Australia E-Pharmacy Market Size, Share, Trends and Forecast by Drug Type, Product Type, Platform, Payment Method, and Region, 2026-2034

Australia E-Pharmacy Market Overview:

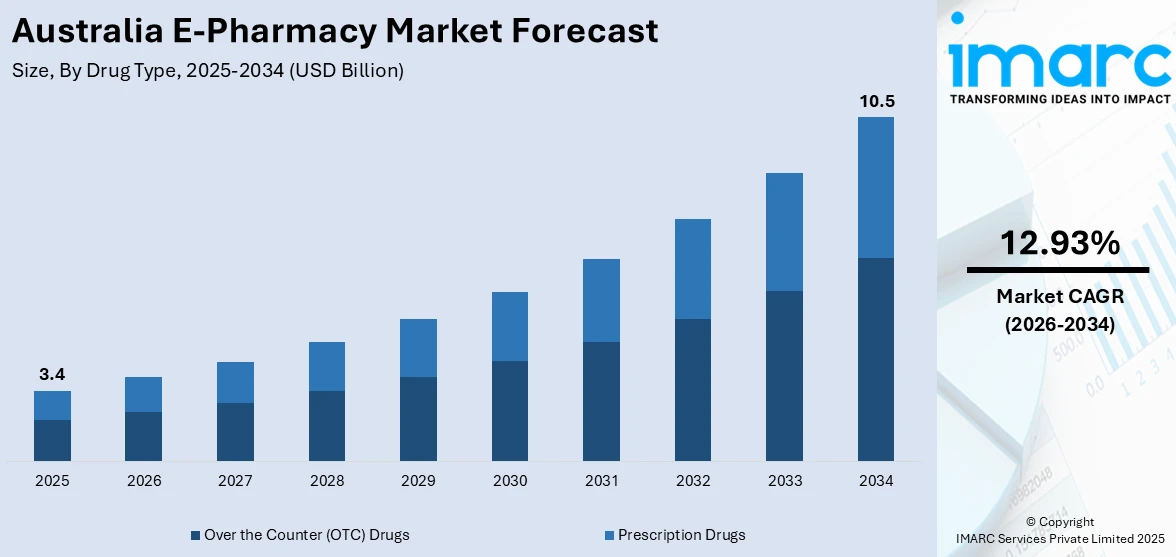

The Australia e-pharmacy market size reached USD 3.4 Billion in 2025. Looking forward, the market is expected to reach USD 10.5 Billion by 2034, exhibiting a growth rate (CAGR) 12.93% during 2026-2034. The market is driven by the rise in internet access and smartphone usage and heightened dependence on smartphones for regular activities, increasing focus on mandatory licensing, prescription authentication procedures, and adherence to standards, and prevalence of chronic diseases among the masses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.4 Billion |

| Market Forecast in 2034 | USD 10.5 Billion |

| Market Growth Rate 2026-2034 | 12.93% |

Key Trends of Australia E-Pharmacy Market:

Rising Internet Penetration and Smartphone Adoption

The rise in internet access and smartphone usage is impelling the growth of the market. According to Datareportal’s Global Digital Report 2024, 96.4% of Australians have internet access, with a growing dependence on smartphones for regular activities. The convenience of buying medicines online is thus becoming more attractive. Customers increasingly value digital channels that are convenient to compare, provide access to a diverse portfolio of drug products, and allow home delivery. This phenomenon is especially noted among younger generations, which are technologically advanced, and urban professionals with hectic lifestyles who focus on efficiency. In addition, the inclusion of easy-to-use mobile apps by large chain pharmacies and upstarts has increased customer satisfaction, with capabilities such as e-prescription upload, artificial intelligence (AI)-powered health suggestions, and live monitoring.

To get more information on this market Request Sample

Supportive Regulatory Framework and Government Initiatives

Australia's regulatory environment is evolving to accommodate the growing digital health ecosystem, including e-pharmacy operations. The Therapeutic Goods Administration (TGA), in collaboration with the Pharmacy Board of Australia, is presenting precise online pharmacy practice guidelines for consumer protection and drug legitimacy. The specifications involve mandatory licensing, prescription authentication procedures, and adherence to standards for keeping and dispensing medicines. Additionally, the Australian Government-led Electronic Prescriptions program has ensured a smooth digital prescription process throughout the nation. The government allocated $111.8 million over four years and $24.2 million ongoing funding to present electronic prescription delivery infrastructure and related developments via the 2023-24 Budget. This allowed patients to have digital prescriptions, which makes physical trips and paper prescriptions obsolete.

Aging Population and Increasing Occurrence of Chronic Disease Management

Australia's aging population is driving the demand for long-term and convenient healthcare options, such as access to prescription drugs. The 2024 Population Statement unveiled that more than 2.1 million individuals aged 75 and above were present in Australia in 2024. With an increase in aging population, the incidence of chronic diseases among them is rising. E-pharmacies are poised to address these demands with recurring delivery services, medication reminders, and convenient access to pharmacist consultations through telehealth services. For elderly individuals with mobility issues or for those who live in remote locations, e-pharmacies offer a valuable service by removing the need to travel to obtain prescriptions. In addition, subscription models and integrated health monitoring services facilitate uniform adherence to medications, enhancing patient outcomes and lightening the load on public health infrastructure.

Growth Drivers of Australia E-Pharmacy Market:

Growing Need for Accessible Healthcare in Remote and Regional Communities

The most important growth driver of Australia's e-pharmacy market is the growing need for accessible healthcare in remote and regional communities. Due to the immense size of Australia, a large number of people are distant from physical pharmacies or healthcare professionals, especially in rural parts of states such as Western Australia, Queensland, and the Northern Territory. E-pharmacy websites provide an essential solution by bringing prescription and over-the-counter drugs to patients' doorsteps, enhancing medication compliance and closing health gaps. The ease of having medications ordered via the internet, particularly among the elderly or the disabled, further increases the attractiveness of e-pharmacies. Furthermore, as telehealth services in the nation continue to grow, especially in the wake of the COVID-19 pandemic, digital prescriptions complementing e-pharmacy platforms are also becoming increasingly convenient. The digital convergence makes it possible for patients even in the remotest communities to receive timely and standardized medication, enhancing the network of healthcare delivery in Australia overall.

Growth in Telehealth and Convergence with E-Pharmacy Services

The quick growth of telehealth services nationwide in Australia has largely contributed to the e-pharmacy market through the provision of a smooth continuum of care digitally. As more Australians are consulting doctors online, particularly in post-pandemic healthcare systems, prescriptions are now being sent electronically and can be completed using digital pharmacy platforms. The integration enables patients to access medical consultations as well as get medications without attending a clinic or physical pharmacy. Regional healthcare services, for example, have adopted this trend to enhance patient outcomes in underserved regions with inadequate healthcare infrastructure. The convenience of having a teleconsultation, followed by home delivery of medication, improves patient compliance and minimizes the burden on in-person services. Healthcare providers are also now working together with e-pharmacies to automate workflows, minimize prescription error, and monitor patient compliance. This network of linked care is a key driver of growth for Australian e-pharmacies, revolutionizing access to and provision of healthcare, particularly in low-resource or geographically fragmented populations.

Shifting Consumer Behavior and Comfort with Convenience

Consumers in Australia are increasingly moving toward online platforms for daily essentials, including healthcare, based on altered lifestyles, deepening internet penetration, and heightened familiarity with e-commerce. This change in behavior is most strongly seen among younger and middle-aged adults who enjoy the speed and convenience of online management of prescriptions and shopping for health products. The increasing emphasis on preventive health, wellness, and self-care has also contributed to heightened demand for vitamins, supplements, and personal care items, which are products that can be delivered efficiently by e-pharmacies. Moreover, subscription plans and customized product suggestions have gained popularity among e-pharmacy platforms, providing a personalized shopping experience that may not be possible from traditional pharmacies. As online transactions gain confidence, and the digital payment systems become increasingly sophisticated, increasing Australians are adopting e-pharmacy services for prescription and non-prescription requirements. This momentum driven by consumers, coupled with technological advancements and healthcare digitization, keeps driving strong growth in Australia's e-pharmacy market.

Opportunity of Australia E-Pharmacy Market:

Serving Disadvantaged Rural and Indigenous Communities

Australia's large and sometimes remote geography provides a major opportunity for e-pharmacies to extend the reach of healthcare services to remote and Indigenous populations. Many of these communities have limited regular access to physical pharmacies, and their residents often experience issues such as poor transportation, fewer healthcare providers, and longer delays in accessing critical medications. E-pharmacy websites can bridge these gaps by providing assurance of delivery of prescription and over-the-counter medications and virtual consultations. In places such as Northern Queensland and the Northern Territory, where Indigenous groups are denser, e-pharmacies could potentially become central agents in meeting healthcare inequities and management of chronic disease. Partnerships between e-pharmacies and local health services, Aboriginal Medical Services (AMS), and telehealth networks may enable them to grasp cultural health needs and provide targeted solutions. This special advantage promotes better health outcomes and also the proper distribution of healthcare resources in Australia's most disadvantaged areas.

Expansion into Preventative Health and Personal Wellness

Since Australian consumers become more proactive in health, there is chance for e-pharmacies to diversify their product lines from prescriptions to wellness and personal care products. The market is experiencing increased demand for vitamins, nutritional supplements, skincare, and natural treatments, which are products all connected to larger trends in active health management. E-pharmacies can take advantage of this by developing curated online shops that provide personalized recommendations for products based on customer health objectives, history, or interests. This is particularly applicable in Australia, where a health-aware population is bolstered by robust government communications regarding preventative care and self-management of chronic disease. Subscription schemes, loyalty programs, and add-on services like virtual consultations with pharmacists can also extend customer interaction and retention. Furthermore, e-pharmacies that focus their products and services on upcoming well-being trends, such as eco-friendly packaging or locally made natural products, which can connect strongly with environmentally and socially aware Australian consumers.

National Digital Health Infrastructure

The continued growth of Australia's national digital health infrastructure is a compelling opportunity for e-pharmacies to integrate as full-scale participants in Australia's healthcare ecosystem. With the increasing use of My Health Record and electronic prescribing systems, e-pharmacies have the potential to integrate seamlessly with general practitioners, specialists, and allied health professionals. This enables integrated medication management, increased accuracy in dispensing, and enhanced adherence tracking. For people suffering from chronic diseases, automated refill reminders and instant alerts on medication history can enhance treatment efficacy and relieve hospitals and clinics of some burdens. Moreover, with Australia further investing in digital transformation in the healthcare sector, e-pharmacies have a critical role to play in minimizing inefficiencies and maximizing patient convenience. Data analytics and health insights are also opportunities where e-pharmacies may provide population health monitoring and tailor-made treatment plans. This increased synergy between digital health infrastructure and e-pharmacy offerings has the potential to greatly bolster the healthcare delivery model overall in Australia.

Australia E-Pharmacy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on drug type, product type, platform, and payment method.

Drug Type Insights:

- Over the Counter (OTC) Drugs

- Prescription Drugs

The report has provided a detailed breakup and analysis of the market based on the drug type. This includes over the counter (OTC) drugs and prescription drugs.

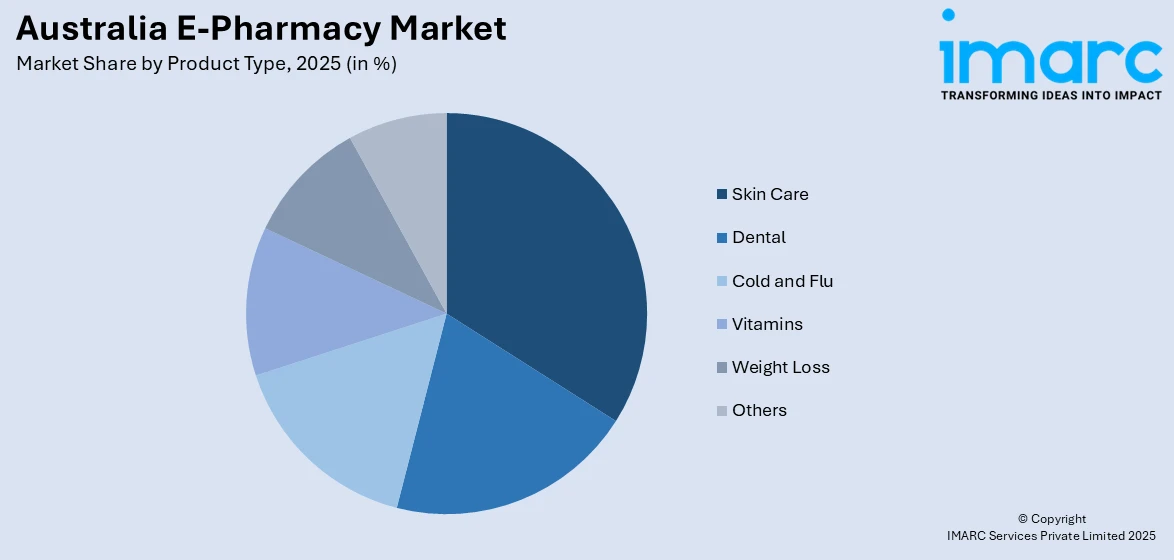

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Skin Care

- Dental

- Cold and Flu

- Vitamins

- Weight Loss

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes skin care, dental, cold and flu, vitamins, weight loss, and others.

Platform Insights:

- App-Based

- Web-Based

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes app-based and web-based.

Payment Method Insights:

- Cash on Delivery

- Online Payment

A detailed breakup and analysis of the market based on the payment method have also been provided in the report. This includes cash on delivery and online payment.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia E-Pharmacy Market News:

- In August 2025, the National Prescription Delivery Service (NPDS), engaged by the Department of Health, Disability and Ageing, declared that electronic prescribing is now broadly accessible in community environments. It offers healthcare professionals and patients the choice to utilize an electronic prescription instead of traditional paper prescriptions. Physical prescriptions are still an option.

Australia E-Pharmacy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Over the Counter (OTC) Drugs, Prescription Drugs |

| Product Types Covered | Skin Care, Dental, Cold and Flu, Vitamins, Weight Loss, Others |

| Platforms Covered | App-Based, Web-Based |

| Payment Methods Covered | Cash on Delivery, Online Payment |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia e-pharmacy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia e-pharmacy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia e-pharmacy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia e-pharmacy market was valued at USD 3.4 Billion in 2025.

The Australia e-pharmacy market is projected to exhibit a CAGR of 12.93% during 2026-2034.

The Australia e-pharmacy market is expected to reach a value of USD 10.5 Billion by 2034.

The Australia e-pharmacy market trends include rising integration with telehealth services and growth in demand for wellness and preventative health products. Subscription models, automated refills, and AI-driven recommendations are becoming common, while rural and Indigenous healthcare access is gaining focus through improved digital delivery platforms.

The Australia e-pharmacy market is driven by increased demand for remote healthcare access, and growing consumer preference for digital convenience. Government support for e-prescriptions, widespread internet adoption, and a focus on chronic disease management also contribute to growth, enabling broader reach and efficiency in medication delivery nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)