Australia E-Bike Market Size, Share, Trends and Forecast by Mode, Motor Type, Battery Type, Class, Design, Application, and Region, 2025-2033

Australia E-Bike Market Size and Share:

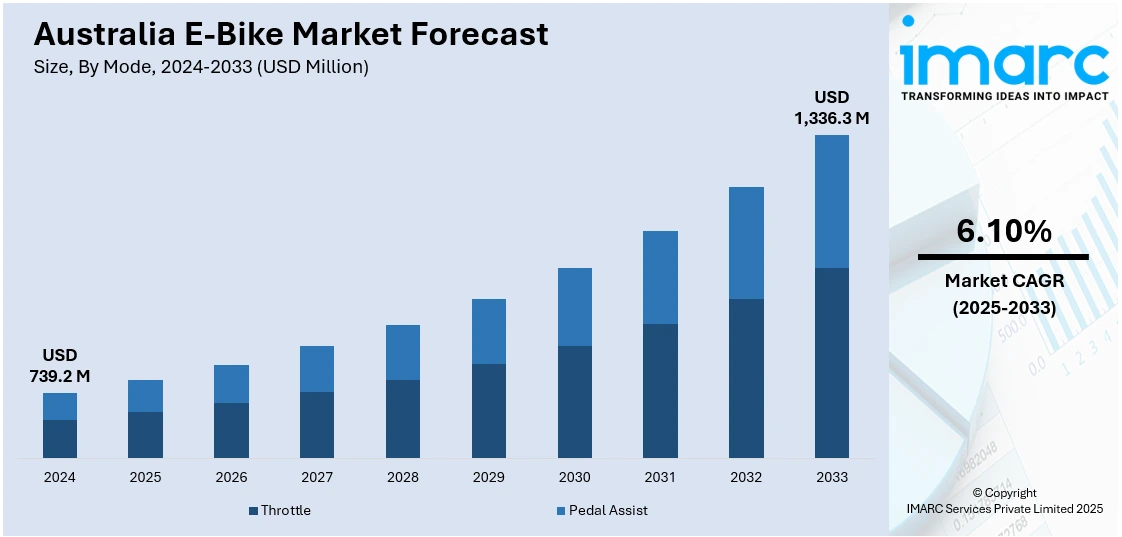

The Australia e-bike market size reached USD 739.2 Million in 2024. Looking forward, the market is expected to reach USD 1,336.3 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The market is witnessing significant growth mainly driven by rising environmental awareness, urban mobility needs, and government support for sustainable transport. Moreover, increasing adoption among commuters and recreational users is strengthening the overall growth in Australia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 739.2 Million |

| Market Forecast in 2033 | USD 1,336.3 Million |

| Market Growth Rate 2025-2033 | 6.10% |

Key Trends of Australia E-Bike Market:

Government Incentives and Subsidies

Government initiatives in the form of incentives and subsidies have become a key driver for the Australia e-bike market. Different state and local initiatives are providing funding, rebates, or tax relief to individuals and companies that are making investments in e-bikes, thereby significantly promoting their uptake. This impetus is driving overall Australia e-bike market growth by making electric bikes more affordable and economical for regular commuting and leisurely uses. For instance, in September 2024, Queensland's government announced the launch of a $1 million rebate scheme for e-scooters and e-bikes, offering $500 and $200, respectively. Starting Monday, the program aims to encourage sustainable transport. Eligibility criteria apply, including specifications on speed and propulsion. The initiative follows previously launched rebates for electric vehicles. These programs align with overall environmental objectives, such as lowering carbon emissions and alleviating city traffic jams. Initiatives in states such as Victoria and the ACT have had particularly high take-up, leading to additional investment in cycling facilities. As policy structures continue to develop in support of clean mobility, these government-sponsored incentives are likely to play a pivotal role in determining the Australia e-bike market outlook, enabling sustained growth among urban and suburban user bases.

To get more information of this market, Request Sample

Retail and Online Channel Growth

The expansion of both retail dealerships and online sales channels is significantly boosting the Australia e-bike market demand. Brick-and-mortar stores are enhancing their in-store experience by offering test rides, financing options, and maintenance services, catering to first-time buyers and experienced cyclists alike. At the same time, online platforms are growing rapidly, providing a convenient way for consumers to compare models, read reviews, and make informed purchases with home delivery options. This dual-channel expansion is addressing diverse customer preferences from urban commuters seeking compact designs to adventure riders looking for performance models. The COVID-19 pandemic further accelerated the shift toward digital shopping, prompting many traditional retailers to adopt hybrid sales models. As more brands enter the market and expand their geographic reach, the availability and visibility of e-bikes have improved considerably, contributing to a larger Australia e-bike market share across consumer categories. For instance, in February 2025, Eozzie announced its plans to open a new physical store in Perth, expanding access to eco-friendly transportation. The store will showcase a full range of electric bikes, scooters, and trikes for the first time. This marks Eozzie's growth beyond Sydney and Melbourne, promoting sustainable mobility across Australia.

Shared E‑Bike Management & Urban Integration

Australia's e‑bike environment is facing a pressing requirement for organized management of shared and dockless operations within urban cities. Sydney, and Victoria Street in Kings Cross, has seen excessive bunching of ride-share bikes within footpaths and disrupting pedestrian traffic. To address this, the NSW government has begun to conduct inquiries and instructed local councils to implement reserved parking spots, reallocate car lanes for bicycle docking, and maintain geo-fencing regulations—such as those trialed in Waverley for ride-share bikes in Bondi. The movement is part of a larger trend toward finding harmony between convenience and safety as e-bikes are increasingly included in regular commutes. Infrastructure developments like the new ramp across Sydney Harbour Bridge will further enhance integration by providing unobstructed, accessible riding for e-bike users of all ages. As e-bike sharing networks grow, Australia is shifting toward a closer regulatory environment, integrating municipal planning, operator accountability, and technological controls. The success of this trend will depend on coordinated urban planning that includes e-bikes in city mobility—preserving walkability, minimizing clutter, and implementing app-based compliance tools.

Growth Drivers of Australia E-Bike Market:

Lifestyle Appeal and Coastal Demand

Australia's e‑bike market is driven by lifestyle trends—especially in high-end coastal suburbs where premium electric bikes have become badges of freedom and environmentally friendly living. Teenagers and young adults in Sydney's Northern Beaches are adopting top-of-the-range models (several thousand dollars) as car alternatives for independence over beach commutes and casual outings. Consumer brands like Ampd Bros and DiRodi have particularly reported burgeoning demand in coastal cities like Newcastle, Manly, Noosa, and the Gold Coast. This reflects economic ability and lifestyle compatibility—warm climate, bike-friendly routes, and surf culture are promoting recreational riding and active transport. The surging popularity of these bikes reflects the cultural trend toward healthier, greener, and socially active living, where e‑bikes provide both status and utility.

Technological Innovation & Accessible Conversion Paths

Strategic technological improvements like powerful motor systems, extended battery life, built-in connectivity, safety features, and mid-drive configurations—are considerably increasing e‑bike appeal throughout Australia. Specialized and Giant companies are introducing sophisticated models that suit local topography, including off-road and city commuting. Conversion kits are available at a relatively reasonable entry price for many consumers, allowing them to retrofit classic bikes into e‑bikes. Though conversion can be dangerous if the batteries used are below standard, conversion kits offer a chance to upgrade old bikes in an environmentally friendly manner. With this technology-based diversity attractive to commuters as well as adventure cyclists, the Australian e‑bike market accommodates a variety of uses, from casual beach cruising to budget-conscious city commuting and rural community utilization.

Infrastructure Growth & Government Support

Australia's urban planning styles and public policy are driven in the direction of adopting e‑bikes. Urban centers such as Canberra and Melbourne are spending strongly on cycle lanes, end-of-trip facilities, and bike libraries to make e‑bikes more convenient for commuting, car-free days, and rental test programs. The City of Adelaide has rolled out trial subsidy schemes allowing residents and professionals to buy e‑bikes and cargo bikes with incentives for racks and safety equipment—climate-strategy goal-driven. Moreover, state rebate programs (such as Queensland's incentives) and increasing backing for charging infrastructure establish an enabling environment. Such public support—both material and fiscal—is important in reducing barriers to entry, promoting trial use by libraries, and integrating e‑bikes into everyday transport and not merely recreation.

Opportunities of Australia E-Bike Market:

Expansion to Regional and Commuter Markets

According to the Australia e-bike market analysis, the region’s widespread geography and burgeoning population in rural towns create huge opportunities for e-bike growth outside of urban centers. With little or no public transport available in many suburban and rural locations, e-bikes provide a cost-effective, convenient alternative to commuting. Towns such as Ballarat, Wollongong, and Bendigo are making commitments to cycling infrastructure and marketing micro-mobility as a green solution for last-mile mobility. With remote and hybrid work arrangements on the rise, individuals are moving away from urban areas of high population density, necessitating personal transportation that covers local distances without a second car. E-bikes are best positioned for such environments, particularly designs constructed for durability and long-lasting batteries. Moreover, escalating fuel prices and the quest for environmentally friendly ways of life are encouraging citizens to seek electric mobility. Regional market players and firms that offer region-specific products and on-the-go servicing opportunities will be able to seize a new generation of eco-conscious travelers looking for strong and versatile travel.

Fleet Integration and Commercial Adoption

An increasing number of Australian businesses and government services are looking at e-bikes for business and logistic use, offering a major opportunity for market diversification. Food and parcel delivery businesses are starting to use cargo e-bikes for inner-city distribution to escape congestion and lower emissions. City councils, university campuses, and town council offices are launching electric bike fleets for in-house transport and local community outreach programs. The transition saves on operational expenses and supports corporate social responsibility and greenhouse gas reduction targets. Start-ups providing e-bike fleet leasing options, maintenance packages, and GPS tracking systems are also emerging, developing new service-driven niches within the market. By providing tailored fleet solutions, Australian e-bike companies can service increasing demand from industries such as tourism, local government, and inner-city logistics, which are increasingly looking for sustainable, cost-effective options to mainstream vehicles.

Tourism and Recreational Experiences

Australia's immense natural terrain and strong domestic tourism culture provide perfect conditions for e-bike tourism to thrive. From picturesque coastal paths in Byron Bay to wine country routes in the Barossa Valley and Margaret River, e-bikes are becoming a popular method for low-impact discovery. Tour operators and hotels are adding e-bike hire and guided tours to their packages, targeting international travelers as well as local holidaymakers looking for active tourism opportunities. National parks and tourist boards at a regional level are also encouraging cycling routes accessible by e-bikes, expanding the demographic base to senior tourists and families. The ability to package e-bike experiences with wellness, food, and cultural tourism enables companies to provide distinctive packages that tap into the values of slow travel and environmental protection. With domestic tourism continuing to be robust and demand for sustainable adventure increasing, the e-bike sector is poised to be an anchor of experiential travel in Australia.

Government Initiatives of Australia E-Bike Market:

State-Level Subsidies and Incentive Programs

Australia's e-bike industry has witnessed a rising pressure from territory and state governments to promote uptake through certain incentive schemes that are targeted. For instance, the Queensland Government has launched rebate programs that provide economic assistance for residents who buy electric bikes that pass certain safety and performance tests. These programs seek to lower the barrier to cost in the first instance and induce people to commute using sustainable modes in cities and suburbs. In Australia's Australian Capital Territory and South Australia, councils have experimented with voucher schemes and grant-based assistance to support small businesses and households in transitioning to electric mobility. Many of these programs involve conditions, such as local living requirements and usage commitments, to ensure the advantages accrue locally. These initiatives mark a change in public policy direction toward more inclusive and sustainable transport planning. Yet the lopsided rollout between states ensures that not all Australians gain equally, making greater federal cooperation on micro-mobility assistance a priority.

Urban Planning and Infrastructure Development Support

Government policy in Australia is increasingly focusing on the physical infrastructure required to facilitate e-bike usage, especially in major cities such as Melbourne, Canberra, and Adelaide. These cities are installing separated bike lanes, shared paths, and enhanced road signage to encourage cycling as a safer and more attractive option. In certain inner-city areas, special e-bike charging stations and secure e-bike parking facilities have also been provided close to transport centers and public buildings. State and local governments are incorporating e-bike availability into wider urban planning initiatives, such as green corridors and active transport networks. Councils in cities such as Brisbane and Perth have initiated pilot schemes to experiment with the feasibility of e-bike sharing schemes and community lending libraries. These infrastructure projects aim to decrease car dependency, lower emissions, and make cities more livable and sustainable. While the pace of implementation is regional, there's no question about the direction: governments are seeing e-bikes as an essential piece in the transformation of urban mobility.

Public Awareness Campaigns and Community Engagement

Besides providing financial incentives and infrastructure, Australian governments are introducing education campaigns and community programs to generate public awareness about e-bikes. Workshops, e-bike demo days, and safety training sessions are being conducted in association with local councils, schools, and environmental organizations. These initiatives are to familiarize people with electric bike technology, allay safety fears, and promote safe riding behaviors. In Hobart and Darwin cities, there has been a move by the councils to encourage community leaders to advocate for e-bikes as ready alternatives for short-distance transportation, particularly for elderly people or those with mobility challenges. Some areas are also teaming with local business organizations to promote e-bike workplace schemes, with trial periods for workers to cycle to work using e-bikes. Grassroots campaigns support a positive public perception of e-bikes, increase the rate of adoption, and make new users feel empowered and well-informed. Eventually, this type of outreach contributes to the mainstreaming of e-bike use among a variety of populations in Australia.

Challenges of Australia E-Bike Market:

Regulatory Fragmentation and Safety Issues

One of the biggest issues confronting the e-bike market in Australia is regulatory fragmentation between states and territories. Though the federal government makes broad guidelines for electric bike classification, each state has its own regulations regarding speed limits, helmet use, and allowable motor wattage. For consumers and retailers both, this fragmentation can be confusing, especially when buying online or moving across jurisdictions. Furthermore, safety issues are building in inner and coastal suburbs where e-bikes are getting more powerful and common, particularly among younger people. With increased speed and heavier frames, some e-bikes are becoming indistinguishable from motor vehicles, raising questions about the safety of pedestrians and the suitability of current cycling infrastructure. Councils in well-off beach suburbs, for instance, are experiencing more confrontation between pedestrians and rapid-paced e-bike riders. The absence of an effective national policy and adequate safety enforcement is restraining market confidence and hindering adoption among crucial segments.

Upfront High Costs and Access Barriers

Even with increased interest, affordability is still a major inhibitor of e-bike purchase in Australia. Good-quality models typically come with high price tags, and although some areas have limited subsidies available, these are patchy and not a national scheme. For the majority of consumers—particularly young adults, low-income households, and those living in outer suburbs—the upfront cost of an e-bike and accessories can be prohibitive. In addition, Australia's small domestic manufacturing sector means that most e-bikes must be imported, subjecting the market to global supply chain shocks and foreign exchange rate variations, further pushing up prices. Repair costs and restricted access to specialized servicing add to the outlay, especially in country towns where e-bike service facilities are thin on the ground. Without mass financial incentives or affordable leasing schemes, the e-bike market can potentially become niche, catering mainly to high-end consumers in cities. That works against the industry's aspirations of mass adoption as a low-carbon transport option.

Infrastructure Gaps and Urban Planning Limitations

Australia's urban planning has historically been based around car-based models, and this creates major barriers to incorporating e-bikes into daily mobility. Bike lanes in most cities are disjointed, poorly maintained, or shared with heavy traffic, making commutes by e-bike unsafe or impractical. Whereas other inner urban areas like Melbourne and Canberra are increasing their cycling infrastructure, many suburbs and regional locations have no continuous, protected bike paths capable of supporting e-bike riders covering longer distances. End-of-trip amenities like secure bike storage and charging points are also lacking in most commercial and residential properties. This shortage between increasing e-bike demand and supportive infrastructure generates resistance to adoption. It also discourages novice riders, especially parents and elderly people, who value safety and convenience. To mature the market, there must be coordinated urban planning and investment to embed e-bikes in Australia's wider transport system, and not as a recreational aside.

Australia E-Bike Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on mode, motor type, battery type, class, design, and application.

Mode Insights:

- Throttle

- Pedal Assist

The report has provided a detailed breakup and analysis of the market based on the mode. This includes throttle and pedal assist.

Motor Type Insights:

- Hub Motor

- Mid Drive

- Others

A detailed breakup and analysis of the market based on the motor type have also been provided in the report. This includes hub motor, mid drive, and others.

Battery Type Insights:

- Lead Acid

- Lithium Ion

- Nickel-Metal Hydride (NiMH)

- Others

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lead acid, lithium ion, nickel-metal hydride (NiMH), and others.

Class Insights:

- Class I

- Class II

- Class III

A detailed breakup and analysis of the market based on the class have also been provided in the report. This includes class I, class II, and class III.

Design Insights:

- Foldable

- Non-Foldable

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes foldable and non-foldable.

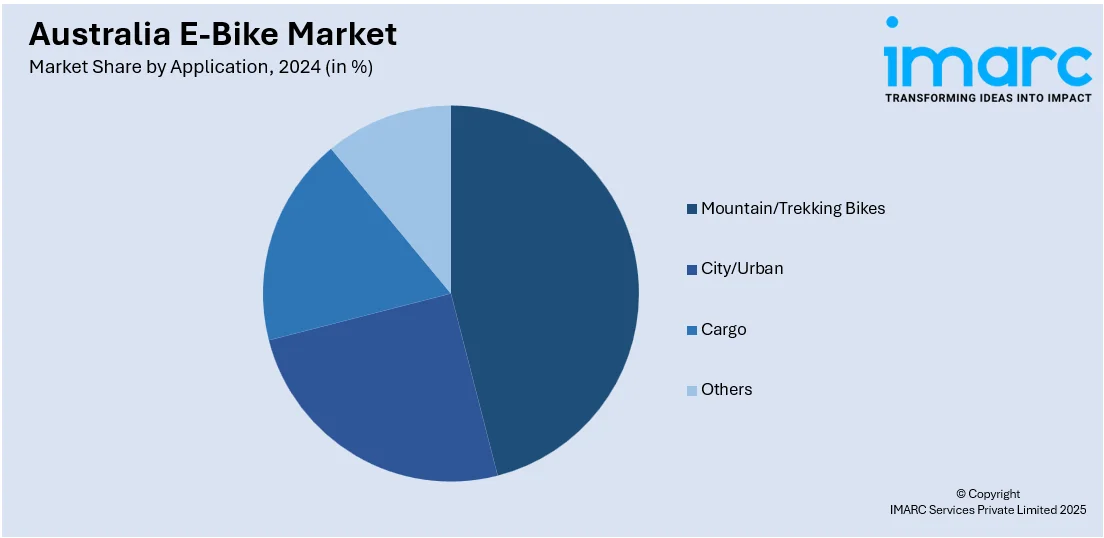

Application Insights:

- Mountain/Trekking Bikes

- City/Urban

- Cargo

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes mountain/trekking bikes, city/urban, cargo, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & South Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- DiroDi

- Dyson Bikes

- Giant Bicycles

- Kona Australia

- Merida Bikes

- NCM Bikes AU

- Norco

- Riese & Müller GmbH

- Trek Bicycle Corporation

Australia E-Bike Market News:

- In July 2024, Segway-Ninebot announced the launch of three e-Motorbike models in Australia this August, featuring high-tech connectivity and eco-friendly designs. The flagship model offers a top speed of 105 km/h and a range of 130 km. Designed for comfort and safety, these bikes aim to enhance urban commuting experiences.

- In March 2023, EMotorad debuted in Australia, exporting its foldable e-bike Doodle v2 to Melbourne under the Indo-Australian trade agreement. It offers a speed of 25 km/h and a range of 55 km. The startup aims to expand globally and increase its market share in India.

Australia E-Bike Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modes Covered | Throttle, Pedal Assist |

| Motor Types Covered | Hub Motor, Mid Drive, Others |

| Battery Types Covered | Lead Acid, Lithium Ion, Nickel-Metal Hydride (NiMH), Others |

| Classes Covered | Class I, Class II, Class III |

| Designs Covered | Foldable, Non-Foldable |

| Applications Covered | Mountain/Trekking Bikes, City/Urban, Cargo, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, Western Australia |

| Companies Covered | DiroDi, Dyson Bikes, Giant Bicycles, Kona Australia, Merida Bikes, NCM Bikes AU, Norco, Riese & Müller GmbH, Trek Bicycle Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia e-bike market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia e-bike market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia e-bike industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia e-bike market was valued at USD 739.2 Million in 2024.

The Australia e-bike market is projected to exhibit a CAGR of 6.10% during 2025-2033.

The Australia e-bike market is expected to reach a value of USD 1,336.3 Million by 2033.

Australia's e-bike market is being fueled by increasing fuel prices, environmentally aware consumerism, and the need for alternative transport in urban areas. Government incentives, increasing cycling infrastructure, and active lifestyles further driving adoption. Regional communities are also motivated by e-bikes, as they offer affordable and flexible travel option in areas with poor access to public transport.

Australia's e-bike market is transforming with high-end, coastal-lifestyle desire and rising demand for hybrid models combining physical and digital attributes. Urban e-bike fleets and cargo bikes are increasingly popular for delivery. Expanding infrastructure and incorporating app-based solutions mirror wider trends toward sustainable, tech-enabled micro-mobility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)