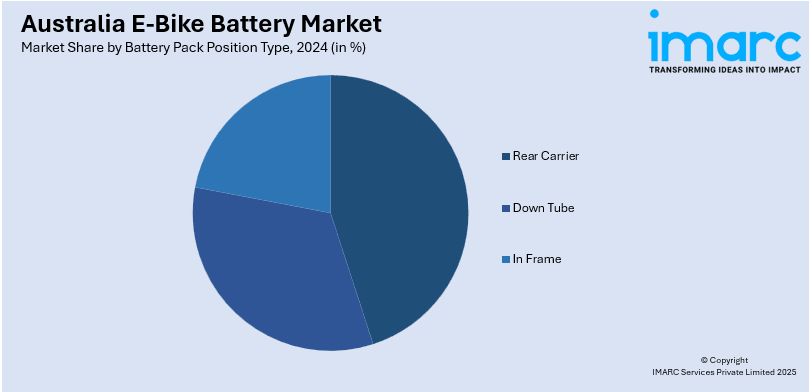

Battery Pack Position Type Insights:

- Rear Carrier

- Down Tube

- In Frame

A detailed breakup and analysis of the market based on the battery pack position type have also been provided in the report. This includes rear carrier, down tube, and in frame.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia E-Bike Battery Market News:

- In April 2025, Energy Safe Victoria in Australia launched a lithium-ion battery safety campaign via SICKDOGWOLFMAN and Sibel Pictures. The campaign highlights the dangers of fires caused by unsafe charging of devices with damaged or non-approved batteries. It will run across TV, BVOD, OOH, social, and digital platforms nationwide.

- In February 2025, New South Wales (NSW), Australia, will begin enforcing mandatory safety regulations for e-mobility devices and lithium-ion batteries starting February 2025. Devices like e-bikes, e-scooters, and hoverboards must comply with specified international standards to reduce fire risks.

Australia E-Bike Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-Ion Battery, Lead Acid Battery, Others |

| Battery Pack Position Types Covered | Rear Carrier, Down Tube, In Frame |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia e-bike battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia e-bike battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia e-bike battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-bike battery market in Australia was valued at USD 173.52 Million in 2024.

The Australia e-bike battery market is projected to exhibit a compound annual growth rate (CAGR) of 10.40% during 2025-2033.

The Australia e-bike battery market is expected to reach a value of USD 422.73 Million by 2033.

The Australia e-bike battery market is witnessing a shift toward high-capacity lithium-ion batteries for extended range, along with integration of smart battery management systems. Growing interest in modular and swappable batteries is also emerging, supported by design innovations for compact and lightweight battery packs.

Key drivers include rising fuel prices encouraging alternative mobility, government incentives promoting electric transport, and growing environmental awareness. Additionally, urban congestion is driving demand for efficient commuting options, while improvements in battery durability and charging speed further boost adoption across cities and regional areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)